AccountRight Plus and Premier, Australia only

STP replaces the need for payment summaries

All employers must now be reporting to the ATO via Single Touch Payroll (STP) so there's no need to prepare payment summaries. If an employee needs a copy of their income statement (payment summary), they can access these details through myGov. Visit the ATO for more information.

Stay compliant by using the latest AccountRight version, and see how we've simplified your end of payroll year.

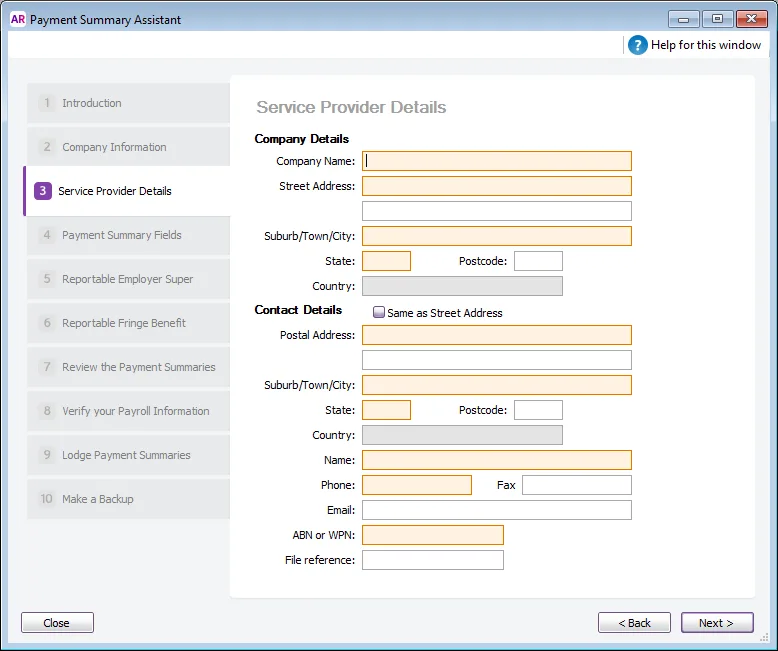

If another party will be lodging the payment summaries for you, or you're a third party service provider - such as a bookeeper, registered tax agent or accountant - preparing payment summaries on behalf of another business, complete the Service Provider Details step of the Payment Summary Assistant. The ATO may need to get in touch with you if there are any issues with the information submitted.

Note that this step is only accessible if the I use a third party service to lodge my payment summaries option was selected in the Company Information step of the assistant.

Once you've entered the details, continue with setting up the payment summary fields.