Set up jobs to track the income and expenses related an area or undertaking in your business, like a project, department, division or location.

When you enter a transaction or record an employee's pay, you can assign a job number to each individual amount. This means you can associate several jobs with the various amounts in a single transaction.

For example, if a sale includes parts for three different jobs, you can specify these jobs on the invoice. You can then report on the profitability of each job.

If you access an AccountRight company file in a web browser, you can follow the steps below to create, edit and delete jobs while in the browser.

Let's take you through the details.

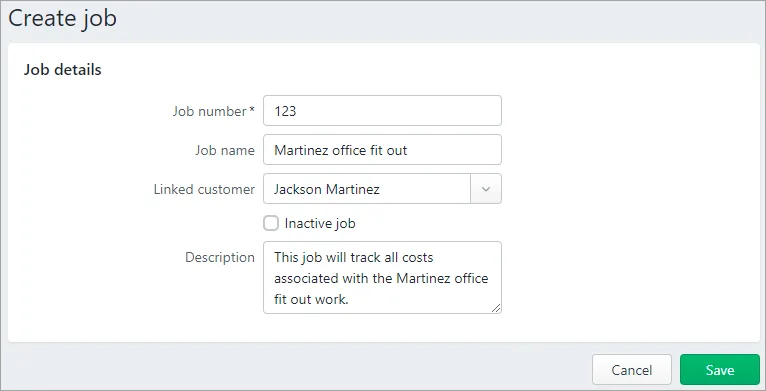

To create a job

Go to the Accounting menu and choose Jobs.

Click Create job.

Enter a Job number. This is a unique identifier for the job and can be letters or numbers.

Enter a Job name and Description.

If you want to link the job to a customer, select the customer in the Linked customer field.

When you're done, click Save. The new job is now listed on the Jobs page.

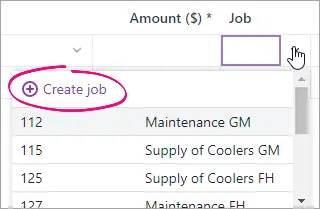

Add new jobs on-the-fly

Click the Job dropdown arrow and choose Create job. Enter as much (or as little) info as you like and click Save. You can always go back later and fill in additional details.

To edit, delete or hide a job

You can update or delete the jobs in your jobs list. If a job is allocated to a transaction and you delete the job, the job will no longer be allocated to that transaction.

If you rarely, or no longer, use a job, you can hide it. Hiding a job will prevent it from appearing in selection lists.

Go to the Accounting menu and choose Jobs.

Click to open the job.

Choose what you want to do.

To... | Do this |

|---|---|

edit the job | Update the job details and click Save. |

delete the job | Click Delete, then click Delete at the confirmation message. |

make a job inactive | Select the Inactive job option then click Save. |

reactivate a job | Deselect the Inactive job option then click Save. |

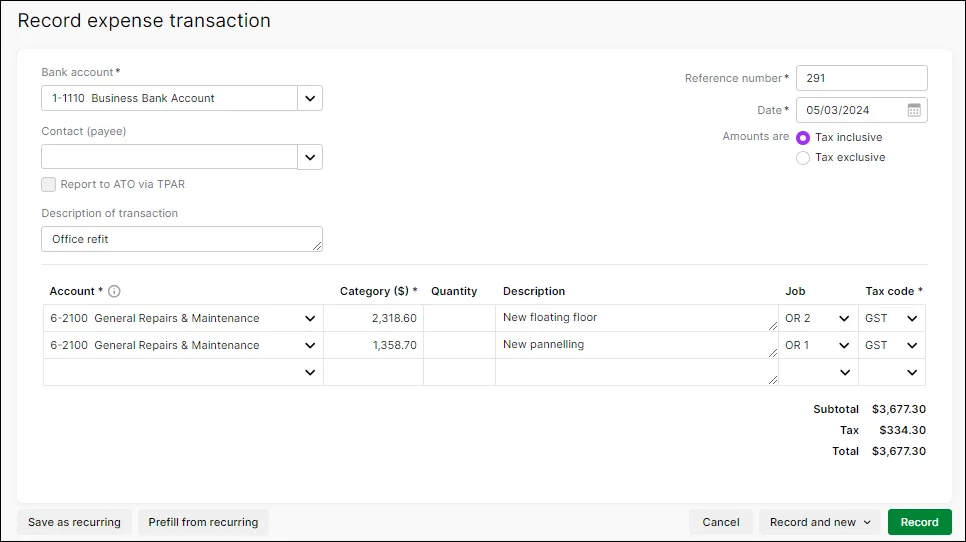

To add jobs to income and expenses

If income or expenses relate to one or more jobs, you can add the jobs when you record the transaction in MYOB. For example, if you've received a bill which relates to a specific job, you can add that job when you record the bill.

You can add jobs to these transactions:

Quotes

Invoices

Bills

Receive money

Spend money

General journals

When you record the transaction, choose the job in the Job column. Only one job can be chosen per line. If multiple jobs apply to the transaction, enter a separate line for each.

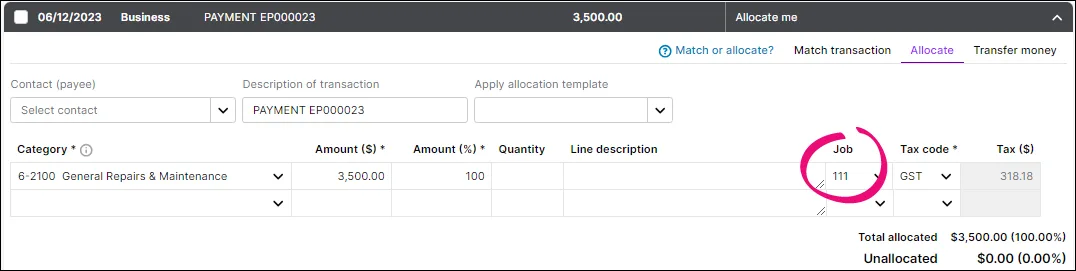

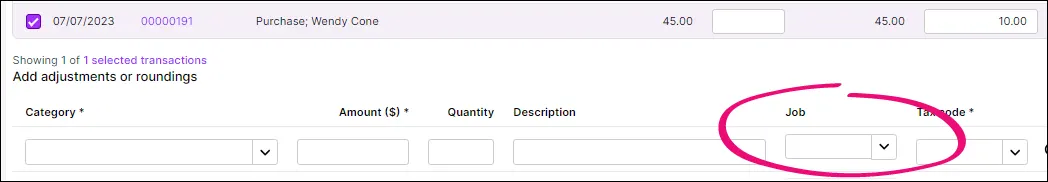

To add jobs to bank transactions

If your bank transactions come into MYOB via bank feeds or imported statements, you can assign jobs to them.

Go to the Banking menu and choose Bank transactions.

Select the transaction and click the dropdown arrow to expand it.

Allocate the transaction as you normally would. Need a refresher?

Choose the job in the Job column. Only one job can be chosen per line. If multiple jobs apply to the transaction, enter a separate allocation line for each.

Click Save.

You can also allocate jobs to any bank transaction adjustments. After you have allocated the bank transaction as described above:

Click the dropdown arrow to expand the transaction.

Click the Match transaction tab.

Click Add adjustment.

Choose the job in the Job column. Only one job can be chosen per line. If multiple jobs apply to the transaction, enter a separate allocation line for each.

Click Save.

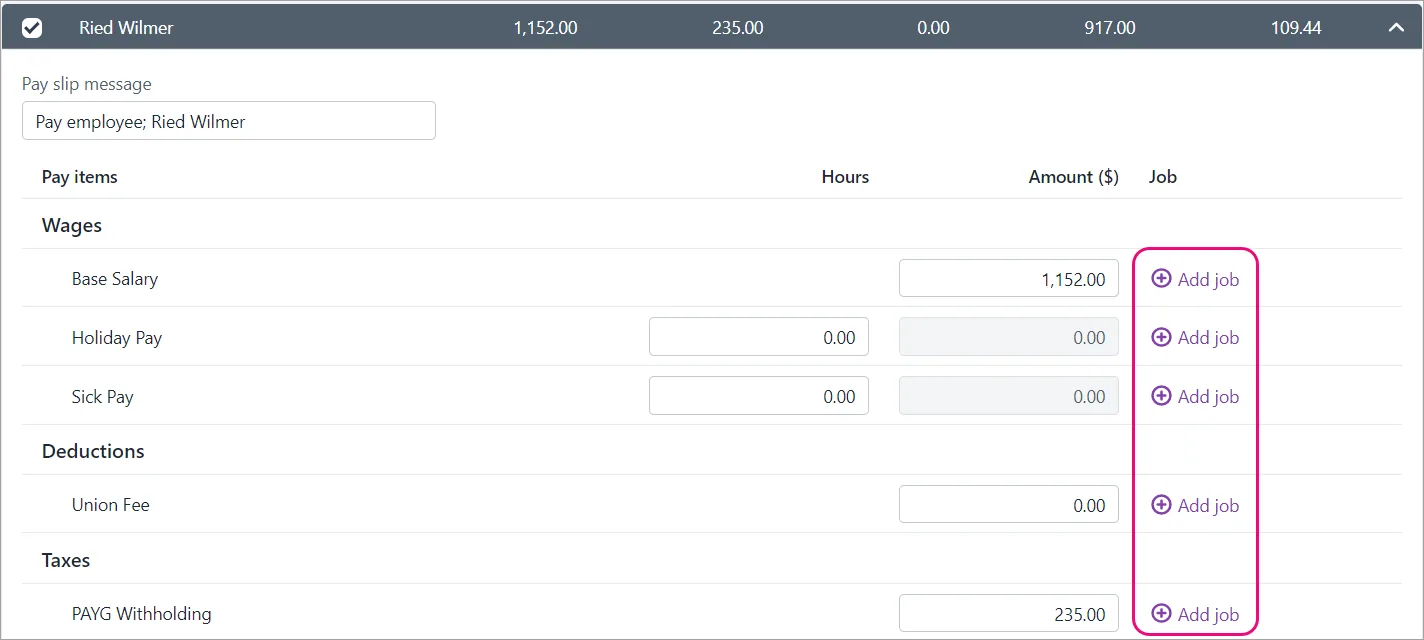

To add jobs to payroll amounts (Australia only)

You can assign jobs to pay items in an employee's pay to track the wage expense of work performed. You can assign one or more jobs to each pay item and enter the amount to allocate to each job.

When processing a pay run, click the arrow to expand the employee's pay.

Click Add job next to the applicable pay item. You'll only be able to add jobs to pay items with an amount.

Select one or more jobs to assign to this pay item and enter the Amount to assign against each job (up to the amount entered against the pay item).

Click Add.

Repeat to add jobs to any other pay item.

Continue processing your pay run as normal. Need a refresher?

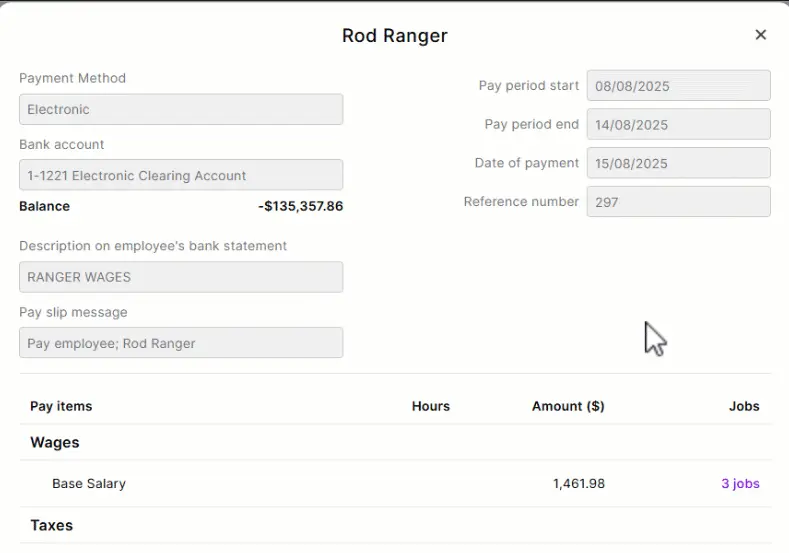

See jobs in past pays

When you look at an employee's past pay you'll see if any jobs were assigned and the job allocation. Just go to the Payroll menu > Pay runs > click the pay run > click the employee.

Jobs reporting. MYOB includes a number of reports to help you keep track of the income, expenses and profitability of your Jobs. See Jobs reports.

Jobs can be set up to track income and expenses related to service jobs. This is particularly useful when multiple jobs are performed for a single customer. When you enter a transaction, the appropriate job number can be assigned to each individual amount. This enables you to associate several jobs with the various amounts in a single transaction.

For example, if a sale includes parts for three different jobs, you can specify these jobs on the invoice. A profit and loss statement can then be prepared for each job.

Specific job-tracking tasks include:

linking jobs to specific customers

assigning jobs to individual line items on transactions

analysing the profit and loss of a job.

In AccountRight Standard, Plus and Premier you can also:

organise jobs in a hierarchy

set budgets for each job

track reimbursable expenses for your jobs and prepare invoices to reimburse job expenses (see Reimbursable expenses)

Job types

There are two types of jobs, header and detail.

Header jobs total associated detail jobs. You cannot assign transactions to header jobs.

Detail jobs are assigned to transactions to track income, costs and expenses. You can also link the job to a customer to invoice them for expense reimbursements.

Set up sub-jobs

You can set up jobs to track individual jobs that form part of a larger job. Note that sub-jobs can be either a detail or header type job.

To create a header job

Go to the Lists menu and choose Jobs. The Jobs List window appears.

Click New. The Job Information window appears.

Select Header Job.

Enter a job number, name and description. The job number can be 30 characters with letters or numbers.

If you want to create this job as a sub-job, type or make a selection from the Sub Job Of field.

Click OK. The header job appears in the Jobs List window.

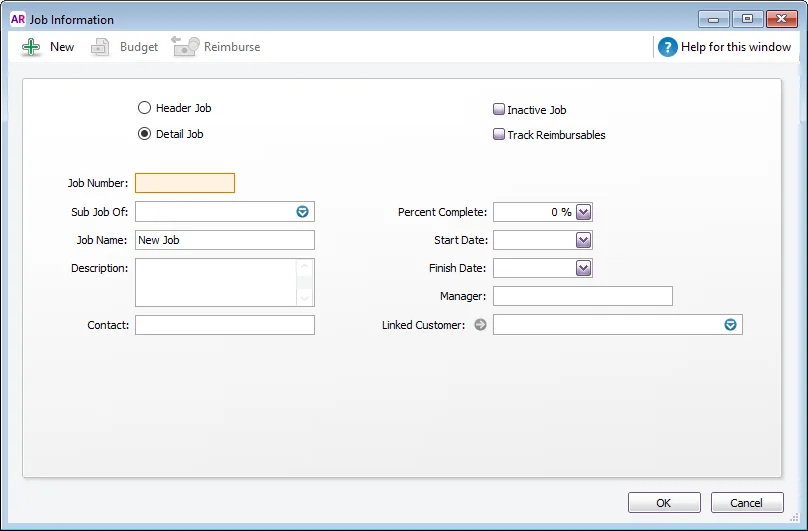

To create a detail job

Go to the Lists menu and choose Jobs. The Jobs List window appears.

Click New. The Job Information window appears.

Select Detail Job.

Type a code for the job in the Job Number field. This can be up to 30 characters with letters or numbers.

Enter a Job Name and Description for this job.

If you're setting up a sub-job, select the header job in the Sub Job Of field.

If the job has already started, enter a Percentage Complete.

The Percent Complete field controls the Adjusted Budget on the Jobs Budget Analysis report. For example, if you have a budget of $100 and the Percent Complete is 50% then the Adjusted Budget will be shown as $50. When a job is complete and you don't want to use it again, select the option, Inactive Job to stop it appearing in selection lists in the future.

(Optional) Enter a Contact, Start Date and Manager for this job. This information is for your records only and can be included in jobs reports.

If you want to link the job to a customer, select the customer in the Linked Customer field. If you track reimbursable expenses for the job, this enables you to invoice the customer for expense reimbursements. You can also view details of all jobs linked to a customer in the Jobs view of the customer’s card.

In AccountRight Standard, Plus and Premier, you need to select this option if you will seek reimbursement for goods and services purchased on the customer’s behalf.

Click OK. The Jobs List window reappears.

Review the jobs you have created. If you need to change the details of a job, select the job and click Edit.

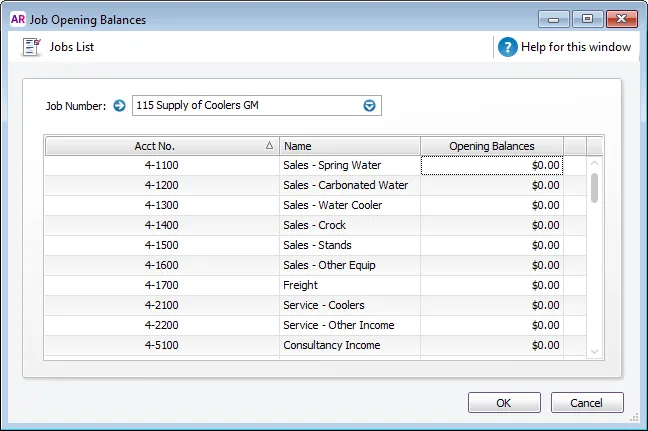

To enter opening balances for jobs

If you started using your AccountRight software while a particular job was in progress, you can create the job and then enter any account activity generated by the job so far in the Job Opening Balances window.

What about header jobs?

You can enter opening balances only for detail jobs. Header jobs take their balances from the detail jobs below them.

Go to the Setup menu, choose Balances and then Job Opening Balances. The Job Opening Balances window appears.

In the Job Number field, enter the job for which you want to enter an opening balance.

In the Opening Balances column, type the opening balances for each account.

Repeat from step 2 for each job with an opening balance.

Click OK when you have finished.

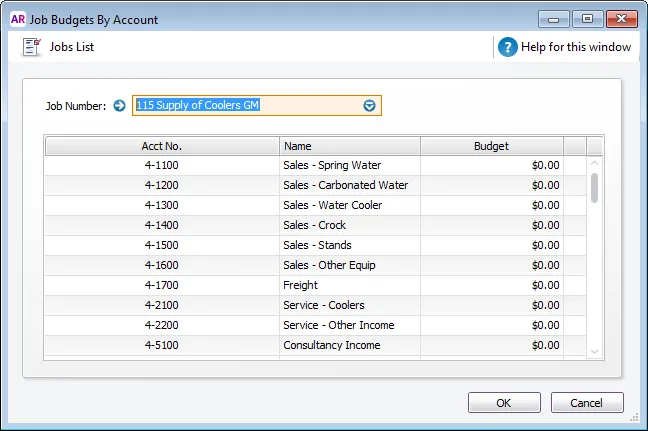

To enter budget amounts for jobs

You can enter budgets for detail jobs. The budget information you enter for each job is used to help you assess your progress on a particular job and to determine the job’s effect on the state of your business. The amounts you enter will be recorded against accounts in your accounts list for comparison purposes.

Once you begin recording transactions for the job, you will be able to print the Jobs Budget Analysis report to see a comparison between the actual amounts and the amounts you have budgeted for the job.

Jobs Budget Analysis - Before preparing this report, you should make sure the Percent Complete field in the Job Information window is up to date. The Percent Complete field controls the Adjusted Budget. If you have a budget of $100 and the Percent Complete is 50% then the Adjusted Budget will be shown as $50. The Difference column compares the Actual and Adjusted Budget amounts.

Go to the Lists menu and choose Jobs. The Jobs List window appears.

Select the detail job for which you want to enter budgets.

Click Budget. The Job Budgets By Account window appears, with the number of the job you selected in the Job Number field.

All your company’s income, cost of sales, expense, other income and other expense accounts appear in the scrolling list.

In the Budget column, type the amounts you’ve budgeted for specific accounts for this job and then click OK.

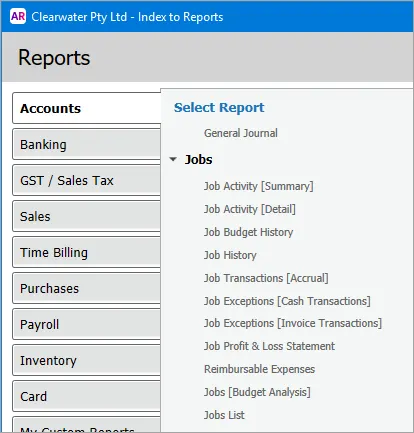

To analyse the profit and loss of a job

You can use the Jobs Profit & Loss report to view the profit and loss of selected jobs.

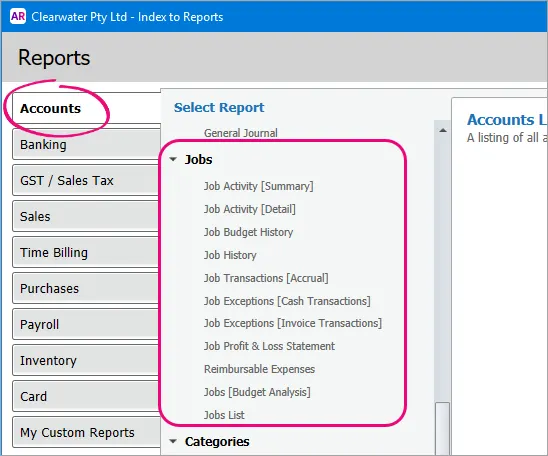

Go to the Reports menu and select Index to Reports. The Index to Reports window appears.

Click the Accounts tab.

In the list of reports that appears in the left column, locate the Jobs subheading, then select Job Profit & Loss Statement in the list below it.

Click Display. The Report window appears.

In the Filters tab, select the jobs to include in the report.

If you want to view the combined profit and loss for the selected jobs, select the Consolidated option.

Select the range of dates for which you want to produce the report.

Click Refresh Report. The filtering options you have selected are applied to the report.

If you want to print the report, click the Print icon ( ) in the toolbar at the top of the Report window.

There's plenty of other Job reports available under Reports > Index to Reports > Accounts tab > Jobs subheading. For descriptions of the Job reports, see Accounts reports.

To delete a job

Deleting a header job will also delete its detail jobs. Also, if a job is allocated to a transaction and you delete the job, the job will no longer be allocated to that transaction.

Go to the Lists menu and choose Jobs.

Click to highlight the job to be deleted.

Go to the Edit menu and choose Delete Job.

If a warning message is displayed, read what it says so you understand the consequences of deleting the job then click OK.

To hide a job

If you rarely, or no longer, use a job, you can hide it. Hiding a job will prevent it from appearing in selection lists.

You can only hide detail jobs, you cannot hide header jobs.

Go to the Lists menu and choose Jobs.

Click to highlight the job to be hidden.

Go to the Edit menu and select the Inactive Job option.

If a warning message is displayed, read what it says so you understand the consequences of hiding the job then click OK.

Click OK.

To set the same job for every line on an item purchase (only available with automated supplier invoices)

This feature is only available if you're using automated supplier invoices.

Tired of manually allocating every single job? With supplier feeds you can allocate one job code to multiple line items. Here’s how:

Go to the Purchases command centre and click In Tray.

Choose a supplier bill.

Click Create New Bill.

In the Set job field, choose your job.

All of your line items will be updated with the same job.

Report on your jobs

Use AccountRight's jobs reports to analyse your jobs (Reports menu > Index to Reports > Accounts tab). Learn more about job reports.

You can add and remove columns in these (and other) reports to show the job information you'd like. For example, add the Job Name or Job No. column to a sales report to see the jobs used in sales. Learn more about adding and removing report columns.