Some states calculate WorkCover premiums as a percentage of both gross wages and superannuation. In AccountRight, you'll need to create two separate payroll categories to calculate the WorkCover attributable to gross wages and that attributable to superannuation.

WorkCover premium calculations vary across businesses and jurisdictions, it's best to check with your accounting advisor for the best method for your business.

The 3% WorkCover Levy Rate used below is for example only. Check with the relevant authority in your state or territory for the current rate.

To create a payroll category for WorkCover

Go to the Payroll command centre and click Payroll Categories.

Click the Expenses tab.

If there is an existing WorkCover category, click the zoom arrow next to this category. If there isn't an existing WorkCover category, click New. The Employer Expense Information window is displayed.

Name the category WorkCover on Gross Wages.

Select your WorkCover or Employer Expense account as the Linked Expense Account.

Select your WorkCover Payable liability account as the Linked Expense Account.

Set the Calculation Basis option to Equals XX Percent of Gross Wages. The value entered in the percentage field needs to be your WorkCover Levy Rate. In this example it is 3%.

Set the Limit option to No Limit.

Set the Threshold to $0.00. The Employer Expense Information window will look similar to the following example:

Click Employee. The Linked Employees window is displayed.

Select the relevant employees.

Click OK to the Linked Employees window and then click OK again at the Employer Expense Information window.

To create a payroll category for WorkCover on superannuation

Go to the Payroll command centre and click Payroll Categories.

Click the Expenses tab.

Click New. The Employer Expense Information window is displayed.

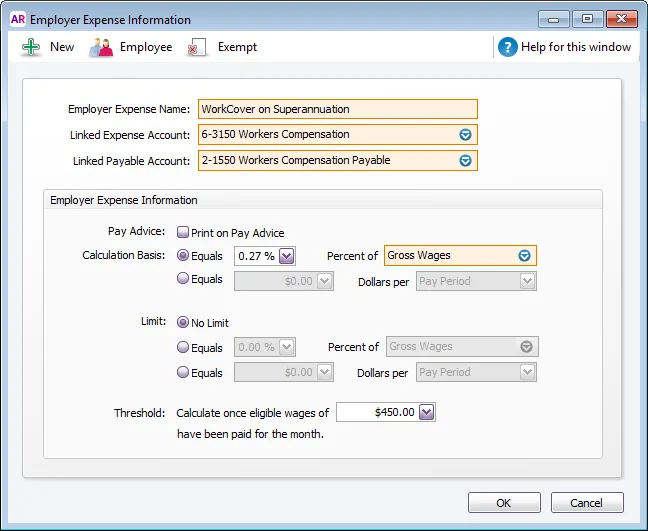

Name the category WorkCover on Superannuation.

Select your WorkCover expense account as the Linked Expense Account.

Select your WorkCover Payable liability account as the Linked Liability Account.

Set the Calculation Basis option to Equals XX Percent of Gross Wages.

The value entered in the percentage field is calculated as follows: Superannuation Rate X WorkCover Rate.

In this example we'll use 9% X 3%=0.09 X 0.03=0.0027=0.27%.Enter the same wages Threshold as specified for your superannuation. This means WorkCover will not be calculated on superannuation unless the employee's wages reach or exceed this threshold in a calendar month. The Employer Expense Information window will look similar to the following example:

Click Employee. The Linked Employees window is displayed.

Select the relevant employees.

Click OK to the Linked Employees window and then click OK again at the Employer Expense Information window.