When you're selling, offering credit is a great way to build strong relationships and increase the amount they spend. And when you're buying, taking advantage of the credit offered to you is a great way to control your cashflow.

Setting credit terms

Customer credit terms

Before you offer credit, consider the impact of late or non-payment on your cashflow and have a plan to reduce your risk. You can do this by running credit checks, only offering credit on subsequent sales or setting limits. And you can provide incentives such as early payment discounts.

You can set your credit terms at three levels:

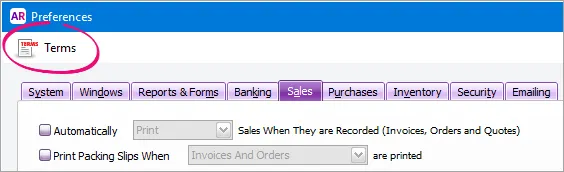

default–you can set default terms to apply to all new customers in the Sales tab of the Preferences window (Setup menu > Preferences > Sales tab > Terms button).

customer–for existing customers, you can override the default terms in the Selling Details tab of the customer's card (Card File command centre > Cards List > Customer tab > open the customer's card > Selling Details tab).

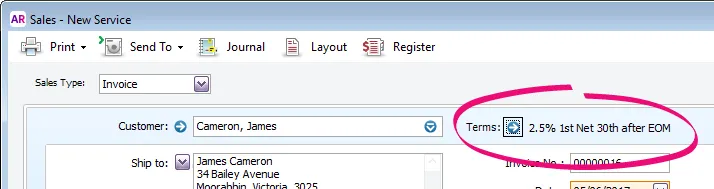

transaction–you can override customer terms for a sale by clicking the Terms arrow in the Sale window.

How you set your terms is up to you. If you only offer credit after doing a credit check, you could set your default terms to a cash-only option (such as COD) and update a customer's terms after credit is approved.

Or, if your only offer credit on subsequent sales, you could set your default terms (such as 7 days) and override the terms with a cash-only option when you record the first sale. Future sales will use the default terms.

Supplier credit terms

When a supplier offers you credit, record the terms they offer in AccountRight so that you can use reports and tools to help you manage your cashflow.

You can set your credit terms at three levels:

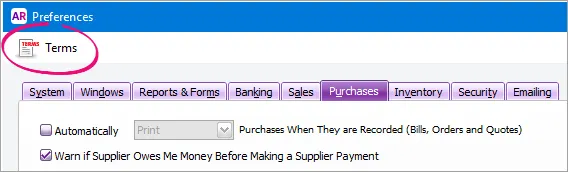

default–you can set default terms to apply to all new supplier cards in the Purchases tab of the Preferences window (click the Terms button). If it's likely that your suppliers offer different terms, you can leave this as a cash option (such as COD) and manually enter the terms for each supplier.

supplier–for existing suppliers, you can override the default terms in the Buying Details tab of the supplier's card (Card File command centre > Cards List > Supplier tab > open the supplier's card > Buying Details tab).

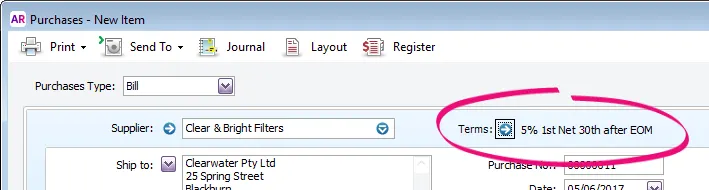

transaction–you can override terms for a purchase by clicking the Terms arrow in the Purchase window.

What terms can you set?

Payments can be due immediately (such as cash), in a number of days or on a day of the month.

When choosing your customer terms, it's a good idea to learn how unpaid amounts are aged and how they appear in customer statements.

The following examples apply to both setting customer and supplier terms.

Option | Description |

|---|---|

Prepaid | Payment is due before goods are delivered. You might use this for website sales where payment is made upfront before the goods are shipped. Leave the Discount Days and Balance Due Days fields as zero. |

On a day of the month | Enter the day of the month when payment is due. For example, if you enter 15th, and a sale or purchase is made on the 14th of the month, payment is due the next day. And if the sale or purchase is made on the 16th, payment is due on the 15th of the next month, You might use this option when payment is due on the same day for all your customers, such as a monthly subscription or membership dues. |

In a given number of days | Enter the number of days before payment is due, like 7 days. |

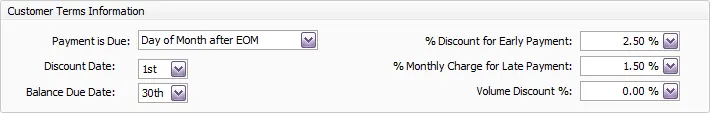

Day of month after EOM (End of Month) | Set the day of the month after the current month that payment is due, such as EOM (the last day of the month). Use this option if payment is due on the last day of the month, regardless of the number of days in the month. |

COD (cash on delivery) | Payment is due when goods are delivered. You'd use this for cash sales where no terms apply. Leave the Discount Days and Balance Due Days fields as zero. |

# of days after EOM (End Of Month) | Enter the number of days after the current month that payment is due, such as 28 days. Note that as you're setting a fixed number of days, entering a number such as 30 or 31 may affect customer statement reporting for months with less than 30 or 31 days. If payments are due on the last day of the next month, use the following option. |

Example of credit terms

In the following example, assume a sale or purchase is made on 10 March. The due date depends on the terms and the balance due date entered.

Option | Balance due days/date | Payment due |

|---|---|---|

COD (cash on delivery) | 0 | 10 March |

Prepaid | 0 | 10 March |

In a given number of days | 7 days | 17 March |

On a day of the month | 15th of month | 15 March |

# of days after EOM (End Of Month) | 31 days | 1 May |

Day of month after EOM (End of Month) | EOM | 30 April |