AccountRight Plus and Premier only

Salary packaging (sometimes called salary sacrificing or total remuneration packaging) is a business-specific arrangement which can be implemented in various ways.

It might simply be where an employee's salary includes a base wage plus a phone and laptop. The employee doesn't own the phone and laptop, nor are they paying them off - they're simply provided as part of the job.

Another way a salary package might be implemented is where part of an employee's salary is deducted to pay for items or services. With this type of arrangement, the employee is simply sacrificing part of their salary to pay for something, like a car, a house, or school fees.

What we'll cover in this topic

There isn't a one-size-fits-all approach to salary packaging. We'll explain how to set up a salary package where deductions are taken from an employee's salary to pay for a phone and laptop.

Things can get tricky

Your salary packaging requirements will be specific to your business, so it's a good idea to check the ATO guidelines about the tax implications. The scenario we cover might not meet your needs, so it's best to check with your accounting advisor about the best solution for you.

Setting up a salary package

For each item being packaged, create a liability account and a deduction category.

Set up a liability account

You'll need a liability account for each item in the salary package. This helps you keep track of how much has been deducted for each item.

Go to the Accounts command centre and click Account List.

Click the Liability tab.

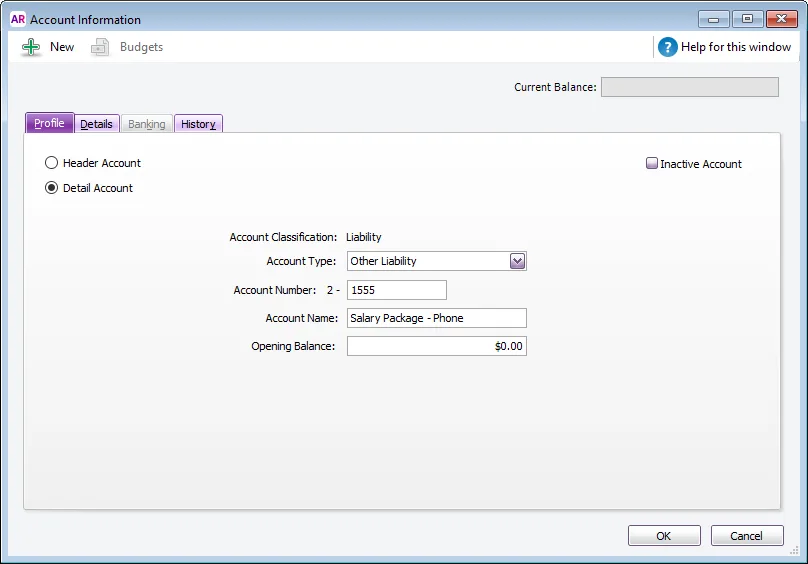

Click New. The Account Information window is displayed.

Set up the ledger account, enter an Account Number and Account Name that best suits your Accounts List and purpose.

Here's an example:

Click OK. You'll be prompted to link the account to a tax code. If you're not sure what tax code to select, consult your accounting advisor.

Repeat for each item in the salary package.

Set up a deduction payroll category

You'll need a deduction payroll category for each item in the salary package. This will clearly show how much of the employee's pay is being deducted for each item.

Go to the Payroll command centre and click Payroll Categories.

Click the Deductions tab.

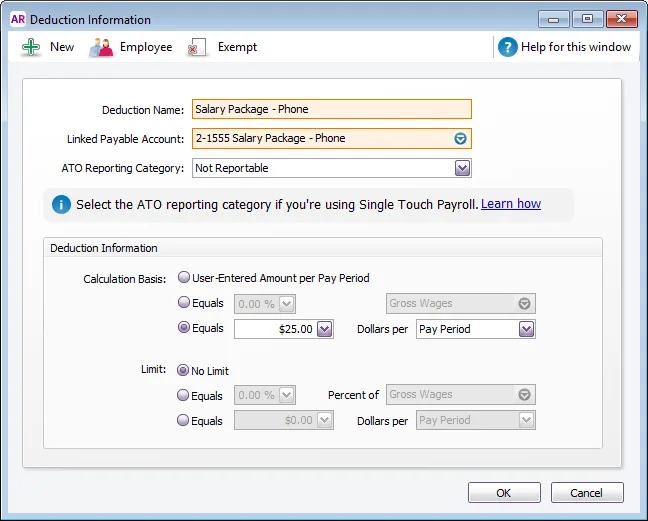

Click New. The Deduction Information window is displayed.

Give the deduction a name and then set the Linked Payable Account to the matching liability account created above.

If applicable, choose the ATO reporting category (for Single Touch Payroll reporting). Deductions that are exempt from fringe benefits tax are generally not reportable. For clarification on which ATO Reporting Category to choose for your deductions, check with your accounting advisor or the ATO. For more information, see Assign ATO reporting categories for Single Touch Payroll reporting.

Set up how to calculate the deduction. If you need to:

enter the amount on each pay, or in the employee's standard pay, select User-Entered Amount per Pay Period.

calculate the deduction as a percentage of the employee's pay, select Equals x% of Gross Wages, or the most appropriate category.

enter a fixed amount on each pay, select Equals $x Dollars per Pay Period.

Here's our example where $25 will be deducted each pay:

Click Employee and select the applicable employee.

If it's a pre-tax deduction (which will be deducted from the employee's gross pay), click Exempt and select the PAYG Withholding category. If you don't select this option, the deduction will be from the employee's net pay (after tax).

Click OK to save your payroll category.

Repeat to set up additional deduction categories for each item in the salary package.

If you've purchased the items in an employee's salary package, the employee's deductions are repaying you for those items.

If this is the case, record the purchase of the item as a Spend Money transaction and allocate it to the item's liability account. For more details see Salary sacrificing.

Processing a pay with salary packaging

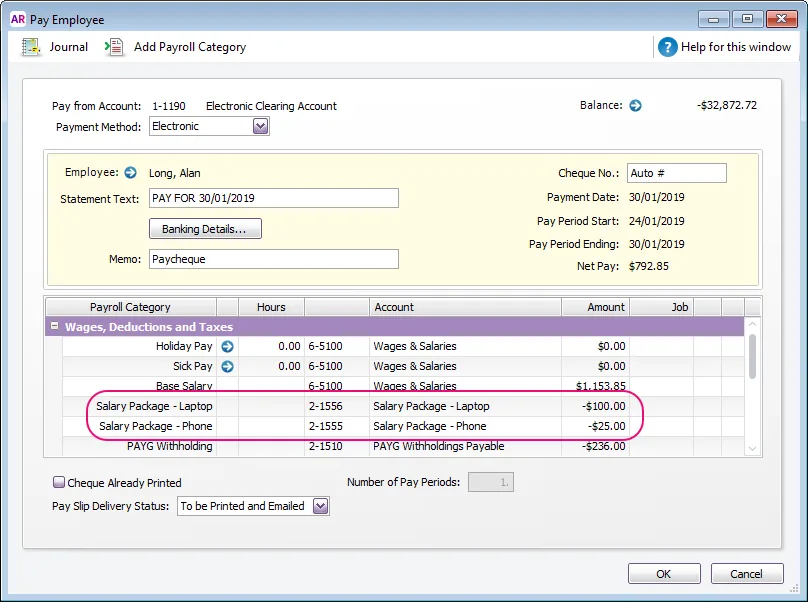

When recording a pay, the deductions will be listed as shown in our example. If the amounts vary each pay, enter the amounts here.

If a deduction amount is wrong, check the setup of the deduction category, or the amount entered on the employee's standard pay.

FAQs

What do I do when a salary packaged item is paid in full?

When the employee has paid for an item in full, you can unlink the deduction payroll category for the employee:

Go to the Payroll command centre and click Payroll Categories.

Click the Deductions tab.

Click the zoom arrow next to the applicable deduction category.

Click Employee and deselect the employee.

Click OK.

When processing your next pay run, the salary packaging deduction will no longer appear for that employee.

What if salary package deductions need to go to a third party?

If your employee's salary package deductions are to pay a third party, use the Pay liabilities feature to process the deductions and clear the liability account.

You can then remit the payments to the third party using one of their preferred payment methods.