Typically when importing, GST is levied at 10% of the landed cost of the goods and is payable to the Australian Tax Office (ATO), not your overseas supplier. You'll usually create one bill to record the overseas purchase and another bill to record the costs associated with the import.

When the goods are landed in Australia, the customs office will generally determine your GST liability and provide you with a detailed account of the amount payable.

How you need to handle overseas purchases will depend on your business, GST reporting requirements, and the import costs which may apply. As such, the information below is of a generic nature. It's best to check with your accounting advisor to determine the best method for you.

Let's take a look at how you can record an overseas purchase, followed by two possible ways you can handle the associated import costs.

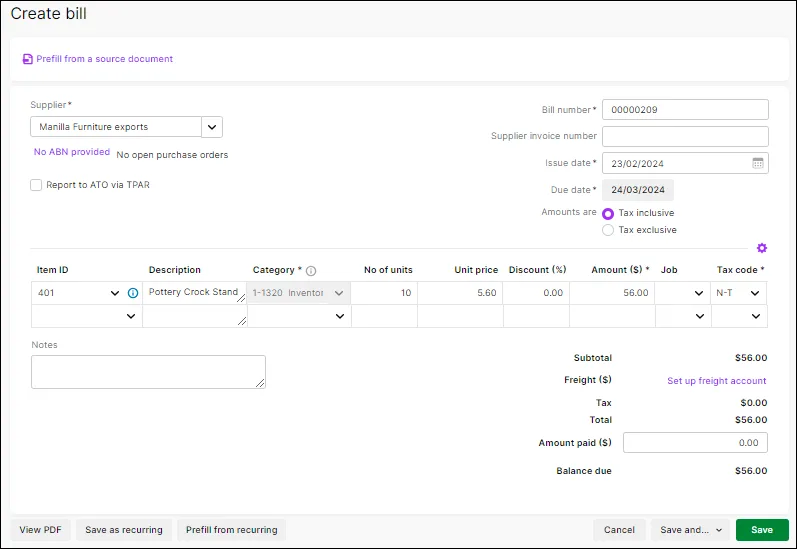

The example below is for recording the overseas purchase of a stock item using the Services and items field layout. For other types of purchases, use the Services field layout.

Recording the overseas purchase

The purchase for the imported goods can be entered like a regular bill (need a refresher?). In our example below, note the following:

The overseas Supplier has been selected as they are being paid for the imported goods.

The N-T (Not Reportable) tax code is used because in this example the GST is not payable to the overseas supplier.

Recording the import costs

Here are two examples of how to record the import costs.

Check with an expert

The info below contains examples only. Always check with your accounting advisor, or the experts on our community forum, about the GST implications for your business.

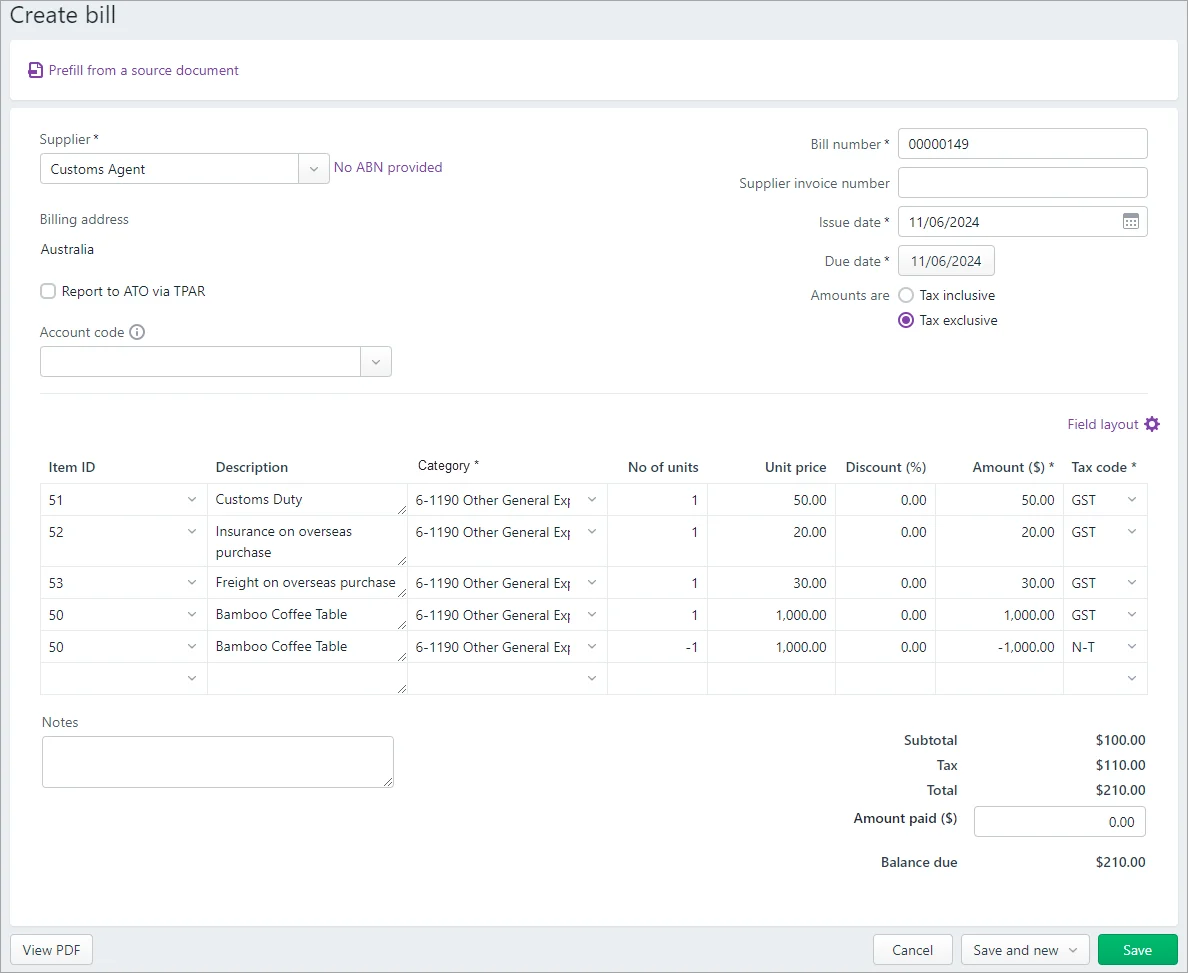

Treating the import costs as expense items

This example shows how to record a purchase with each import cost listed separately. In the example purchase below:

The customs agent has been selected as the Supplier as they are being paid the import costs.

The import costs have been set up as stock items which means you can use the Services and items field layout. Otherwise, you can enter the purchase using the Services layout to enter the details of the import costs on each line.

The double entry for the imported stock item on the last two lines is to account for the GST.

The Category you choose for each line will be up you.

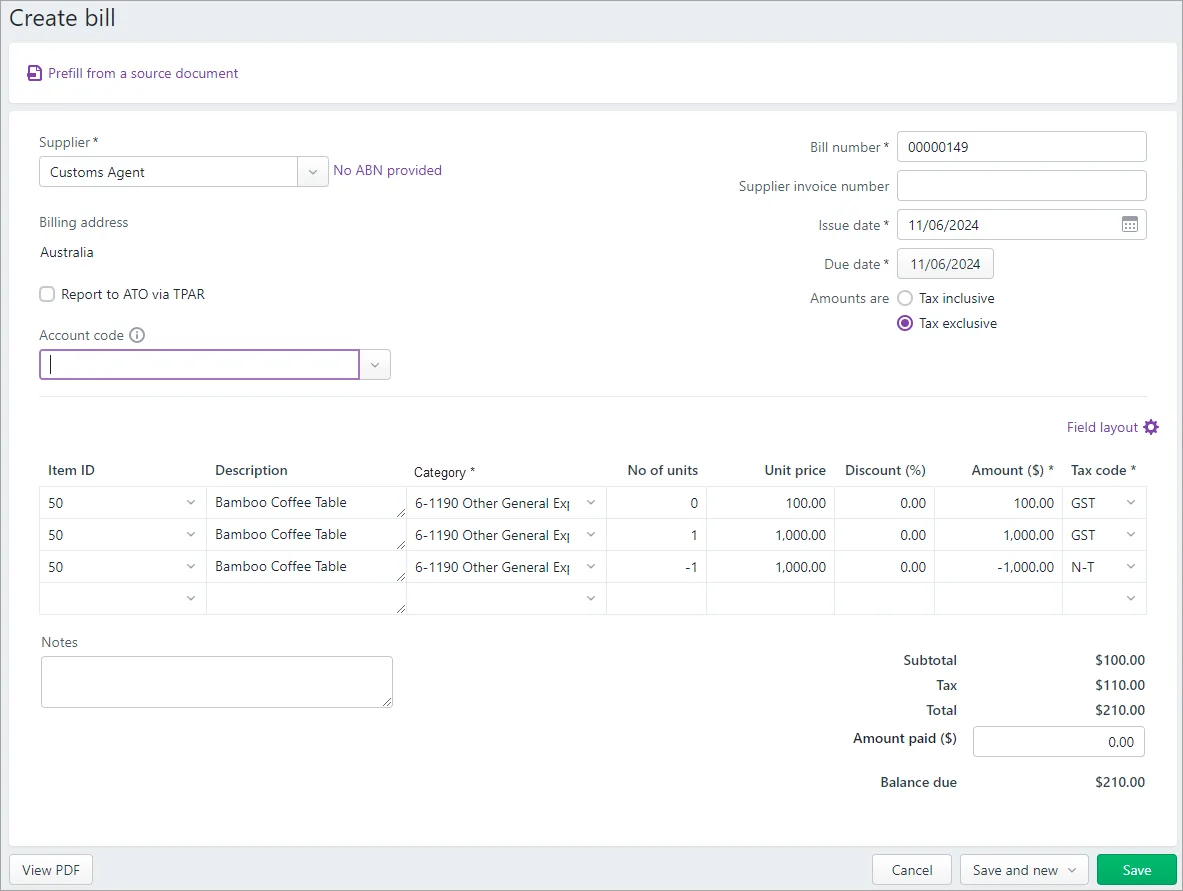

Treating the import costs as part of the inventory value

This method combines all associated import costs and assigns the value to the inventory item. In the example below:

The customs agent has been selected as the Supplier as they are being paid the import costs.

The first line represents the combined import costs and is assigned against the imported stock item.

The second and third line represent a double-entry to account for any GST payable on the imported goods.

Typically when importing, GST is levied at 10% of the landed cost of the goods and is payable to the Australian Tax Office (ATO), not your overseas supplier. You'll usually create one purchase order to record the overseas purchase and another purchase order to record the costs associated with the import.

When the goods are landed in Australia, the customs office will generally determine your GST liability and provide you with a detailed account of the amount payable.

How you need to account for overseas purchases will depend on your business, GST reporting requirements, and the import costs which may apply. As such, the information below is of a generic nature. It's best to check with your accounting advisor to determine the best method for you.

Let's take a look at how you can record an overseas purchase, followed by two possible ways you can account for the associated import costs.

The example below is for recording the overseas purchase of an inventory item using the Item layout. For other types of purchases, use the Service layout.

Are you in New Zealand? See Recording overseas purchases and import costs (New Zealand)

Recording the overseas purchase

The purchase for the imported goods can be entered like a regular purchase. In our example below, note the following:

The overseas Supplier has been selected as they are being paid for the imported goods.

The N-T (Not Reportable) tax code is used because in this example the GST is not payable to the overseas supplier.

Recording the import costs

Here are two examples of how to record the import costs.

Check with an expert

The info below contains examples only. Always check with your accounting advisor, or the experts on our community forum, about the GST implications for your business.

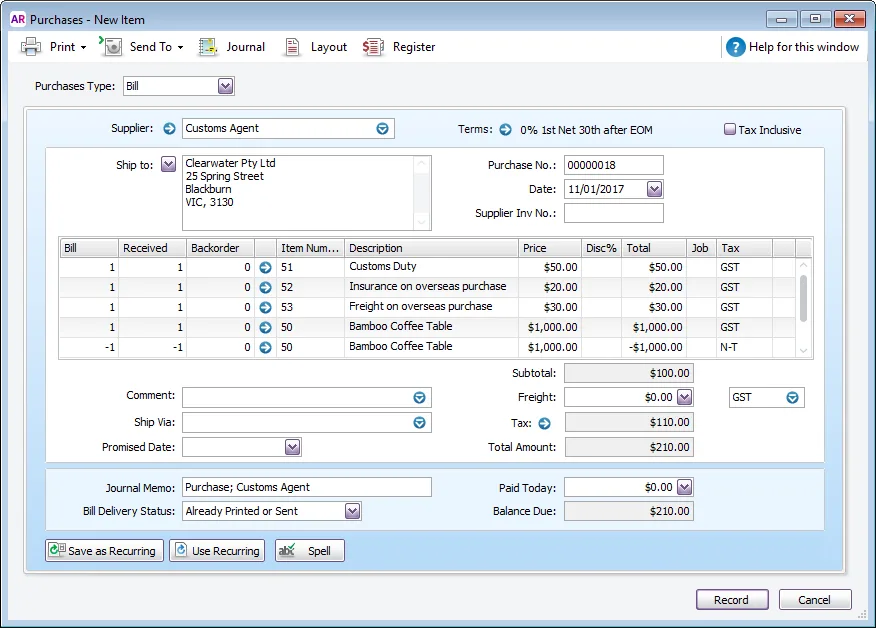

Treating the import costs as expense items

This example shows how to record a purchase with each import cost listed separately. In the example purchase below:

The customs agent has been selected as the Supplier as they are being paid the import costs.

The import costs have been set up as inventory items which means you can use the Item layout. Otherwise, you can enter the purchase using the Service layout.

The double entry for the imported item is to account for GST without affecting the inventory quantity.

Treating the import costs as part of the inventory value

This method combines all associated import costs and assigns the value to the inventory item. In the example below:

The customs agent has been selected as the Supplier as they are being paid the import costs.

The first line represents the combined import costs and is assigned against the imported inventory item. The bill quantity is zero (0) to ensure only the value is affected, not the stock levels.

The second and third line represent a double-entry to account for any GST payable on the imported goods. This ensures only the GST is accounted for and the stock levels remain unaffected.