AccountRight Plus and Premier only

Salary sacrifice super

If an employee wants to salary sacrifice part of their pay for superannuation, see Set up salary sacrifice superannuation.

In some industries and professions, items such as cars, phones and laptops can be salary sacrificed (sometimes called salary packaging).

The example we'll use below is a business which purchases a laptop computer for an employee. Repayments for the laptop are then deducted from the employee's pay until the laptop is paid in full.

Here's how you can handle this salary sacrifice arrangement in AccountRight:

Allocate the purchase of the item being sacrificed to a Salary Sacrifice liability account.

Set up a salary sacrifice deduction and link it to this account.

Record the employee's pay with the salary sacrifice amount deducted from their pay. The amount offsets the payable liability account.

If the salary sacrifice is "paying off" a purchased item, over time the salary sacrifice deducted from the employee's pay will provide a full reimbursement for the purchase of the item.

While this example might not apply to your scenario, the same approach can be used for any salary sacrifice arrangement (see the FAQs below for another scenario). If an employee simply needs to pay back an amount they owe you, see Wage advances and employee loans.

It might be a good idea to also get help from your accounting advisor to work through the specifics of your salary sacrifice or salary packaging arrangements.

Setting up a salary sacrifice agreement

Start by creating a salary sacrifice liability account and a deduction category for each item being sacrificed.

Set up a salary sacrifice liability account

Go to the Accounts command centre and click Account List.

Click the Liability tab.

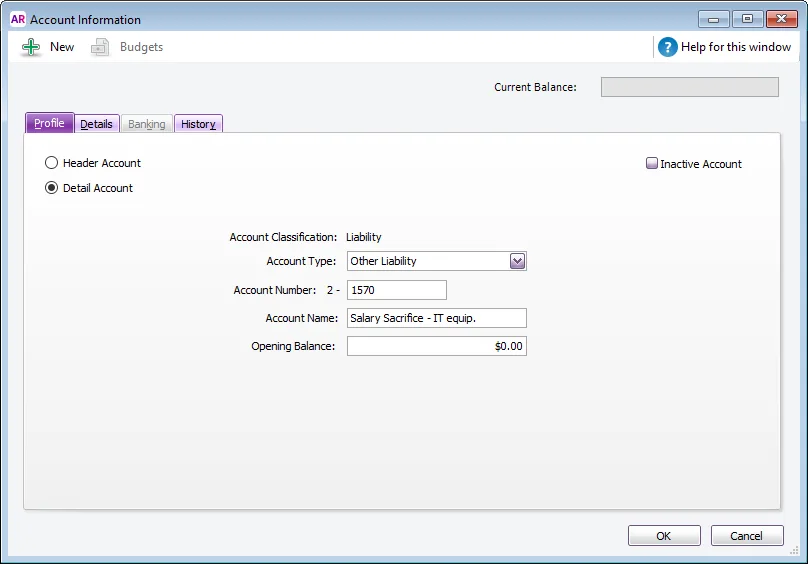

Click New. The Account Information window is displayed.

Set up the ledger account, enter an Account Number and Account Name that best suits your Accounts List and purpose.

Here's an example:

Click OK. You'll be prompted to link the account to a tax code. If you're not sure what tax code to select, consult your accounting advisor.

Set up a deduction category

Go to the Payroll command centre and click Payroll Categories.

Click the Deductions tab.

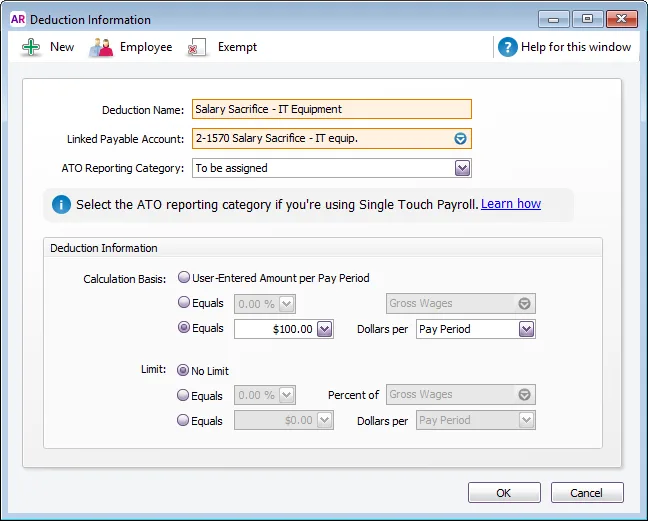

Click New. The Deduction Information window is displayed.

Give the deduction a name and then set the Linked Payable Account to the salary sacrifice liability account set up in the previous procedure.

If applicable, choose the ATO reporting category (for Single Touch Payroll reporting). Salary sacrifice deductions that are exempt from fringe benefits tax are generally not reportable. For clarification on which ATO Reporting Category to choose for your deductions, check with your accounting advisor or the ATO. For more information, see Assign ATO reporting categories for Single Touch Payroll reporting.

Set up how to calculate the deduction. If you need to:

enter the amount on each pay, or in the employee's standard pay, select User-Entered Amount per Pay Period.

calculate the deduction as a percentage of the employee's pay, select Equals x% of Gross Wages, or the most appropriate category.

If you have employees that need to sacrifice using different percentages, you'll need to set up separate deduction categories for each rate.

enter a fixed amount on each pay, for all employees linked to this category, select Equals $x Dollars per Pay Period.

Click Employee and select the employees to whom the salary sacrifice AND calculation basis applies.

If it's a pre-tax deduction (which will be deducted from the employee's gross pay), click Exempt and select the PAYG Withholding category.

Click OK to save your payroll category.

Processing the salary sacrifice transactions

In our scenario, the business purchases the laptop (recorded using a Spend Money transaction), then the repayments are sacrificed from the employee's pay.

Purchase the item that's being salary sacrificed

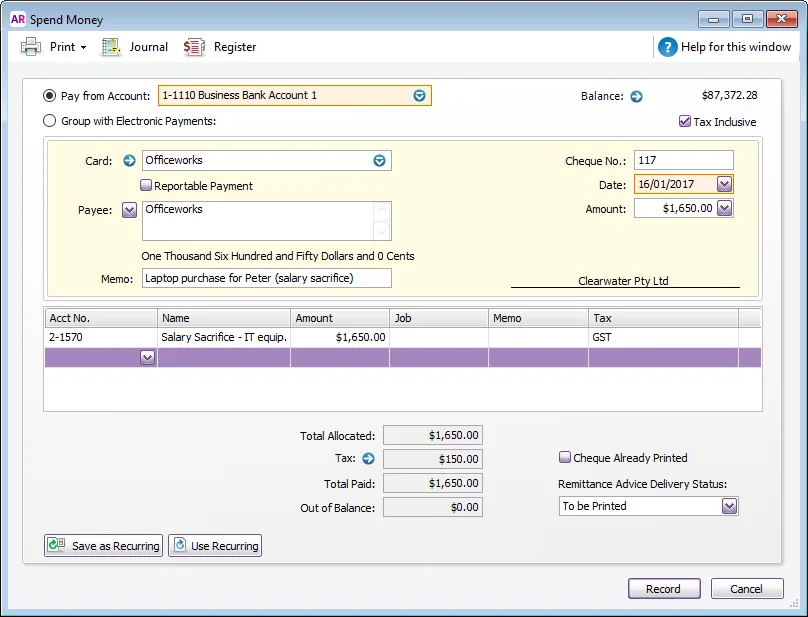

Go to the Banking command centre and click Spend Money.

Set the Card field to the supplier, or if reimbursing the employee, your employee.

Enter the transaction details including the amount.

Set the Acct # field to the liability account you set up above.

Click Record.

In the example above:

The laptop has been purchased from a supplier, and the GST Tax Code has been used as this business is able to claim an input tax credit.

The tax exclusive value of the purchase is $1500. This represents the total salary sacrifice amount to be deducted from the employee's pay.

Note:

Apply the GST tax code if the business can claim the GST input tax credit for the purchase. Similarly, apply the N-T tax code if the purchase isn't to be reported on the BAS.

Your accountant or the ATO will be able to confirm your GST liabilities on items purchased for the purpose of salary sacrifice.

Where a business claims the GST input tax credit, the item's GST exclusive price becomes the total salary sacrifice amount to be deducted from the employee's pay.

Record a pay with a salary sacrifice deduction

When recording a pay (need a payroll refresher?), the deduction will automatically be calculated, as in the example below.

If the amount is incorrect, check the setup of the salary sacrifice deduction category, or the amount entered on the employee's standard pay.

FAQs

How can I tell when the salary sacrifice amount has been repaid?

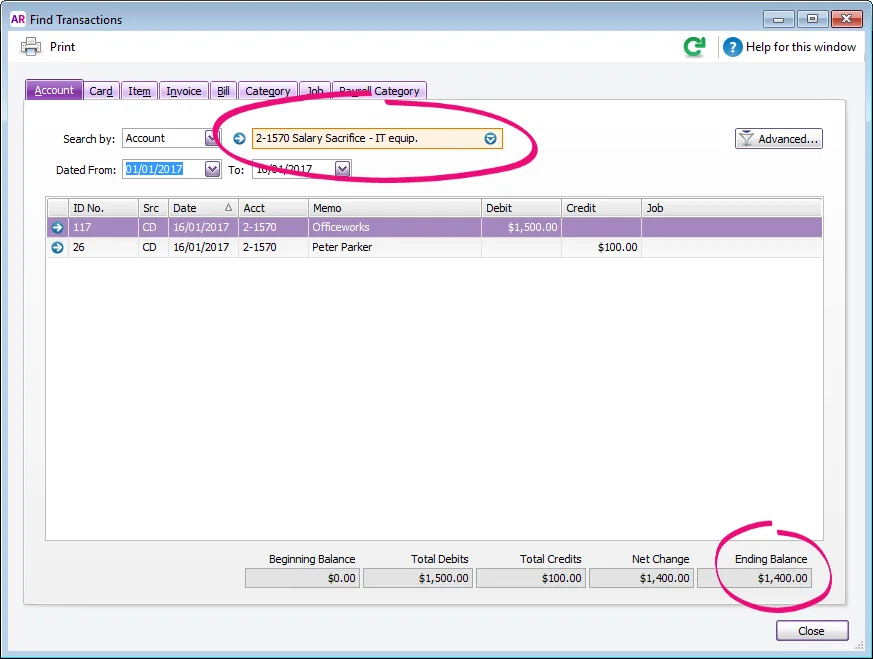

Use the Find Transactions window to keep track of the Salary Sacrifice liability account balance as this will show how much is still to be paid by the employee. The balance of this account is reduced each time a pay is recorded, and eventually the Ending Balance will become zero.

To check the balance outstanding:

Click Find Transactions along the bottom of any command centre.

In the Search by field, select Account and specify the Salary Sacrifice liability account.

In the Dated From and To fields, specify a date range which spans the Salary Sacrifice liability account's life activity, in other words from when the salary sacrifice began up to the current date.

The Ending Balance will be displayed.

In the example below, there $1400 left for the employee to pay for the laptop.

What do I do when the salary sacrifice amount has been repaid?

When the item has been repaid, you can unlink the deduction payroll category for the employee:

Go to the Payroll command centre and click Payroll Categories.

Click the Deductions tab.

Click the zoom arrow next to the Salary Sacrifice deduction category.

Click Employee and deselect the employee to whom the salary sacrifice applied.

Click OK.

When processing your next pay run, the salary sacrifice deduction will no longer appear for the employee's pay.

What if salary sacrifice payments need to go to a third party?

If your employee's salary sacrifice deductions are to pay a third party, you can still set up and process the salary sacrifice using the above scenario as a guide.

You can then use the Pay liabilities feature to process the deductions and clear the liability account. You can then remit the payments to the third party using one of their preferred payment methods.