Payday Super is coming 1 July 2026 - find out how to get ready and stay compliant.

Setting up payroll might seem daunting, but we'll take you through it one step at a time. Once you're set up, paying your employees and staying on top of your superannuation payments and ATO reporting will be a breeze.

Every business's payroll setup is different. So if you need specific advice beyond what's covered below, the community forum is a great place to start. For more tailored help, speak with an accounting advisor.

Use the payroll feature to:

keep track employee entitlements, like annual leave and sick leave

print or email pay slips

send your payroll information to the ATO for Single Touch Payroll.

Before you begin

-

If you're brand new to payroll, take a look at our handy guide to payroll for small business

-

Know your employees' entitlements - check the National Employment Standards if you're not sure

1. Set up payroll for your business

Each business has different payroll needs, so start by entering a few details about how payroll works in your business.

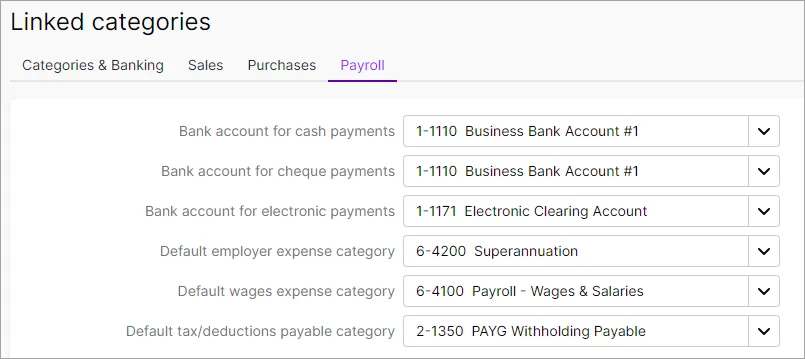

Check your payroll linked categories

There are default categories in MYOB that help group your payroll amounts for accounting purposes. Your bookkeeper or accounting advisor likely set up your categories when you started using MYOB, but it's worth becoming familiar with these before you start paying employees.

These are known as linked categories, and they'll be specific to your business. For example, there are categories that group your cash, cheque and electronic wage payments. There are also categories for things like tax, deductions and wage expenses.

Tell me more about linked categories.

To check your linked categories, go to the Accounting menu > Manage linked categories > Payroll tab. To change a linked category, click the dropdown arrow and choose a different category. If needed, you can create new categories.

Confirm your payroll settings

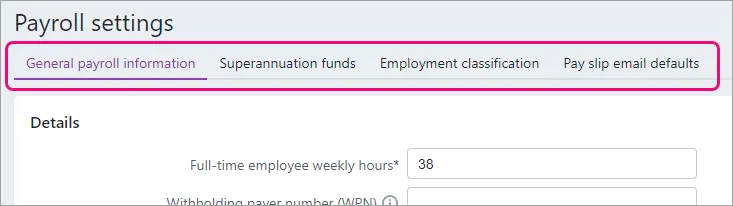

Basic payroll settings, like the number of hours in your working week, your default superannuation fund (if you have one), and your pay slip email defaults are accessed by clicking the settings menu (⚙️) > Payroll settings.

Here's more information about the settings on each of the tabs on this page.

General payroll information

Here are some pointers on the information you can enter on this tab:

Full-time employee weekly hours are the default hours in your working week. You can change employee hours when you pay them

Only enter a Withholding payer number (WPN) if you have one

You might choose to round pays down to a specific cent value if you pay cash

The Tax table revision date is the date the tax tables in MYOB apply from. The tax tables (or tax scales) in MYOB are updated annually and provided by the ATO. This ensures that pays dated from 1 July onwards will use the latest tax tables to ensure the correct amount of tax is calculated on your employees' pays

Every employer must have a Default Superannuation fund. This is the super fund your employees can join if they don't already have one. It can be any complying fund that's registered by the Australian Prudential Regulation Authority (APRA). If you need help choosing a default super fund, check the ATO guidelines or ask your advisor. When you've chosen your default super fund, first add it to MYOB and then choose it here.

If you have employees paid by the hour, you can opt to use timesheets to track their hours. Select the option Use timesheets to track employee hours and choose the starting day for your working week. These employees can also submit timesheets using the MYOB Team mobile app. Learn more about entering and processing Timesheets.

If your workplace is covered by the Fair Work System (check this Fair Work info to confirm), select the option to Include fair work information statement during employee self-onboarding. This ensures the applicable fair work information statement will be provided to the employee when they self-onboard.

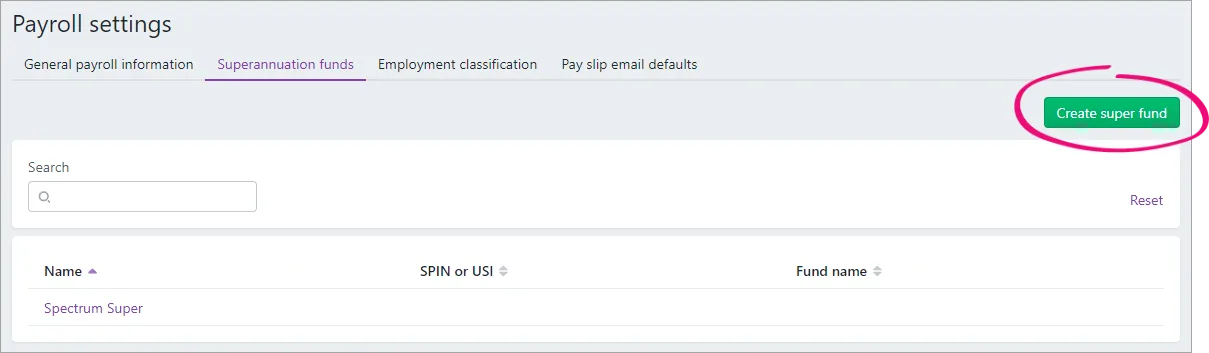

Superannuation funds

This tab is where you'll set up the superannuation funds that your employees' contributions will be paid to. You'll need to add these funds before you Set up Pay Super (for more details on setting up your superannuation, see below).

To add a super fund, click Create super fund and enter the details of the fund and the employee's membership details.

For step-by-step instructions, see Set up superannuation funds.

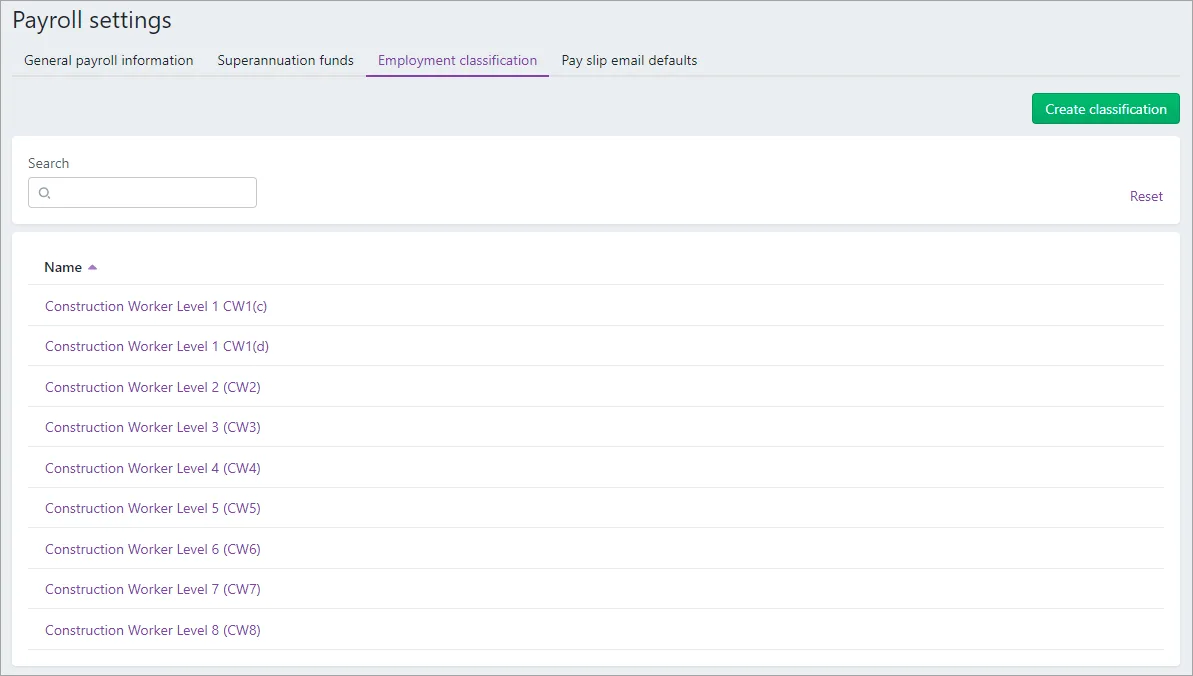

Employment classification

An employment classification is like a job title, position description or any other role classification that might suit your business.

You might not use employment classifications in your business – but if you do, MYOB comes with a default list. But you can customise this to suit your business.

Click Create classification to add a new classification, or click an existing classification to change its name or delete it.

Once you've set up your employment classifications, you can assign a classification to each of your employees to display on their pay slips (Payroll menu > Employees > click an employee > Payroll details tab > Employment classification).

Learn more about Adding an employee.

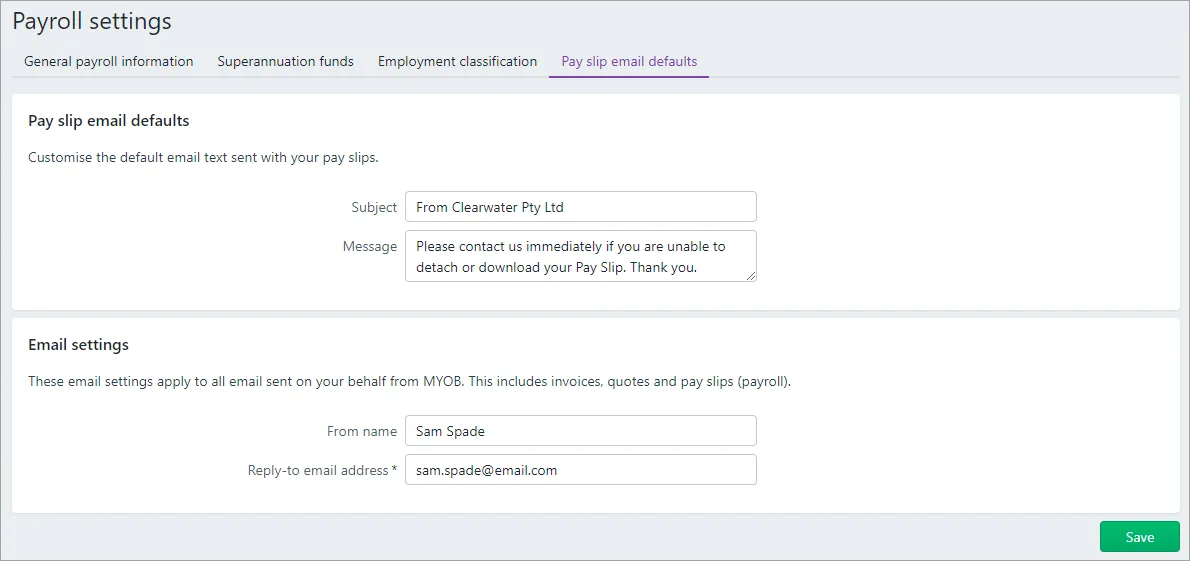

Pay slip email defaults

This is where you set the default subject and message for the pay slips emails you send your employees. You can also set your From name and Reply-to email address for the emails you send from MYOB – but be aware this will change those details for all emails you send from MYOB, including invoices and quotes.

If an employee wants their pay slip emailed, make sure you've entered their email address (Payroll menu > Employees > click an employee > Payroll details tab > Pay slips section).

When you've finished entering your payroll settings, click Save and continue your setup.

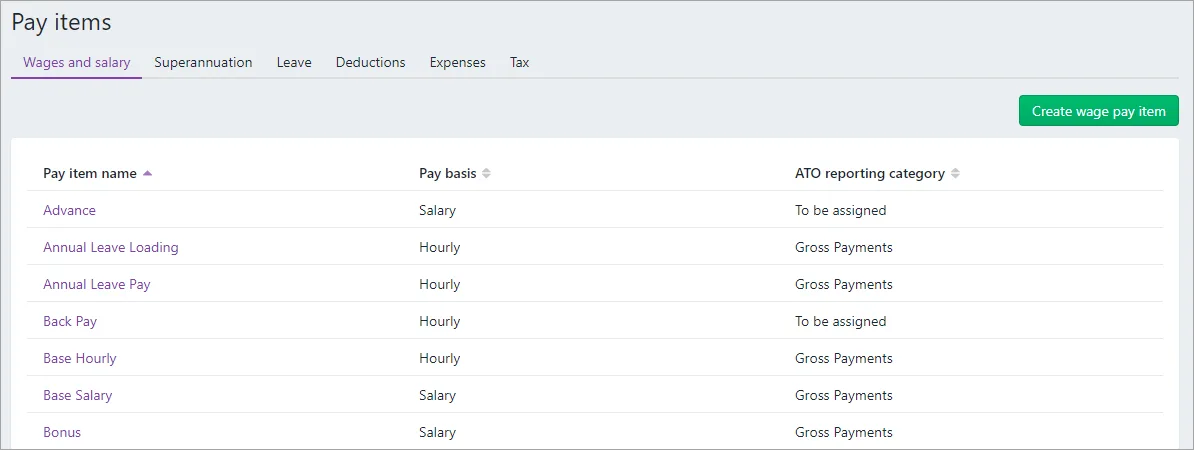

Set up wages and deductions

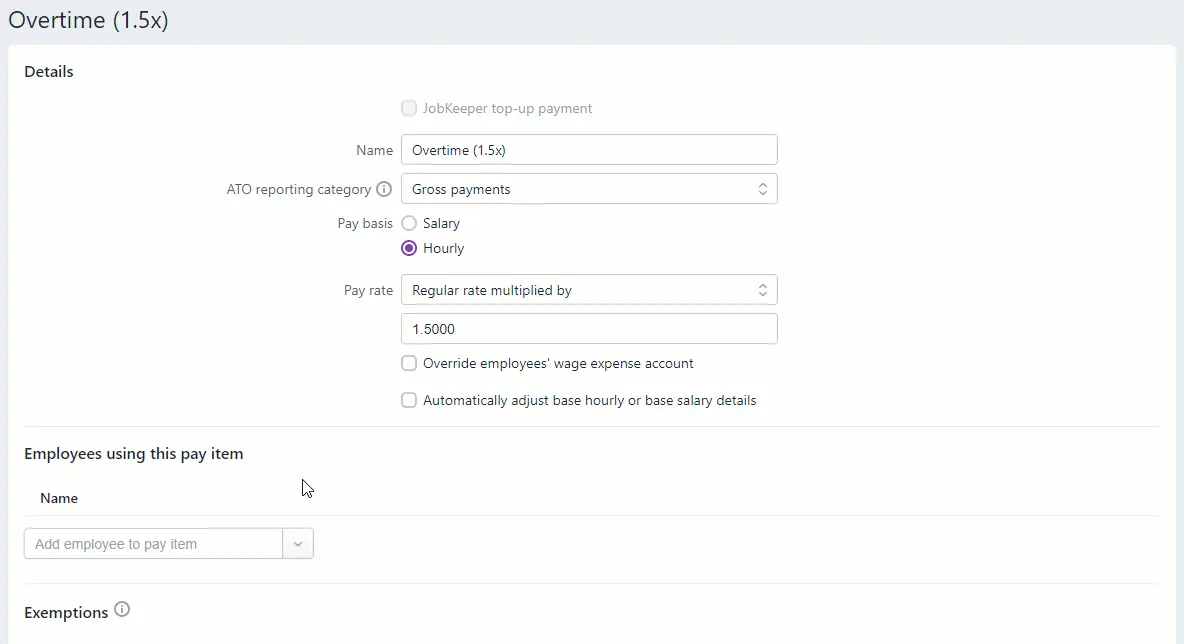

The different parts of your employees' pays are called pay items. For example, you'd use pay items for things like wages, overtime and bonuses. Similarly, deductions like union fees are also handled using pay items.

But that's just the beginning. Pay items also look after things like leave and superannuation (which we cover later on).

To start with, you'll want to set up pay items for the wages and deductions that apply in your business. To make it easier, there's a set of default pay items in MYOB that you can use.

See your pay items via the Payroll menu > Pay items. To keep things simple, there's a tab for each type of pay item (Wages and salary, Superannuation, Leave, etc.).

For all the details, see Setting up pay items.

Once you've set up your pay items, you can assign them to the applicable employees. See 'Set up employees' below for details.

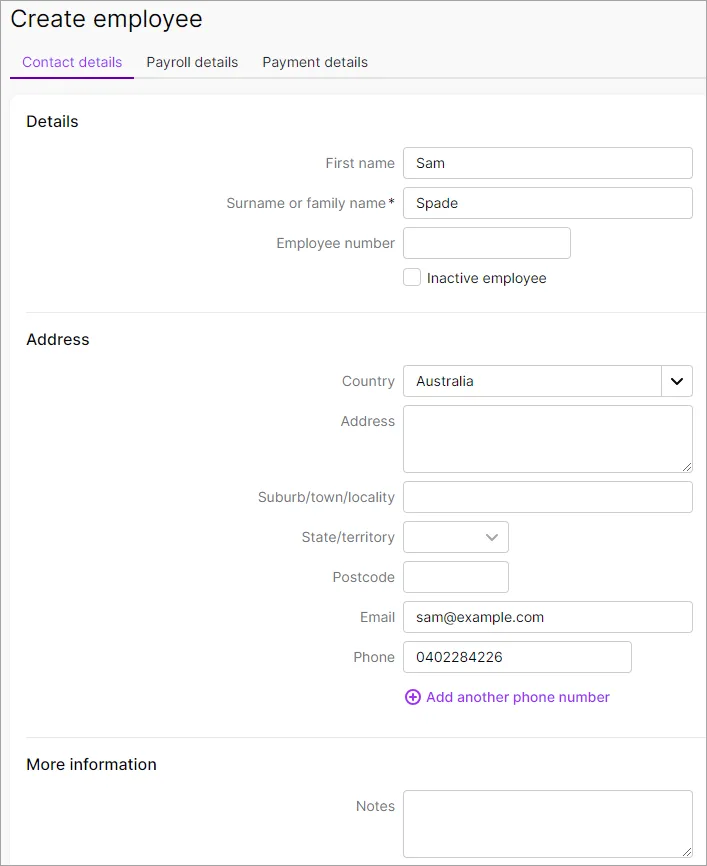

2. Set up employees

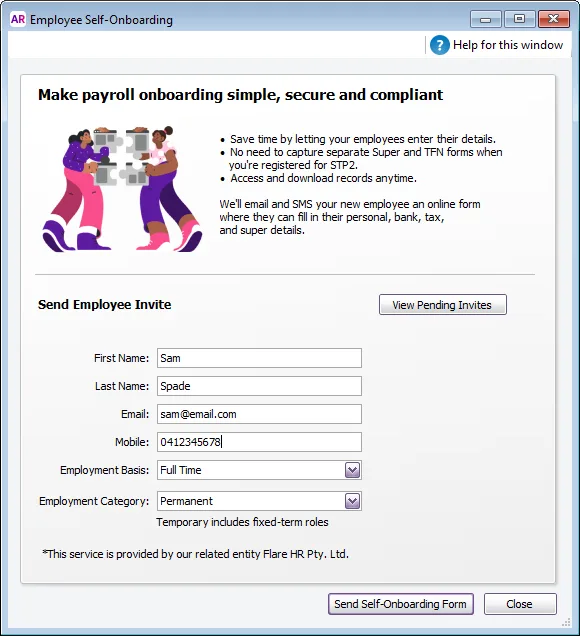

You'll need to set up each of your full-time, part-time and casual employees. To speed things up, you can send a request from MYOB for new employees to submit their own details. You can then finish setting them up by adding their leave and pay amounts.

If you've already paid an employee this payroll year using different software, you can enter the amounts you've already paid them.

Add employees

Add employees by going to the Create menu and choosing Employee. Enter some basic details and click Save and continue to send the employee a self-onboarding form. This lets the employee submit their own personal, banking, tax and super details straight into your MYOB business. All you need to do is add their payroll information.

If you don't want to send the employee a self-onboarding invitation, click the dropdown arrow next to the Save and continue button and choose Set up your employee manually. You can then manually enter the employee's details yourself. Learn all about manually adding employees.

If you'll pay an employee straight into their bank account, make sure their bank details are entered on the Payment details tab. Find out all about paying employees directly into their bank accounts.

Need to add lots of employees? Speed things up by importing them.

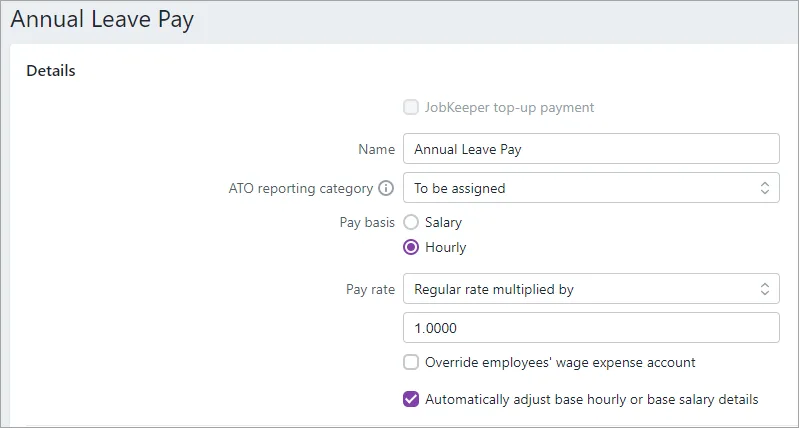

Set up employee leave

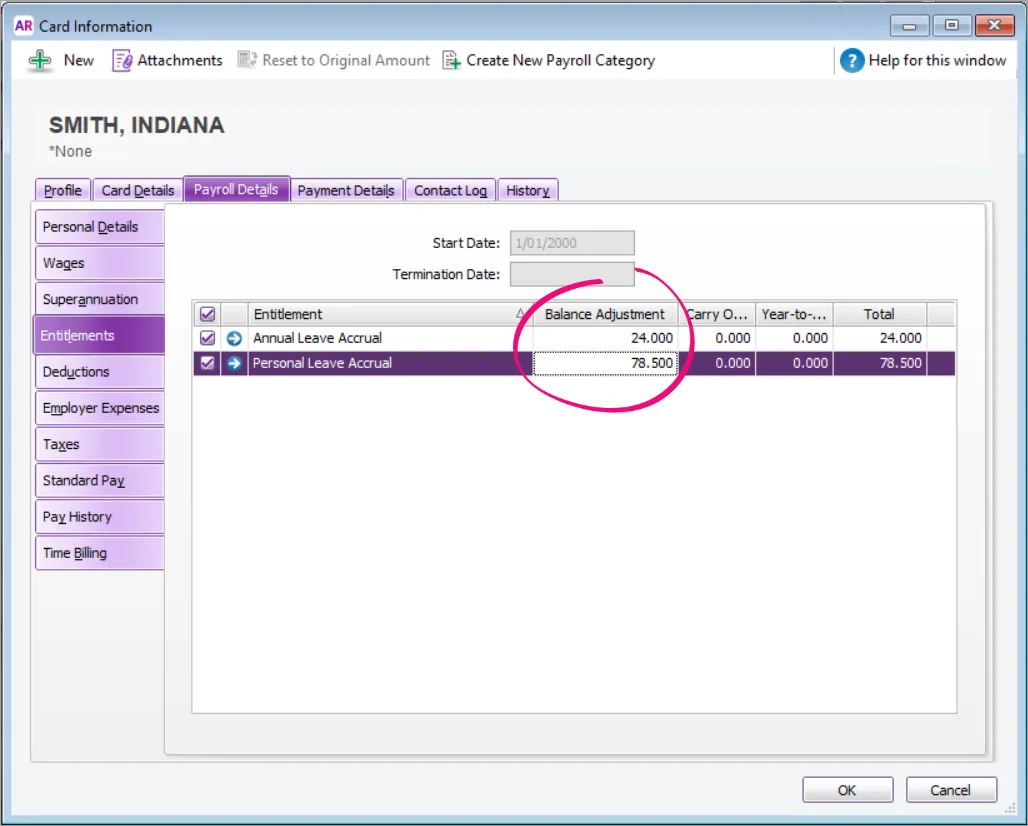

If your employees are entitled to leave, you'll need to set this up in MYOB. This involves setting up how the leave is calculated and whether it accrues (accumulates).

MYOB handles leave using pay items, and there are some default pay items you can use (like the example below) or you can create your own. Find your pay items via the Payroll menu > Pay items.

If a new employee has carried-over leave from previous payroll years, or they've accrued leave this payroll year, you can enter these carry over leave balances.

For all the details, see Set up leave.

Set up employee pays

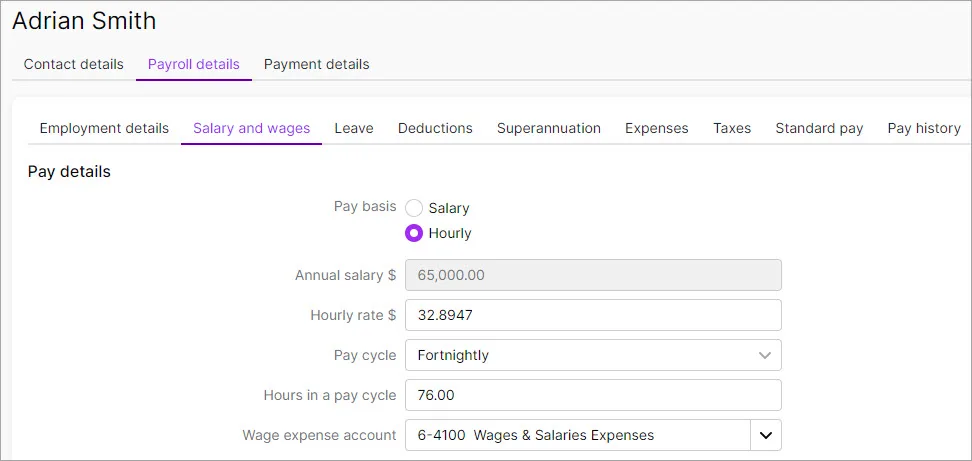

When you add your employees, you'll set their salary or hourly rate in their record (Payroll menu > Employees > click the employee > Payroll details tab > Salary and wages tab).

Also, when you set up your wage and deduction pay items earlier, like overtime, allowances and deductions, you might have assigned them to your employees. If you didn't, no problem – you can assign them now. Just go to the Payroll menu > Pay items > click a pay item > choose the employees to assign it to.

For all the details, see Assigning pay items to employees.

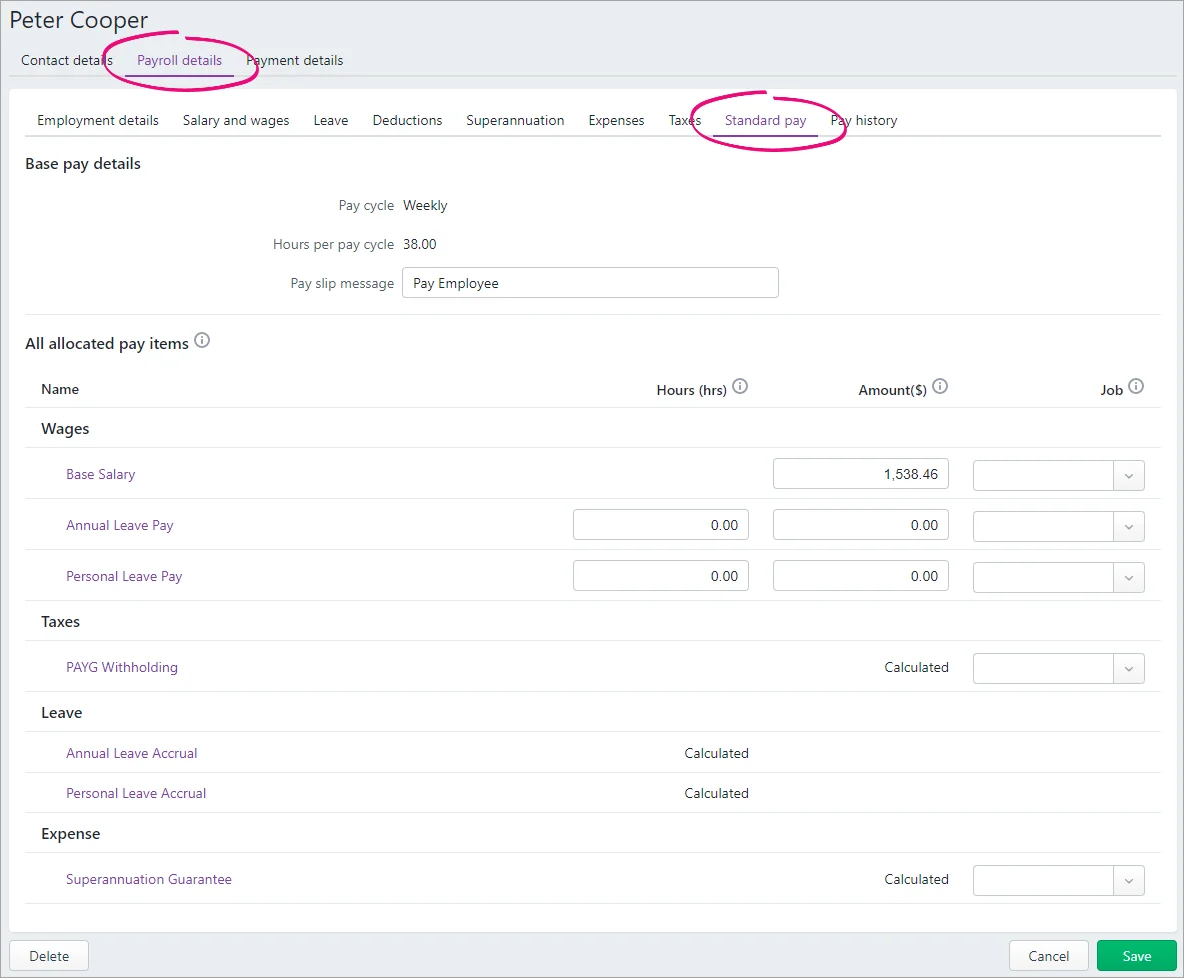

You can check all the pay items assigned to an employee in their Standard pay. Just go to the Payroll menu > Employees > click an employee > Payroll details tab > Standard pay tab.

This shows what an employee's typical pay will look like – but you can change hours and amounts when you do a pay run.

For all the details, see Review standard pay details.

Set up MYOB Team

Your hourly-based employees can clock on and off through the MYOB Team app, submit their hours worked, check their timesheets and payslips, and see upcoming shifts. Get started with MYOB Team.

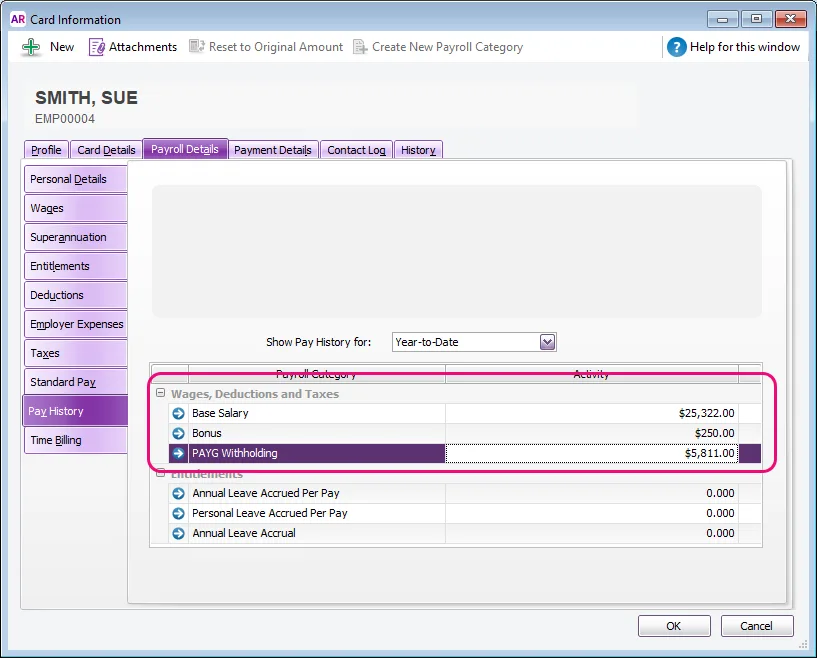

Enter amounts already paid to employees

If you've already paid employees in the current payroll year, you'll need to enter these amounts. This includes all wages, deductions, taxes, leave (paid and accrued), and super. This ensures the employee's year-to-date payroll information is accurate—for your records and ATO reporting.

You'll do this via the Pay history tab in the employee's record (Payroll menu > Employees > click an employee > Payroll details tab > Pay history tab).

Choose the period in the Pay history for field and enter the amounts for that period. For all the details, see Pay history.

3. Set up reporting obligations

You're almost done. To stay compliant you'll need to set up Single Touch Payroll reporting to ensure your payroll information is reported correctly to the ATO. And finally you'll set up the superannuation payments you'll contribute for your employees.

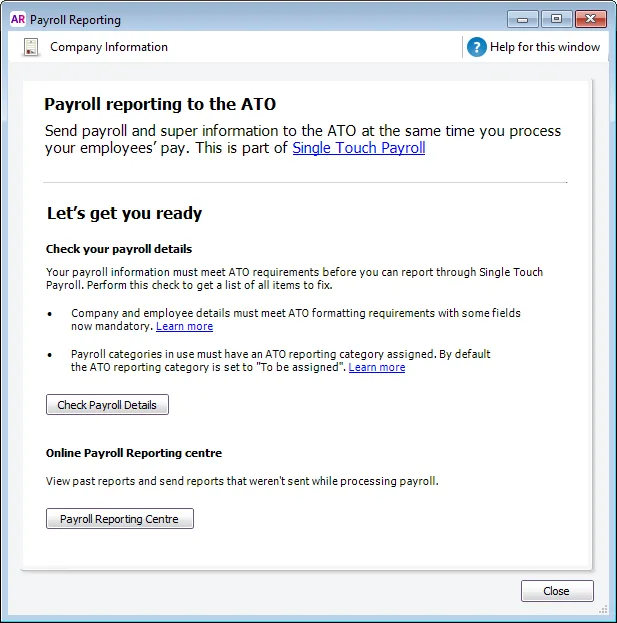

Set up Single Touch Payroll reporting

Single Touch Payroll (STP) is a simple way to report your employees’ payroll information to the ATO and keep your business compliant. It’s included with your MYOB subscription, so there's no additional charges.

There are two parts to setting up STP:

Check your MYOB details

Notify the ATO you're ready to start reporting

For all the details, see Setting up Single Touch Payroll reporting.

Set up superannuation

To make superannuation payments straight to your employees' super funds, you'll need to set up Pay Super. It's simple, fast and lets you make regular super payments – so it's Payday Super-ready. This keeps your employees happy and keeps you in the good books with the ATO.

Pay Super is included with your MYOB subscription, so there's no additional charges.

For all the details, see Set up Pay Super.

How Pay Super works

1. Get set up Sign up for Pay Super and tell us which bank account you want to make super payments from. We'll get you to verify the account so we know it’s really you. Finally, you'll need to check that your fund and employee details are complete and correct. | 2. Process your pays Process your pays as usual. Superannuation will be calculated and tracked for you automatically when you record employee pays. | 3. Make a super payment When you're ready to make a payment to your employees' funds, you just select the contribution amounts to pay, authorise the payment, and you're done! |

If the employee isn't self-onboarding (during which they will choose a super fund or enter details of their existing fund), you can provide new employees with a Superannuation standard choice form so they can provide you with their super fund details.

What's next?

That's it—you're now ready to pay your employees! To keep track of your payroll information, take a look at the payroll reports. And when the end of the payroll year comes around, thanks to STP there's not much you need to do.

Personalise your pay slip emails

If you haven't already, add your own touches to the pay slip emails you send your employees on pay day. Just click the settings menu (⚙️ ) and choose Payroll settings > Pay slip email defaults.

Need some help?

If you need help using payroll or anything in MYOB, click the chat bubble below and ask MOCA, our virtual assistant, for help. If MOCA can't help, you'll be guided to our other support options, including live chat. You can also submit a support request to get help from our team.

AccountRight Plus and Premier only

Setting up payroll might seem daunting, but we'll take you through it one step at a time. Once you're set up, paying your employees and staying on top of your superannuation payments and ATO reporting will be a breeze.

Need help setting things up?

Book a 30-minute session with an expert to help you get started – it's all part of AccountRight Priority Support.

Use the payroll feature to:

keep track employee entitlements, like annual leave and sick leave

print or email pay slips

send your payroll information to the ATO for Single Touch Payroll.

Before you begin

-

If you're brand new to payroll, take a look at our handy guide to payroll for small business

-

Know your employees' entitlements - check the National Employment Standards if you're not sure

Setting up payroll

Before using payroll, there are a few important things you'll need to set up. They're one-off tasks, and doing them now makes sure payroll is set up to suit your business. It'll also make payday a breeze because you'll set up your employees' default pay details now, so you won't need to enter them on pay day.

If anything changes after you're set up, like a new employee starts or someone's pay rate changes, it's easy to make the change in AccountRight.

Use the Payroll Easy Setup Assistant

Simplify your payroll setup by using the Payroll Easy Setup Assistant. It'll step you through the required setup tasks so nothing gets missed. Go to the Setup menu, choose Easy Setup Assistant then click Payroll.

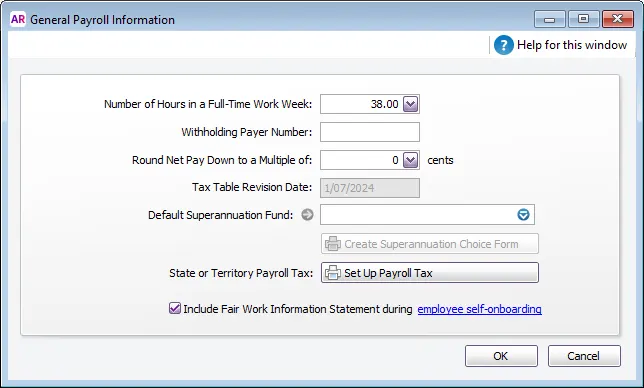

Enter general payroll information

This is where you define the basic payroll settings for your business.

Go to the Setup menu > General Payroll Information and set the number of hours in your normal working week, your Withholding Payer Number (if you have one) and your business's Default Superannuation Fund that new employees can choose to join. To choose a super fund, you'll first need to set it up in AccountRight.

The Tax Table Revision Date is set for you and determines which tax scales are used in your employees' pays. More about the PAYG tax tables.

If your workplace is covered by the Fair Work System (check this Fair Work info to confirm), select the option to Include fair work information statement during employee self-onboarding. This ensures the applicable fair work information statement is provided to new employees when they self-onboard.

Review payroll categories

The different parts of an employee’s pay, like their wages, superannuation, leave entitlements, deductions and taxes, are called payroll categories. You'll assign the relevant ones to your employees to define their standard pay. This simplifies pay day because an employee's typical pay amounts are automatically included in their pay – but you can make any required changes.

Click the zoom arrow for each relevant payroll category to make sure they're set up to suit your business. Then when you set up your employees you can assign them the applicable payroll categories. More about setting up payroll categories.

Set up your employees

The quickest way to set up your employees is to get them to self-onboard (Payroll > Employee Self-Onboarding). You simply send them a secure request so they can send their personal, contact, tax and super details straight into AccountRight. Then all you need to do is enter their pay details.

Or you can add all your employee details manually.

Enter pay history and leave balances

If you've already paid an employee in the current payroll year, enter the amounts you've paid them (Card File > Cards List > Employee tab > open the employee's card > Payroll Details tab > Pay History tab).

Pay history amounts will be included in an employee's year-to-date payroll totals sent to the ATO for Single Touch Payroll (STP) reporting. They'll also be included in some payroll reports so you have an accurate view of what you've paid.

You can enter pay history for specific months, quarters or for the year to date. More about entering employee payroll information.

If an employee has leave balances carried over from previous years, or they have accrued leave this payroll year (perhaps when you were using a different payroll system), enter these opening leave balances (Card File > Cards List > Employee tab > open the employee's card > Payroll Details tab > Entitlements tab).

Enter current leave balances in the Balance Adjustment column for each applicable leave type. More about entering opening leave balances.

Set up Single Touch Payroll (STP)

Employers must report their payroll information to the ATO after every pay run. It's easy to set up STP and it makes end of year a breeze. More about setting up STP.

To get started, go to the Payroll command centre and click Payroll Reporting.

Set up Pay Super

Sign up for Pay Super to make super payments directly from AccountRight into your employee's super funds. This helps you meet your employee super obligations and always stay on top of government changes. And it's included with your AccountRight subscription.

Pay Super is simple, fast and lets you make regular super payments – so it's Payday Super-ready. This keeps your employees happy and keeps you in the good books with the ATO.

To get started, go to the Payroll command centre and click Pay Superannuation.

Optional payroll setup tasks

You may also want to do the following tasks if they're relevant to your business.

Set up timesheets - Use timesheets to record all the hours worked by hourly employees or to record extra hours worked by employees that are paid based on a standard pay. If you pay employees for time-billing activities, you can also enter activity details on timesheets and use these details to create activity slips.

Set up payroll tax - Calculate your state or territory payroll tax amounts using the payroll information in your AccountRight software.

Customise pay slips - Change the appearance of the default pay slip and paycheque forms. You can set up different pay slip forms for different employees and select the applicable form (using Advanced Filters) when printing or emailing pay slips. Learn more about personalising pay slips.

Import cards - Import employee information from:

another company file

another accounting system

a spreadsheet

a text file.

Synchronise employee records with Outlook - Synchronise your employee records with your contact records in Microsoft Outlook.

Group cards - Use identifiers and custom lists to group the cards of employee who have similar attributes.

Check your payroll linked accounts - Payroll linked accounts are the default accounts in AccountRight used for payroll features. This includes the accounts used for cash, cheque and electronic payroll payments.

Can't find the payroll command centre?

If you've upgraded from AccountRight Basics or Standard to AccountRight Plus or Premier (Australia only) and you’ve never used payroll features before, the Payroll command centre won’t appear.

But this is easily fixed: open your file, go to the Help menu and choose Change Product. Select the product you’re licensed to use and the missing command centre will appear when you next open the file (you'll need internet access to confirm the file and save the change).

What's next?

That's it – you're now ready to pay your employees! To keep track of your payroll information, take a look at the payroll reports. And when the end of the payroll year comes around, thanks to STP there's not much you need to do.

Need some help?

If you need help using payroll or anything else in AccountRight, click the chat bubble below and ask MOCA, our virtual assistant, for help. If MOCA can't help, you'll be guided to our other support options, including live chat. You can also submit a support request to get help from our team.