There's two ways to pay an employee a bonus or commission:

include the payment on the employee's regular pay, or

process the payment in a separate pay (if this helps you or the employee keep track of these payments).

Tax on bonus and commission payments

When paying a bonus or commission, AccountRight treats the total gross pay as the employee's regular wage and taxes it accordingly. This means you'll need to calculate and manually adjust the PAYG withholding on the pay.

For the current rates of PAYG withholding on bonuses and commissions, check the ATO's tax tables or speak to your accounting advisor.

Setting up a bonus or commission

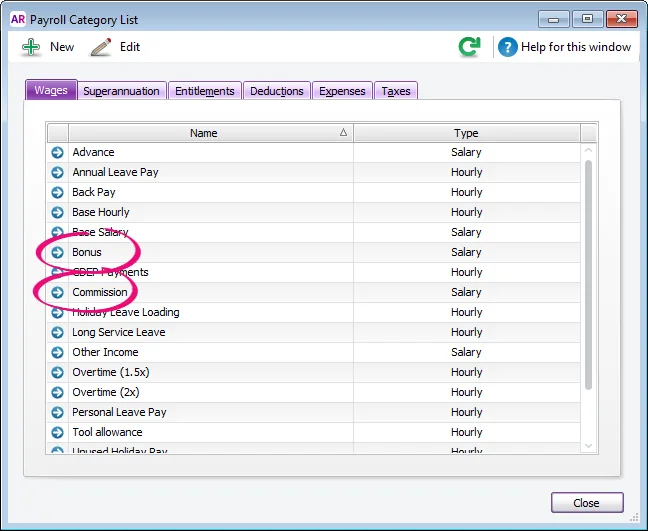

AccountRight comes with default Bonus and Commission payroll categories which you can assign to your employees (Payroll command centre > Payroll Categories > Wages tab).

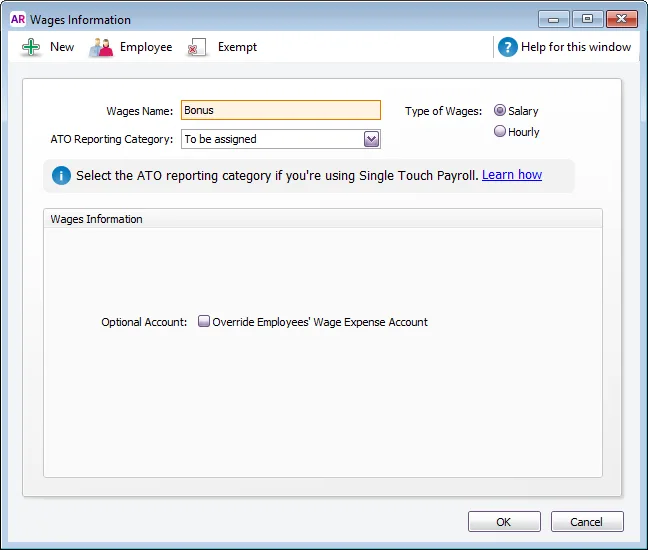

Click the blue zoom arrow to open a payroll category, or click New to create one (if the default ones aren't there). The default Bonus and Commission categories are set up the same way (the Type of Wages can be set to Salary, regardless of an employee's pay basis).

To ensure payments using this wage category are reported correctly to the ATO, choose the applicable ATO Reporting Category. If unsure, check with your accounting advisor or the ATO. Learn more about assigning ATO reporting categories for Single Touch Payroll reporting.

Here's an example:

If a bonus or commission is paid regularly, click Employee and select the employees who receive these payments. Or, you can add a payroll category to an employee's pay when completing the pay run (see the next task for details).

If a bonus or commission payment is the same amount each pay, you can add it to an employee's standard pay so it automatically appears on their pay (Card File command centre > Cards List> open the employee's card > Payroll Details tab > Standard Pay). Or, you can enter the amount when completing the pay run (see the next task for details).

Including a bonus or commission in a regular pay

Start a pay run (Payroll > Process Payroll).

Choose the employees you want to pay and confirm the Payment Date and Pay Period.

Click Next.

Click the zoom arrow to review the employee's pay.

If the Bonus or Commission wage category hasn't already been added to the employee:

Click Add Payroll Category.

Select the Bonus or Commission wage category.

Click OK.

Enter the payment in the Amount column against the Bonus or Commission wage category.

Adjust the PAYG Withholding value as required.

Finalise the pay as normal.

Processing a separate pay for the bonus or commission

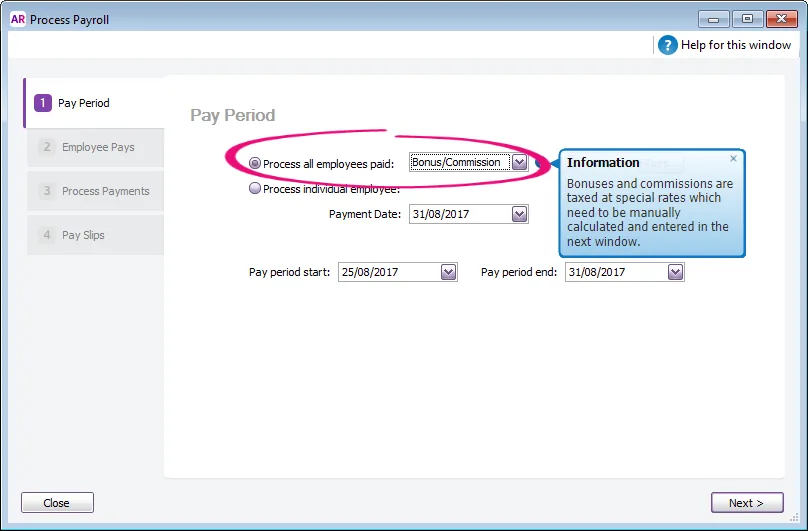

Start a pay run (Payroll > Process Payroll).

At the Process all employees paid field, select Bonus/Commission. Information is displayed about the need to manually calculate and enter the tax for this payment.

Confirm the Payment Date and Pay Period then click Next.

Click the zoom arrow to review the employee's pay.

If the Bonus or Commission wage category hasn't already been added to the employee:

Click Add Payroll Category.

Select the Bonus or Commission wage category.

Click OK.

Enter the payment in the Amount column against the Bonus or Commission wage category.

Adjust the PAYG Withholding value as required.

(Optional) Record information about the bonus or commission in the Memo field.

Finalise the pay as normal.

Superannuation on bonuses

Some bonus payments need to be included in your superannuation calculations. To clarify if your bonus payments should accrue super, check the ATO guidelines or speak to your accounting advisor.