Key changes

As part of the 2020–21 Budget, the government announced temporary tax incentives to allow eligible corporate tax entities to offset tax losses against the previous year's income tax liabilities. See Loss carry back offset on the ATO's website.

Corporate entities can offset their tax losses against previous tax liabilities through a refundable tax offset. This will allow eligible corporate entities to offset their current tax losses immediately rather than carry them forward.

Eligible corporate tax entities can claim the loss carry back tax offset by carrying back tax losses made in 2019–20, 2020–21 and 2021–22 years to a prior year's income tax liability in the 2018–19, 2019–20 and 2020–21 years.

An aggregated turnover threshold of less than $5billion in turnover in the loss year (or the income year before that year) applies.

Eligibility

Corporate tax entities with less than $5 billion aggregated turnover.

How much refundable offset can you claim?

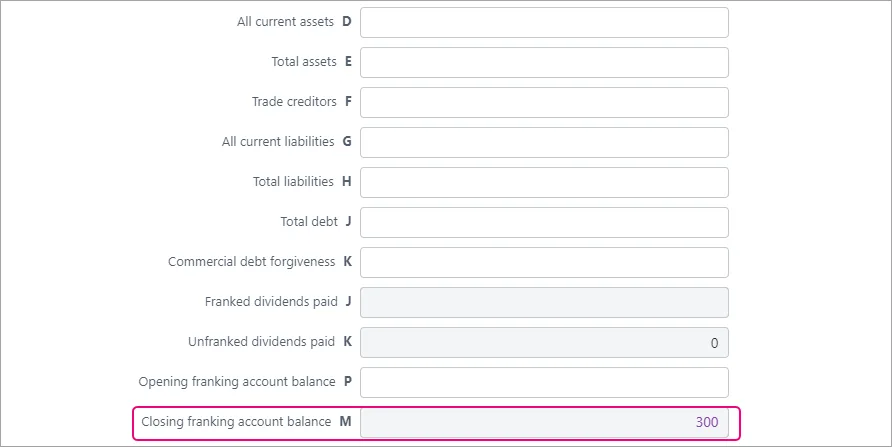

The maximum refundable tax offset you can claim is the lower of the amount of income tax liability in the tax year you're carrying forward to and the closing franking account balance (Item 13 Label S) for the current year.

Calculating the offset

In Tax, you need to manually calculate the loss carry back offset and enter it in the Item 13 S - Loss Carry Back tax Offset.

Completing the labels

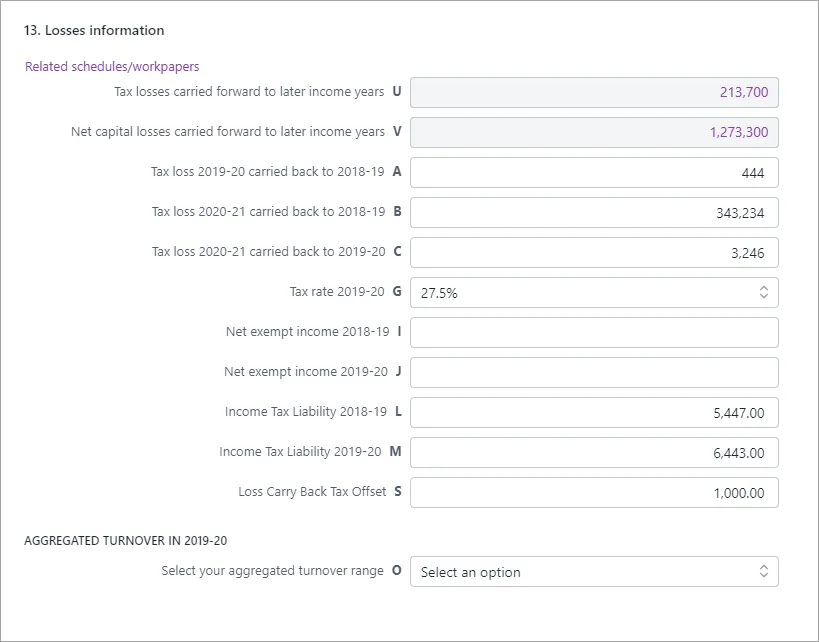

You'll need to complete the following labels to calculate the loss carry back offset.

Label A, B, C: Amount of tax losses you choose to carry back

Label G: Tax rate you used to calculate your income tax liability in 2019–20. Mandatory if choosing to carry back a tax loss from 2019–20

Labels I: Mandatory if choosing to carry back a loss to the 2018–19 year. If none, enter zero

Label J: Mandatory if choosing to carry back a loss to the 2019–20 year. If none, enter zero

Labels L: Mandatory if choosing to carry back a loss to the 2018–19 year

Label M: Mandatory if choosing to carry back a loss to the 2019–20 year

Label O: Choose the aggregated turnover from the drop-down.

Label P: This field is mandatory if you've chosen $1 billion or over at Label O.

Label S: Enter the offset amount. This is a manually calculated value.

Loss carry back tax offset calculation

Calculate( Amount of tax loss (Labels A,B,C) - any net exempt income (Labels I, J, L)) * tax rate (Label G).

Compare the above amount with Income tax liability for the tax loss year (Label J or L) and Franking account closing balance (Item 8 Label M).

At Item 13 Label S, enter the lower of Income tax liability for the tax loss year and Franking account closing balance (Item 8 Label M).

To calculate the offset if you're carrying back a tax loss to multiple income years (ie, 2020-21 tax loss carried back to 2018-19 and 2019-20) or carrying back multiple tax loss years to an income year (ie, 2019-20 and 2020-21 tax loss years carried back to 2018-19).

See how to calculate loss carry back calculation on the ATO's website.

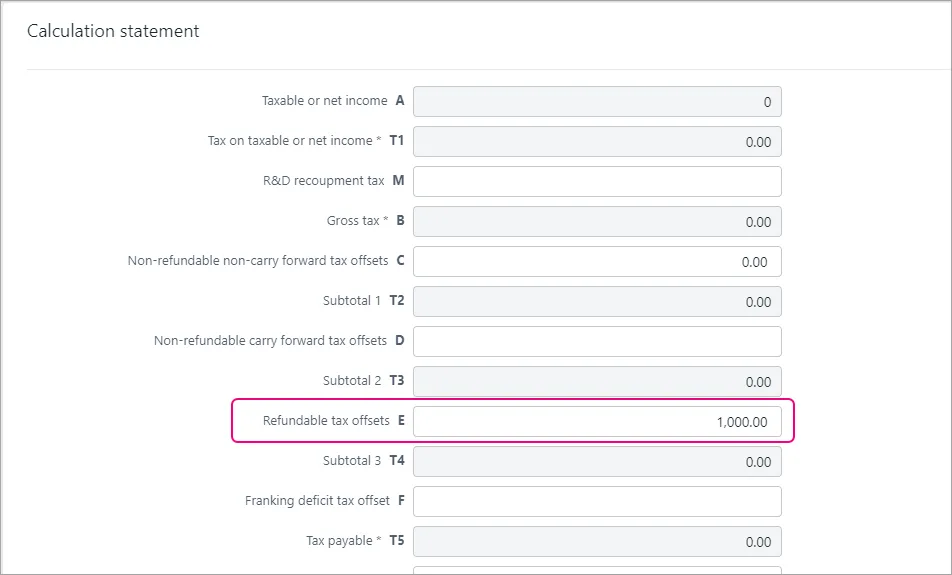

Enter the loss carry back offset manually into Label E Refundable Tax offsets in the Calculation statement.

Example

If you've completed label A, you must complete:

Label G: Tax rate for 2019-20

Label J: Net exempt income 2019-2020 (0 is an acceptable value)

Label O & P Aggregated turnover range and the amount for 2019-2020.

If you have tax loss in 2019-2020 tax which you want to carry back to the 2018-19 tax year, complete label A.

If you've completed label A, you must complete:

Label A: $100000 (Ignoring the wasting of tax losses)

Label G: 27.5

Label J: 0

Label M: $10000

Label O: A

Label P: $5000000

Calculation

(Item 8 Label A - Label J) * tax rate

(100000 - 0) * 27.5 = 27500

Item 8 Label M (income tax liability 2019 -20): $10000

Item 13 Lable M (Closing franking account balance): $5000

Lesser of all the above amounts: $5000.

The maximum refundable tax offset to enter at Item 13 S is $5000.