AccountRight Plus and Premier

A payroll liability is an amount withheld from an employee's pay which is paid to an appropriate authority or agency, for example, deductions, expenses, superannuation payments, and taxes.

Your payroll liabilities are recorded when you process your payroll, and you can pay these amounts using the Pay Liabilities feature.

If you use BASlink to record your PAYG withholding payments, be aware of the following before recording PAYG withholding payments using the Pay Liabilities feature:

There is the potential for duplicating PAYG Withholdings payments if you use both BASlink and Pay Liabilities.

PAYG Withholding payments not recorded in the Pay Liabilities window will appear as exceptions in the Company Data Auditor.

There is the potential for variances in Salary Sacrifice Superannuation amounts in BASlink.

Remitting PAYG using both the Pay Liabilities feature and BASlink

If you want to use the Pay Liabilities window to record PAYG withholding payments, and you also want use BASlink to complete your BAS or IAS, you need to post your PAYG withholding payments to a temporary holding account, sometimes called a clearing account.

When you pay your PAYG withholding payments using Pay Liabilities, the value is posted to the clearing account. Then when you make your payment to the ATO, that value is paid from the clearing account - balancing everything nicely.

Let's step you through the required tasks.

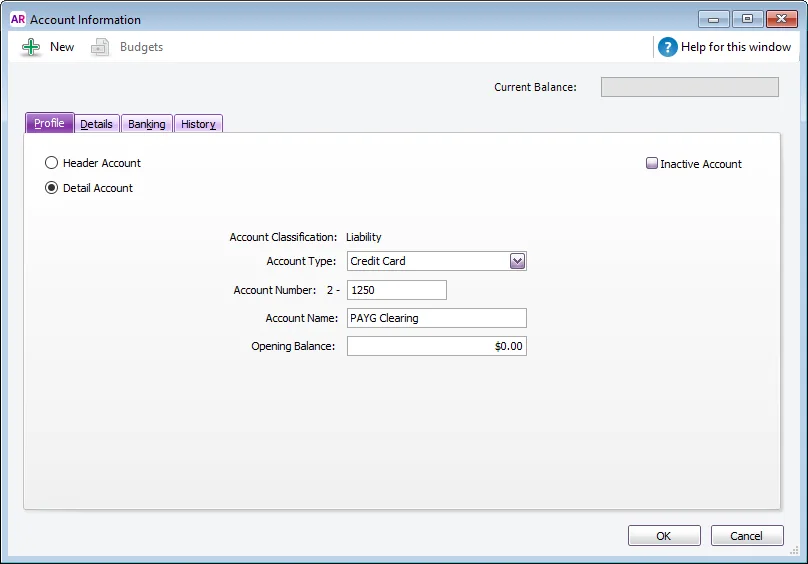

1. Create the clearing account

Go to the Accounts command centre and click Account List.

Click the Liability tab and click New.

Select Credit Card from the Account Type list.

Give the account a unique number that suits your accounts list.

In the Account Name field, type PAYG Clearing.

Click OK. See our example account below.

2. Complete BASlink

Complete BASlink as you normally do. Press F1 on your keyboard while using BASlink for more information on using this feature.

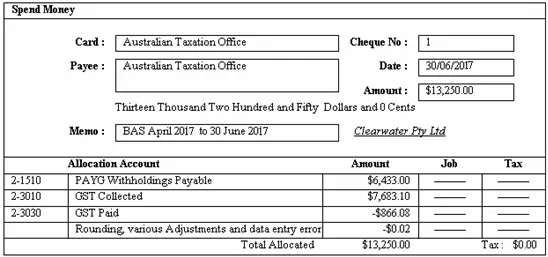

In BASlink, click the Transaction button. The following window appears. In this example, money is owed to the ATO, and BASlink generates a picture of the Spend Money transaction that is required.

Notice the amount of PAYG Withholdings. When processing PAYG withholding through the Pay Liabilities window, these amounts should equal.

PAYG Withholdings

When processing the BASlink, if the Pay Liabilities feature has been used in the same reporting period as the BAS, then the amount displayed at W2 on the BAS will incorporate any payments made by subtracting these payments from the actual amount accrued in this period. As such, this will leave a 'net' amount at W2. This will particularly effect the value of PAYG Withholding amounts in the BAS.

Example:

-

PAYG accrued in the BAS period of the July - August = $10,000

-

PAYG accrued in the prior BAS period of April - June but paid through Pay Liabilities in July = $12,000

-

The figure at W2 will be -$2,000 for the July - August BAS.

In this circumstance, it is recommended to manually enter the amount of PAYG actually accrued for the July - August period into W2 on your BASlink. This figure can be obtained by running the Payroll Activity Summary report for the July - August period. The below tasks can then be followed.

When processing the BASlink, if the Pay Liabilities feature has been used in the same reporting period as the BAS, then the amount displayed at W1 on the BAS will incorporate any payments made by subtracting these payments from the actual amount accrued in this period. As such, this will leave a 'net' amount at W1. This will particularly effect the value of Salary Sacrifice Superannuation amounts in the BAS. As detailed above in the PAYG Withholdings example, it is recommended to manually enter the amount of Salary Sacrifice Superannuation actually accrued for the July - August period into W1 on your BASlink. This figure can be obtained by running the Payroll Activity Summary report for the July - August period. The below tasks can then be followed.

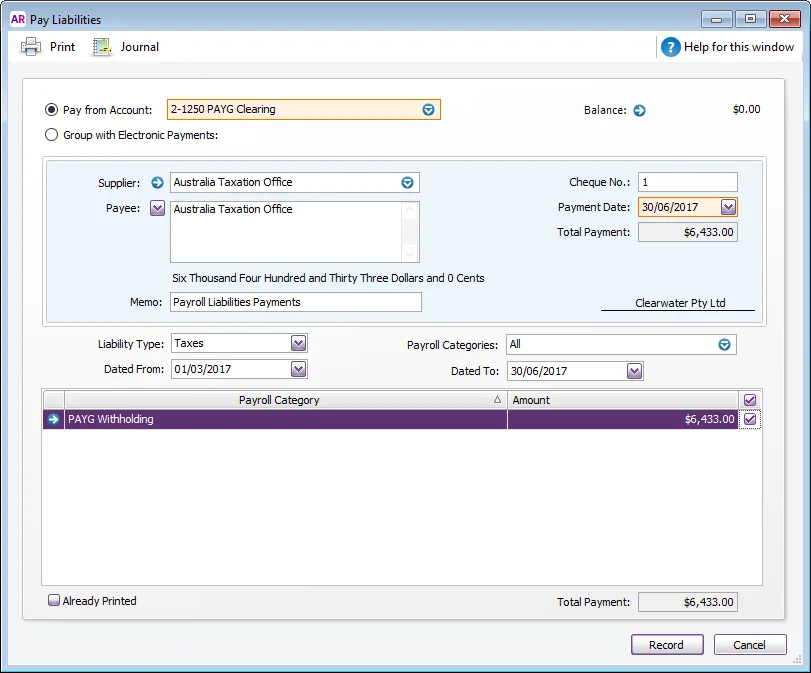

3. Record PAYG withholding payments using Pay Liabilities

Record the payment of the PAYG amount through the Pay Liabilities window. This entry will move the liability from the PAYG Withholding accrual account and post it to the PAYG Clearing account as well as remove it from the list of liabilities in the Pay Liabilities window.

Go to the Payroll command centre and click Pay Liabilities.

Select the PAYG Clearing Account in the Pay from Account field.

Select the Liability Type as Taxes.

Select the period for which you are reporting and the appropriate payment date.

Select PAYG Withholding in the Payroll Category list.

Click Record.

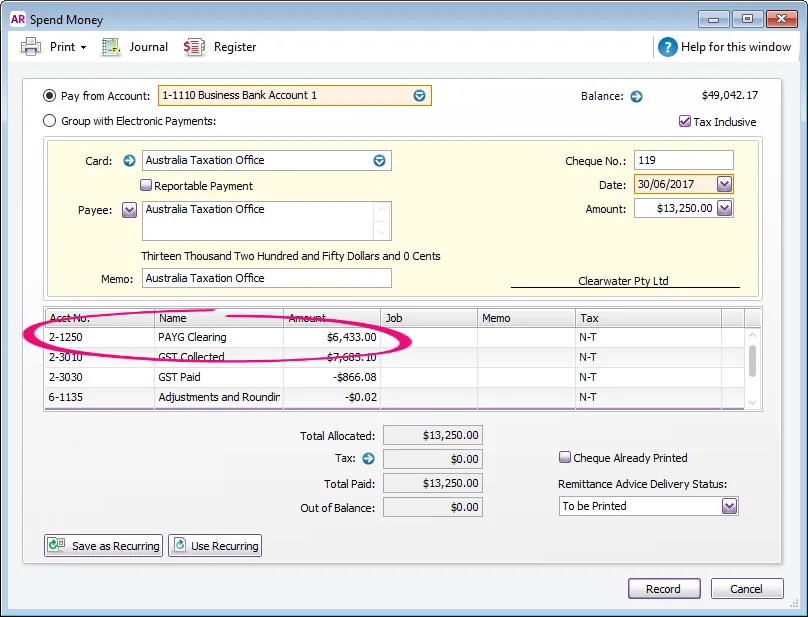

4. Record the ATO transaction

Enter the Spend Money transaction for the BAS payment (as shown above).

Change the PAYG Withholdings Payable account to the PAYG Clearing account. Here's our example:

After recording this transaction, the PAYG Clearing account should have a zero balance.