The Statement of cash flow report shows:

how your cash position has changed over a period of time

the amount of cash earned from profit

where you received additional cash, and

where your cash was spent.

Once your categories are classified (as Operating, Investing or Financing), they are displayed in that section of the report.

In accounting terms, the Statement of cash flow report uses the 'indirect' or 'add-back' method to calculate the cash flows.

Not sure which classification to use? Check with your accounting advisor or ask an expert on the community forum.

To run the Statement of cash flow report, go to the Reporting menu and choose Reports, then click Statement of cash flow.

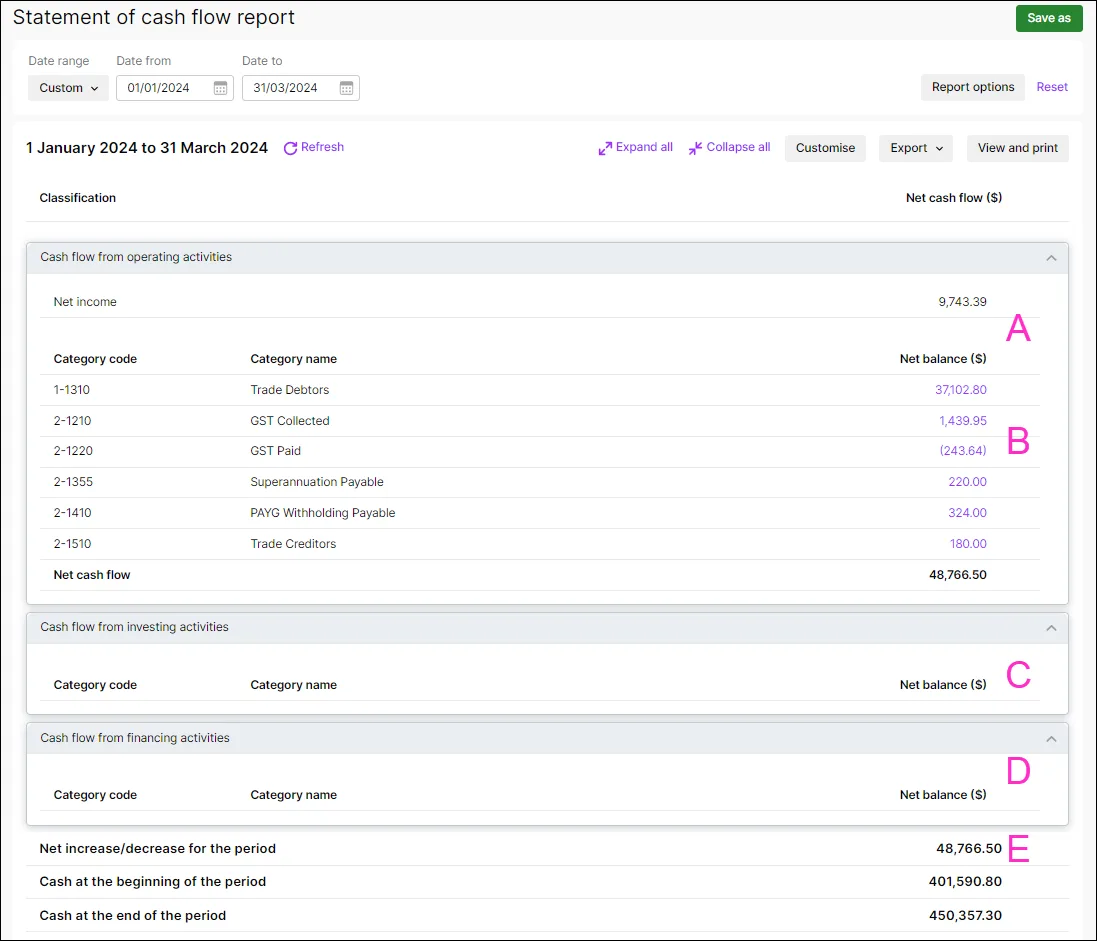

Example Statement of cash flow report

A | This figure is the Net Profit/(Loss) amount from the Profit and Loss (Accrual) report. |

B | This section details changes in Asset and Liability categories that are classified as Operating. |

C | This section details changes in Asset and Liability categories that are classified as Investing. |

D | This section details changes in Asset, Liability and Equity categories that are classified as Financing. |

E | This section details changes in Asset categories that are classified as Bank. |

Positive and negative amounts

An increase in an Asset category will show as a negative amount, while a decrease in an Asset category will show as a positive amount.

An increase in a Liability or Equity category will show as a positive amount, while a decrease in a Liability or Equity category will show as a negative amount.

FAQs

How do I change the classification of my categories?

Go to the Accounting menu and choose Categories (Chart of accounts).

Click to open the category you want to change.

In the Classification for statement of cash flows field, choose the required classification. If unsure, check with your accounting advisor.

Click Save

How are the category types classified?

The three classifications used in the Statement of cash flow report are described below. If you're unsure about which classification to use, check with your accounting advisor.

Financing | Balance sheet items that are to do with borrowing money or the repayment on borrowings. For example, Hire Purchase, Leases, and Bank Loans. In some cases, this may also include directors' or shareholders' loans. |

Investing | Balance sheet items that are used when deciding on how to utilise cash for the acquisition of fixed assets, plant and equipment, and investments. The sale of these assets or the redemption of investments into cash is also an 'investing' activity. |

Operating | All other balance sheet items, where it is effectively a timing issue that creates the transaction, for example, accruals and prepayments. Accumulated depreciation is classified as 'operating' so that it offsets the depreciation expense in the profit and loss report. |

(AccountRight Standard, Plus and Premier only)

The Statement of Cash Flow report shows:

how your cash position has changed over a period of time

the amount of cash earned from profit

where you received additional cash, and

where your cash was spent.

Once your accounts are classified (as Operating, Investing or Financing), they are displayed in that section of the report.

In accounting terms, the Statement of Cash Flow report uses the 'indirect' or 'add-back' method to calculate the cash flows.

Not sure which classification to use? Check with your accounting advisor or ask an expert on the community forum.

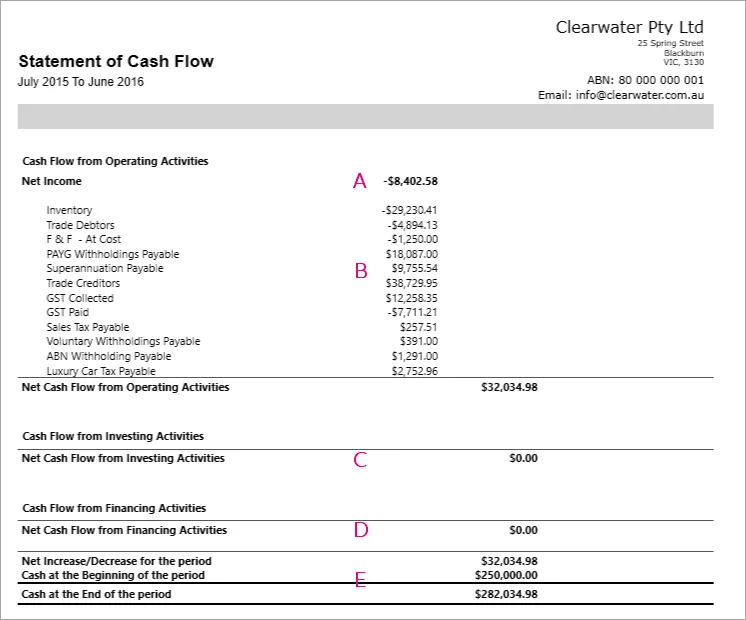

Example report

A | This figure is the Net Profit/(Loss) amount from the Profit and Loss (Accrual) report. |

B | This section details changes in Asset and Liability accounts that are classified as Operating. |

C | This section details changes in Asset and Liability accounts that are classified as Investing. |

D | This section details changes in Asset, Liability and Equity accounts that are classified as Financing. |

E | This section details changes in Asset accounts that are classified as Bank. |

An increase in an Asset account will show as a negative amount, while a decrease in an Asset account will show as a positive amount.

An increase in a Liability or Equity account will show as a positive amount, while a decrease in a Liability or Equity account will show as a negative amount.

FAQs

Where do I find the Statement of Cash Flow report?

Go to the Reports menu and choose Index to Reports.

Click the Banking tab.

Under the Cheques and Deposits heading, select Statement of Cash Flow.

How do I change the classification of my accounts?

Go to the Accounts command centre and click Accounts List.

Click on the zoom arrow beside the account you want to change. The Edit Accounts window is displayed.

[Optional] In the Account Type field, select the appropriate account type. Note that the Bank account type will not display on the Statement of Cash Flow report.

Click the Details tab.

In the Classification for Statement of Cash Flows field, select the required classification.

Click OK.

How are the account types classified?

The three classifications used in the Statement of Cash Flow report are described below. If you are unsure about which classification to use, consult your accountant or an MYOB Certified Consultant.

Financing | Balance sheet items that are to do with borrowing money or the repayment on borrowings. For example, Hire Purchase, Leases, and Bank Loans. In some cases, this may also include directors' or shareholders' loans. |

Investing | Balance sheet items that are used when deciding on how to utilise cash for the acquisition of fixed assets, plant and equipment, and investments. The sale of these assets or the redemption of investments into cash is also an 'investing' activity. |

Operating | All other balance sheet items, where it is effectively a timing issue that creates the transaction, for example, accruals and prepayments. Accumulated depreciation is classified as 'operating' so that it offsets the depreciation expense in the profit and loss report. |