AccountRight Plus and Premier only

When you set up Single Touch Payroll, your payroll details were checked to identify any company information that need updating. What gets checked?

But you can manually check your details at any time via the Payroll command centre > Payroll Reporting > Check Payroll Details.

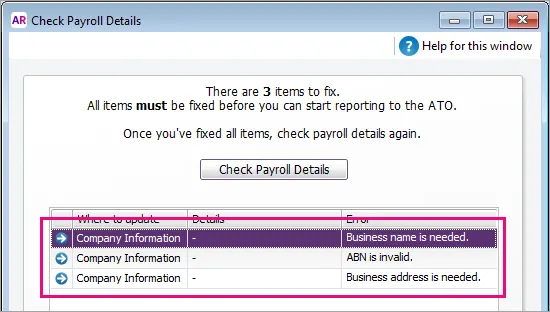

If any issues are found in your company information, they'll be listed like in this example:

Here's what to do:

To edit your company details

If you're not already on the Check Payroll Details window (shown above), go to the Payroll command centre > Payroll Reporting > Check Payroll Details. The Check Payroll Details window appears listing the results.

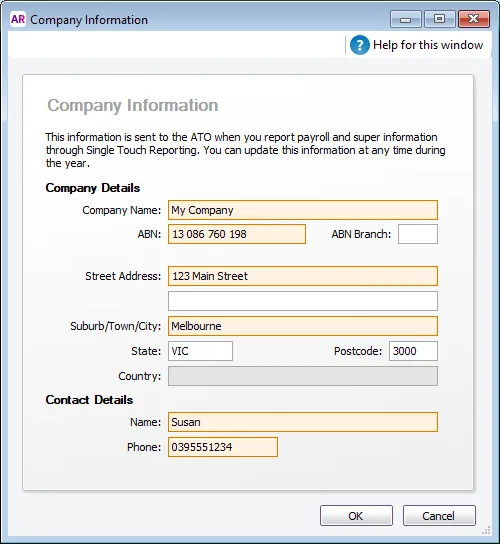

Click the arrow next to the company information error in the list (see example above). The Company Information window appears. You can also get to this window via the Payroll command centre > Payroll Reporting > Company Information.

Make the required fixes. Do you have an overseas address?

Check your ABN

The ABN you enter here is what is sent to the ATO each time you process payroll. Ensure the ABN is your current ABN and doesn't have any typos.This ABN must match what is entered when you Notify the ATO you're using MYOB for Single Touch Payroll reporting. If they don't match, the payroll reports will be rejected and not sent to the ATO.

Click OK to save your changes and return to the Payroll Reporting window.

Click Check Payroll Details to refresh the list to see if everything is done. If everything is fine, you're ready to Notify the ATO you're using MYOB for Single Touch Payroll reporting.

FAQs

What payroll details are checked during STP setup?

When you set up STP, the following details are checked in MYOB to make sure they meet the STP requirements.

| What gets checked |

|---|---|

Business information | Business name ABN (if you only have a Withholding Payer Number (WPN) the ATO has exempted employers with a withholding payer number from reporting under the STP framework until 30 June 2033) GST branch number (if you have an ABN you'll have a branch number – if unsure, check with the ATO). Learn more on the ATO website Address You can access this information in MYOB by clicking the settings menu (⚙️) > Business settings. |

Employee details | Employees paid in the current and previous payroll year are included in the payroll check, including inactive and terminated employees.Here is the information that's checked for your employees (accessed via the Payroll menu > Employees > click an employee).On the Contact details tab: First name Surname or family name Country Address Suburb/town/locality State/territory Postcode On the Payroll details tab > Employment details section: Date of birth Start date Employment basis On the Payroll details tab > Taxes section: Tax file number Income type Do you employ working holiday makers? If you choose Working holiday maker as the Income type, you'll also need to choose the worker's Home country (Country code). Also check that the correct Tax table is assigned to working holiday makers based on your business's working holiday maker registration status. |

Pay items | Wages and salary, superannuation and deduction pay items used in the current and previous payroll year are included in the check. You can access your pay items via the Payroll menu > Pay items. Each of these must have an ATO reporting category assigned. By default, this is set to To be assigned, so you know what pay items still need assigning. |

What if I have an overseas address?

If your company is a non-resident and has an overseas address, enter OTH in the State field:

The Country field is activated. You must enter your company's country information in this field.

The Postcode field defaults to 9999 and cannot be changed.

The state and postcode as well as the town must all be reported in the Suburb/Town/City field.

For example, assume your address is 275 Central Park West, Apartment 14F, New York, NY USA 10024. This address would be entered as follows:

Street Address - Line 1: 275 Central Park West

Street Address - Line 2: Apartment 14F

Suburb/Town/City: New York, NY 10024

State: OTH

Postcode: 9999

Country: USA