If you no longer hold or use a depreciating asset (for example, if you sell an asset), we'll create journals in the following accounts:

Accumulated depreciation

Depreciation

Asset realisation

Profit/loss on sale

a cost of an asset account, for example, fixtures & fittings.

A sold asset isn't rolled forward to future years. It's still displayed as an active asset in previous years, but it can't be resold, edited or deleted.

You can only reverse the sale of an asset in the year you sold it. You might need to do this if you've sold the wrong asset by mistake. We'll reverse any journal entries created by the sale of the asset.

(Australia) You can also select whether to calculate Capital Gains Tax (CGT) on the asset when sold where the acquisition date is on or after 20 September 1985.

To sell an asset

Click the asset ellipsis next to the item you want to sell and select Sell.

In the Sell an asset window, enter the asset's Disposal date in dd/mm/yyyy format or select it from the calendar.

The CAV (closing asset value) at disposal date is calculated based on the disposal date entered. The Disposal date can‘t be earlier than the asset start date, or later than the current financial year.(New Zealand) This does not include depreciation for the year the asset is sold in.

Enter the Termination value. This is the amount received for the asset when it was sold or disposed of (after making balancing adjustments).

(Australia) If required, select Calculate capital gains tax using then select a CGT calculation Method from the drop-down.

Calculate capital gains tax using is only available if the depreciation calculation is for Taxation purposes.

Click Confirm. The sold asset is now greyed out.

To reverse the sale of an asset

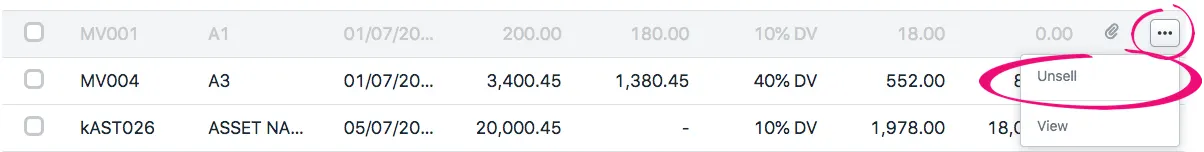

Click the asset ellipsis next to the greyed out (sold) asset that you want to unsell, then select Unsell.

Click Confirm. The asset is active again for the current and subsequent years. All entries created by the sale of the asset are reversed.

FAQs

How do I part-sell an asset?

Part-selling an asset is currently unavailable in Assets.If you need to part sell an asset, split the original asset into 2 assets and sell the one being sold. This needs to be performed in the year the asset was added.

Edit the existing asset and reduce the cost by the cost value of the part of the asset being sold.

Create a new asset for the cost value of the part being sold. Make sure the assets details (e.g. depreciation rate, method and private use %, etc.) are the same as the main asset.

The net effect on depreciation and total closing written down value should be the same as before you split the asset into 2.

Open the year in which the part-sale is being made and sell the asset.

How do I work out the disposal date?

The disposal date of an asset sold under contract is taken to be the date on the legal binding contract.In circumstances where no legal contract is present, the disposal date is taken to be the date in which the asset changes ownership.

When the asset is destroyed or lost, the date of disposal is the date when first compensation is received; or if there is no compensation, the disposal date is the date on which the asset was first discovered, lost or destroyed.