You need to pay superannuation guarantee contributions for employees aged under 18 if they work more than 30 hours in a week. To work out if you have to pay super, check the ATO rules.

Make sure you've entered the employee's date of birth in their contact record so MYOB knows their age (Payroll menu > Employees > click the employee > Payroll details tab > Date of birth).

How the employee's super is calculated in MYOB depends on how often they're paid.

If the employee is paid weekly

If the under 18 employee is paid weekly, MYOB will automatically calculate their super contributions based on the hours worked* when you do a pay run. For example, if the employee has worked for more than 30 hours in the week, super will be calculated and included in their pay. If they work 30 hours or less, super will not be included in that pay.

*Check the hours worked

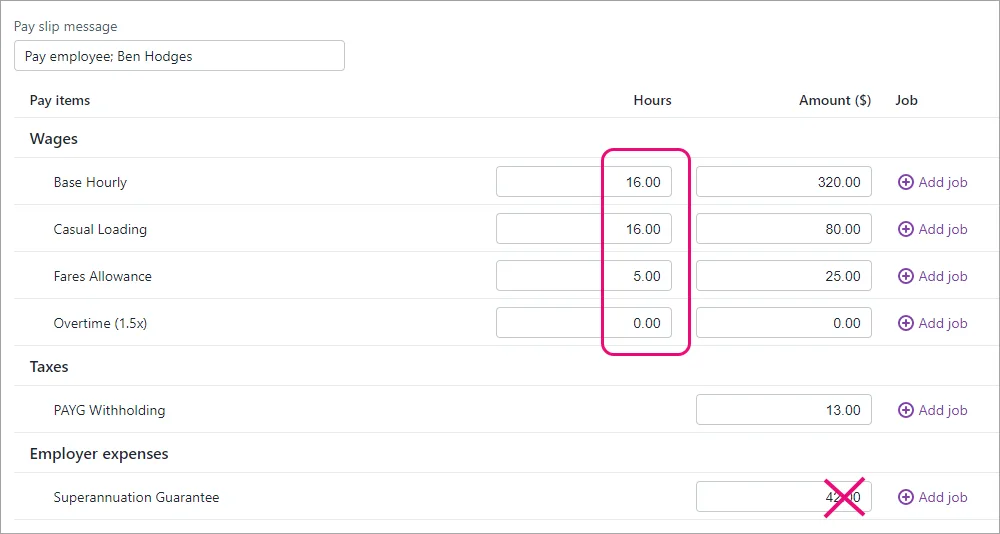

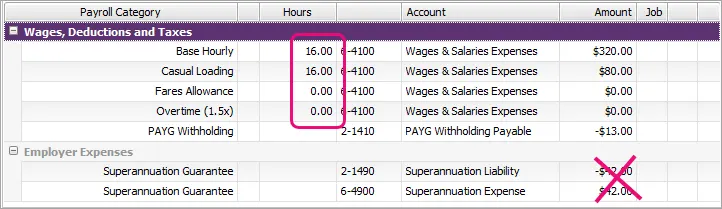

MYOB counts all the hours in an employee's pay run to work out the number of hours worked (unless the pay item is exempt from super guarantee calculations). But if any of those hours don't represent actual hours worked, like allowances or loading, you'll need to manually exclude them.

If the employee hasn't actually worked more than 30 hours for the week, you'll need to manually remove any calculated super amount.

Here's an example where the employee has only worked 16 hours, so we'll need to remove the super amount.

If the employee is not paid weekly

If the under 18 employee is paid fortnightly, twice a month, monthly or quarterly, you'll need to:

check how many hours they worked each week in the pay period, and

if they've worked 30 hours or less in any week in the pay period, you'll need to manually adjust the super in their pay.

1. Check the hours worked

When you pay the employee, check how many hours they worked each week during the pay period to see if super is payable.

Take a look at this example for a monthly paid employee aged under 18 whose hours vary each week.

| Hours worked | Is super payable? |

|---|---|---|

Week 1 | 25 | No |

Week 2 | 32 | Yes |

Week 3 | 30 | No |

Week 4 | 31 | Yes |

Based on this example, you'd need to pay super for weeks 2 and 4 where the employee worked more than 30 hours. So even though the employee worked 118 hours for the month, you only need to pay super on 63 hours (32 hours + 31 hours).

2. Adjust the super in the employee's pay

Once you've worked out how many hours you need to pay super on, you can calculate the super amount during the pay run. You can then adjust the super amount in the employee's pay.

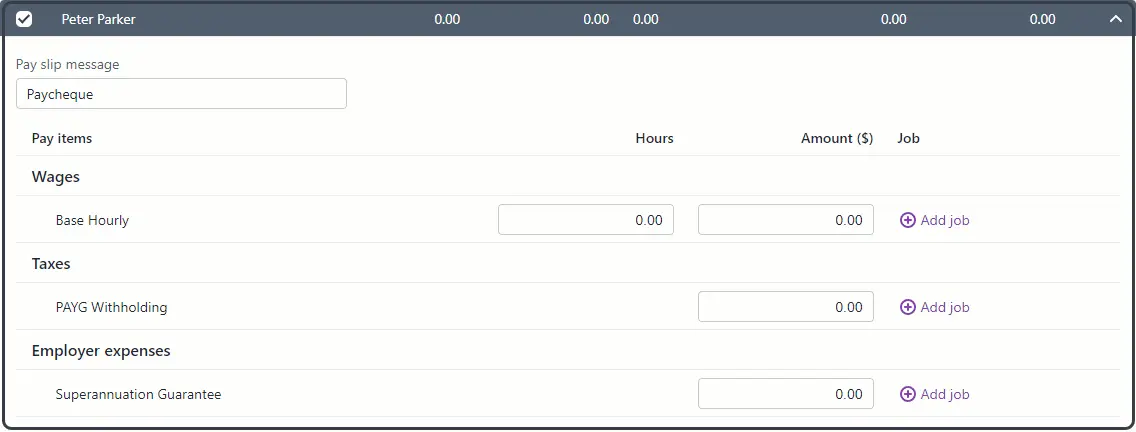

Start the pay run as usual. Need a refresher?

Click the down arrow to open the employee's pay.

Calculate the super amount you need to pay this employee:

In the Hours field for the Base Hourly pay item, enter the number of hours you need to pay super for. Using our example above for a monthly paid employee, this is 63.

Take note of the calculated Superannuation Guarantee amount.

In the Hours field for the Base Hourly pay item, enter the number of hours the employee is being paid for this pay period. Using our example above, this is 118.

Overtype the Superannuation Guarantee with the amount you noted above. If the employee isn't entitled to any super for this pay, change this amount to zero ($0.00).

Complete the pay run as normal.

See it in action

FAQs

What if the employee is part time or full time?

If the under 18 employee is paid a fixed salary instead of an hourly rate, and they work more than 30 hours per week, set them up for super the same as any other salaried employee. Learn about setting up an employee's super details.

What if an employee turns 18 part way through the pay period?

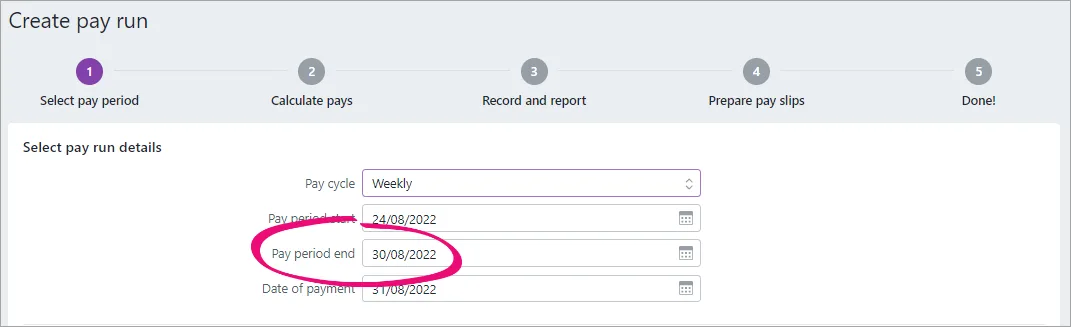

It's the employee's age on the Pay period end date in the pay run that determines your super obligation. For example, if the employee is 18 on the Pay period end date, they're treated as an 18 year old for the whole pay period.

You need to pay superannuation guarantee contributions for employees aged under 18 if they work more than 30 hours in a week. To work out if you have to pay super, check the ATO rules.

Make sure you've entered the employee's date of birth in their employee card so AccountRight knows their age (Card File > Cards List > Employee tab > click to open the employee's card > Payroll Details tab > Date of Birth).

How the employee's super is calculated depends on how often they're paid.

If the employee is paid weekly

If the under 18 employee is paid weekly, AccountRight will automatically calculate their super contributions based on the hours worked* when you do a pay run. For example, if the employee has worked for more than 30 hours in the week, super will be calculated and included in their pay. If they work 30 hours or less, super will not be included in that pay.

*Check the hours worked

MYOB counts all the hours in an employee's pay run to work out the number of hours worked (unless the payroll category is exempt from super guarantee calculations). But if any of those hours don't represent actual hours worked, like allowances or loading, you'll need to manually exclude them.

If the employee hasn't actually worked more than 30 hours for the week, you'll need to manually remove any calculated super amount.

Here's an example where the employee has only worked 16 hours, so we'll need to remove the super amount.

If the employee is not paid weekly

If the under 18 employee is paid fortnightly, twice a month, monthly or quarterly, you'll need to:

check how many hours they worked each week in the pay period, and

if they've worked 30 hours or less in any week in the pay period, you'll need to manually adjust the super in their pay.

1. Check the hours worked

When you pay the employee, check how many hours they worked each week during the pay period to see if super is payable.

Take a look at this example for a monthly paid employee aged under 18 whose hours vary each week.

| Hours worked | Is super payable? |

|---|---|---|

Week 1 | 25 | No |

Week 2 | 32 | Yes |

Week 3 | 30 | No |

Week 4 | 31 | Yes |

Based on this example, you'd need to pay super for weeks 2 and 4 where the employee worked more than 30 hours. So even though the employee worked 118 hours for the month, you only need to pay super on 63 hours (32 hours + 31 hours).

2. Adjust the super in the employee's pay

Once you've worked out how many hours you need to pay super on, you can calculate the super amount during the pay run. You can then adjust the super amount in the employee's pay.

Start the pay run as usual. Need a refresher?

Click the blue zoom ( ) arrow to open the employee's pay.

Calculate the super amount you need to pay this employee:

In the Hours field for the Base Hourly payroll category, enter the number of hours you need to pay super for. Using our example above for a monthly paid employee, this is 63.

Take note of the calculated Superannuation Guarantee amount.

In the Hours field for the Base Hourly payroll category, enter the number of hours the employee is being paid for this pay period. Using our example above, this is 118.

Overtype the Superannuation Guarantee with the amount you noted above. If the employee isn't entitled to any super for this pay, change this amount to zero ($0.00).

Complete the pay run as normal.

See it in action

FAQs

What if the employee is part time or full time?

If the under 18 employee is paid a fixed salary instead of an hourly rate, and they work more than 30 hours per week, set them up for super the same as any other salaried employee. Learn about setting up an employee's super details.

What if an employee turns 18 part way through the pay period?

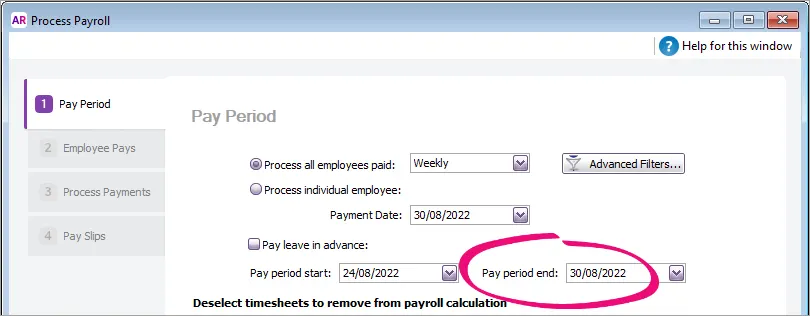

It's the employee's age on the Pay period end date in the pay run that determines your super obligation. For example, if the employee is 18 on the Pay period end date, they're treated as an 18 year old for the entire pay period.