New to payroll? Take a look at this handy guide to PAYG withholding.

Pay As You Go (PAYG) withholding is the tax that's calculated and withheld from your employees' pays.

In MYOB Business, the PAYG withholding pay item is used to calculate tax on employee pays. It uses the tax tables (or tax scales) provided by the ATO that are automatically applied in your pays. This pay item is automatically assigned to your employees.

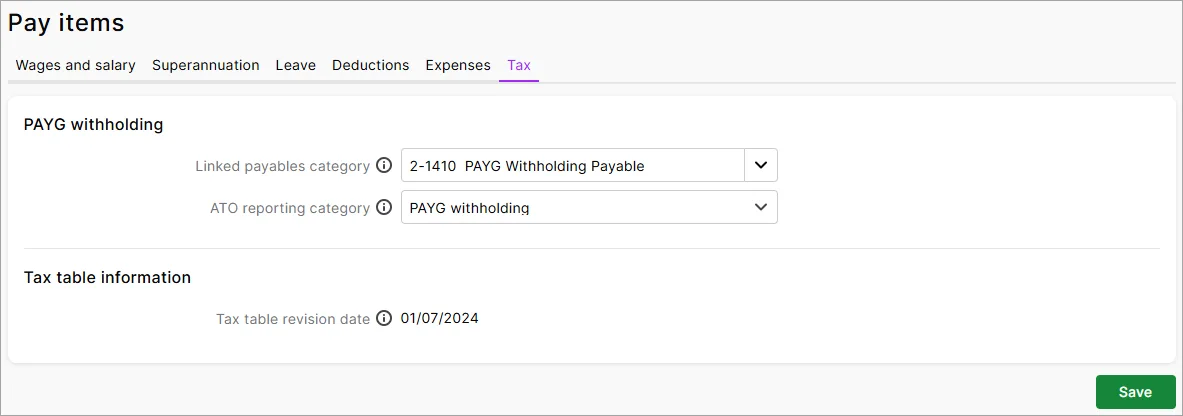

You can view the PAYG withholding pay item via the Payroll command centre > Pay items > Tax tab.

Looking for information on reporting your PAYG Income Tax Instalments? See Lodge your activity statement.

Setting up the PAYG withholding pay item

This pay item is set up for you so there's nothing you need to do. The only thing that can be changed is the Linked payables category. This is the category where the tax from your employees' pays accumulates. By default, this will be set to the PAYG Withholding Payable category and shouldn't be changed.

The balance of the Linked payables category is used to show the PAYG withholding balance on your MYOB Business dashboard.

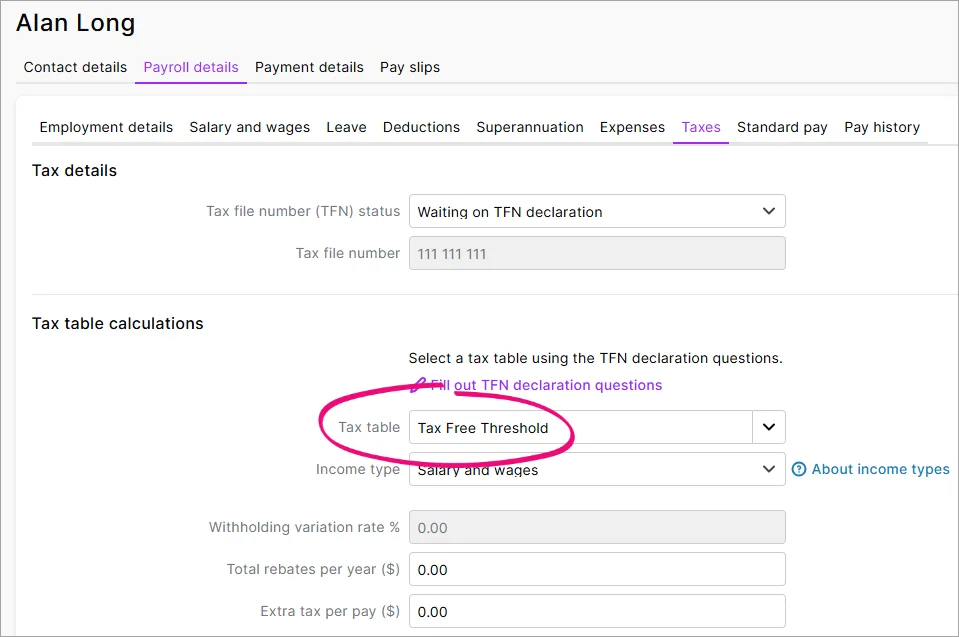

Assigning a tax table to an employee

For each employee, you need to specify which tax table applies to them. We can't tell you which tax table to assign, so if you're note sure you'll need to check with your payroll advisor or the ATO.

Go to the Payroll menu > Employees.

Click the employee to open their record.

Click the Payroll details tab > Taxes tab.

Choose the Tax table that applies to the employee and click Save.

FAQs

I think the PAYG is calculating incorrectly

Here are some things to check:

Are the most current tax tables being used?

Has the correct tax table been selected in the employee's record (Payroll > Employees > click the employee > Payroll details tab > Taxes tab)? Are any rebates or extra tax amounts showing as well?

Have wages or deductions been incorrectly made exempt from tax? Open a wage or deduction pay item (such as Base Hourly) and check the Exemptions – make sure the PAYG Withholding pay item isn't listed.

To confirm tax calculations, use this ATO PAYG tax calculator.

How do I handle PAYG Withholding Variations?

If an employee requires PAYG to be deducted at a flat rate (previously known as a 221D Variation), for example 20%, you need to assign the Withholding variation rate to the employee.

Go to the Payroll menu > Employees.

Click to open the employee's record.

Click the Payroll details tab > Taxes tab.

Click Fill out TFN declaration questions.

Select the option Has approved withholding variation then click Save.

Enter the Withholding variation rate.

Click Save.

How do I deduct extra PAYG for an employee?

If you need to deduct a set additional amount of PAYG from an employee's pay, you can enter the additional amount in the employee's record.

Go to the Payroll menu > Employees.

Click to open the employee's record.

Click the Payroll details tab > Taxes tab.

Enter the Extra tax per pay.

Click Save.

The calculated PAYG Withholding amount will now be increased by this amount in the employee's pays, and will be reported correctly to the ATO for Single Touch Payroll.

What is a tax rebate?

If an employee is claiming a tax rebate, you can enter the annual rebate value in the Total rebates per year field of their employee record (Payroll > Employees > click the employee > Payroll details tab > Taxes tab).

Amounts entered in this field reduce the tax payable over the year in instalments based on the employee’s pay frequency. For example, if the employee is paid monthly, 1/12th of the rebate is applied to each pay.

New to payroll? Take a look at this handy guide to PAYG withholding.

Pay As You Go (PAYG) withholding is the tax that's calculated and withheld from your employees' pays.

In AccountRight, the PAYG Withholding payroll category is used to calculate tax on employee pays. It uses the tax tables (or tax scales) provided by the ATO and downloaded automatically by AccountRight. This payroll category is automatically assigned to your employees.

You can view the PAYG Withholding payroll category via the Payroll command centre > Payroll Categories > Taxes tab.

Looking for information on reporting your PAYG Income Tax Instalments? See Lodge your activity statement.

The tax tables are already set up for you. If the government changes them, AccountRight will download the latest tax tables for you.

As part of Single Touch Payroll reporting, the ATO reporting category PAYG Withholding is automatically assigned to the PAYG Withholding payroll category and can't be changed.

For more information on ATO reporting categories, see Assign ATO reporting categories for Single Touch Payroll reporting.

How is PAYG calculated?

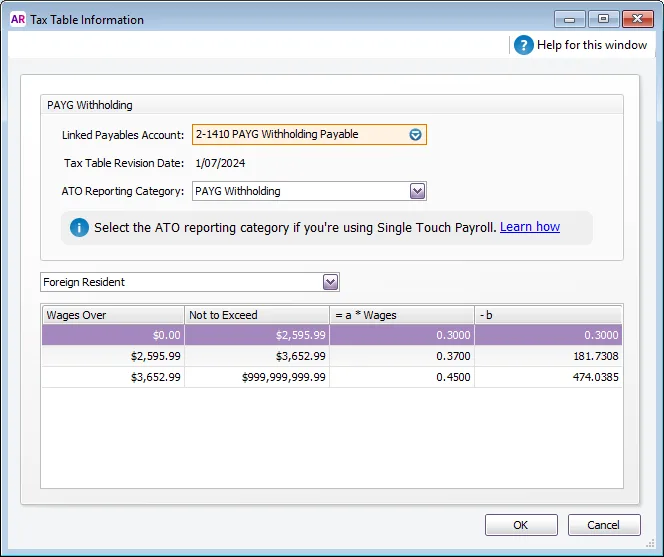

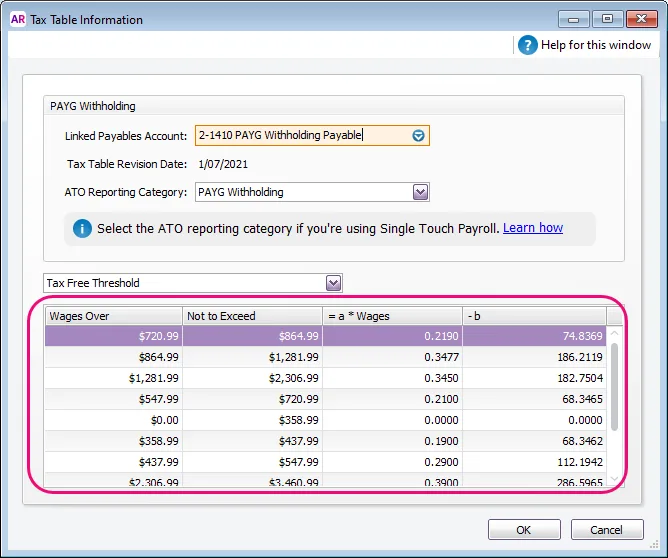

You don't need to worry about this bit, but if you're interested, here's how PAYG is calculated using the tax scales in the PAYG Withholding category (Payroll command centre > Payroll Categories > Taxes tab > click the blue zoom arrow to open the PAYG Withholding category).

PAYG withholdings = (Weekly wage amount x a) - b

Using the values shown in the screenshot above (which isn't using the latest tax tables) for an employee that has been assigned the Tax Free Threshold tax table and a fortnightly wage of $1500.

The calculation would be as follows:

Fortnightly wage = $1500

"a" coefficient = 0.3450

"b" coefficient = 182.7504

so, ($1500 x 0.3450) - 182.7504 = $334.7496

Note that when processing a pay using this example, the PAYG amount will be rounded to $334.75, or it might be different by a few cents if you've chosen to round the net pay (Setup menu > General Payroll Information).

The tax table information is set by the ATO. So, if you have any queries, please ask the ATO (or use their Tax Withheld Calculator).

Setting up the PAYG Withholding tax category

This pay item is set up for you so there's nothing you need to do. The only thing that can be changed is the Linked Payables Account. This is the account where the tax from your employees' pays accumulates. By default, this will be set to the PAYG Withholding Payable account and shouldn't be changed.

If you open your online company file in a web browser, the balance of the Linked Payables Account is used to show the PAYG withholding balance on your dashboard.

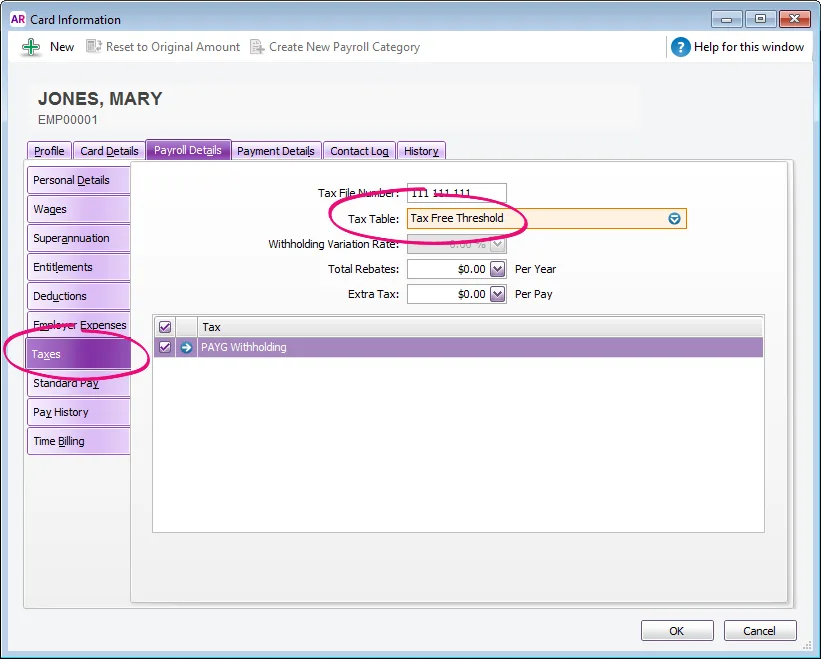

Assigning a tax table to an employee

For each employee, you need to specify which tax table applies to them. We can't tell you which tax table to assign, so if you're note sure you'll need to check with your payroll advisor or the ATO.

Go to the Card File command centre > Cards List.

Click the Employee tab.

Click to open an employee's card.

Click the Payroll Details tab > Taxes tab.

Choose the Tax Table that applies to the employee and click OK.

FAQs

I think the PAYG is calculating incorrectly

Here are some things to check:

Are the most current tax tables being used?

Has the correct tax table been selected in the employee's card (Card Information window > Payroll Details tab > Taxes tab)? Are any rebates or extra tax amounts showing as well?

Is the difference less than $1? PAYG is always rounded up to the nearest dollar (unless you're rounding the net pay - see the next point).

Have you chosen to round the net pay (Setup menu > General Payroll Information)? The PAYG amount will be adjusted to make the rounding work. For example, if you enter 100 as the rounding selection, the PAYG will be adjusted so that the net pay is rounded to a full dollar.

Have wages or deductions been incorrectly made exempt from tax? Open a wage or deduction payroll category (such as Base Hourly), click the Exempt button at top of the window, and check that the PAYG Withholding category is not selected.

To confirm tax calculations, use this ATO PAYG tax calculator.

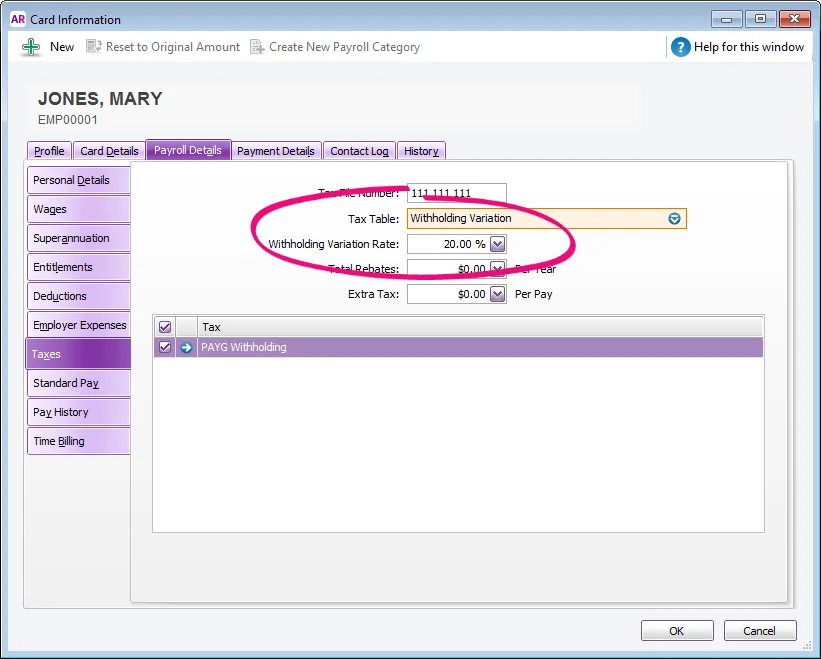

How do I handle PAYG Withholding Variations?

If an employee requires PAYG to be deducted at a flat rate (previously known as a 221D Variation), for example 20%, you need to assign the Withholding Variation tax table to the employee's card.

Open the Card File and edit the employee's card.

Select the Payroll Details tab.

Select the Taxes tab.

Select the Withholding Variation tax table.

Enter the rate in the Withholding Variation Rate field.

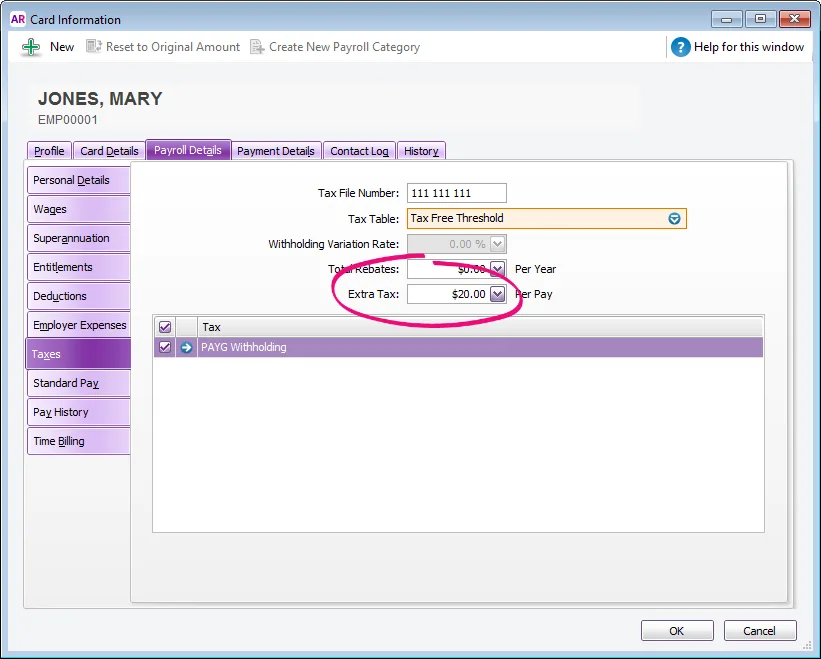

How do I deduct extra PAYG for an employee?

If you need to deduct a set additional amount of PAYG from an employee's pay, you can enter the additional amount in the employee's card.

Open the Card File and edit the employee's card.

Select the Payroll Details tab.

Select the Taxes tab.

Enter the extra PAYG deduction amount in the Extra Tax field.

Click OK.

The calculated PAYG Withholding amount will now be increased by this amount in the employee's pays, and will be reported correctly to the ATO for Single Touch Payroll.

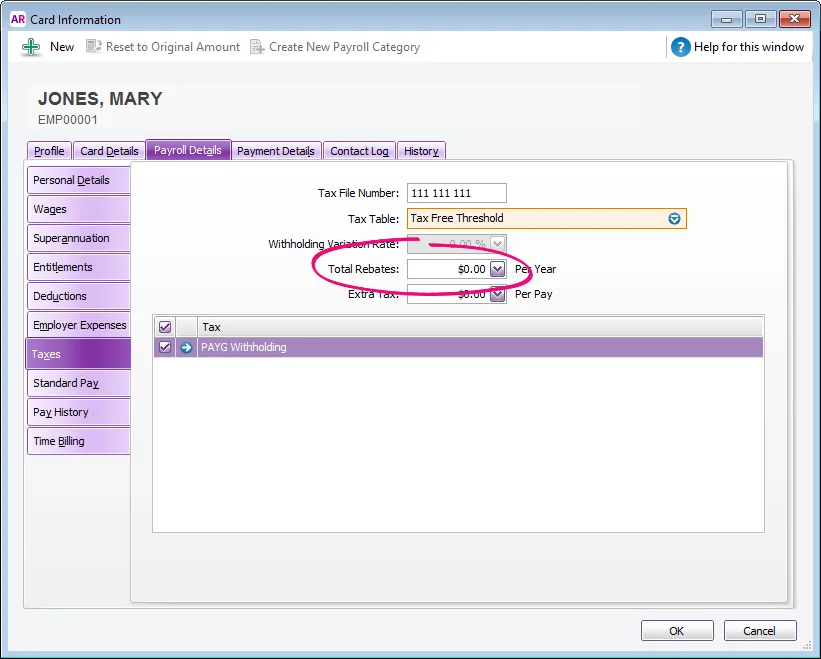

What is a tax rebate?

If an employee is claiming a tax rebate, you can enter the annual rebate value in the Total Rebates field of their employee card.

Amounts entered in this field reduce the tax payable over the year in instalments based on the employee’s pay frequency. For example, if the employee is paid monthly, 1/12th of the rebate is applied to each pay.