Get up to 94% off MYOB for 12 months

From job quotes to insurance claims, we've got your back office covered so you can focus on what you do best, getting the job done right.

Compare all features

SoloExplore Solo | LiteExplore Lite | ProExplore Pro | |

|---|---|---|---|

| Standard features | |||

| Track income and unlimited expenses | |||

| Send unlimited invoices | |||

| Send unlimited quotes | — | ||

| Track GST and lodge BAS | Track GST only | ||

| Online payments | |||

| Scan and store receipts | |||

| Tap to pay | — | — | |

| In-app business bank account | — | — | |

| Connected bank accounts | Up to 2 | Up to 2 | Unlimited |

| User profiles | 1 | Unlimited | Unlimited |

| Available on | Mobile app only | Web browser and companion app | Web browser and companion app |

| Insights and reporting | Simple | Standard and custom | Standard and custom |

| Payroll | — | $2/month per employee, up to 2 employees | $2/month per employee, unlimited employees |

| Inventory | — |

MYOB is for businesses just like yours

Automate everything with MYOB: the essential toolkit for thriving sole traders and growing businesses.

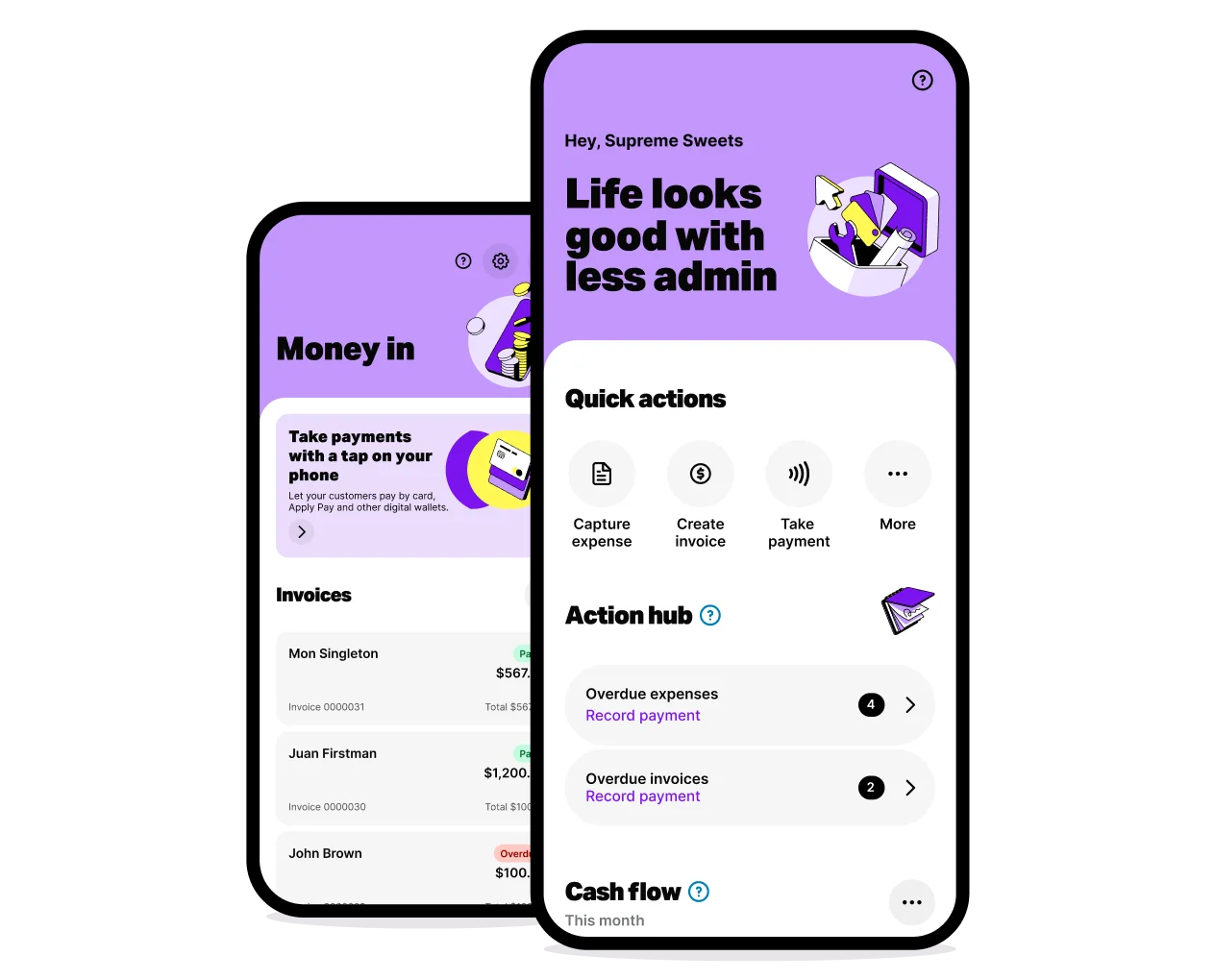

Solo by MYOB

The all-in-one mobile app designed for sole operators, freelancers, and the self-employed — freeing you up to focus on what you do best.

Snap and manage expenses

Create and send unlimited invoices

Enable in-person payments with Tap to Pay

Connect up to 2 bank accounts

Open an in-app Solo Money bank account

MYOB Lite and Pro

These plans adapt to your evolving needs, whether you're expanding your product range or team. You can easily add features like inventory and payroll, allowing you to scale up or down as needed.

Track GST and lodge BAS

Create and send unlimited invoices and quotes

Create customised reports

Optional payroll and inventory management

I'm ready to move beyond spreadsheets and streamline my workflow

Switching between tabs and documents to manually enter (and re-enter) the same details over and over — sound familiar? It's not only tricky to manage but chews up a lot of time. With MYOB, you can automate all your expense and income-tracking tasks. Faster, easier and error-free.

I want accurate taxes—down to the last cent

Record expenses easily, stay compliant, and maximise your returns. Avoid blunders with automatic tax calculations. No more shocks with MYOB tracking GST on sales. Plus, collaborate effortlessly with experts at no extra cost.

I want insights on my performance, without the guesswork

Easy-to-understand reporting shows your financial performance, bringing everything together in one place for clear spending insights. Make confident decisions with customisable budgets, and track your income and expenses on the go to instantly see what your business needs.

I want compliant (and straightforward) payroll

Make payday a breeze, whether you’re paying one person or a whole team. With MYOB Business, you can manage everything from onboarding to leave entitlements all in one place. Be confident in your payroll calculations and key your records safe and accessible on any device.

All your questions answered

Do I have to sign a lock in contract?

This offer is an annual plan meaning your chosen Solo by MYOB or MYOB Business subscription auto-renews for 12 months at the end of your initial 12 months unless you request to cancel at least 10 days before your renewal date, in accordance with the MYOB Business product terms of use.

At the end of your initial 12 month period, the cost of your base subscription will automatically revert to the standard price advertised on our website.

How long does it take to set up?

Just a few minutes, honestly. Your coffee won’t even get cold.

Start using Solo by MYOB or MYOB Business by purchasing a subscription from this page.

For Solo by MYOB, once you’ve created an account, simply download the iOS or Android app on your phone. For MYOB, follow the prompts to sign up.

Sign in using your subscription account details. Once you’ve signed in, we’ll guide you through the quick set-up so you can spend less time on admin and more time doing what you do best.

How will I be billed?

For MYOB Business, depending on whether you paid via credit card or direct debit at sign-up, your card or account will automatically be debited. You will raeceive a billing reminder notification ~30-days in advance that the payment is going to be taken.

For Solo by MYOB, you will receive a billing reminder notification ~7 days in advance that the payment will be taken.

Can I migrate my data into my MYOB Business or Solo software?

There are two ways to move your data to MYOB.

Option 1: Manage your own move

See our step-by-step guides:

Migrate from other software (Reckon, Xero or QuickBooks)

Option 2: Get help moving from Reckon, QuickBooks or Xero to MYOB

With the help of MMC Convert, our migration partner, you can have your data securely migrated from your current accounting software to MYOB. Plus, we'll cover the cost to migrate data from the current and previous financial year. Make the move.

Please note: At this time, we cannot support migration of data to Solo by MYOB. However, you can enter your data into Solo to get started.

What happens if I upgrade or downgrade my subscription?

For MYOB Business if you upgrade your subscription in the 12 month bonus period, you will be required to pay the price difference you will only get the benefit of the offer for the remaining period you were originally entitled to (the 12 months does not reset).

If you downgrade your subscription in the 12 month bonus period, you will not receive a refund on the difference between the lower and higher subscription, but you will get the offer benefit for the remaining period of the 12 month period (the 12 months does not reset).

Right now, you can't switch between Solo by MYOB and other MYOB products while keeping your data - this applies both ways. If you're moving to or from Solo by MYOB, you'll need to cancel your current subscription and start fresh with a new one.

Can I use my account on my phone?

Our MYOB Business software is available on all desktop, mobile and tablet operating systems. We also have handy apps for managing your business on the go. For small business plans, our accounting software is compatible with all browsers on desktop, mobile, and tablet.

Plus, you can enhance your workflow with our companion app MYOB Assist, which allows you to create invoices and snap receipts directly from your mobile device. Explore the full range of MYOB mobile apps.

Solo by MYOB is an app-only experience, allowing to you to manage all your admin from your phone.

Can I give account access to other people?

From MYOB Business, you can share access to your MYOB account with your advisor, accountant or bookkeeper at any time at no extra cost. You can also adjust their access level so you can control what they can see and do.

The Solo app is designed for use by one user at a time but if you have an accountant, bookkeeper or tax agent, you can invite them to your Solo account for easy tax time collaboration. Download and share reports, or give them secure access to your file. They'll have access to all the records they need to smash EOFY, you get to focus the good bits.

I still have questions – how can I get help?

Please visit our support centre if you need help with:

your MYOB account

using a product

troubleshooting

For support specific to Solo by MYOB, click here.