AccountRight Plus and Premier, Australia only

If you're registered for Single Touch Payroll (STP), there's no need to prepare payment summaries so we've removed that option from the Payroll command centre. If an employee needs a copy of their income statement (payment summary), they can access these details through myGov. Visit the ATO for more information.

Stay compliant by using the latest AccountRight version, and see how we've simplifed your end of payroll year.

If you're registered for STP but you need to complete a payment summary (confirm with the ATO if you're not sure), you'll need to complete a manual payment summary for the employee using forms available from the ATO.

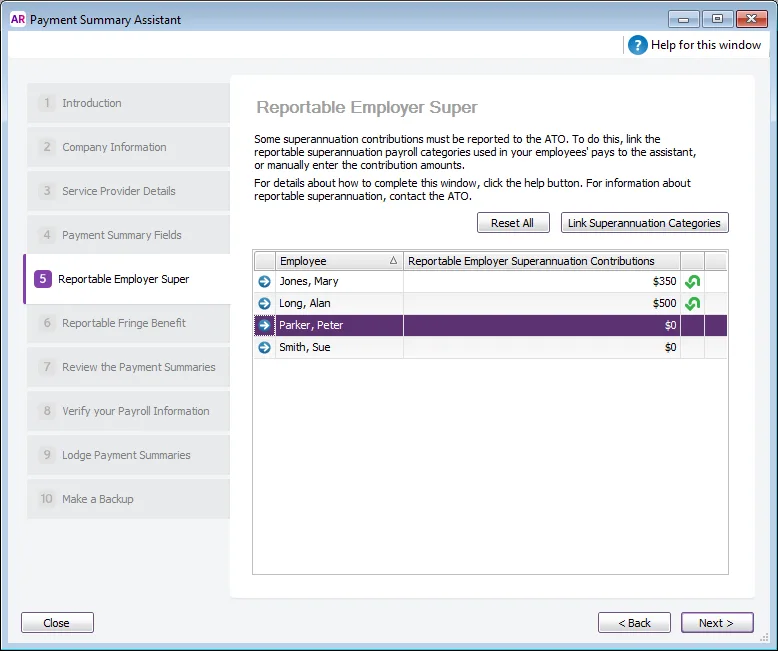

In the Reportable Employer Super step of the Payment Summary Assistant, you need to report superannuation contributions such as salary sacrifice and over-award superannuation contributions.

What super is reportable?

Superannuation contributions that exceed the superannuation guarantee amount are reportable, for example salary sacrifice and some salary packaged amounts.

Superannuation guarantee payments (the compulsory employer contributions) are not reportable.

If you need help deciding whether an amount is reportable, see the ATO guidelines.

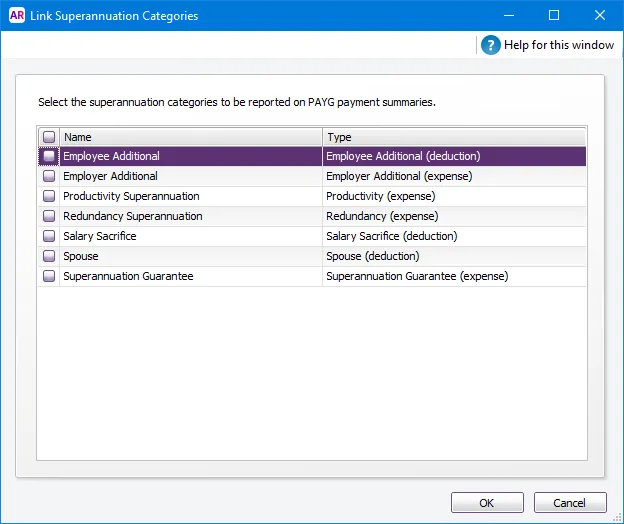

Click Link Superannuation Categories and then click in the column next to each superannuation category that should be reported as Reportable Employer Superannuation.

The Reportable Employer Super step of the assistant shows you the total amount of super that will be reported for each employee, based on the categories you selected. These are known as Reportable Employer Super Contributions (RESC).

If you need to change an amount, you can simply type over the calculated value. To reset the value, click the green arrow that appears next to the amount. Or click Reset All to recalculate all of the amounts.

When you have finished entering the superannuation amounts, you need to report fringe benefits.

Reportable super FAQs

Why is an employee missing from the Payment Summary Assistant?

Only employees who have been paid in the current payroll year appear in the payment summary assistant. If an employee is not appearing, check that:

pay history has been recorded for the year (run the Payroll Register report for the year). If you started using AccountRight during the year, you may need to enter opening balances for your employees.

the employee's Employment Basis is set to Individual or Labour Hire. You'll find this setting in the Payroll Details tab> Personal Details of the employee's card. Employees set as Other won't appear in the assistant.

Note that if you want to include an employee who hasn't been paid during the year (for example, they have a fringe benefit amount you need to report), see the FAQ section of this help topic.