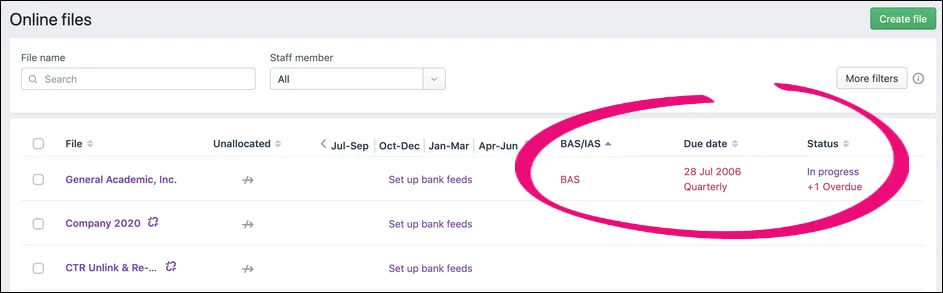

You can see your clients' activity statement obligations, including due dates and status information, on the Online files page. This makes it easy to identify and prioritise the work you need to complete for each client. And it’s conveniently located next to their other file details, so you can finish coding their file and then move on to preparing their activity statements from the same page.

View activity statement details on the Online files page

The Online files page shows the next activity statement that’s due for each client and any overdue statements you haven’t lodged yet. You can quickly open the next form that needs completing by clicking the status.

Setup checklist

As a Practice Administrator, review this checklist to make sure you’ve set up everything that’s required to view activity statement details on the Online files page.

Setup your agent

Set up a tax/BAS agent in Practice Compliance and enter the ABN that’s associated with your tax agent number.

Authorise MYOB to lodge for you in your ATO Access Manager. This number appears when entering your agent details in Practice Compliance.

Client setup

Creating clients and contacts for the files that appear on the Online files page. Ensure that the client's ABN and branch are correct.

Link each client record in Practice Compliance to their MYOB Essentials or AccountRight file on the Online files page.

Check that your clients are also listed in ATO Online, and their details match what appears in Practice Compliance, including their ABN and branch.

If another agent adds one of your clients to that agent's ATO Online, you’ll no longer get that client’s activity statement details on the Online files page. The ATO only allows a client to be associated with one agent at a time.

If the 'Multiple' status appears

If you prepare activity statements for more than one branch, you might see the Multiple status appear on the Online files page.

This means we've received ATO activity statement information for multiple branches but can't match them to the client because their branch number is missing in their record.

You will need to enter a branch number before you can see their activity statement details on the Online files page.

Add a branch number to a client record

Select All clients and go to Clients > Client list.

Click the client name link in the list.

Click Edit (the pen icon) icon in the Details section.

Enter the Branch number in the Tax information section.

Click Save.

Add a branch number to a client record (if you use MYOB AE/AO)

There are two steps to complete.

First you need to create a user defined field in MYOB AE or AO so you can enter the branch number, and then you’ll need to enter the number in each client record.

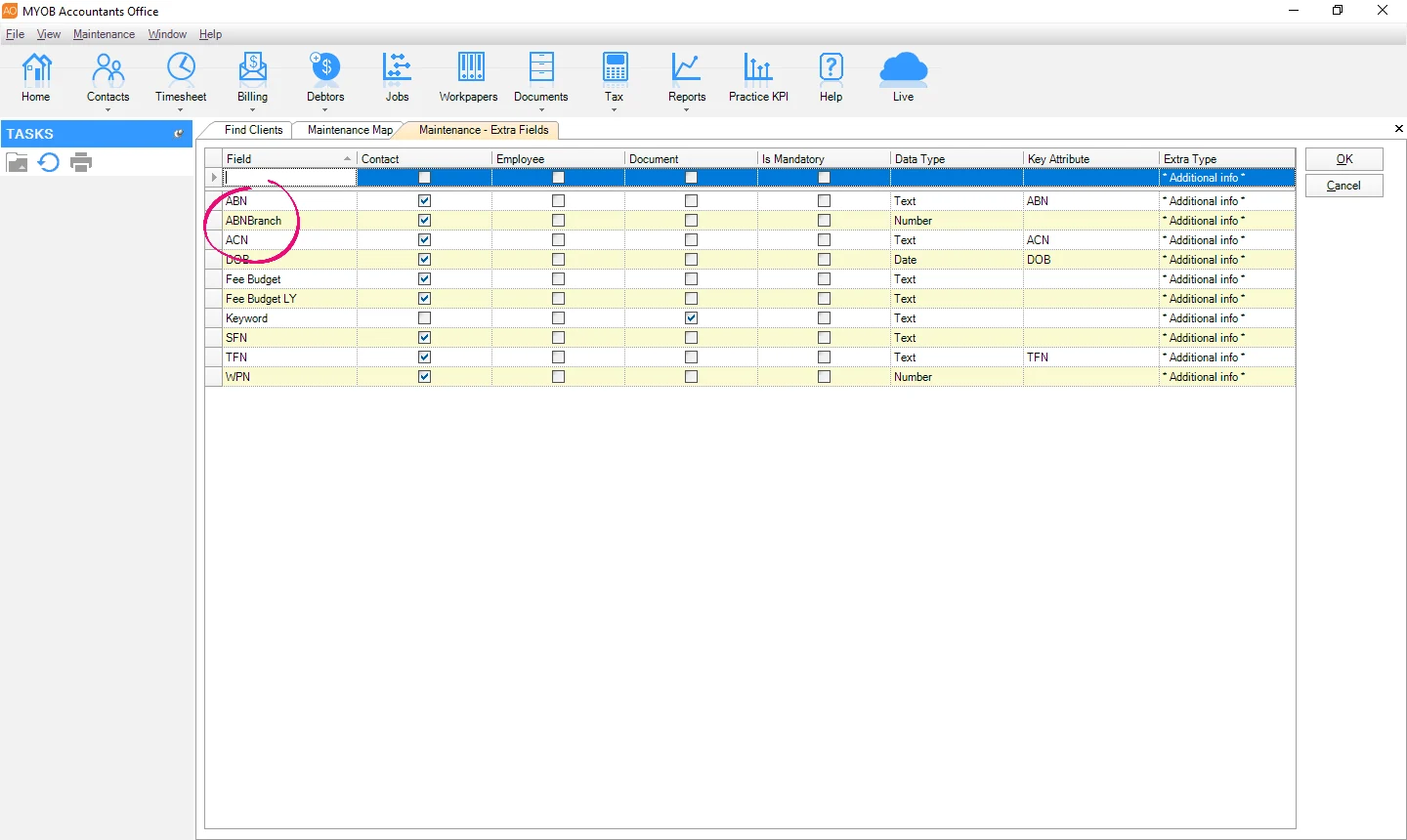

Create the ABNBranch field

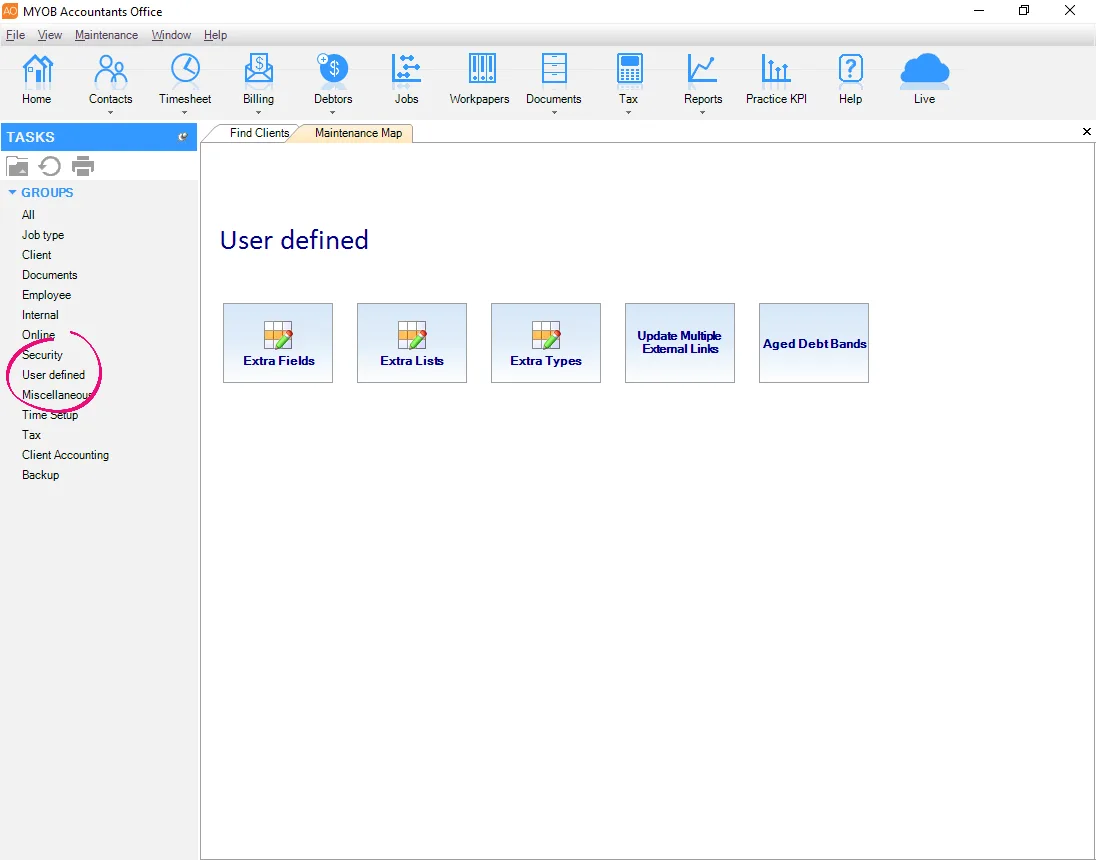

In MYOB AE or AO, go to the Maintenance menu and choose Maintenance Map.

Click User defined in the left menu.

Click Extra Fields.

In the first row of the table, right under the header row:

Type ABNBranch in the Field column.

Select the Contact checkbox.

Click in the Data Type field, and select Number from the list.

Press Enter, and the ABNBranch field will be saved to the list.

Click OK.

Add the branch number to a client

In MYOB AE or AO, click Contacts in the toolbar.

Open a client record.

Click the Extra tab.

Type the branch number in the Value column of the ABNBranch row.

Click OK.

Tracking activity statements for a client's other branches

If you use MYOB AE/AO | You can’t have more than one client with the same ABN, which means you won’t be able to track activity statement obligations for multiple branches on the Client files page. To help you track the status details of forms you've added for their other branches, go to the Compliance list |

If you don't use MYOB AE/AO | Since you can only specify one branch number for each client record, here's what you can do if you prepare activity statements for another branch: Create another client record with the same ABN, and enter the other branch number you service. You will need to link the client to a file that hasn't already been linked. OR Only have one record for the client, and track the status details of forms you've added for their other branches on the Compliance list The Compliance list only shows details for forms you have started. |