AccountRight Plus and Premier only

If you've paid an employee too much or not enough, you can:

adjust the employee's next pay, or

process a separate pay for the adjustment.

If an employee is owed money due to a wage increase, see back pay.

Using Single Touch Payroll?

Only year to date (YTD) amounts are sent to the ATO as part of Single Touch Payroll reporting. If your pay adjustment affects YTD amounts, the updated amounts will be sent with your next pay run.

To fix an overpayment

Check the rules

For all the rules about handling overpayments, see this Fair Work information.

To adjust the employee's next pay

When you process the next pay for the employee, reduce the hours or amounts for the wage category that was overpaid. This will also adjust their PAYG and super amounts accordingly.

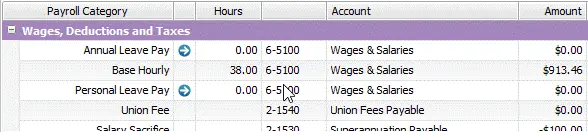

For example, if you've overpaid an hourly-based employee 8 hours of normal time, reduce the Base Hourly wage category on their following pay by 8 hours.

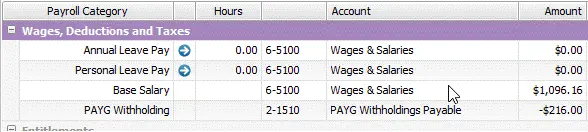

Similarly, if you've overpaid a salaried employee $100, reduce the Base Salary amount on their following pay by $100.

To process a separate pay for the adjustment

Start a new pay run for the employee and enter the adjustment as a negative (-) amount in the Hours or Amount column of the category that was overpaid. Remember to zero out all the categories that you're not adjusting. The net pay amount should be equal to the overpayment, and shown as a negative amount. You can also use the Memo field on the pay to enter a note about this payment.

For example, if you've overpaid an hourly-based employee 8 hours of normal time, record a pay with -8 hours in the Base Hourly wage category.

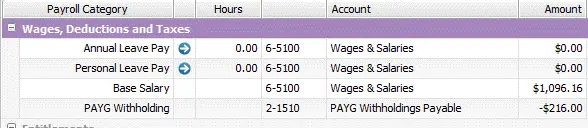

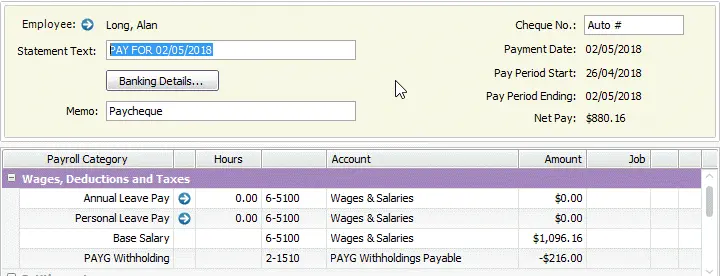

Similarly, if you've overpaid a salaried employee $100, record a pay with -$100 in the Base Salary wage category.

When recording a pay with a negative net pay amount, the payment method is automatically changed to Cash and the linked bank account for cash payments will be used. This can't be changed.

To fix an underpayment

To adjust the employee's next pay

When you process the next pay for the employee, increase the hours or amounts for the wage category that was underpaid. This will also adjust their PAYG and super amounts accordingly.

For example, if you've underpaid an hourly-based employee 8 hours of normal time, increase the Base Hourly wage category on their following pay by 8 hours.

Similarly, if you've underpaid a salaried employee $100, increase the Base Salary wage category amount on their following pay by $100.

To process a separate pay for the adjustment

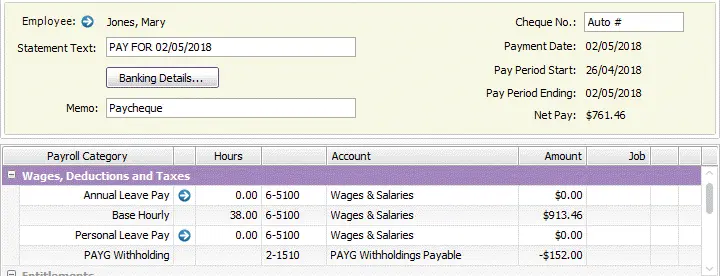

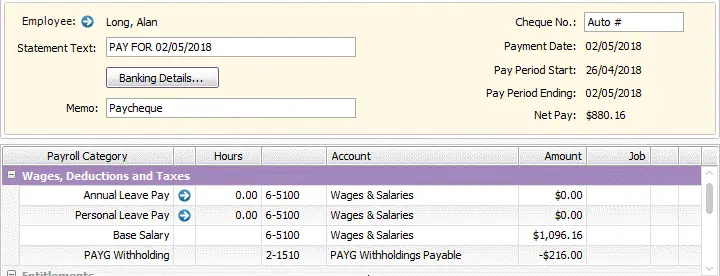

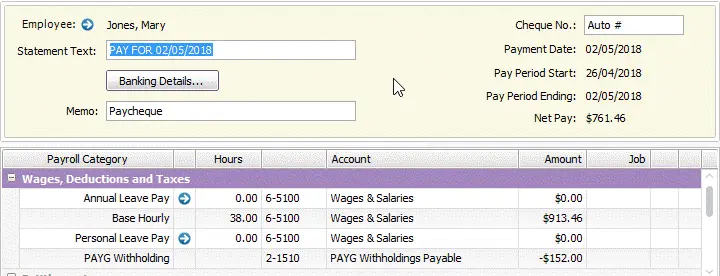

Start a new pay run for the employee and enter the adjustment amount in the Hours or Amount column of the category that was underpaid. Remember to zero out all the categories that you're not adjusting. The net pay amount should be equal to the underpayment. You can also use the Memo field on the pay to enter a note about this payment.

For example, if you've underpaid an hourly-based employee 8 hours of normal time, record a pay with 8 hours in the Base Hourly wage category.

Similarly, if you've underpaid a salaried employee $100, record a pay with $100 in the Base Salary wage category.

FAQs

What if the employee pays back an overpayment?

If the employee has paid back an overpayment, or is intending to do so, we recommend processing a separate pay for the adjustment as described above.

This lets you match the payment by the employee to the overpayment in your bank reconciliation.

How does a pay adjustment affect tax calculations?

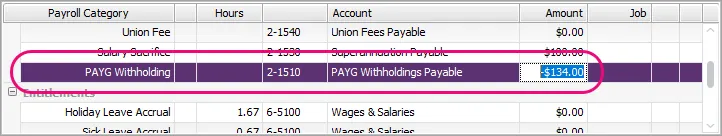

When paying an employee, AccountRight treats the total gross pay as the employee's regular wage and taxes it accordingly. This means when you process a pay adjustment, you might need to adjust the PAYG withholding on the pay.

If unsure, check with your accounting advisor or the ATO about calculating and adjusting the tax amount.