The ATO agent settings page is where you schedule or request agent reports from the ATO's practitioner lodgment service (PLS). These reports replace the ATO's ELS reports.

Activity statement lodgment report (ASLR)

Income tax client report (ITCRPT)

If you select Subscribe to ATO reports, you'll receive a daily activity statement download in Practice Compliance. This means any other software (other than MYOB AE/AO) you've been using to download ATO data won't work any more, since the ATO allows only one activity statement download each day.

Activity statement lodgement report (ASLRPT)

The ASLR shows all your outstanding activity statement obligations.

Key points

This is a scheduled report. When you've scheduled the daily report for an agent, it will automatically create daily activity statement obligations for your agents, using data from the ATO.

You can also continue manually creating an activity statement.

The ASLRPT will remove activity statements that are not outstanding with the ATO (i.e., not in the ATO tax agent portal) if the activity statements have not been started.

If the activity statements are not outstanding with the ATO, but have an In progress status, you need to delete them manually.

See the workflow page on how to auto-create activity statements.

Income tax client report (ITCRPT)

The ITCRPT lists the clients that you'll be completing tax returns for. This report will show your client's tax return's due date.

Key points

You can schedule ITCRPT for Individual, Company, Partnership and Trust tax returns.

When you select Income Tax, we will immediately retrieve the report for you. The report will update the Due dates in your client's income tax returns in the compliance list.

We will retrieve and update the data if any, at the same time every week.

This report will retrieve the lodgement due dates from 2024 tax year onwards.

Subscribing to the ATO reports

Have you updated the activity statement periods that only need to lodge in the client settings?

Follow the steps below to find out how to subscribe to the reports

Click Settings on the left navigation bar.

Click ATO agent settings.

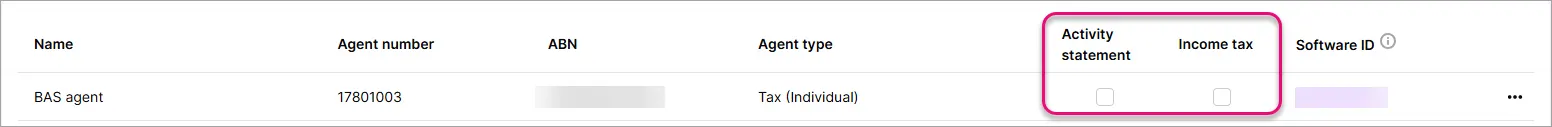

At the agent you want to receive the ATO reports for, tick Activity statement or Income tax.

For the Activity statement report, you'll receive the activity statements a Not started status .

For the Income Tax Client Report, the due dates will be displayed in the compliance window.

If this activity statement is lodged via another software, it will be removed from the report the next day

FAQs

What if I can't see the details in the Compliance list?

Ensure the client details are set up in Practice Compliance with the correct ABN, TFN, WPN and branch code.

Check the client settings page for this client to check if the relevant period has been selected. See Client settings.

How do I link a client from Practice Compliance to the ATO reports?

We use ABN, TFN & branch code details in the ASLRPT report to link to Practice Compliance. Make sure your client details are correct so the client links correctly.

What time are the ATO reports scheduled? Can I change the scheduled time?

The ASLRPT reports run daily at 2:00 am. This is for every agent you've selected Activity statement on the Agent settings page.

You can't change the scheduled time. If you don't want to receive activity statement obligations at the next scheduled time, deselect Subscribe to ATO reports in the Agent settings page.

The ICTRPT reports are scheduled at 10 pm weekly. This is for every agent you've selected Income tax on the Agent settings page.

For example, if you tick the Income tax report on Wednesday, you'll receive the report every Wednesday.

You can't change the time. If you want to change the day, untick and tick Income Tax on the day you want.

How do I link a tax/BAS agent to a client?

We'll automatically link the agent to the client when we process the ASLRPT report. You can also manually link agents to clients.

What happens if I have the reports scheduled in AE/AO?

If the reports are scheduled in AE/AO and in Practice Compliance, depending on where you lodge the activity statement, it will be updated when the report is downloaded the next day.

What happens if I've lodged the activity statement elsewhere using the ASLRPT?

If the obligation in Practice Compliance has a Not Started status, we'll automatically delete the obligation in the next scheduled run. If the obligation has an In progress status, delete it manually.

What if I've manually created the activity statement before Practice Compliance automatically creates it?

We'll use your manual activity statement and won't duplicate the activity statement by creating a new one.