Last updated 2 May 2025

Each month we release improvements, new features and bug fixes to MYOB Business. You'll also notice these changes if you use AccountRight in a web browser. If you use AccountRight desktop software, see what's new.

See what's new without leaving MYOB Business

Click the help icon and look for the What's new link at the bottom of the help panel.

What we released in April

Payroll

Simplifying STP compliance (Australia only)

When you create a new MYOB Business file, the ATO Reporting Category is now set for you in these pay items:

Base Hourly

Base Salary

Annual Leave Pay

Personal Leave Pay

Overtime (1.5)

Overtime (2x)

This speeds up STP setup and prevents these payments from being reported incorrectly to the ATO.

Helping you stay compliant with super calculations (Australia only)

When you set up a new type of wage payment, like a new allowance, there's a new option to exclude those payments from super guarantee calculations. To help you choose, there's some handy info – just click the blue question mark.

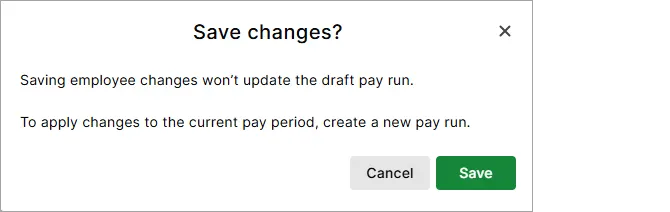

No longer lose a draft pay run when you update an employee (New Zealand only)

If you save changes to an employee who's included in a saved (draft) pay run, the draft pay run is no longer deleted. Instead, after saving the changes (which won't be reflected in the draft pay run), you'll see a message that explains it. It's then up to you whether you continue the draft pay run or create a new one. More about saving and resuming pay runs

Performance improvements

Smarter handling of uploaded documents

We're improving the Optical Character Recognition (OCR) that scans uploaded invoices and receipts to create new bills in MYOB Business. This improves the accuracy and processing times for uploads.

A fresh new colour

We've tweaked the purple colour you'll see in our logo and on images and buttons throughout MYOB Business.

Previous releases

To learn about changes to MYOB Business in previous releases, see MYOB Business release history.