If you need to adjust an employee's Employment Termination Payment (ETP) that you've reported to the ATO, you'll need to reverse the incorrect ETP pay and record the ETP again with the correct details. This ensures the changes are submitted correctly to the ATO.

You can't adjust ETP Taxable and ETP Tax Free amounts by using negative values in a pay. Similarly, you can't adjust the ETP Tax Withheld using a positive number.

Before you can record the adjusted ETP pay for the employee, there might be some additional things you need to do. For example, if you've added a termination date to their employee contact record, you'll need to remove it. Also, if you've finalised the employee you'll need to undo their finalisation.

To fix an ETP

1. Reverse the incorrect ETP pay

Go to the Payroll menu > Pay runs.

Click the Date of payment to display the details.

Click the name of the Employee whose pay you want to reverse.

Click Reverse pay.

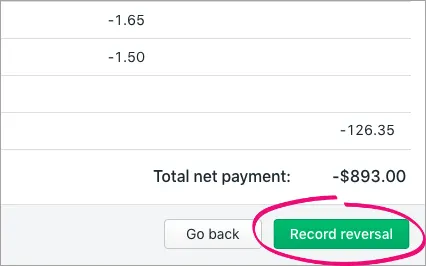

The details of the pay reversal are shown (a negative pay).

Click Record reversal.

When prompted to send your payroll information to the ATO, enter your details and click Send to submit the reversal to the ATO. The employee's year-to-date payroll amounts are updated accordingly.

The reversed pay will appear in the Payroll Reporting Centre with a negative amount, like this example:

2. Undo the employee's termination

When you terminated the employee, if you completed any of these tasks you'll need to undo them before re-recording their ETP pay:

If you added a termination date to the employee's contact record, you'll need to remove it.

If you notified the ATO of the employee's termination date in the STP reporting centre, you'll need to remove the termination.

If you finalised the employee in the STP reporting centre, you'll need to undo their finalisation.

To remove the termination date from the employee's contact record

Go to the Payroll menu > Employees.

Click the employee's name.

Click the Payroll details tab.

On the Employment details tab, clear the Termination date.

Click the Contact details tab.

Deselect the option Inactive employee.

Click Save.

To remove the termination from the STP reporting centre

Go to the Payroll menu > Single Touch Payroll reporting.

Click the Employee terminations tab.

Choose the Payroll year.

Click X Undo for the employee.

When prompted to send your payroll information to the ATO, enter your details and click Send.

To undo the employee's finalisation

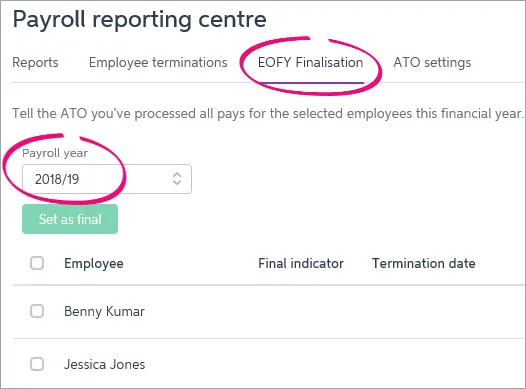

If the employee has been finalised, they will have the Final indicator ticked in the STP reporting centre.

If this is the case for the terminated employee, you'll need to undo their finalisation like this:

Go to the Payroll menu > Single Touch Payroll reporting.

Click the EOFY Finalisation tab.

Choose the Payroll year.

Select the employee whose finalsation you want to undo.

Click Remove finalisation and notify the ATO.

When prompted to send your payroll information to the ATO, enter your details and click Send. The Final indicator tick is removed for the employee. If it's still there, click a different tab then return to the EOFY finalisation tab.

You can now record the employee's ETP pay with the correct details.

3. Record the ETP again

You can now record the terminated employee's ETP pay again, with the correct ETP amounts and details. If you need help workout out an ETP amount, or whether you need to pay super on the payment, check with your accounting advisor.

Start a new pay run (Create menu > Pay run).

Select the employee being paid the ETP.

Click the dropdown arrow for the employee to view their pay details.

For any non-ETP earnings or deductions, enter 0 in the Hours or Amount column. This is because you should only pay ETPs in this pay run.

Enter required amounts against the applicable ETP pay items.

Click the Select ETP code button.

Select a Benefit type from the dropdown list and choose a Benefit code. If unsure, check with the ATO or your accounting advisor.

Clear all other hours and amounts from the pay. This ensures only the ETP amounts are paid and no super or leave is accrued on this pay.

When you're finished, click Save and finish processing the pay. Need a refresher?

4. Re-terminate the employee

You can now re-terminate the employee by:

adding the termination details to the employee's contact record

notify the ATO of the employee's termination date

finalise the employee.

To add the termination details to the employee's contact record

Go to the Payroll menu > Employees.

Click the employee's name.

Click the Payroll details tab.

On the Employment details tab, enter or choose the Termination date.

Click the Contact details tab.

Select the option Inactive employee.

Click Save. You'll see a message confirming the termination.

Click Save to this message.

To notify the ATO of the termination

You need to let the ATO know the employee's end date and termination reason.

Go to the Payroll menu > Single Touch Payroll reporting.

Click the Employee terminations tab.

Choose the applicable Payroll year and click Add Termination.

Enter the termination details and click Notify the ATO.

When prompted to send your payroll information to the ATO, enter your details and click Send.

To finalise the employee

Go to the Payroll menu > Single Touch Payroll reporting.

Click the EOFY finalisation tab.

Select the terminated employee and click Finalise and notify the ATO. This button only appears when you select an employee.

When prompted to send your payroll information to the ATO, enter your details and click Send.

If you need to adjust an employee's Employment Termination Payment (ETP), you'll need to reverse the incorrect ETP pay and record the ETP again with the correct details. This ensures the changes are submitted correctly to the ATO.

You can't adjust ETP Taxable and ETP Tax Free amounts by using negative values in a pay. Similarly, you can't adjust the ETP Tax Withheld using a positive number.

Before you can record the adjusted ETP pay for the employee, there might be some additional things you need to do. For example, if you've added a termination date to their employee card, you'll need to remove it. Also, if you've finalised the employee you'll need to undo their finalisation.

To fix an ETP

1. Reverse the incorrect ETP pay

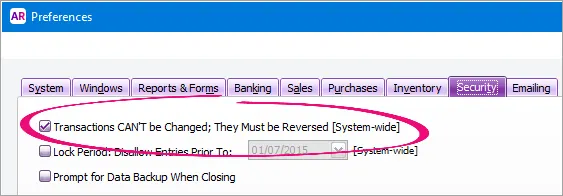

Set an AccountRight security preference to allow transactions to be reversed (go to the Setup menu > Preferences > Security tab > select the option Transactions CAN'T be Changed, They Must be Reversed > OK).

Display the pay to be reversed:

Click Find Transactions at the bottom of the Command Centre then click the Card tab.

Specify your search criteria to find the pay to be reversed.

Open the pay by clicking its zoom arrow ().

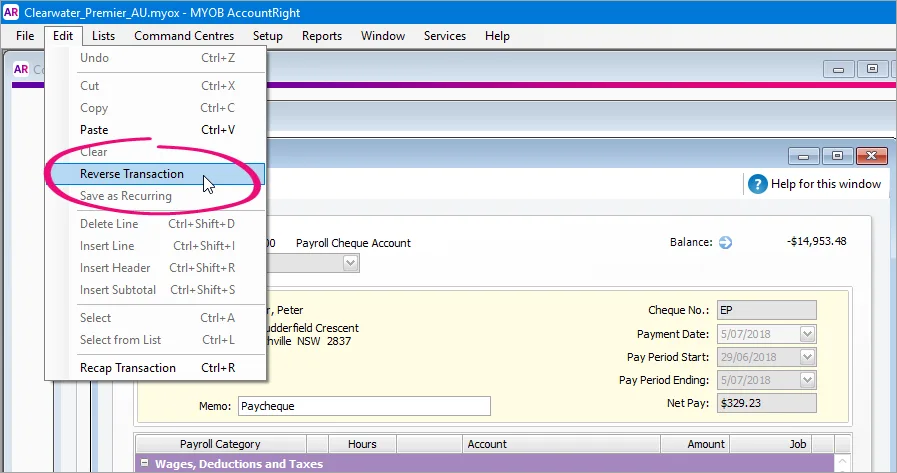

Go to the Edit menu and choose Reverse Transaction. If you only see the option to Delete Transaction, check your security preference as shown in step 1.

If the pay being reversed is a cheque or electronic payment, a message will be displayed advising it will be recorded as cash. Click Yes to proceed.

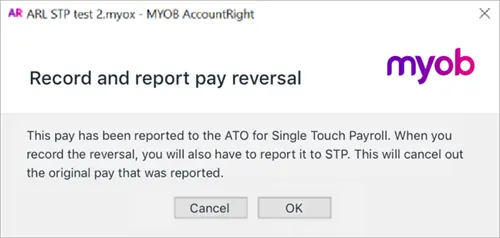

Click OK to the following confirmation message:

Click Record to process the reversal.

When prompted to declare the reversal to the ATO, enter the name of the Authorised sender and click Send.

2. Undo the employee's termination

When you terminated the employee, if you completed any of these tasks you'll need to undo them before re-recording their ETP pay:

If you added a termination date to the employee's card, you'll need to remove it.

If you notified the ATO of the employee's termination date in the STP reporting centre, you'll need to remove the termination.

If you finalised the employee in the STP reporting centre, you'll need to undo their finalisation.

To remove the termination date from the employee's card

Go to the Card File command centre > Cards List > Employees tab > open the employee's card.

Click the Payroll Details tab.

(Optional) Click the blue zoom arrow next to the Termination Date and take note of the employee's termination details (this will help when you need to add these details back later).

Clear the Termination Date (click to highlight the date and press the <Delete> key on your keyboard).

Click OK.

To remove the termination from the STP reporting centre

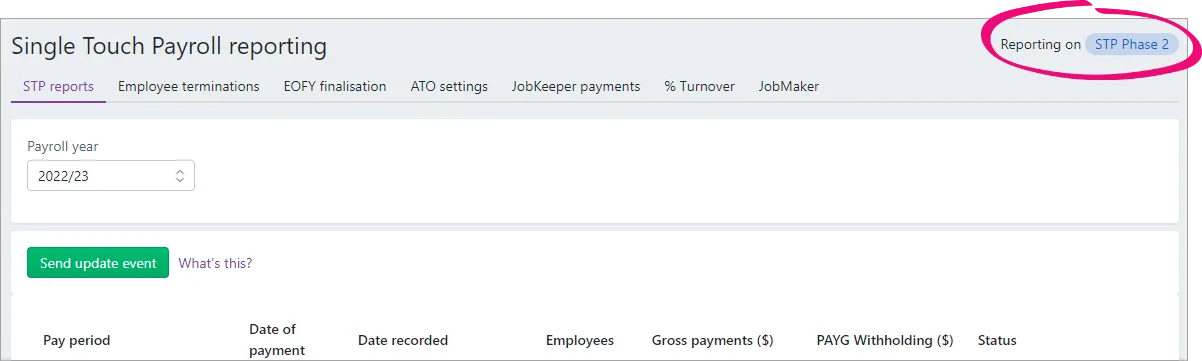

How you remove the termination depends on whether you're set up for STP Phase 1 or STP Phase 2. If you set up STP after mid-December 2021, you're likely on STP Phase 2.

You can check in the STP reporting centre (Payroll command centre > Payroll reporting > Payroll Reporting Centre). If you don't see this label, you're on STP Phase 1. How do I get ready for STP Phase 2?

To remove the termination

I'm set up for STP Phase 1

Go to the Payroll command centre and click Payroll Reporting.

Click Payroll Reporting Centre.

If prompted, sign in using your MYOB account details (email address and password).

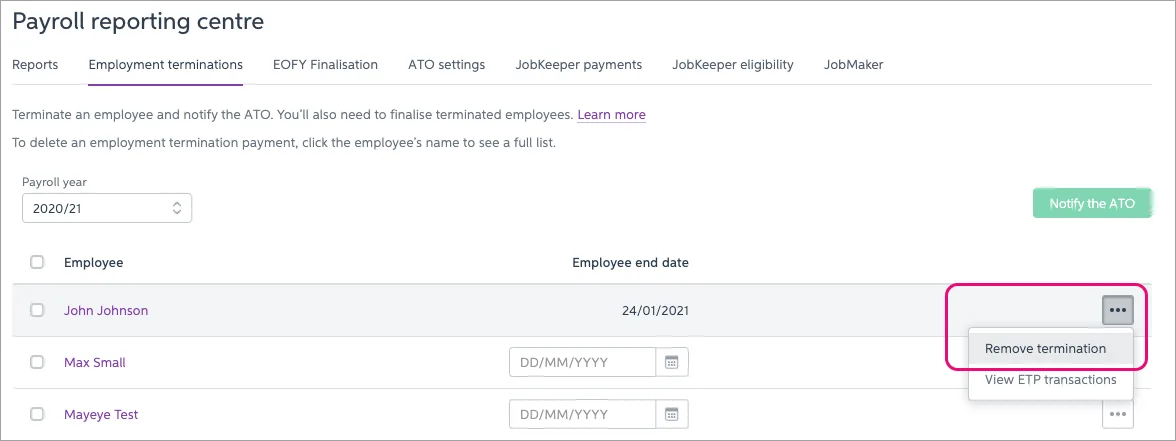

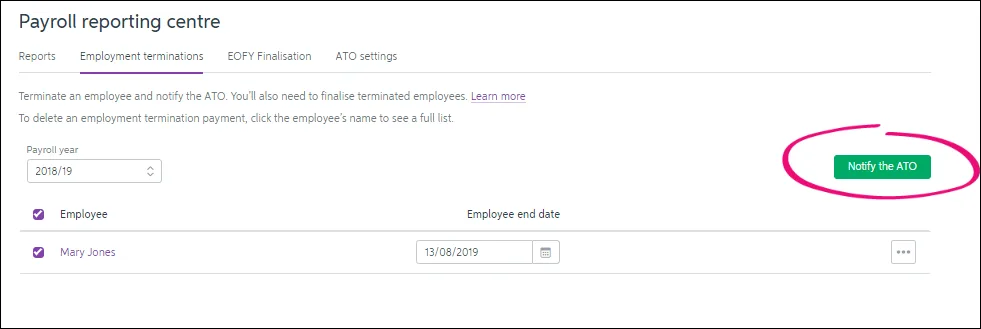

Click the Employment terminations tab.

Choose the Payroll year.

For the employee whose termination you need to remove, click the ellipsis (...) button and choose Remove termination.

When prompted to send your payroll information to the ATO, enter your details and click Send.

I'm set up for STP Phase 2

Go to the Payroll command centre and click Payroll Reporting.

Click Payroll Reporting Centre.

If prompted, sign in using your MYOB account details (email address and password).

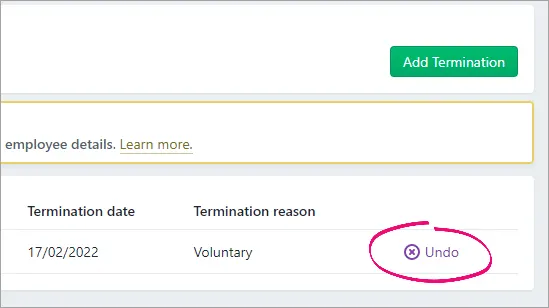

Click the Employee terminations tab.

Choose the Payroll year.

Click X Undo for the employee.

When prompted to send your payroll information to the ATO, enter your details and click Send.

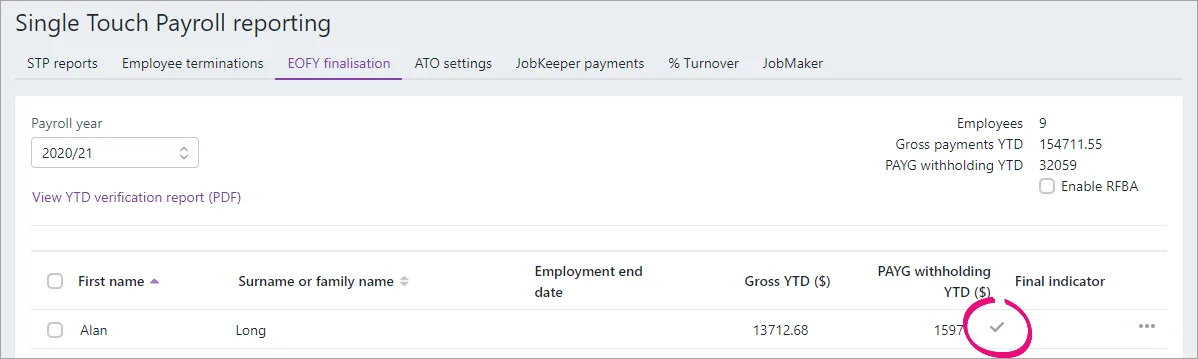

To undo the employee's finalisation

If the employee has been finalised, they will have the Final indicator ticked in the STP reporting centre.

If this is the case for the terminated employee, you'll need to undo their finalisation like this:

Go to the Payroll command centre and click Payroll Reporting.

Click Payroll Reporting Centre.

If prompted, sign in using your MYOB account details (email address and password).

Click the EOFY Finalisation tab.

Choose the Payroll year.

Remove the finalisation. How you do this depends on what you see.

If there's an ellipsis button next to the employee (as shown in the example above), click it and choose Remove finalisation.

If there is no ellipsis button, select the employee and click Remove finalisation and notify the ATO.

When prompted to send your payroll information to the ATO, enter your details and click Send. The Final indicator tick is removed for the employee. If it's still there, click a different tab then return to the EOFY Finalisation tab.

You can now record the employee's ETP pay with the correct details.

3. Record the ETP again

You can now record the terminated employee's ETP pay again, with the correct ETP amounts and details. If you need help workout out an ETP amount, or whether you need to pay super on the payment, check with your accounting advisor.

Go to the Payroll command centre and click Process Payroll.

In the Pay Period section, click Process individual employee and type or select the employee you want to process in the adjacent field.

Click Next.

Click the zoom arrow ( ) next to the employee’s name to display their pay details.

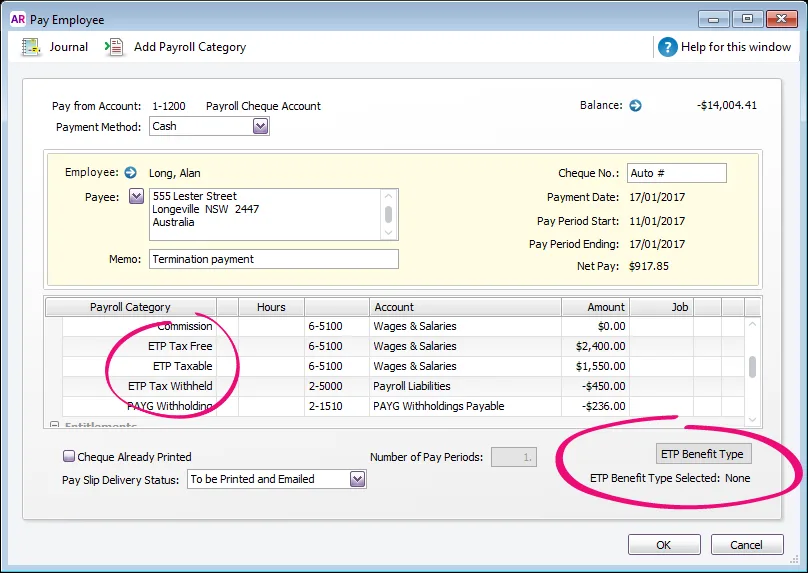

Enter the applicable amounts against the ETP Taxable, ETP Tax Free and ETP Tax Withheld payroll categories. If unsure about these amounts, check with your accounting advisor.

Here's an example:

Click ETP Benefit Type

This button only appears once you've entered values against an ETP wage category in the pay. If it doesn't appear after entering values against an ETP wage category, check that your ETP wage categories have an ETP ATO Reporting Category selected, such as ETP - Taxable Component, or ETP - Tax Free Component.

Choose the applicable Benefit Type and Benefit Code. If unsure, check with the ATO or your accounting advisor.

Click OK.

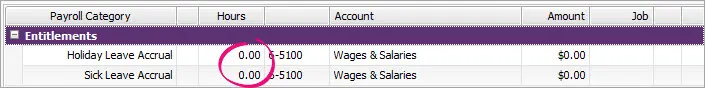

If leave should NOT accrue on this payment, enter 0.00 in the Hours column for the entitlements.

Click OK.

Click Record then declare the pay to the ATO.

4. Re-terminate the employee

You can now re-terminate the employee by:

adding the termination details to the employee's card

notify the ATO of the employee's termination date

finalise the employee.

To add the termination details to the employee's card

Go to the Card File command centre > Cards List > Employees tab > open the employee's card.

Click the Payroll Details tab.

Enter or choose the employee's Termination Date.

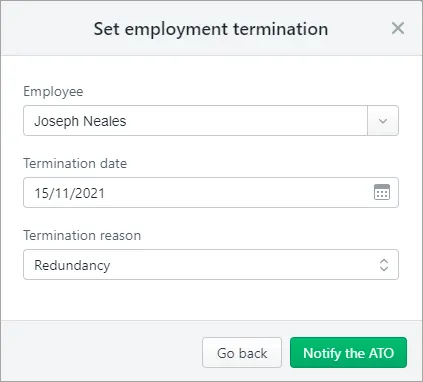

Click the blue zoom arrow next to the Termination Date and click Yes to the waring message.

Click the blue zoom arrow again and enter the employee's termination details.

Click OK then click OK again.

To notify the ATO of the termination

How you notify the ATO of the termination depends on whether you're set up for STP Phase 1 or STP Phase 2. If you set up STP after mid-December 2021, you're likely on STP Phase 2.

The easiest way to check is to look in one of your wage categories:

Sign in to your company file and go to the Payroll command centre > Payroll Categories.

Click the zoom arrow to open a wage category.

Check how many ATO Reporting Category fields there are.

If there are two ATO Reporting Category fields (and a message about "STP Phase 2 is coming", you're on STP Phase 1 — which is fine!

If there's only one ATO Reporting Category field, your file is set up for STP Phase 2.

To notify the ATO

I'm set up for STP Phase 1

Go to the Payroll command centre and click Payroll Reporting.

Click Payroll Reporting Centre.

Click the Employment terminations tab.

Select the employee who's leaving, choose their last day of employment, then click Notify the ATO.

When prompted to send your payroll information to the ATO, enter your details and click Send.

This declaration is processed in the same way other STP reports, and it can take up to 72 hours to be accepted by the ATO. You can check the status of the report in the STP reporting centre.

I'm set up for STP Phase 2

Click Payroll Reporting Centre.

If prompted, sign in using your MYOB account details (email address and password).

Click the Employee terminations tab.

Choose the applicable Payroll year and click Add Termination.

Enter the termination details and click Notify the ATO.

When prompted to send your payroll information to the ATO, enter your details and click Send.

This declaration is processed in the same way other STP reports, and it can take up to 72 hours to be accepted by the ATO. You can check the status of the report in the STP reporting centre.

To finalise the employee

Go to the Payroll command centre and click Payroll Reporting.

Click Payroll Reporting Centre.

If prompted, sign in using your MYOB account details (email address and password).

Click the EOFY Finalisation tab and choose the Payroll year you're finalising.

If you need to report fringe benefits for the employee (what is this?):

Click the ellipsis button for the employee and choose Enter RFBA.

Enter in both the:

Reportable fringe benefits amount $

Reportable fringe benefits amount exempt from FBT under section 57A $

The combined value of these must be above the thresholds set by the ATO.

Click Add amounts.

Select the employee to be finalised, then click Set as Final.

Enter the name of the Authorised sender and click Send.