Your company’s vehicles and equipment deteriorate and lose value each year. Part of the cost of vehicles and equipment can be allocated as an expense to your business each year you benefit from their use. The allocation of the cost of a piece of equipment over its useful life is called depreciation.

There are several methods of recording depreciation. Consult an accounting advisor (such as your accountant) to see which method is best for your business.

If you depreciate your assets at the end of the financial year, make this step a part of your end-of-year routine. Consult an accounting advisor (such as your accountant) for information about when to depreciate your assets.

While MYOB doesn’t calculate depreciation automatically, you can quickly record your depreciation figures using a general journal entry.

For example, you might have two asset categories containing depreciable assets: Motor Vehicles (fixed asset category 1-1140) and Office Equipment & Computers (fixed asset category 1-1160).

To allow for depreciation, MYOB comes with some standard depreciation categories. But if needed, you can create two new asset categories:

Motor Vehicles—Accumulated Depreciation (fixed asset category 1-1150), and

Office Equipment & Computers—Accumulated Depreciation (fixed asset category 1-1170).

You would also create an expense category called Depreciation.

The asset categories will always have a negative balance to show a reduction in the value of the depreciable assets.

Let's take a look at setting up these categories and recording a depreciation amount with a journal entry.

1. Create a depreciation asset category

Go to the Accounting menu and choose Categories (Chart of accounts).

Find an asset category in the list that contains assets which are depreciated (for example, Motor Vehicles (fixed asset category 1-1140). Make note of the Code, Name and Type.

Click Create category.

Leave Detail category selected.

For the Type, choose the same type that you made note of at step 2 (e.g. Fixed Asset).

Choose the applicable Parent header (e.g. Assets).

Enter a unique Code based on the one you made note of at step 2 (e.g. 1-1150).

Enter the Name that you wrote down at step 2 and add ‘Accumulated Depreciation’ (or a standard abbreviation) at the end (e.g. Motor Vehicles—Accum Depreciation).

Enter the Opening balance for this new category.

Choose a Tax code from the list. If unsure, check with your accounting advisor.

Click Save.

Repeat from step 3 to create a new asset depreciation category for each type of asset you depreciate.

Click Save. The new categories are now listed.

2. Create a depreciation expense category

Go to the Accounting menu and choose Categories (Chart of accounts).

Click Create category.

Leave Detail category selected.

For the Type, choose Expense.

For the Parent header, choose Expenses.

Enter a unique Code (e.g. 6-2070).

Enter Depreciation as the Name.

Enter the Opening balance for this new category.

Choose a Tax code from the list. If unsure, check with your accounting advisor.

Click Save.

3. Record a depreciation amount using a journal entry

Go to the Accounting menu and choose Create general journal.

Enter or choose a date in the Date field.

Select whether this journal should display in GST reports as a Sale or Purchase.

Enter a Description of transaction.

Make sure the Reference number is correct. If not, enter a new number.

Changing the numbering

If you change the reference number, you’ll change the automatic numbering. For example, if you change the number to 000081, the next time you create a journal entry the new reference number will be 000082.

If this is an end of year adjustment, select the option EOFY adjustment.

If you want, enter Notes to describe the set of entries.

Select whether the amounts are Tax inclusive or Tax exclusive.

Enter all of the individual depreciation amounts:

In the Category column, choose the first depreciation asset category listed (e.g. 1-1150 Motor Vehicles—Accumulated Depreciation).

Enter the depreciation amount in the Credit column as a positive number (e.g. 1200).

Add a short Description for the line item (e.g. 2018 Toyota depreciation).

Choose the appropriate Tax code. If unsure, check with your accounting advisor.

Repeat from step 9A for all other asset depreciation accounts.

When all of the individual depreciation amounts are entered, enter the amount which will balance them.

In the Category column, choose the depreciation expense category you set up above in To create a depreciation expense category (e.g. 6-2070 Depreciation).

Enter the depreciation amount in the Debit column as a positive number (e.g. 1200).

This amount must equal the total of all the depreciation line items you‘ve entered in the Credit column, i.e. they must balance.

Add a short Description for the line item (e.g. 2018 Depreciation).

Choose the appropriate Tax code. If unsure, check with your accounting advisor.

Check that the total of your depreciation line items is balanced by your Depreciation expense category line item.

Check the total Debits and Credits.

If the amounts are not equal, there will be an amount in the Out of balance field. If you see an amount in this field, make sure that for each credit, there’s an equal debit, and vice versa. The Out of balance amount must equal 0.00 before you can continue.Click Record.

Your company’s vehicles and equipment lose value each year. Part of the cost of vehicles and equipment can be allocated as an expense to your company each year you benefit from their use. The allocation of the cost of a piece of equipment over its useful life is called depreciation.

There are several methods of recording depreciation. Consult your accountant to see which method is best for you.

If you depreciate your assets at the end of the financial year, make this step a part of your end-of-year routine. Consult an accounting advisor (such as your accountant) for information about when to depreciate your assets.

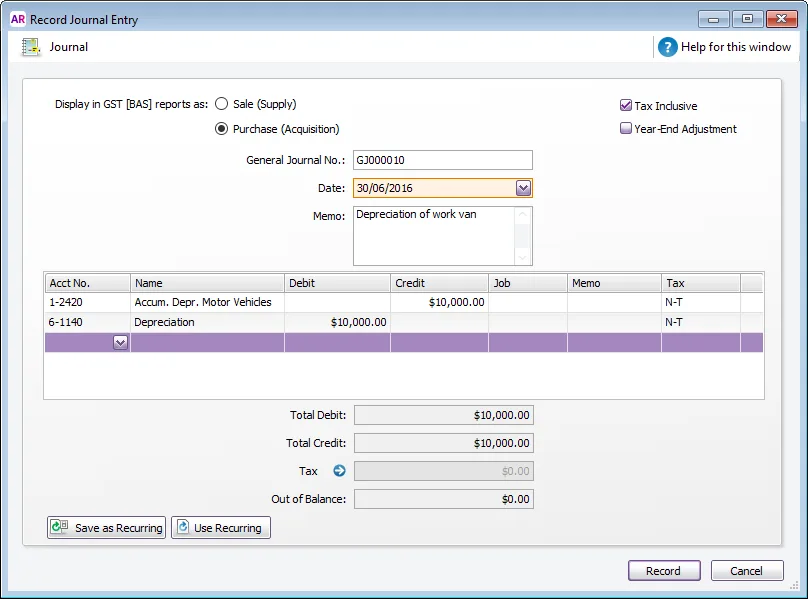

Depreciation isn’t calculated automatically, but you can record your depreciation figures with a journal entry.

To record depreciation

Before you can record depreciation for an asset, you need to create an asset account and an expense account for each type of asset you depreciate. You only need to create these accounts once.

Create a new asset account for each type of asset you depreciate

Add the words ‘Accum. Depr.’ (for Accumulated Depreciation) at the start of each new account name. Give the new account a number that allows it to come after its corresponding asset account in the accounts list. For more information on creating a new account, see Set up accounts.

In the following example, we have a header account, Motor Vehicles numbered 1‑2400, and a detail account Motor Vehicles At Cost numbered 1‑2410. We have created a new asset account called Accum. Depr. Motor Vehicles numbered 1‑2420. Notice that the header account shows the current book value of the vehicles.

Create a new expense account. You may want to call it Depreciation.

Once you’ve determined your depreciation amounts, make journal entries to credit the new accumulated depreciation asset account (for example, the Accum. Depr. Motor Vehicles account) and debit the new depreciation expense account. The accumulated depreciation asset accounts will always have a negative balance to show a reduction in the value of the depreciable assets. Check with your accounting advisor if you're not sure which tax/GST codes to use.