Trust returns

Income to which no beneficiary is presently entitled

When there is income to distribute in a trust, first you'll see the income showing under the Income to which no beneficiary is presently entitled until you've added a beneficiary.

The Income to which no beneficiary is presently entitled will not appear if:

if you've selected Special disability trust - 203 on the Type of trust field.

the trust has an overall loss

the income amounts are fully allocated to beneficiaries.

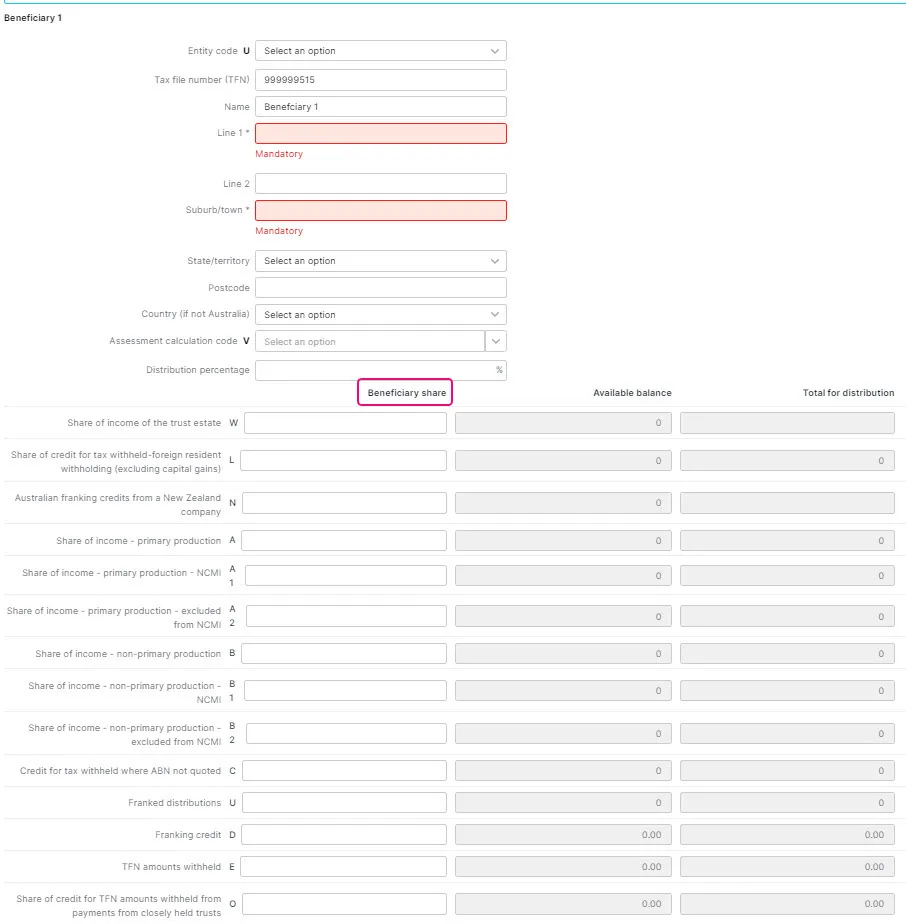

Amounts to distribute

The amounts showing in the Available balance fields integrate from the corresponding labels such as Primary Production, Non-Primary Production, Franked Distributions, Capital Gains, Attributed foreign income and Other foreign income, and any credits that have been entered in the trust return.

If you've completed item 57 Income of the trust estate, that amount will pre-fill label W.

To distribute the amounts, either:

enter a number in the Distribution percentage field or

enter the amount directly in the Beneficiary share field.

Using distribution percentage

If you use the distribution percentage, you can edit the amount by clicking the little pen icon in the Beneficiary share field.

Entering the amount in the Beneficiary share

To manually distribute the amounts, enter the amount in the Beneficiary Share field.

Distributing income and credits to beneficiaries presently entitled

Select Add Beneficiary.

When you enter the details of the beneficiary, it will automatically populate the Distribution summary table.

For any individual beneficiaries:

make sure you add the TFN and click Distribute to beneficiaries.

In the Distribute Income window, select the Client name and select Distribute to selected.

In the individual return, you'll find the Distribution received from trust schedule with the share of the beneficiary income in the respective labels.

For non-individual beneficiaries, you'll need to manually enter the share of the income in their tax return.

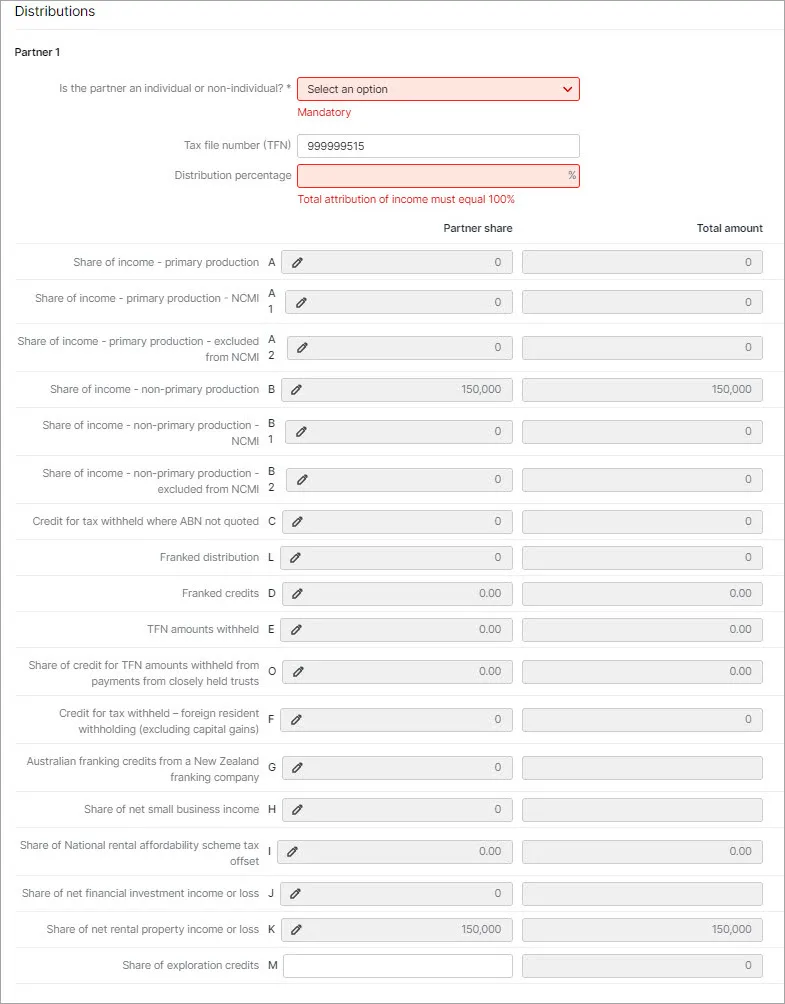

Partnership returns

Amounts to distribute

The amounts showing in the Partner share field integrate from the corresponding labels such as Primary Production, Non-Primary Production, Franked Distributions, Capital Gains, Attributed foreign income and Other foreign income, and any credits that have been entered in the trust return.

To distribute amounts to the partners:

enter a number in the Distribution percentage field or

enter the amount directly in the Partner share field.

Using distribution percentage

If you use the distribution percentage, you can edit the amount by clicking the little pen icon in the Partner share field.

Entering the amount in the Partner share

To manually distribute the amounts, enter the amount in the Partner Share field.

Distributing income to partners

Select Add Partners.

When you enter the details of the beneficiary, it will automatically populate the Distribution summary table.

For any individual beneficiaries:

make sure you add the TFN and click Distribute to partners.

In the Distribute Income window, select the Client name and select Distribute to selected.

In the individual return, you'll find the Distribution received from partnership schedule with the share of the partner's income in the respective labels.

For non-individual partners, you'll need to manually enter the share of the income in their tax return.

FAQs

Can I share the income to an individual return that has not been created?

No, first you'll need to create the tax return that you're sharing into. Otherwise, you'll see an error message when distributing.Can I share the income to an individual return that is lodged or approved?

No, the tax return needs to be in an In-progress status.What if I don't know the TFN for the individual tax return? Can I use the name instead?

We've linked the tax return using TFN. If you don't enter a TFN, we won't be able to bring up the individual return.