Key points

-

Deductions are amounts withheld from employee pays (other than taxes) and paid to a third party, such as child support payments

-

Deductions are set up as pay items and assigned to your employees to be included in their pays

-

You can set up one deduction for multiple employees, or individual employee deductions

-

For the rules governing workplace deductions, the Fair Work website is a good place to start.

Before or after tax deductions?

If you're not sure whether a deduction is pre-tax or post-tax, check with your accounting advisor or the ATO.

There's a handful of deduction pay items which come with MYOB, including a Union Fee and One-Time Deduction. You can customise these to suit your needs and assign them to your employees, or create new deductions from scratch.

To set up a deduction

Go to the Payroll menu and choose Pay items. The Pay items page appears.

Click the Deductions tab.

Click to open an existing deduction, or click Create deduction pay item to create a new one.

Enter a Name for the deduction.

If you'd like a different, more personalised, name to show on pay slips for this earning, enter a Name for pay slip, such as "Union fees - Steven". If you leave this blank, the pay item Name will display instead.

Choose the Linked payable category.

What's a linked payable category?

This is the category (usually a liability category) in which all the deducted money will be accrued. The Default Tax/Deductions Payable Category you specified when setting up payroll appears as the default. You can change this default if you want to track the deduction separately. For example, if you're deducting union fees, create a Union Fees Payable liability category. This way, the balance sheet will display the deductions separately from your PAYG Withholding and other deductions.

Choose the ATO reporting category for this deduction. If you're not sure, check with your accounting advisor or the ATO. Learn about assigning ATO reporting categories for Single Touch Payroll.

Choose the Calculation basis.

User-entered amount per pay period - Select this option if you want to manually enter a specific amount for each employee each time you pay them. Note that manually entered deductions should be entered as negative values.

Equals a percentage of a pay item - This option allows you to enter a percentage of any of the wage pay items. This amount will be deducted until the deduction Limit (see below) is reached.

Select a wage pay item upon which the calculation is to be based. Alternatively, you can select Gross Wages or Federal Wages, which totals all wage pay items (hourly and salary) you pay an employee.Equals dollars per pay period - This option allows you to deduct the specified amount per pay period, per month, per year or per hour. This amount will be deducted until the Limit (see below) is reached.

Choose an applicable Limit.

No limit - signifies no limit on the amount of money that can be deducted from the employee’s pay for this category.

Equals a percentage of wages - results in the maximum deduction amount being a percentage of a wage pay item. For example, a deduction might be $50 per pay period up to a maximum of 50% of the employee’s base salary. Gross Wages and Federal Wages are also available here which total all wage pay items (hourly and salary) you pay an employee.

Equals dollars per pay period - results in the maximum deduction being a fixed dollar amount per pay period, per month or per year. For example, a deduction might be 10% of the employee’s gross wages up to $1,500 per year.

Under Allocate employees, choose the employees who require this deduction. To remove an employee, click the delete icon for that employee.

Under Exemptions, choose any taxes that shouldn't be calculated on this deduction. For example, if it's a pre-tax deduction, choose PAYG Withholding. If you're not sure if the deduction should be pre- or post-tax, check with your accounting advisor or the ATO.

When you're done, click Save.

To process a pay with the deduction

After you've set up a deduction and assigned it to one or more employees, it'll appear in their pay. Let's take a look:

Go to the Create menu and choose Pay run.

Choose the Pay cycle and confirm the pay dates.

Click Next.

Click the employee to open their pay details.

If required, enter or change the deduction amount for this pay.

Continue processing the pay as normal. Need a refresher?

Amounts deducted are allocated to your payroll deductions category, ready to be paid to the applicable third party. See the FAQ below for more info.

FAQs

What happens to the deducted money?

Money deducted from employee pays needs to be paid to the applicable third party. For example, deducted union fees need to be paid to the applicable union. Check with the third party regarding their accepted payment methods.

After you've made the payment, you can record it in MYOB using a spend money transaction (Banking menu > Spend money).

When recording the transaction:

In the Bank account field choose the bank account the payment is coming from.

In the Contact field choose the organisation the payment went to (you can set up a supplier for this purpose).

In the Category field choose the MYOB Payroll Deductions category.

Do I have to set up deductions for PAYG and superannuation?

No. These amounts are automatically calculated on your employees' pays so you don't need to set up deductions for them.

Learn more about Taxes and Superannuation.

What if I deducted the wrong amount from a pay?

If you've deducted the wrong amount from an employee's pay, you can fix it in the employee's next pay. Here's all the details.

AccountRight Plus and Premier, Australia only

Deductions are the amounts withheld from employee pays (other than taxes), that are then forwarded on to an authority or other organisation.

For example, employees might pay a union fee out of their wage. The fees are then forwarded on to the union.

Here are some more specific scenarios which might help:

ETP payments where you need to track the amount of tax you withhold

Before or after tax deductions?

If you're not sure whether a deduction is pre-tax or post-tax, check with your accounting advisor or the ATO.

To set up a deduction

Go to the Payroll command centre and click Payroll Categories. The Payroll Category List window appears.

Click the Deductions tab.

If the deduction you want to set up already exists, open the category. Otherwise, click New and give the deduction a name.

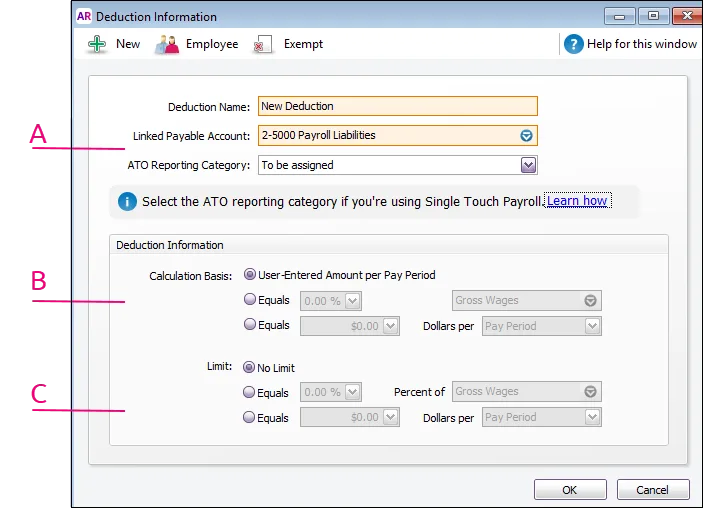

Make the required selections in the window.

A - Linked Payable Account - is the account (usually a liability account) in which all the deducted money will be accrued. The Default Tax/Deductions Payable Account you specified when setting up payroll appears as the default.

You can change this default if you want to track the deduction separately. For example, if you are deducting union fees, create a Union Fees Payable liability account. This way, the balance sheet will display the deductions separately from your PAYG Withholding and other deductions.

Also choose the ATO Reporting Category for each deduction category. If unsure, check with your accounting advisor or the ATO.

Learn more about assigning ATO reporting categories for Single Touch Payroll reporting.B - Calculation Basis - can be one of the following choices:

User-Entered Amount per Pay Period - should be selected if you want to manually enter a specific amount for each employee, each pay period or if you want to use the amount you have entered in an employee’s standard pay details. Note that manually entered deductions should be entered as negative values.

Equals x Percent of - allows you to enter a percentage of any of the wage categories. This amount will be deducted until the deduction limit (see below) is reached.

Type or select a wage category upon which the calculation is to be based. Alternatively, you can select Gross Wages or Federal Wages, which totals all wage categories (hourly and salary) you pay an employee.Equals x Dollars per - allows you to deduct the specified amount per pay period, per month, per year or per hour. This amount will be deducted until the limit (see below) is reached.

C - Limit - may be one of the following choices:

No Limit - signifies no limit on the amount of money that can be deducted from the employee’s pay for this category.

Equals x Percent of - results in the maximum deduction amount being a percentage of a wage category. For example, a deduction might be $50 per pay period up to a maximum of 50% of the employee’s base salary. The special categories of Gross Wages and Federal Wages is also available here (refer to discussion in ‘Equals x Percent of’, above).

Equals x Dollars per - results in the maximum deduction being a fixed dollar amount per pay period, per month or per year. For example, a deduction might be 10% of the employee’s gross wages up to $1,500 per year.

Click Employee. The Linked Employees window appears.

Select the employees whose pay will include this category, then click OK.

If it's a pre-tax deduction (which means it'll be deducted from the employee's gross pay), click Exempt and select the PAYG Withholding category. If you're not sure if the deduction should be pre- or post-tax, check with your accounting advisor or the ATO.

Click OK.

Click OK to return to the Payroll Category List window.

The deduction category will now appear for the selected employees when you complete your next pay run. When you're ready to pay the authority (or whoever the payment was deducted for), you can record the transaction using Pay Liabiltiies.

To delete a deduction category

You can only delete a deduction category if it hasn't been used in an employee's pay.

Go to the Lists menu and choose Payroll Categories.

Click the Deductions tab.

Click the zoom arrow to open the deduction category to be deleted.

Go to the Edit menu and choose Delete Deduction.

FAQs

Can I set up a deduction to pay additional HECS/HELP repayments?

You can set up a deduction (as described above) to deduct additional HECS (now called HELP) repayments from an employee's pay. These repayments will be in addition to compulsory HECS/HELP repayments (which are deducted automatically and included in an employee's PAYG Withholding when they are assigned a tax table with HELP in the description).

Use the Pay Liabilities feature in AccountRight to process deducted amounts, then pay them to the ATO using BPAY, credit card or direct credit.

See the ATO guidelines to learn more about voluntary repayments.

What are Federal Wages?

Federal wages are the total amount of all wage categories assigned to an employee, except those wage categories which are exempt from PAYG Withholding.

If you're not sure whether to use Gross Wages or Federal Wages in your deduction calculation, check with the ATO or your accounting advisor.