Instead of waiting until a customer pays their unpaid invoice, you can obtain invoice funding. This means you'll have access to valuable cashflow when you need it, instead of waiting until the customer pays you.

MYOB has partnered with invoice finance experts Butn to provide this service. You simply apply for a Butn account, then request funding whenever you need it.

Invoice funding is currently only available to selected Australian businesses

If it's currently not available to you but you're keen to try it, register your interest by submitting a support request via My Account (log in at myaccount.myob.com and click Contact support).

How it works

Apply for an account with Butn.

Enter an invoice in MYOB as you normally would.

Request funding from Butn—directly from your MYOB.

Upon approval, Butn deposits up to 100% of the invoice value (minus fees) into your nominated bank account.

When the repayment is due, Butn debits your account for the amount you owe them.

Who's Butn?

Butn Limited (ACN 644 182 883) is an Australian business-to-business financing company. They offer a range of funding solutions to help small businesses manage their cashflow and provide them with faster access to their money.

Visit Butn.co for more information, and take a look at Butn's terms and conditions.

Getting invoice funding

The first time you apply for invoice funding, you'll apply for a Butn account. They'll verify your identity and perform a credit check on you and all directors of the business.

Once you have a Butn account, you can request invoice funding.

Already have a Butn account? You can connect your account to MYOB by emailing Butn at customerservice@butn.co or calling 1300 333 863 (1 300 33 FUND).

1. Apply for a Butn account

Make sure you have:

-

entered your ABN into MYOB

-

your driver license

-

the driver license for every director or owner of your business

Butn will require signatures from all directors of the business to finalise the account setup. You’ll be asked to provide their contact details and ID as part of the registration process.

If you have all the required documentation, it can take as little as 15 minutes to set up your account. If other directors need to sign the Butn End User Agreement, it might take a little longer.

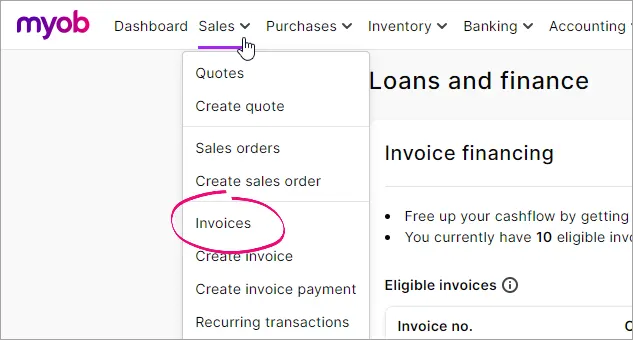

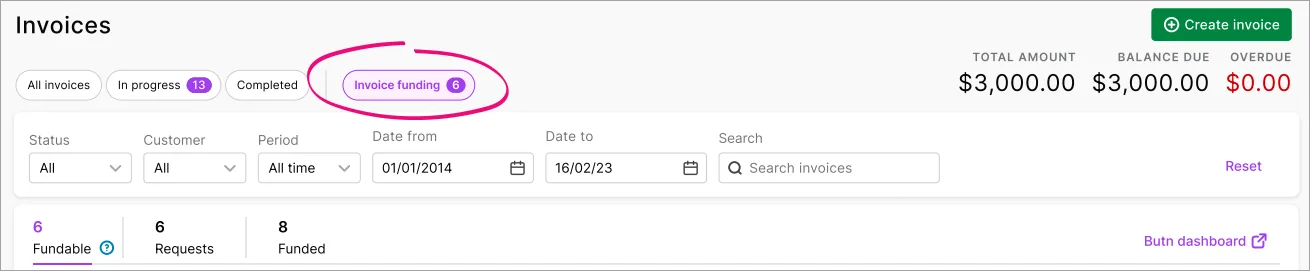

Open the Invoices page (Sales menu > Invoices).

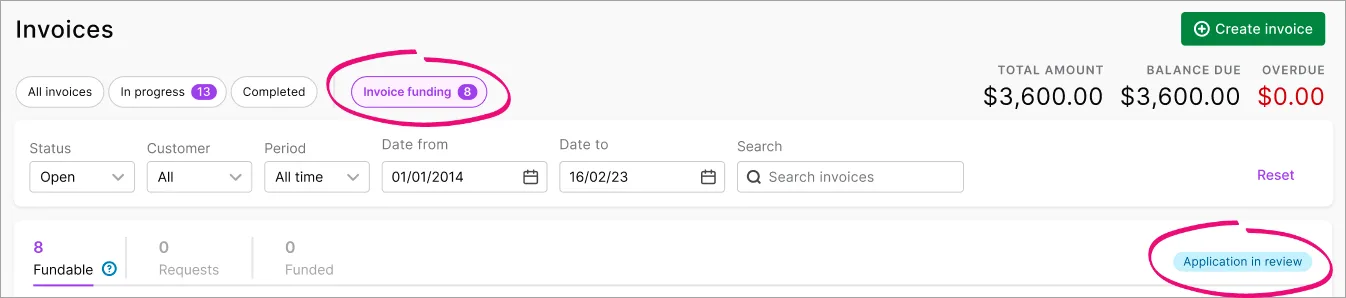

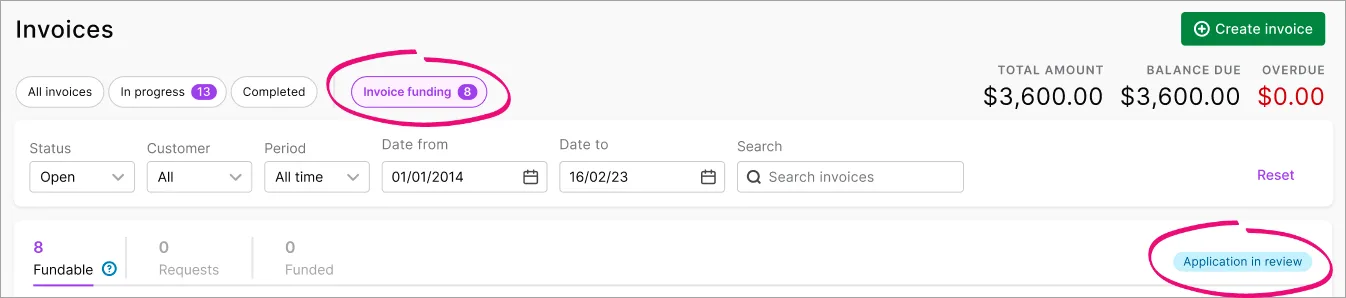

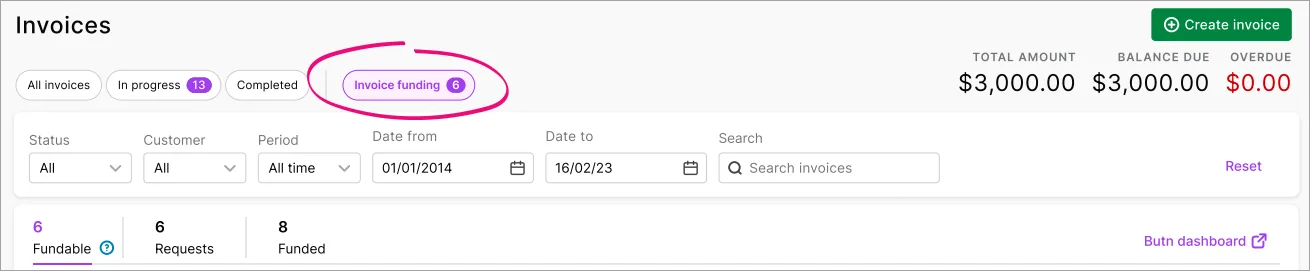

Click the Invoice funding tab. If you don't see this tab, your business isn't eligible for invoice funding.

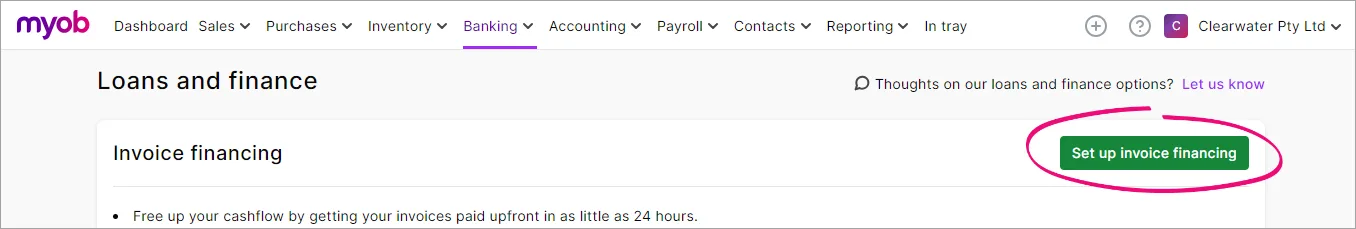

Click Set up invoice funding.

Follow the prompts to set up your Butn account. If you have any issues applying for your account, contact Butn for help (email customerservice@butn.co or call 1300 333 863).

Butn will let you know once your account is set up, then you'll be able to request funding for your unpaid invoices. You can check the status of your application on the Invoices page > Invoice funding tab.

If you need to change this account later, you'll need to contact Butn for help (email customerservice@butn.co or call 1300 333 863).

2. Request funding for an invoice

Once your Butn account is set up, you can request funding for any unpaid invoices that aren't overdue.

If you're using AccountRight in a web browser, you can also apply for invoice funding in your AccountRight desktop software.

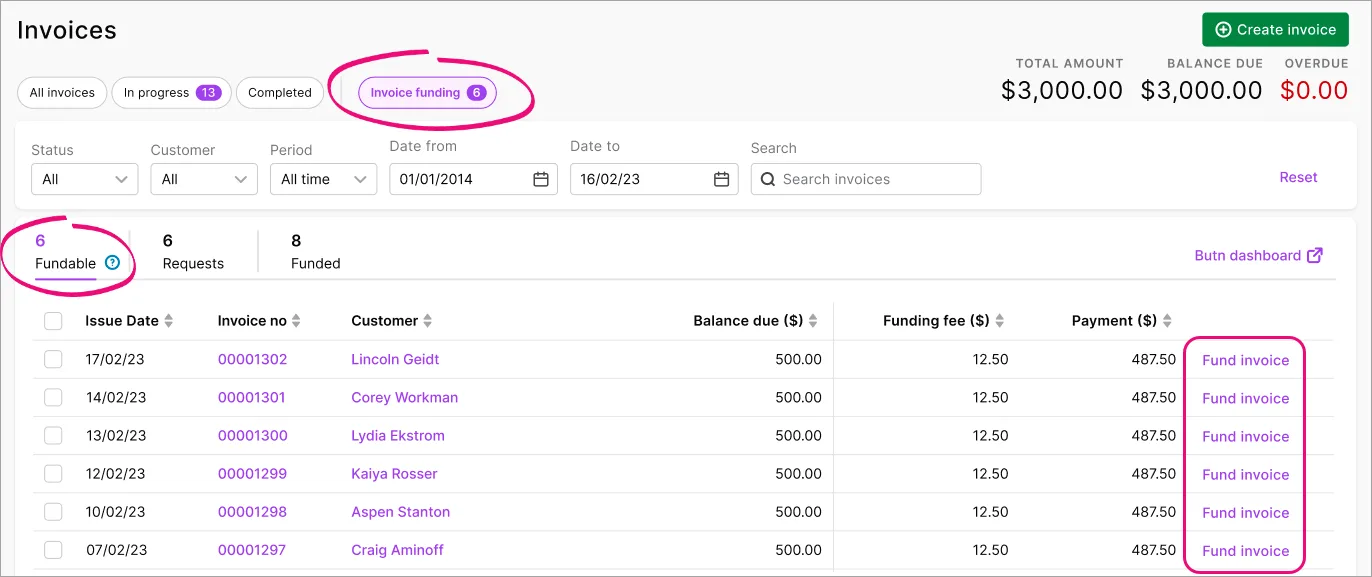

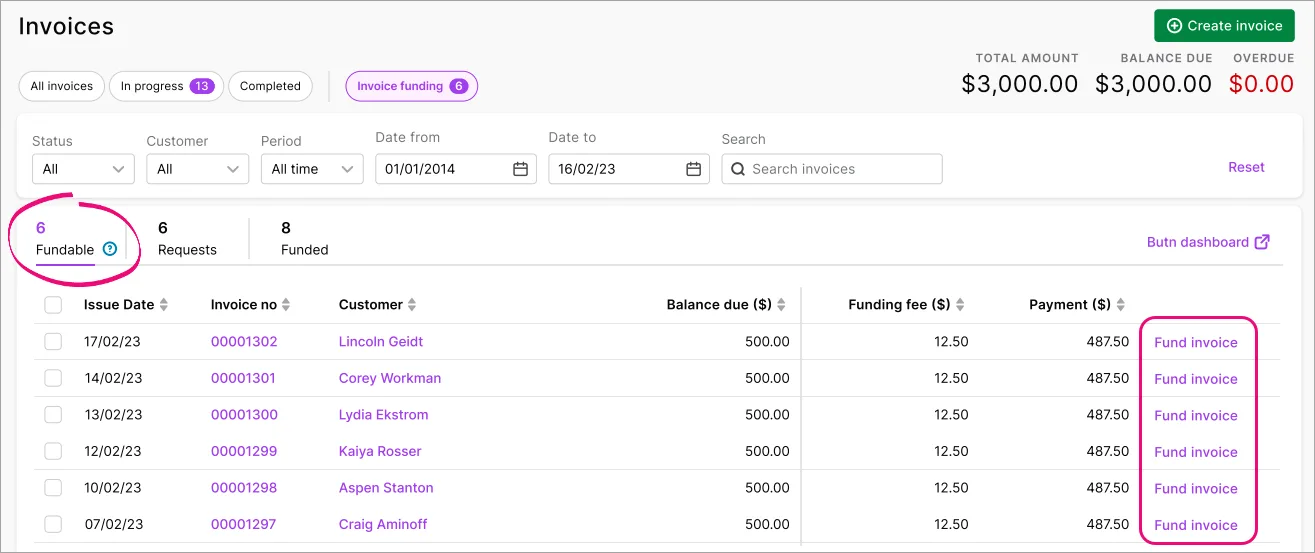

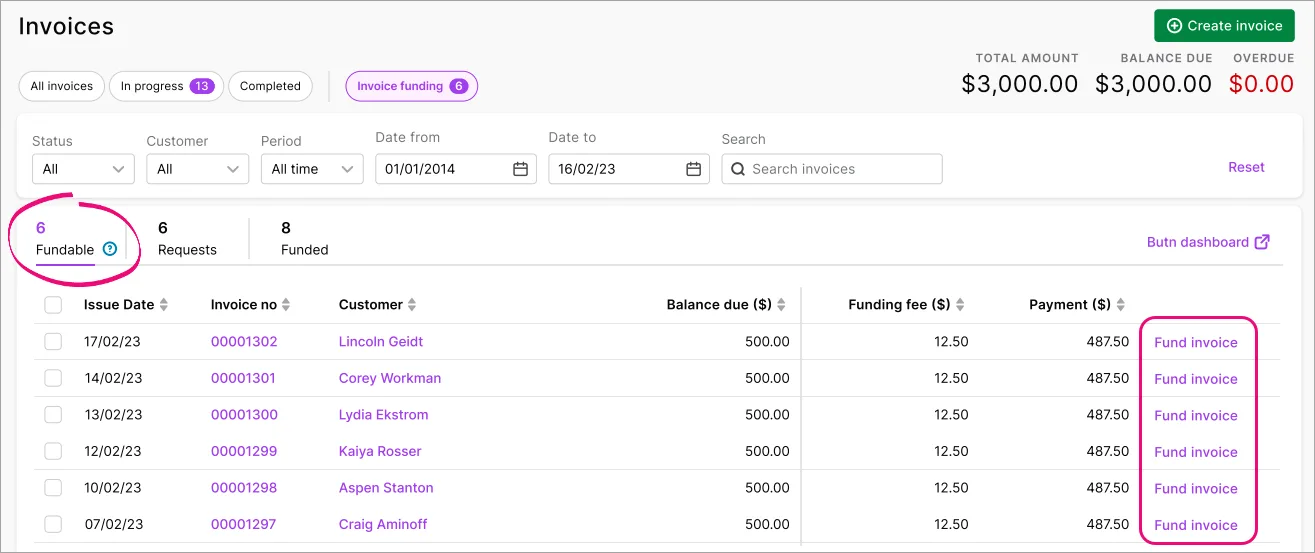

Open the Invoices page to see your fundable invoices (Sales > Invoices > Invoice funding tab > Fundable tab).

Click Fund invoice for the invoice you want funded. You'll be directed to the Butn dashboard to review and confirm your funding request.

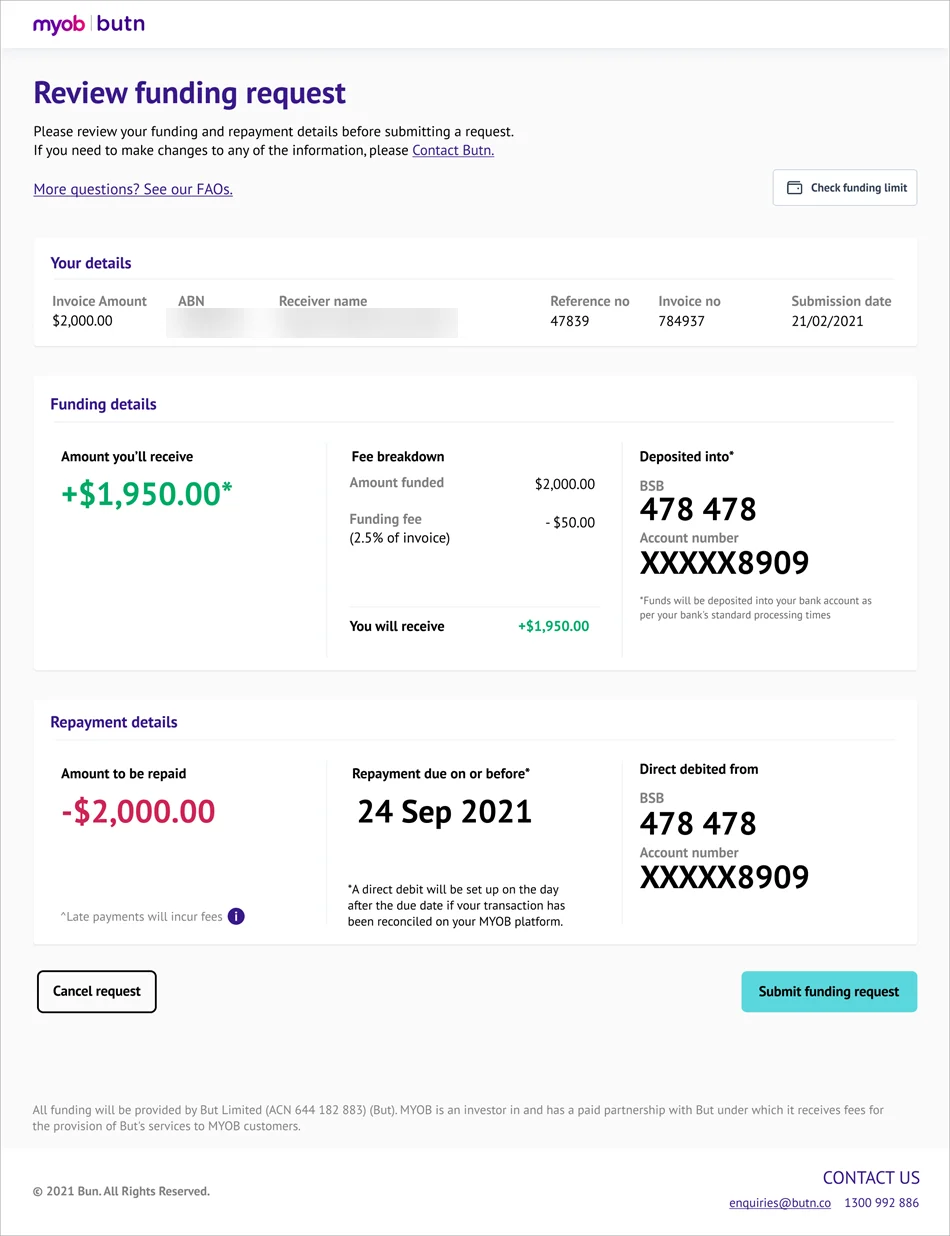

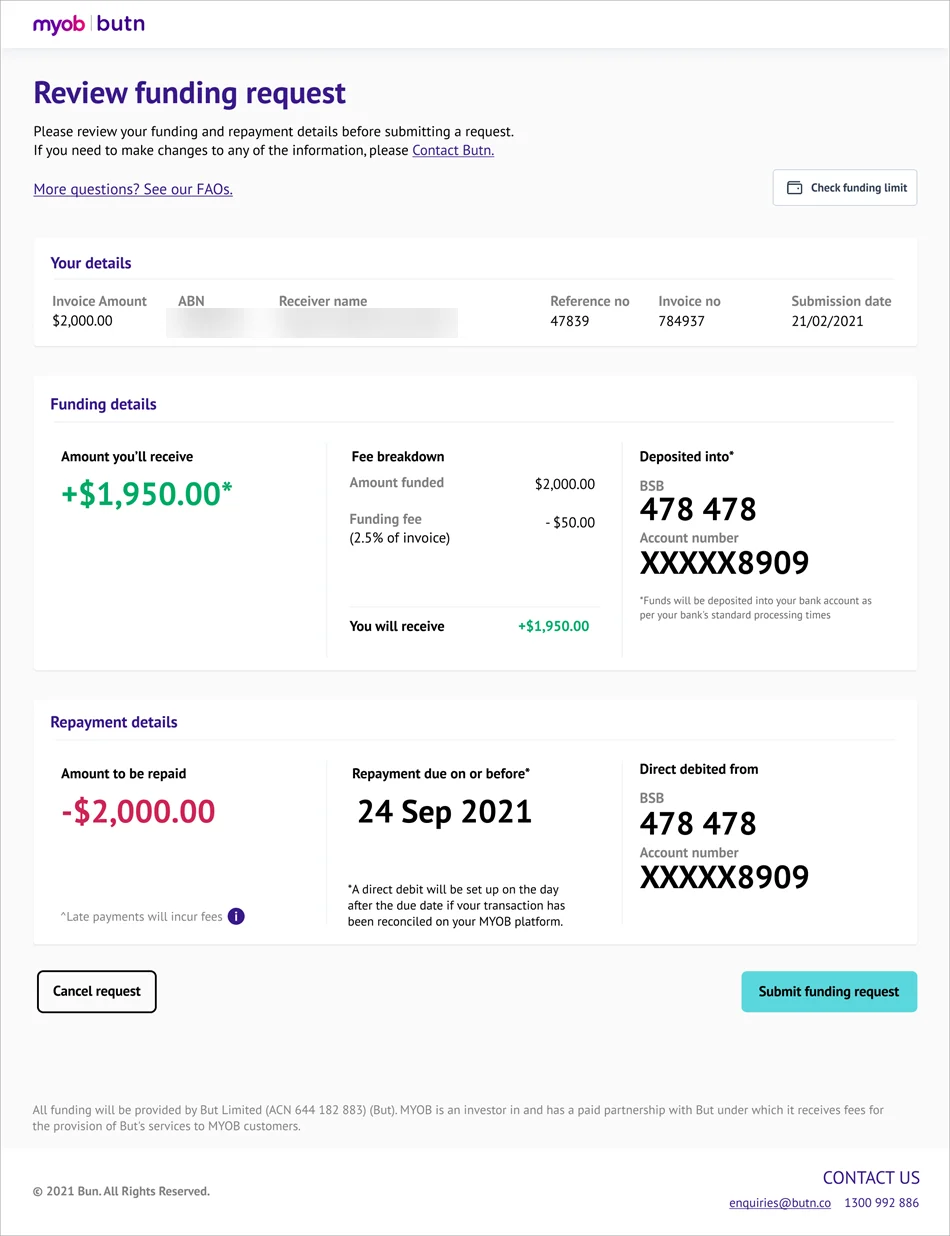

Follow the prompts and review the details of the funding transaction. You'll see a breakdown of what's being funded and the associated fees. Here's an example:

Click Submit funding request for Butn to review. This can take a couple of days.

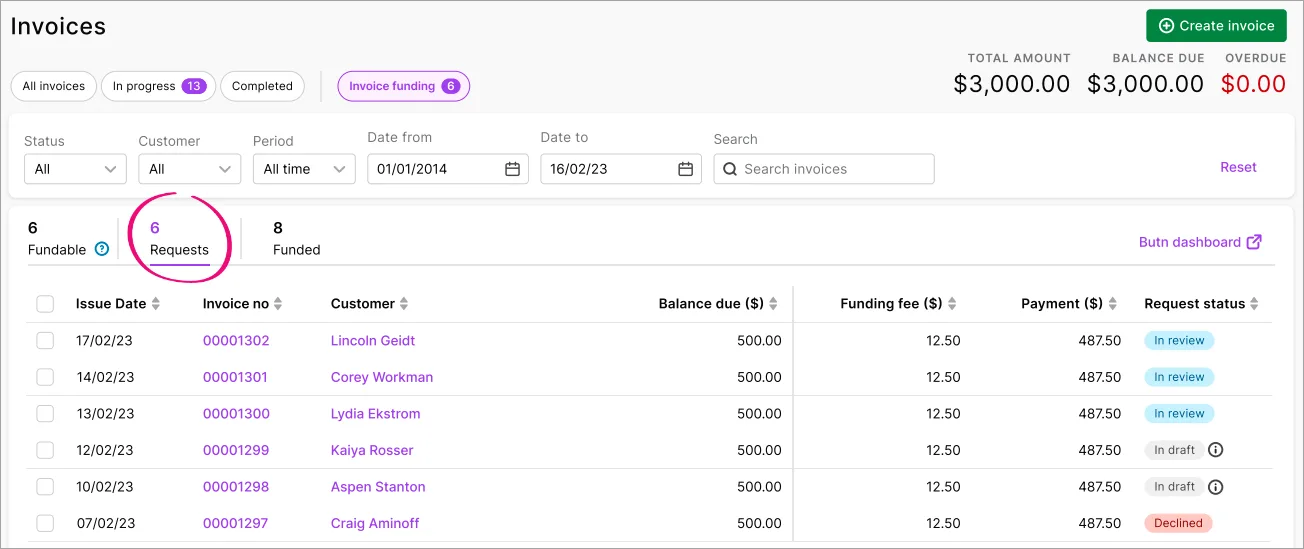

Butn will send you an email when the funding has been approved. You can check the status of each funding request on the Invoices page (Sales > Invoices > Invoice funding tab > Requests tab).

Butn will deposit the funds into the same bank account you've specified in MYOB for your customer invoice payments. How to check your invoice payment details.

Need to change or delete a funded invoice?

Contact Butn to update your repayment terms by emailing customerservice@butn.co or calling 1300 333 863 (1 300 33 FUND).

3. Check your funding requests

After you've requested funding, you can check the status of funding requests and see the details of funded invoices.

Go to the Sales menu > Invoices > Invoice funding tab.

Click the:

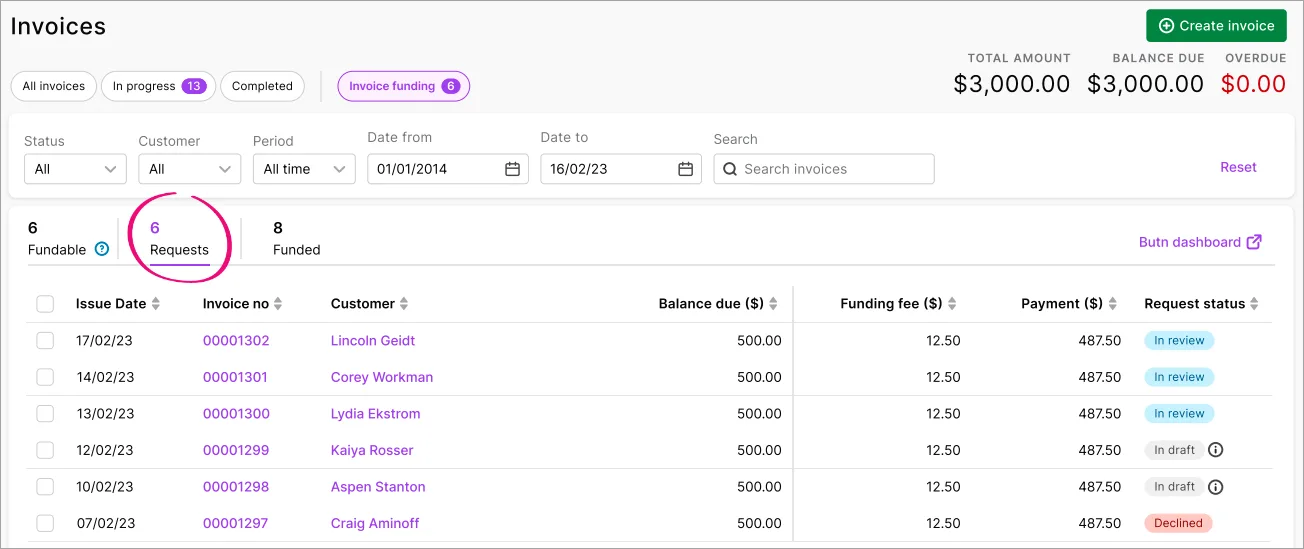

Requests tab – to check the status of funding requests.

In review – Butn is reviewing the request which can take a couple of days to approve or decline, but is usually a lot quicker.

In draft – You've started a funding request but didn't finish it. Click Butn dashboard on the Invoices page to sign into your Butn account to submit or cancel the request.

Declined – the funding request wasn't successful. Butn will contact you if a request is declined, but you can also contact Butn if you need more information. Declined requests will disappear from this list after 3 days, and also disappear from the list of fundable invoices.

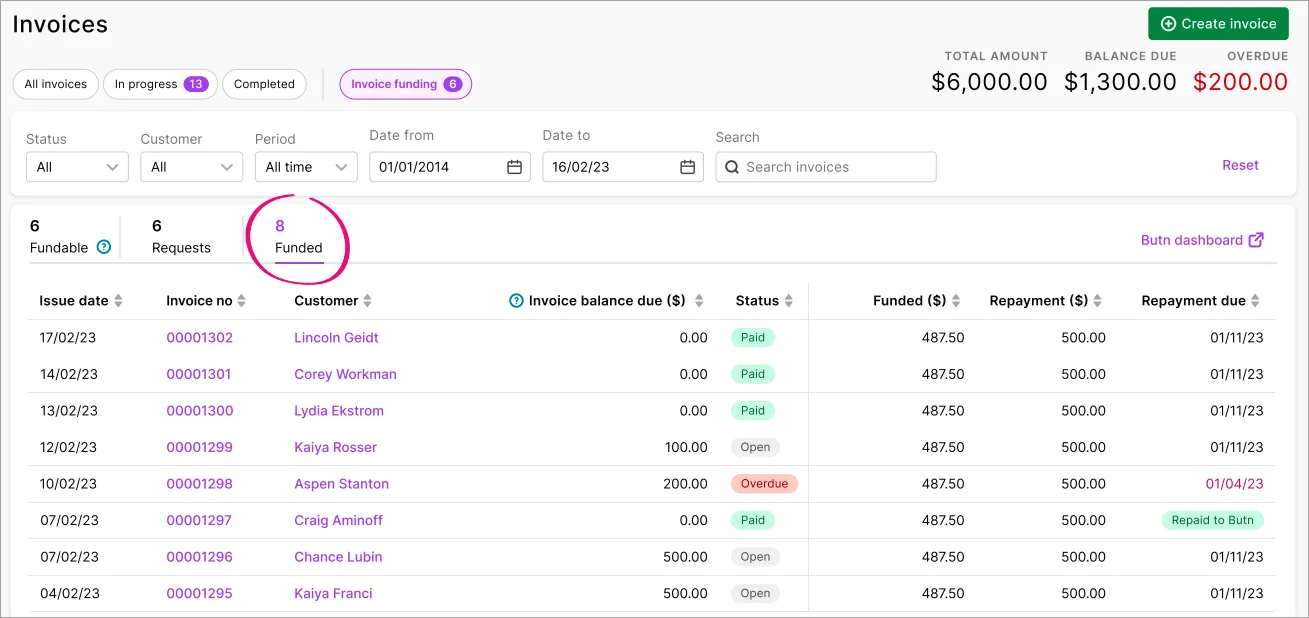

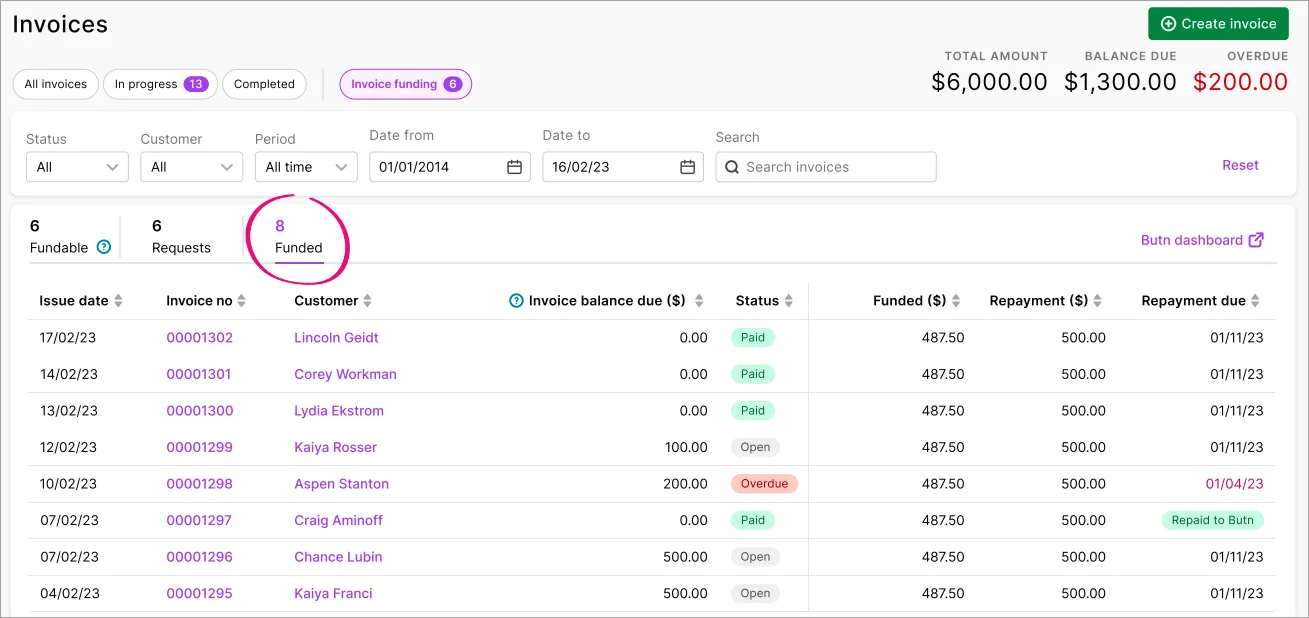

Funded tab – to see details of funded invoices.

Quickly access your Butn account

On the Invoices page > Invoice funding tab, click Butn dashboard to sign into and manage your Butn account.

Recording funding in MYOB

You'll want to keep track of the funding you receive from Butn, their fees, and the amounts you pay back to them. To help you do this, we recommend setting up two accounts in MYOB

This might seem tricky, but with the steps below (or maybe with help from your accounting advisor if you're unsure) you'll see it's not that bad.

Set up your categories

We recommend setting up:

a liability category – to keep track of the funding you receive from Butn and the repayments you make to them

an expense category – to keep track of Butn's fees

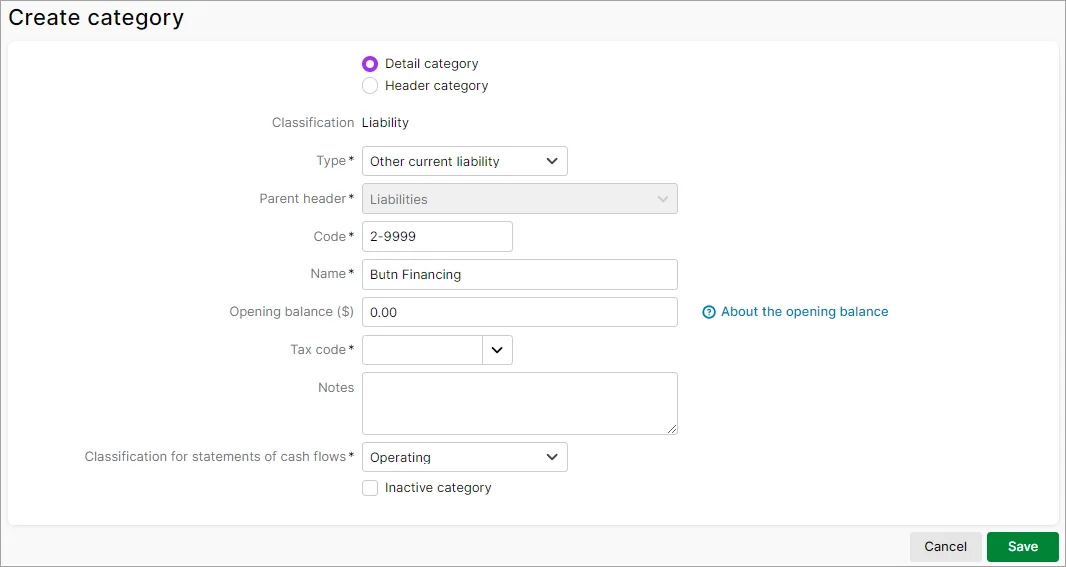

To set up the liability category:

Go to the Accounting menu and choose Categories (Chart of accounts).

Click Create category.

For the Type, choose Other current liability.

Give the category a Code that suits your category list. The prefix (the number before the dash) is based on the Type and can't be changed.

Enter the Name as "Butn Financing" (or similar).

Choose the applicable Tax code for the amounts you'll post to this category. Check with your accounting advisor if unsure. If needed, you'll be able to choose a different tax code when recording your transactions.

Choose the applicable Classification for statements of cash flow. Check with your accounting advisor if unsure. Learn more about the Statement of cash flow report.

Click Save. Here's our example category:

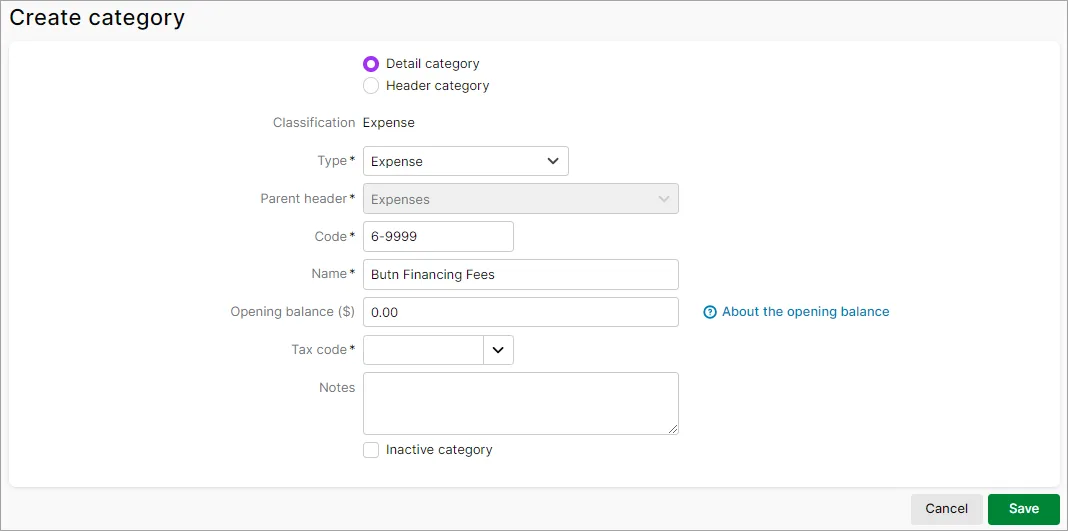

To set up the expense category:

Go to the Accounting menu and choose Categories (Chart of accounts).

Click Create category.

For the Type, choose Expense.

Give the category a Code that suits your category list. The prefix (the number before the dash) is based on the Type and can't be changed.

Enter the Name as "Butn Financing Fees" (or similar).

Choose the applicable Tax code for the amounts you'll post to this category. Check with your accounting advisor if unsure. If needed, you'll be able to choose a different tax code when recording your transactions.

Click Save. Here's our example category:

Record Butn transactions

When Butn deposits funding into your nominated bank account, and when they withdraw your repayment, you'll need to record these transactions in MYOB.

When Butn fund an invoice

Butn will deposit the funding into your nominated bank account, minus their funding fee.

Want to see a breakdown of the Butn funding transaction?

To review the amount Butn have funded you, including their fees, you can:

-

check the Butn funding confirmation email they sent you, or

-

check the funding details in the Butn portal (accessible by clicking the funding status in the invoice or by logging in here).

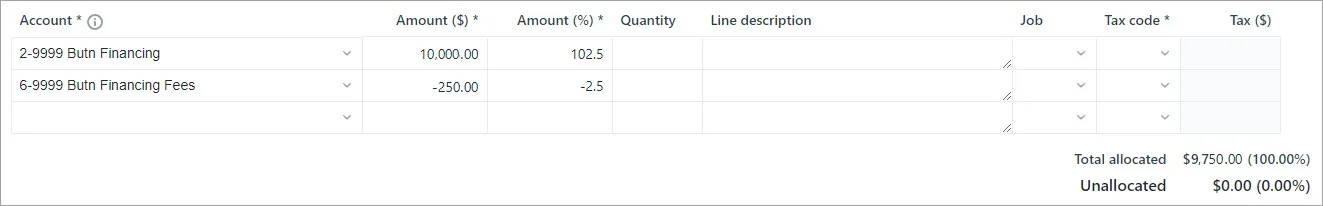

To record the funding transaction in MYOB, you'll need to allocate it to the two accounts you've set up—like this:

allocate the total funded amount (without fees deducted) to the Butn Financing liability category

allocate the fees (as a negative value) to the Butn Financing Fees expense category.

Example

Total invoice value = $10000

Total fees = $250 (2.5% of invoice value)

Funding deposited into your bank account = $9750 (10000 - 250).

If you use bank feeds

If you have a bank feed set up on the bank account where Butn deposited your funding, it's easy to categorise these amounts. Check with your accounting advisor about the applicable tax codes to use.

If you don't use bank feeds

If you don't use bank feeds on this account, you can record a receive money transaction to categorise these amounts. Check with your accounting advisor about the applicable tax codes to use.

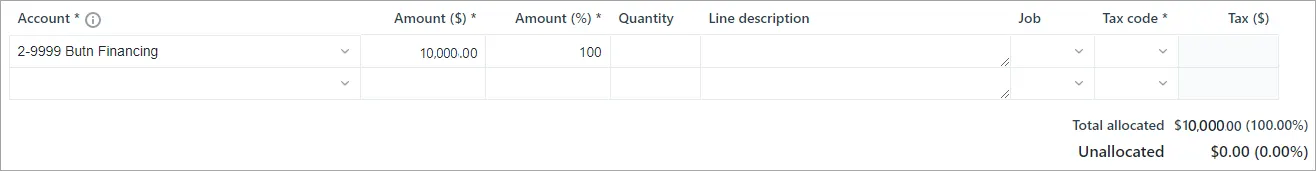

When Butn withdraw their repayment

Butn will withdraw the amount you owe them from your nominated bank account, and this will include their fees. Based on the example we used above, this means Butn will debit $9750.00 from your bank account.

Example

Funding originally deposited into your bank account from Butn = $9750.00

Total fees = $250.00

Total amount withdrawn from your bank account by Butn = $10000.00 (9750.00 + 250.00).

If you use bank feeds

If you have a bank feed set up on the account that Butn withdrew their funds from, you can categorise this amount to the Butn Financing liability category you created earlier. Check with your accounting advisor about the applicable tax code to use.

Any additional fees charged by Butn can be categorised to the Butn Financing Fees expense category you created earlier.

If you don't use bank feeds

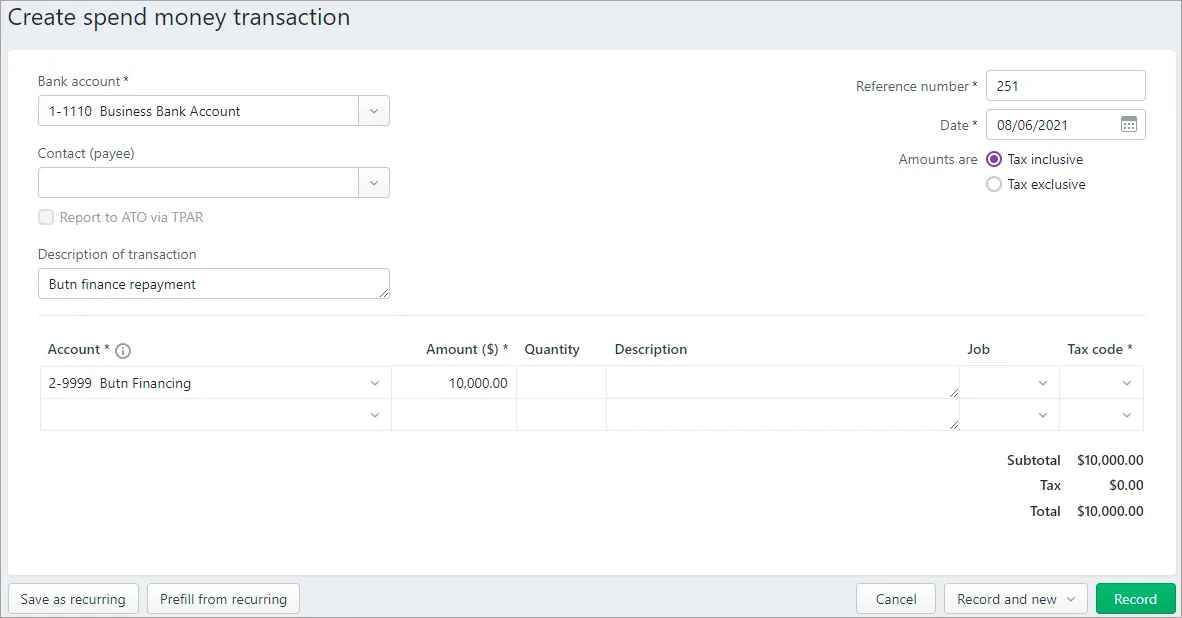

If you don't have a bank feed set up on the account that Butn withdrew their funds from, you can record a spend money transaction to allocate the withdrawal to the Butn Financing liability category. Check with your accounting advisor about the applicable tax codes to use.

Need to contact Butn?

If you have any questions or concerns, email Butn at customerservice@butn.co or call 1300 333 863 (1 300 33 FUND).

FAQs

What fees do Butn charge for using this service?

Type of fee* | Amount* | When is it due* |

|---|---|---|

Establishment fee | $199 | One-time only, deducted from your first approved funding request when funds are transferred by Butn |

Funding fee (also referred to as the Butn fee) | The funding fee is a % of the total invoice value, and is calculated based on the number of days between the funding request and when the invoice is due: From 1 to 30 days: 2.5% From 31 to 60 days: 4.5% From 61 to 90 days : 6.5% | Charged per approved funding request and deducted from funds transferred by Butn |

Extension fees | 0.1% per day of the outstanding balance owed if the funding transferred by Butn isn’t repaid in full by or on the repayment date* | Payable on request by Butn |

*Actual fees may vary. For a full breakdown of fees, please refer to your End User Agreement between you and Butn or contact Butn.

When your funding request is approved, Butn will transfer 100% of the value of the invoice to your account, minus the establishment fee (if applicable) and funding fees. They will then direct debit your account for the full 100% on the repayment date (or as per any special terms you might have negotiated separately with Butn). If applicable, Butn will get in touch to arrange a separate direct debit for any outstanding fees you might have incurred during the funding process.

Example

Melissa wants to fund a $10,000 invoice (including GST), due 60 days from the day she requests funding. Butn approve the request and agree to fund 100% of the invoice value. As it’s her first funding request with Butn, they deposit the funds into her account minus the establishment & funding fees (in this example, the establishment fee is $199 and the funding fee is 4.5% of $10,000 as the invoice is due in 60 days), for a total of $9,551.00.

Melissa’s customer pays the invoice on time and she records the payment in MYOB. This triggers Butn to schedule a direct debit for the full $10,000, which is debited from the repayment account she nominated when requesting funding. As the funding was repaid on time and she didn’t change the terms during that time, she incurs no additional charges.

How does repayment work?

During the registration process, Butn require a direct debit agreement be put in place so they can debit the funds from your account on the due repayment date. The repayment date is defined by the fee bracket you fall under (see the FAQ, 'What fees do Butn charge for using this service?', above) allowing you to maximise your funding for the full fee period.

So for example, if your funding fee bracket is for 30 days, you’ll have 30 days from when your invoice is funded to pay the funds back, regardless of when your customer pays you. The same applies for the 60 and 90 day fee brackets.

Example

Melissa wants to fund another $10,000 invoice, due 15 days from the day she requests funding. As the invoice due date is less than 30 days from when she requests funding, she is charged a 2.5% funding fee and her repayment is set for 30 days from when her invoice is funded.

This means if her customer pays her back after the invoice’s due date but before her repayment date, she will not be charged late fees and can continue to use the money Butn has funded until the repayment date.

Can I apply for funding on multiple invoices at the same time?

You absolutely can, so long as the total amount of funds loaned is within the credit limit set by Butn for your account.

For more information about fees, review your Butn End User Agreement or contact Butn by emailing customerservice@butn.co or calling 1300 333 863 (1 300 33 FUND)

Can I edit or delete the invoice once I’ve applied for funding?

Yes! After you edit the invoice or delete the invoice just let Butn know about the changes so they can update your funding agreement, otherwise your repayment amount and terms won't get updated.

Email Butn at customerservice@butn.co or call them on 1300 333 863 (1 300 33 FUND).

How do I change my nominated bank account?

To update the bank account you nominated when you set up your Butn account, submit a request through your Butn account by logging into app.butn.co/s/login or contact Butn for help. You can email them at customerservice@butn.co or call 1300 333 863 (1 300 33 FUND).

How do I cancel my Butn account?

Contact Butn for help by emailing customerservice@butn.co or calling 1300 333 863 (1 300 33 FUND).

Is there GST on the funding I receive from Butn?

Butn has advised there is no GST on the funding they provide. But as a general rule, you should always speak to your accounting advisor about your business's tax obligations.

Online company files only

Instead of waiting until a customer pays their unpaid invoice, you can obtain invoice funding. This means you'll have access to valuable cashflow when you need it, instead of waiting until the customer pays you.

MYOB has partnered with invoice finance experts Butn to provide this service. You simply apply for a Butn account, then request funding whenever you need it.

Invoice funding is currently only available to selected Australian businesses

If it's currently not available to you but you're keen to try it, register your interest by submitting a support request via My Account (log in at myaccount.myob.com and click Contact support).

How it works

Apply for an account with Butn.

Enter an invoice in MYOB as you normally would.

Request funding from Butn—directly from AccountRight.

Upon approval, Butn deposits up to 100% of the invoice value (minus fees) into your nominated bank account.

When the repayment is due, Butn debits your account for the amount you owe them.

Who's Butn?

Butn Limited (ACN 644 182 883) is an Australian business-to-business financing company. They offer a range of funding solutions to help small businesses manage their cashflow and provide them with faster access to their money.

Visit Butn.co for more information, and take a look at Butn's terms and conditions.

Getting invoice funding

The first time you apply for invoice funding, you'll apply for a Butn account. They'll verify your identity and perform a credit check on you and all directors of the business.

Once you have a Butn account, you can apply for funding directly from your invoices in MYOB.

Already have a Butn account? You can connect your account to MYOB by emailing Butn at customerservice@butn.co or calling 1300 333 863 (1 300 33 FUND).

1. Apply for a Butn account

Make sure you have:

-

entered your ABN into MYOB

-

your driver license

-

the driver license for every director or owner of your business

Butn will require signatures from all directors of the business to finalise the account setup. You’ll be asked to provide their contact details and ID as part of the registration process.

If you have all the required documentation, it can take as little as 15 minutes to set up your account. If other directors need to sign the Butn End User Agreement, it might take a little longer.

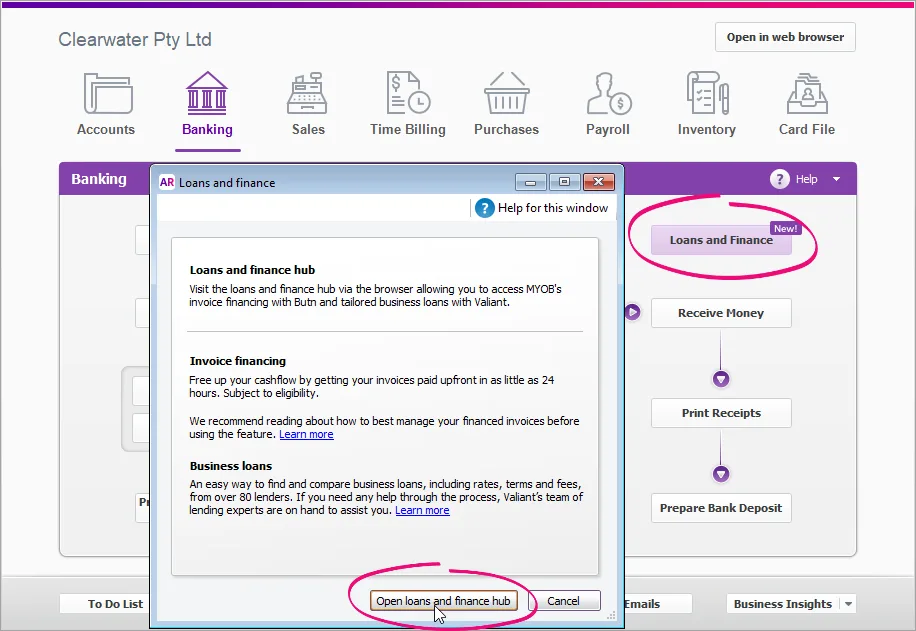

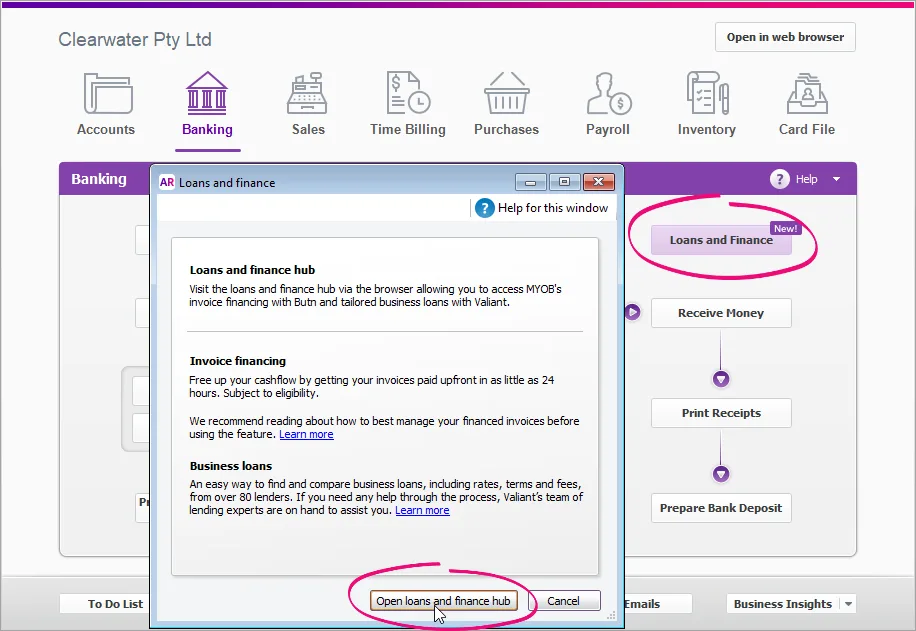

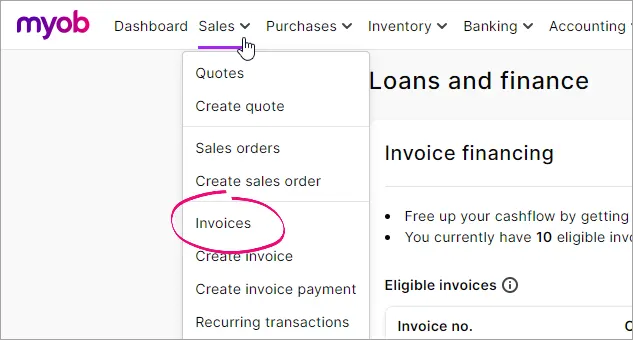

Go to the Banking command centre > Loans and Finance > Open loans and finance hub.

If prompted, sign in with your MYOB account details.

Click Set up invoice financing.

If you don't see this button, your business isn't eligible for invoice funding.

Follow the prompts to set up your Butn account. If you have any issues applying for your account, contact Butn for help (email customerservice@butn.co or call 1300 333 863).

If you need to change this account later, you'll need to contact Butn for help (email customerservice@butn.co or call 1300 333 863).

Butn will let you know once your account is set up, then you'll be able to request funding for your unpaid invoices. You can check the status of your application by accessing your AccountRight company file in a web browser (sign in at app.myob.com) then go to the Sales menu > Invoices > Invoice funding tab.

2. Request funding for an invoice

Once you have a Butn account, you can request funding for any unpaid invoices that aren't overdue.

Go to the Banking command centre > Loans and Finance then click Open loans and finance hub. If prompted, sign in with your MYOB account details.

Go to the Sales menu and choose Invoices.

Click the Invoice funding tab.

From the list of invoices on the Fundable tab, click Fund invoice for the invoice you want funded. You'll be directed to the Butn dashboard to review and confirm your funding request.

Follow the prompts and review the details of the funding transaction. You'll see a breakdown of what's being funded and the associated fees. Here's an example:

Click Submit funding request for Butn to review. This can take a couple of days.

Butn will send you an email when the funding has been approved. You can check the status of each funding request on the Invoices page (Sales > Invoices > Invoice funding tab > Requests tab).

Butn will deposit the funds into the same bank account you've specified in MYOB for your customer invoice payments. How to check your invoice payment details.

Need to change or delete a funded invoice?

Contact Butn to update your repayment terms by emailing customerservice@butn.co or calling 1300 333 863 (1 300 33 FUND).

3. Check your funding requests

After you've requested funding, you can check the status of funding requests and see the details of funded invoices. You'll do this by accessing your AccountRight company file in a web browser.

In your AccountRight desktop software, go to the Banking command centre > Loans and Finance then click Open loans and finance hub. If prompted, sign in with your MYOB account details.

Go to the Sales menu and choose Invoices.

Click the Invoice funding tab.

Click the:

Requests tab – to check the status of funding requests.

In review – Butn is reviewing the request which can take a couple of days to approve or decline, but is usually a lot quicker.

In draft – You've started a funding request but didn't finish it. Click Butn dashboard on the Invoices page to sign into your Butn account to submit or cancel the request.

Declined – the funding request wasn't successful. Butn will contact you if a request is declined, but you can also contact Butn if you need more information. Declined requests will disappear from this list after 3 days, and also disappear from the list of fundable invoices.

Funded tab – to see details of funded invoices.

Quickly access your Butn account

On the Invoices page > Invoice funding tab, click Butn dashboard to sign into and manage your Butn account.

Recording the funding in AccountRight

We recommend setting up two new accounts in MYOB to help you keep track of the funding you receive from Butn, their fees, and the amounts you pay back to them.

This might seem tricky, but with the steps below (and maybe with help from your accounting advisor) you'll see it's not that bad.

Set up your accounts

We recommend setting up:

a liability account—to keep track of the funding you receive from Butn and the repayments you make to them

an expense account—to keep track of Butn's fees

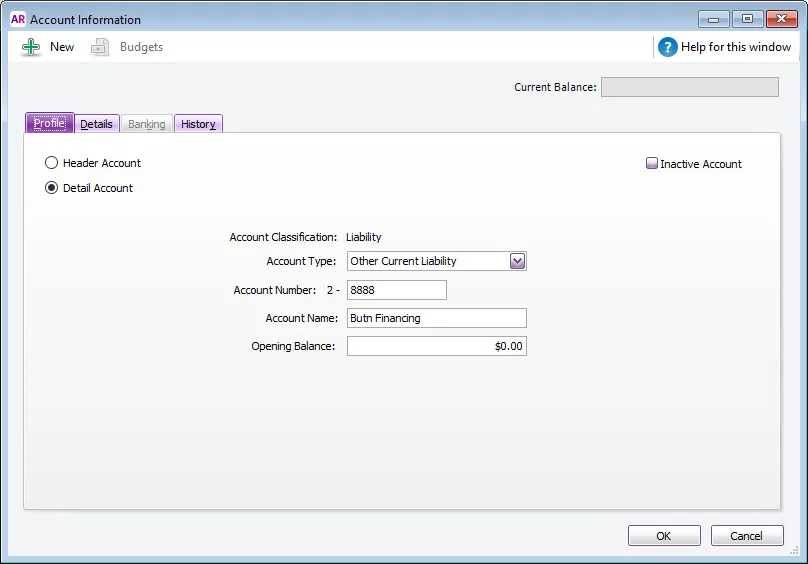

To set up the liability account:

Go to the Accounts command centre and click Accounts List.

Click New.

Make sure the Detail Account option is selected.

For the Account type, choose Other Current Liability.

Give the account a number that suits your accounts list. The prefix (the number before the dash) is based on the Account Type and can't be changed.

Enter the Account Name as "Butn Financing" (or similar).

Click the Details tab and choose the applicable Tax Code for the amounts you'll post to this account. Check with your accounting advisor if unsure. If needed, you'll be able to choose a different tax code when recording your transactions.

Choose the applicable Classification for Statement of Cash Flows. Check with your accounting advisor if unsure. Learn more about the Statement of cash flow report.

Click OK. Here's our example account:

To set up the expense account:

Go to the Accounts command centre and click Accounts List.

Click New.

Make sure the Detail Account option is selected.

For the Account Type, choose Expense.

Give the account a number that suits your accounts list. The prefix (the number before the dash) is based on the Account Type and can't be changed.

Enter the Account Name as "Butn Financing Fees" (or similar).

Click the Details tab and choose the applicable Tax Code for the amounts you'll post to this account. Check with your accounting advisor if unsure. If needed, you'll be able to choose a different tax code when recording your transactions.

Click OK. Here's our example account:

Record Butn transactions

When Butn deposits funding into your nominated bank account, and when they withdraw your repayment, you'll need to record these transactions in MYOB.

When Butn fund an invoice

Butn will deposit the funding into your nominated bank account, minus their funding fee.

Want to see a breakdown of the Butn funding transaction?

To review the amount Butn have funded you, including their fees, you can:

-

check the Butn funding confirmation email they sent you, or

-

check the funding details in the Butn portal (accessible by clicking the funding status in the invoice or by logging in here).

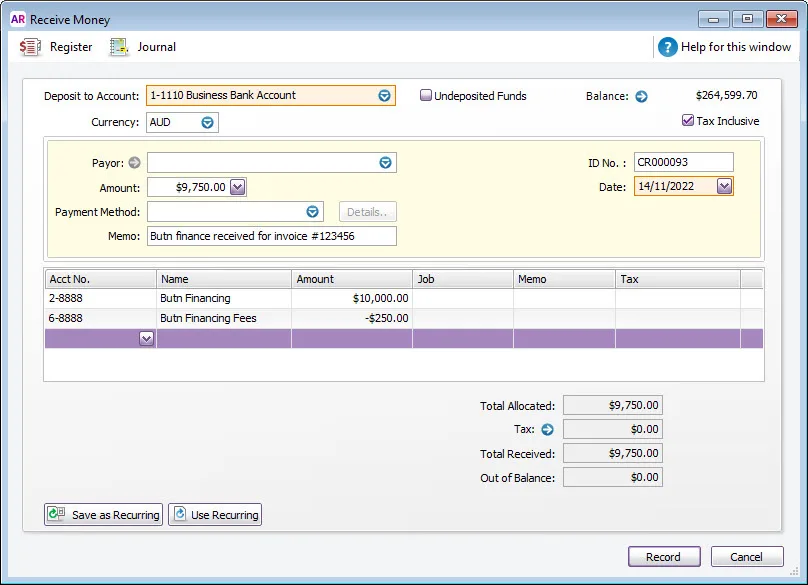

To record the funding transaction in MYOB, you'll need to allocate it to the two accounts you've set up—like this:

allocate the total funded amount (without fees deducted) to the Butn Financing liability account

allocate the fees (as a negative value) to the Butn Financing Fees expense account.

Example

Total invoice value = $10000

Total fees = $250 (2.5% of invoice value)

Funding deposited into your bank account = $9750 (10000 - 250).

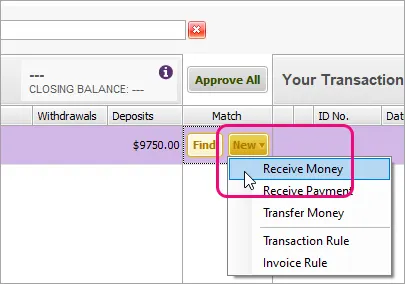

If you use bank feeds

If you have a bank feed set up on the bank account where Butn deposited your funding, create a new receive money transaction from the Bank Feeds window (click New > Receive Money for the Butn deposit). You can then allocate the amounts as shown in the example transaction below.

If you don't use bank feeds

If you don't use bank feeds on this account, you can record a receive money transaction to allocate these amounts (Banking > Receive Money). Check with your accounting advisor about the applicable tax codes to use.

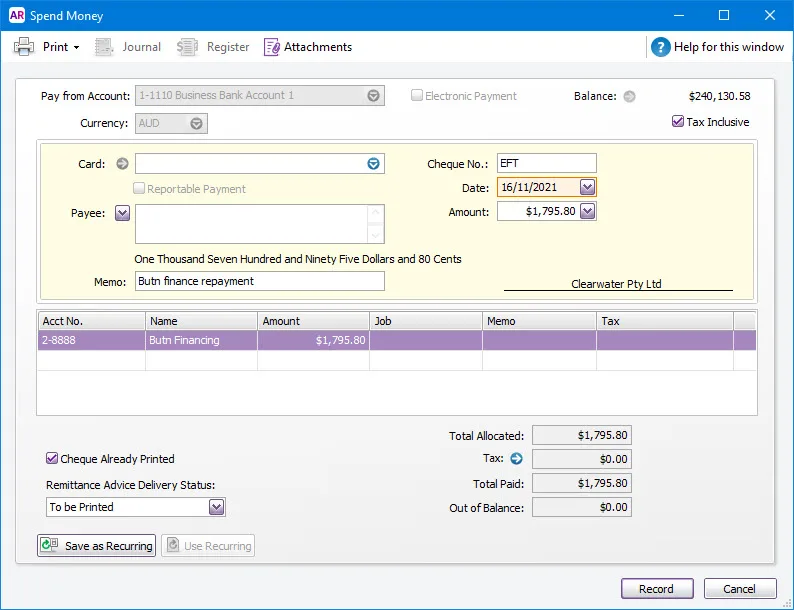

When Butn withdraw their repayment

Butn will withdraw the amount you owe them from your nominated bank account, and this will include their fees. Based on the example we used above, this means Butn will debit $9750.00 from your bank account.

Example

Funding originally deposited into your bank account from Butn = $9750.00

Total fees = $250.00

Total amount withdrawn from your bank account by Butn = $10000.00 (9750.00 + 250.00).

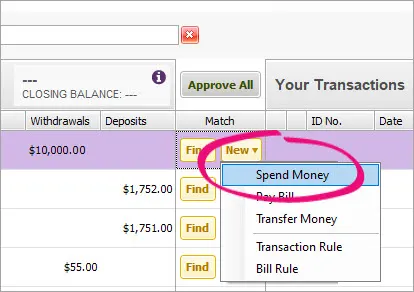

If you use bank feeds

If you have a bank feed set up on the bank account where Butn deposited your funding, create a new spend money transaction from the Bank Feeds window (click New > Spend Money for the Butn withdrawal). You can then allocate the amount as shown in the example transaction below.

Any additional fees charged by Butn can be categorised to the Butn Financing Fees expense category you created earlier.

If you don't use bank feeds

If you don't have a bank feed set up on the account that Butn withdrew their funds from, you can record a spend money transaction to allocate the withdrawal to the Butn Financing liability account. Check with your accounting advisor about the applicable tax codes to use.

Need to contact Butn?

If you have any questions or concerns, email Butn at customerservice@butn.co or call 1300 333 863 (1 300 33 FUND).

FAQs

What fees do Butn charge for using this service?

Type of fee* | Amount* | When is it due* |

|---|---|---|

Establishment fee | $199 | One-time only, deducted from your first approved funding request when funds are transferred by Butn |

Funding fee (also referred to as the Butn fee) | The funding fee is a % of the total invoice value, and is calculated based on the number of days between the funding request and when the invoice is due: From 1 to 30 days: 2.5% From 31 to 60 days: 4.5% From 61 to 90 days : 6.5% | Charged per approved funding request and deducted from funds transferred by Butn |

Extension fees | 0.1% per day of the outstanding balance owed if the funding transferred by Butn isn’t repaid in full by or on the repayment date* | Payable on request by Butn |

*Actual fees may vary. For a full breakdown of fees, please refer to your End User Agreement between you and Butn or contact Butn.

When your funding request is approved, Butn will transfer 100% of the value of the invoice to your account, minus the establishment fee (if applicable) and funding fees. They will then direct debit your account for the full 100% on the repayment date (or as per any special terms you might have negotiated separately with Butn). If applicable, Butn will get in touch to arrange a separate direct debit for any outstanding fees you might have incurred during the funding process.

Example

Melissa wants to fund a $10,000 invoice (including GST), due 60 days from the day she requests funding. Butn approve the request and agree to fund 100% of the invoice value. As it’s her first funding request with Butn, they deposit the funds into her account minus the establishment & funding fees (in this example, the establishment fee is $199 and the funding fee is 4.5% of $10,000 as the invoice is due in 60 days), for a total of $9,551.00.

Melissa’s customer pays the invoice on time and she records the payment in MYOB. This triggers Butn to schedule a direct debit for the full $10,000, which is debited from the repayment account she nominated when requesting funding. As the funding was repaid on time and she didn’t change the terms during that time, she incurs no additional charges.

How does repayment work?

During the registration process, Butn require a direct debit agreement be put in place so they can debit the funds from your account on the due repayment date. The repayment date is defined by the fee bracket you fall under (see the FAQ, 'What fees do Butn charge for using this service?', above) allowing you to maximise your funding for the full fee period.

So for example, if your funding fee bracket is for 30 days, you’ll have 30 days from when your invoice is funded to pay the funds back, regardless of when your customer pays you. The same applies for the 60 and 90 day fee brackets.

Example

Melissa wants to fund another $10,000 invoice, due 15 days from the day she requests funding. As the invoice due date is less than 30 days from when she requests funding, she is charged a 2.5% funding fee and her repayment is set for 30 days from when her invoice is funded.

This means if her customer pays her back after the invoice’s due date but before her repayment date, she will not be charged late fees and can continue to use the money Butn has funded until the repayment date.

Can I apply for funding on multiple invoices at the same time?

You absolutely can, so long as the total amount of funds loaned is within the credit limit set by Butn for your account.

For more information about fees, review your Butn End User Agreement or contact Butn by emailing customerservice@butn.co or calling 1300 333 863 (1 300 33 FUND)

Can I edit or delete the invoice once I’ve applied for funding?

Yes! After you edit the invoice or delete the invoice just let Butn know about the changes so they can update your funding agreement, otherwise your repayment amount and terms won't get updated.

Email Butn at customerservice@butn.co or call them on 1300 333 863 (1 300 33 FUND).

How do I change my nominated bank account?

To update the bank account you nominated when you set up your Butn account, submit a request through your Butn account by logging into app.butn.co/s/login or contact Butn for help. You can email them at customerservice@butn.co or call 1300 333 863 (1 300 33 FUND).

How do I cancel my Butn account?

Contact Butn for help by emailing customerservice@butn.co or calling 1300 333 863 (1 300 33 FUND).

Is there GST on the funding I receive from Butn?

Butn has advised there is no GST on the funding they provide. But as a general rule, you should always speak to your accounting advisor about your business's tax obligations.