Most employees are entitled to a certain number of days of leave that they can take during the year. This might include annual leave, personal leave (sick leave), bereavement or compassionate leave, or carer's leave. Regardless of the name, MYOB handles all leave in a similar way.

If you're not sure what leave your employees are entitled to, the Fair Work website has great info on leave entitlements and the National Employment Standards.

How leave works in MYOB

There are 2 parts to leave:

the leave balance (how much leave is available to be taken), and

the leave payment (how much is paid when leave is taken).

MYOB uses leave pay items to track your employees' leave balance. The payment of leave is handled using a wage pay item. So when an employee takes leave, the wage pay item looks after the payment and the leave pay item keeps track of their leave balance.

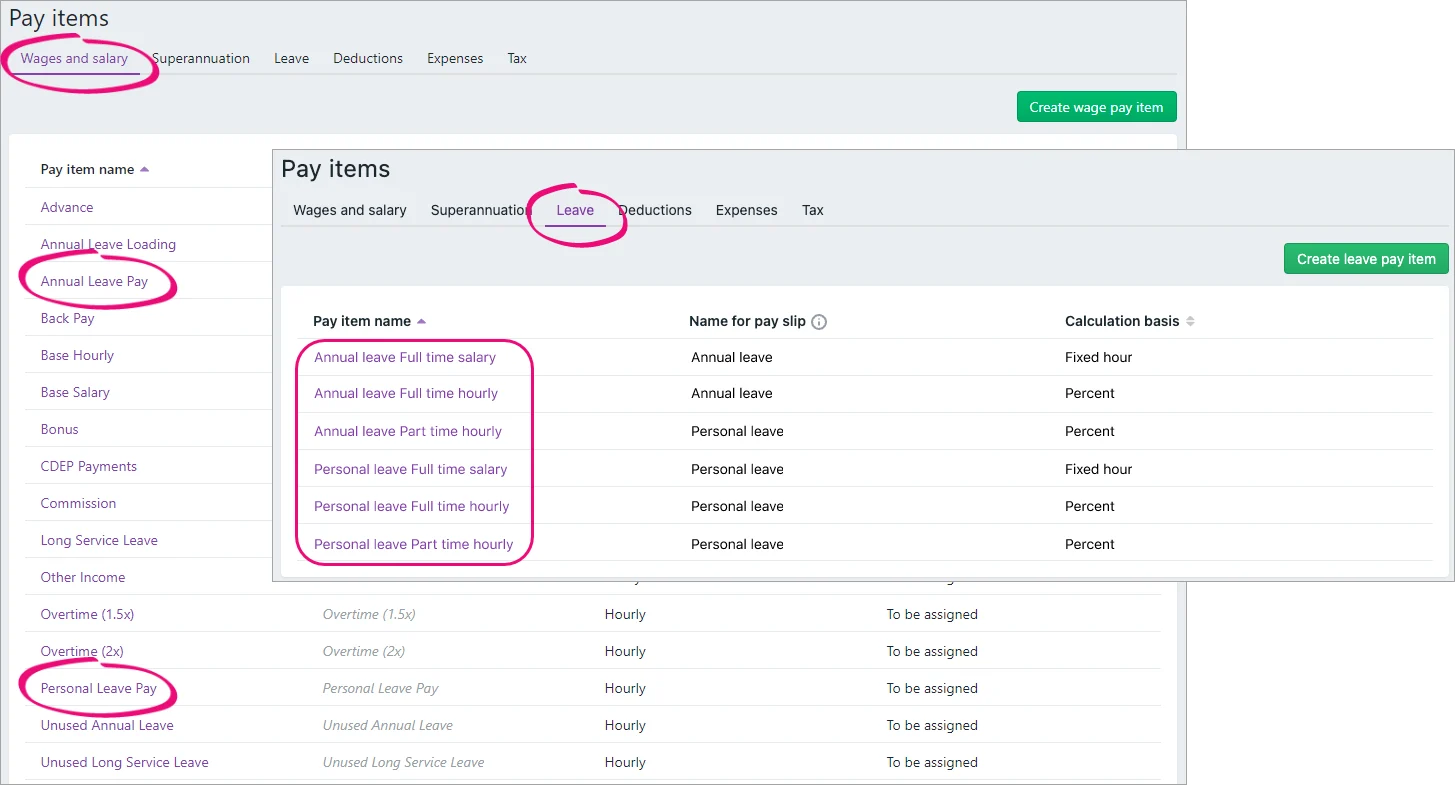

To help manage your employees' leave, MYOB comes with some default pay items (Payroll > Pay items):

2 wage pay items – to pay for annual leave and personal leave payments and to reduce the employee's leave balance

6 leave pay items – to calculate and maintain the accrued leave for different types of employees

Don't see all these default pay items?

If you've been using MYOB for a while, you might see fewer default pay items. But you can create new pay items to suit the needs of your business – see below.

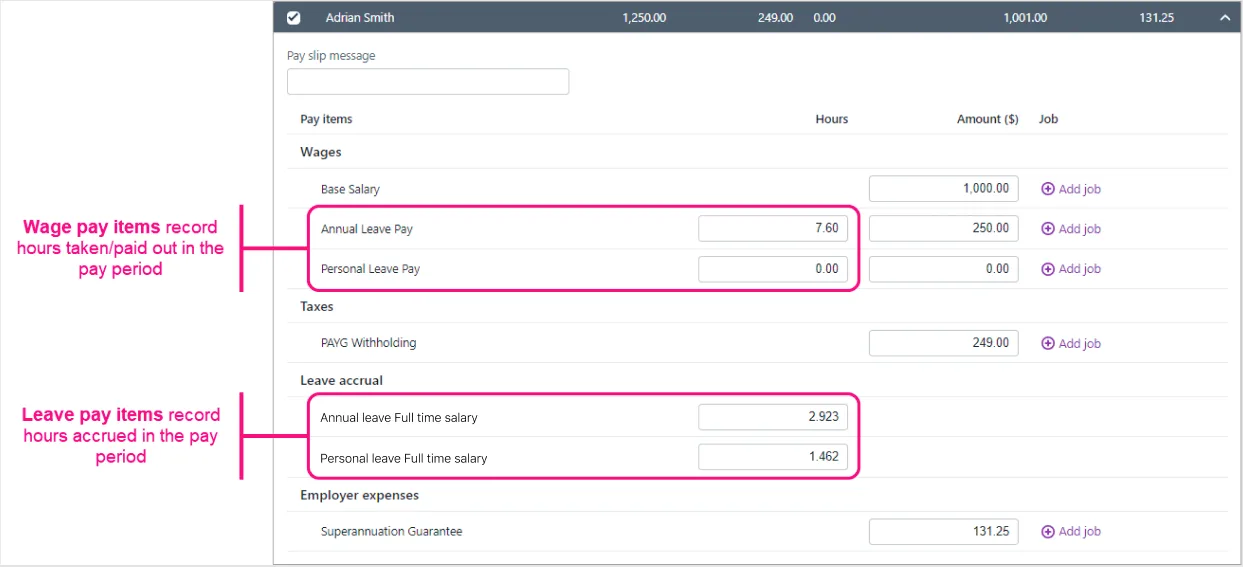

Once the applicable pay items are assigned to an employee, you can pay them for leave – like this example:

In the above example, an employee is taking 7.6 hours of annual leave in the pay period, and this is entered against the Annual Leave Pay pay item. The Annual leave Full time salary leave pay item shows the number of hours the employee is accumulating over the pay period (2.923 hours).

Need to fix some leave? See Managing your employees’ leave. What about unpaid leave? See Leave without pay.

Assigning annual leave and personal leave to your employees

From the Payroll menu, choose Pay items.

Click the Wages and salary tab.

Click to open the Annual Leave Pay pay item.

If it hasn't already been chosen, choose the applicable ATO reporting category. If unsure, check with your accounting advisor or the ATO. Learn more about assigning ATO reporting categories for Single Touch Payroll reporting.

Under Employees using this pay item, choose the employees who are entitled to annual leave.

When you're done, click Save.

Click the Leave tab.

Click to open the annual or personal leave pay item you want to assign. Choose the one that matches the employees you're assigning it to (full time, part time, salaried or hourly).

Under Employees using this pay item, choose the employees who are entitled to annual leave.

Click Save.

Repeat the above steps to assign the Personal Leave wage and leave pay items to your employees.

Linking wage pay items and adding exemptions

MYOB's default leave pay items are set up to suit most businesses. But if you've created additional wage pay items, you might need to choose additional linked wage pay items or add additional exemptions. To learn more see Linking a wage pay item and adding leave exemptions.

Creating a wage pay item for paying leave

If you have other types of leave that you need to pay your employees (apart from annual and personal leave) you'll need to set up a wage pay item for it.

Remember – wage pay items are used to include payments on an employee's pay.

Go to the Payroll menu and choose Pay items. The Pay items page appears.

Click the Wages and salary tab

Click Create wage pay item.

Enter a Name for the new pay item.

If you'd like a different, more personalised, name to show on pay slips for this earning, enter a Name for pay slip, such as "Saturday rate - Steven". If you leave this blank, the pay item Name will display instead.

Choose the ATO reporting category for this wage. If you're not sure, check with your accounting advisor or the ATO. Learn about assigning ATO reporting categories for Single Touch Payroll.

For the Pay basis, choose Hourly. This is applicable for both salaried and hourly-based employees.

Choose whether the pay rate is:

Regular rate multiplied by—choose this option if the pay rate is to be calculated on the employee's regular pay rate. Enter the multiplier in the next field. So if you were setting up double time overtime, you'd enter 2 here.

Fixed hourly rate of—choose this option if the pay rate is the same amount each pay. Enter the hourly rate in the next field.

(Optional) Select the option Automatically adjust base hourly or base salary details if you'd like the base hourly or base salary hours and amounts to be adjusted for amounts paid using this new wage pay item.

(Optional) If you have a specific account that you want to use to keep track of payments made using this pay item:

Select the option Override employees' wage expense account.

Choose the applicable Wage expense account. How do I create accounts?

Under Allocated employees, choose the employees to be assigned this wage pay item. To remove an employee, click the delete ( ) icon for that employee.

Under Exemptions, choose any deductions or taxes that shouldn't be calculated on this wage pay item. If you're not sure, check with your accounting advisor or the ATO.

When you're done, click Save.

Creating a leave pay item for accruing leave

If you have other types of leave that your employees will accrue (apart from annual and personal leave) you'll need to set up a leave pay item for it.

Remember – leave pay items are used to track the leave an employee has accrued.

Go to the Payroll menu and choose Pay items. The Pay items page appears.

Click the Leave tab

Click Create leave pay item.

Enter a Name for this leave.

Choose the Calculation basis.

User-entered amount per pay period - Select this option if you want to enter the hours to accrue in each employee’s standard pay, or manually enter hours accrued when recording the pays.

Equals a percentage of wages - Select this option if your employees are paid on an hourly basis or work variable hours.

You'll need to specify a percentage rate, which will be multiplied by the hours worked in the pay period, to determine the number of leave hours accrued.

Select the pay item to base the calculation on from the Percent of selection list. We suggest you select the Gross Hours option and then use the Exemptions below to choose the pay items you don’t want the entitlement to accrue on.

For example, say your employees work a 38 hour week, and occasionally work overtime. You need to exempt any pay items that are paid in addition to the employee’s standard 38 hour working week, such as overtime hours, holiday leave loading. But don’t exempt pay items that are paid instead of their normal hours, such as annual leave or personal leave, otherwise the accrual will not calculate correctly.The National Employment Standards specify that as a minimum, full-time and part-time employees get 4 weeks of annual leave, based on their ordinary hours of work. Also, the minimum personal leave entitlement is 10 days per year for full-time employees, or pro rata of 10 days for part-time employees, depending on their hours of work.

If your employees are entitled to:

-

4 weeks annual leave per year (or pro-rata for part-time employees), use the percentage 7.6923%

-

10 days personal leave per year (or pro-rata for part-time employees), use the percentage 3.8462%

Have more questions about minimum leave entitlements? See the Fair Work website.

-

Equals dollars per pay period - Select this option if your employees are paid a salary.

To calculate the correct number of entitlement hours, you need to specify a fixed rate that should be accrued each Pay Period, Month or Year, regardless of the hours worked by the employee. No matter which option you choose, the total hours accrued per year will be the same, so choose the calculation that’s easiest for you to work out.Example:

Say your employees are entitled to 4 weeks annual leave per year, and they work a 7.6-hour day (38-hour week). You would enter:

-

152 hours per year (4 weeks x 38 hours) or

-

12.67 hours per month (152 hours / 12 months) or

-

the rate per pay period, which you calculate by dividing the entitlement hours by the number of pay periods. For example, if your employees are paid fortnightly, you would enter 5.846 per pay period (152 hours / 26 pay periods).

-

(Optional) If you don't want the balance of this leave to show on employee pay slips, deselect the option Show leave balance on pay slips.

(Optional) To carry over accrued leave into the next payroll year, select the option Carry remaining leave over to next year.

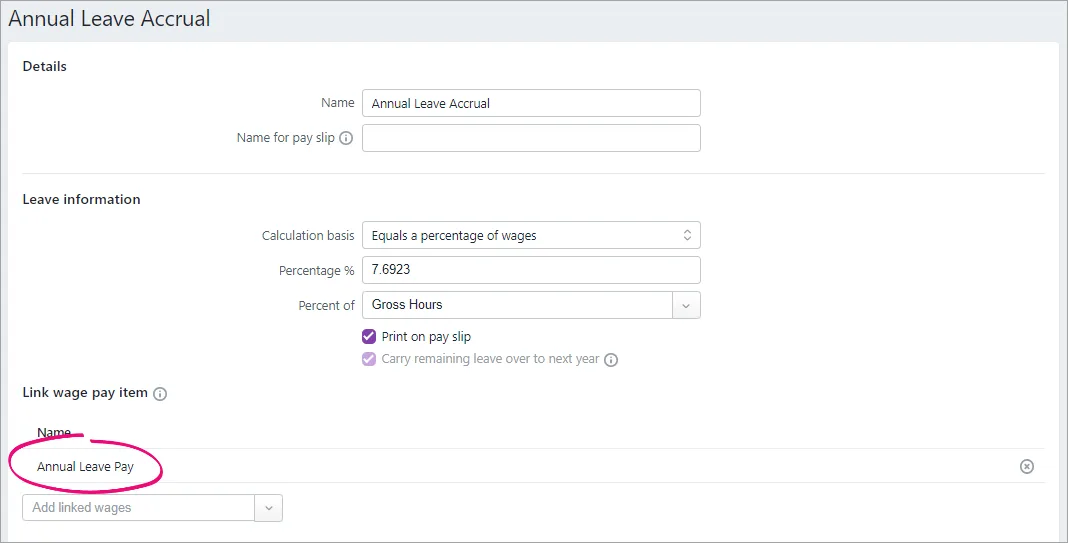

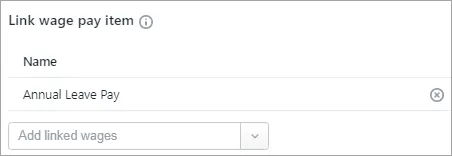

Under Link wage pay item, select one or more wage pay items.

What is this?

Each leave pay item must be linked to at least one wage pay item. Select the pay items that you’ll use to record the hours taken by employees for this leave. When recording a pay for an employee who has used this leave type, for example, by taking a holiday, you allocate the hours taken using the linked wage pay item, and the employee’s accrued leave balance will be automatically reduced.

For example, when setting up a Personal Leave pay item, you could link the Personal Leave Pay and Personal Leave Pay (No Cert) wage pay items (or whatever pay items you've set up for this purpose). When an employee takes some personal leave, the Personal Leave accrual balance is reduced by the hours you enter in those linked wage pay items.Learn more about linking wage pay items.

Under Employees using this pay item, choose the employees who are entitled to this leave. To remove an employee, click the delete icon for that employee.

Under Exemptions (if the Calculation basis you chose at step 5 is Equals a percentage of wages), choose all wage pay items that should not accrue this leave. If you're not sure, check with your accounting advisor or the ATO. Learn more about adding exemptions.

When you're done, click Save.

Entering opening leave balances

When you add an employee into MYOB, if they have already accrued leave in your previous payroll system you can record their opening leave balance.

Go to the Payroll menu and choose Employees.

Click the employee's name.

Click the Payroll details tab.

Click the Leave tab. The leave pay items the employee is entitled to should be listed. You can add or remove pay items here if needed.

Enter the employee's opening leave balances in the Balance adjustment column for each applicable leave pay item.

When you're done, click Save.

Repeat for all other employees with opening leave balances.

Paying leave

Once you've set up your employees' leave, you can include leave in their pays. More about paying leave.

FAQs

How do I get leave balances to reset at the start of the payroll year?

If you use a type of leave where the balance of leave doesn't carry over into the next payroll year, you can prevent it from doing so.

Go to the Payroll menu > Pay items > Leave tab > click to open the leave pay item > deselect the option Carry remaining leave over to next year.

How do I adjust an employee's leave balance?

You can adjust an employee's leave balance by recording a zero dollar pay with a leave adjustment value. The employee won't be paid anything, but their leave balance will be corrected. You can also add a note to the pay so the resulting pay slip will clearly show the adjustment you've made. It also provides a record and audit trail of what happened and how you fixed it.

For all the details, see Managing your employees’ leave.

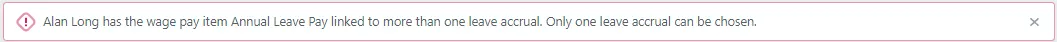

Why am I getting an error about a wage pay item being linked to more than one leave accrual?

Each type of leave has:

one leave accrual pay item (which looks after the amount of leave being accrued), and

one linked wage pay item (to look after the amount being paid when the leave is taken).

You can see in this example that the Annual Leave Accrual pay item is linked to the Annual Leave Pay wage pay item:

But if you have another leave accrual pay item that's linked to the same wage pay item as another accrual, it'll cause an error when you try to pay leave:

To fix this error:

Take note of the employee who's mentioned in the error message, then complete these steps:

Open the employee's record (Payroll menu > Employees > click the employee).

Click the Payroll details tab > Leave tab. You'll see each of the leave accruals assigned to the employee.

Click a leave accrual pay item and check the Linked wage pay item. Each accrual pay item should have a different linked wage pay item.

If the wrong wage pay item has been linked:

Click the remove ( ) icon to remove the incorrect wage pay item.

Click Add linked wages and choose the correct wage pay item.

Click Save.

Once you've fixed the issue, you can resume the saved pay run to successfully complete the pay (Create menu > Pay run > Edit existing pay run).

How do I set up compassionate leave?

Employees don't accumulate compassionate leave and it's not a part of their sick and carer's leave entitlement. Employees can take compassionate leave any time they need it, for example for family bereavement.

So you just need to set up the wage pay item for paying compassionate bereavement leave (see 'Creating a wage pay item for paying leave', above) and record the leave taken in their pay run.

For guidelines on providing compassionate leave, see this Fair Work info.

AccountRight Plus and Premier only

Most employees are entitled to a certain number of days of leave that they can take during the year. This might include annual leave, personal leave (sick leave), bereavement or compassionate leave, or carer's leave. Regardless of the name, AccountRight handles all leave in a similar way.

If you're not sure what leave your employees are entitled to, the Fair Work website has great info on leave entitlements and the National Employment Standards.

New to payroll?

Book a 30-minute session with an expert to help you get started – it's all part of AccountRight Priority Support.

How leave works in AccountRight

There are 2 parts to leave:

the leave balance (how much leave is available to be taken), and

the leave payment (how much is paid when leave is taken).

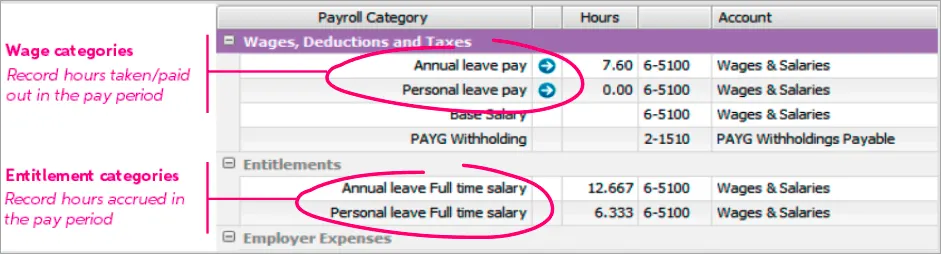

AccountRight uses entitlement payroll categories to track your employees' leave balance. The payment of leave is handled using a wage payroll category. So when an employee takes leave, the wage payroll category looks after the payment and the entitlement payroll category keeps track of their leave balance.

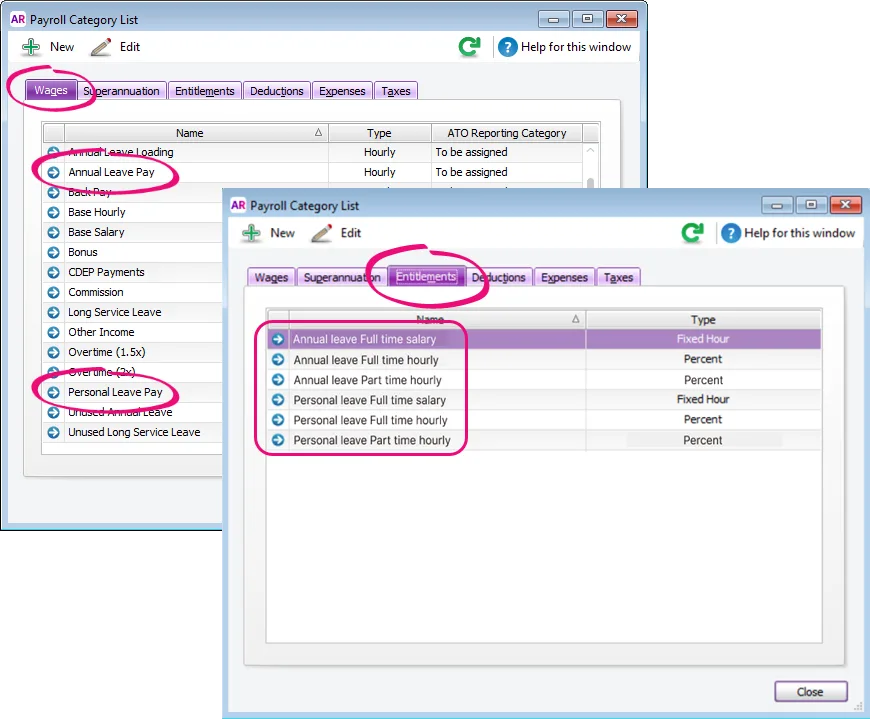

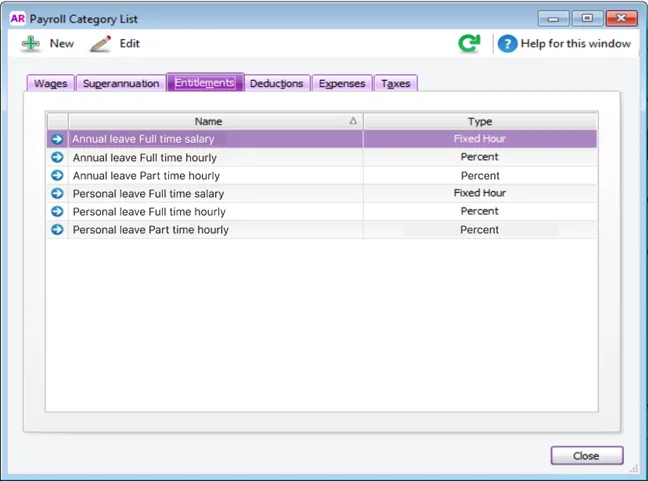

To help manage your employees' leave, AccountRight comes with some default payroll categories:

2 wage payroll category – to pay for annual and personal leave when it's taken and to reduce the employee's leave balance

6 entitlement payroll categories – to calculate and maintain the accrued leave for different types of employees

Don't see all these default payroll categories?

If you've been using AccountRight for a while, you might see fewer default payroll categories. But you can create new payroll categories to suit the needs of your business.

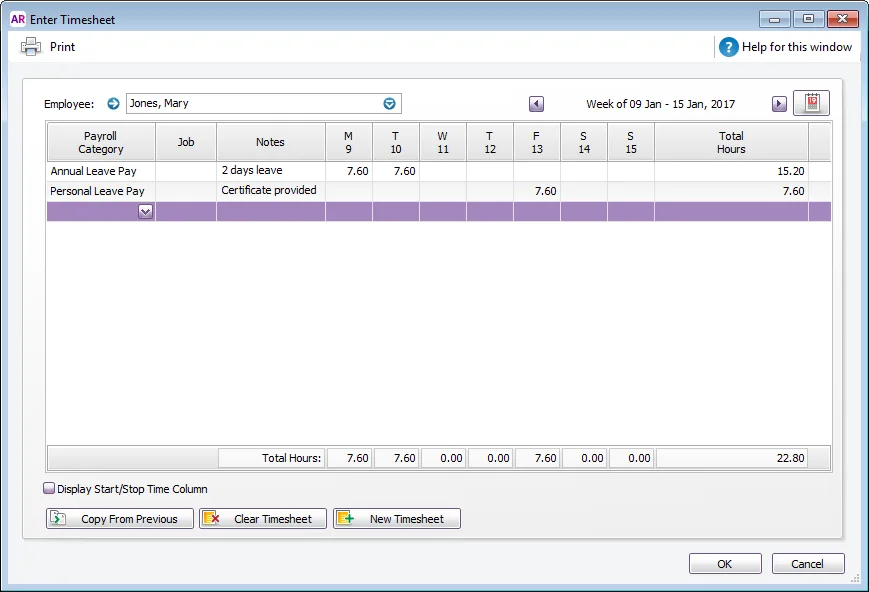

Once the applicable payroll categories are assigned to an employee, you can pay them for leave – like this example:

In the above example, an employee is taking 7.6 hours of annual leave in the pay period, and this is entered against the Annual Leave Pay payroll category. The Annual leave Full time salary payroll category shows the number of hours the employee is accumulating over the pay period (12.667 hours).

Need to fix some leave?

See Adjusting leave entitlements. What about unpaid leave? See Leave without pay.

Assigning annual leave and personal leave to your employees

There are default wage and entitlement categories in AccountRight that are set up to suit most businesses. All you need to do is assign them to your employees.

Go to the Payroll command centre and click Payroll Categories.

Click the Wages tab.

Click the Annual Leave payroll category.

If it hasn't already been chosen, choose the applicable ATO Reporting Category. If unsure, check with your accounting advisor or the ATO. Learn more about assigning ATO reporting categories for Single Touch Payroll reporting.

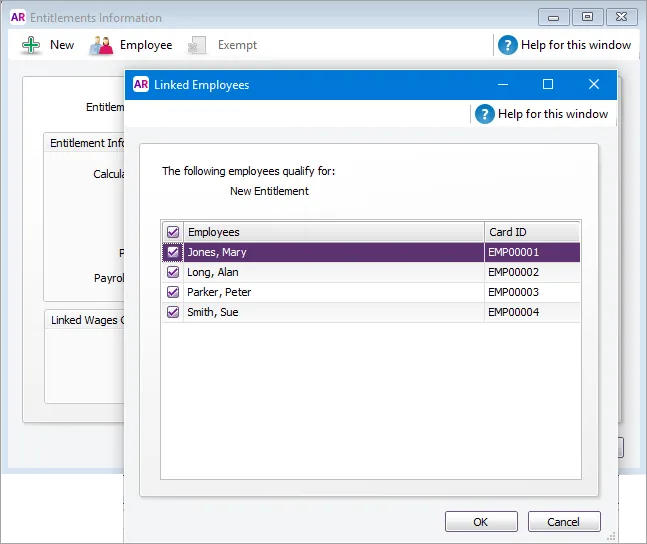

Click Employee.

Select the employees who are entitled to annual leave and click OK.

Click OK.

Click the Entitlements tab.

Click the zoom arrow to open the entitlement category you want to assign. Choose the one that matches the employees you're assigning it to (full time, part time, salaried or hourly).

Click Employee.

Select the employees who are entitled to annual leave and click OK.

Linking wage categories and adding exemptions

AccountRight's default entitlement categories are set up to suit most businesses. But if you've created additional wage categories, you might need to choose additional linked wage categories or add additional exemptions. To learn more see Linking a wage category and adding leave exemptions.

Click OK to save the entitlement category.

Repeat the above steps to assign the Personal Leave wage and entitlement categories to your employees.

Creating a wage category for paying leave

If you have other types of leave that you need to pay your employees (apart from annual and personal leave) you'll need to set up a wage category for it.

Remember – wage categories are used to include payments on an employee's pay.

Go to the Payroll command centre and click Payroll Categories.

Click the Wages tab.

If a wage category already exists for the type of leave you're setting up, click the zoom arrow to open it. Otherwise, click New and give the category a name.

For the Type of Wages, select Hourly (you can use this for both hourly-based and salaried employees).

Choose the applicable ATO reporting category. If unsure, check with your accounting advisor or the ATO. Learn more about assigning ATO reporting categories for Single Touch Payroll reporting.

For the Pay Rate, select Regular Rate Multiplied by and leave the next field set to 1.0000. This means the leave will be paid at the same rate as the employee's regular pay.

If you've set up a separate account to track these leave payments, select the Optional Account option and choose the Override Account.

Select the option Automatically Adjust Base Hourly or Base Salary Details. This ensures that when you pay an employee for leave, their regular pay hours and amounts are adjusted accordingly – so they're not overpaid.

Click Employee and select the employees who are entitled to these leave payments.

Click OK then click OK again.

Creating an entitlement category for accruing leave

If you have other types of leave that your employees will accrue (apart from annual and personal leave) you'll need to set up an entitlement category for it.

Remember – entitlement categories are used to track the leave an employee has accrued.

Go to the Payroll command centre and click Payroll Categories.

Click the Entitlements tab.

If the entitlement you want to set up already exists, click the zoom arrow to open it. Otherwise, click New and give the entitlement a name.

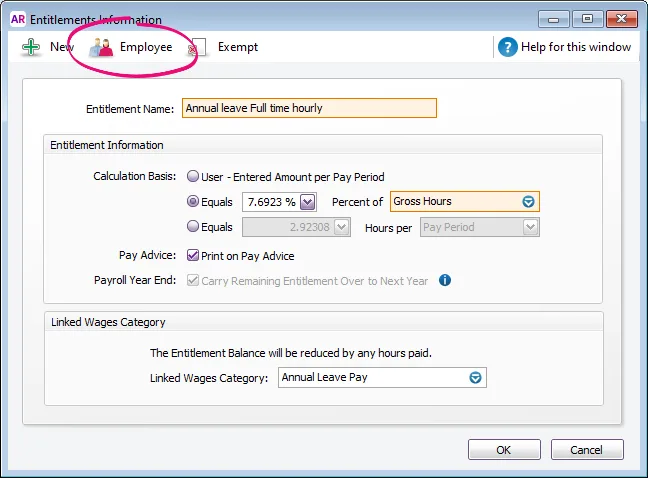

In the Entitlement Information sectionSet up how you want to calculate the accrual of entitlement hours. You have three options:

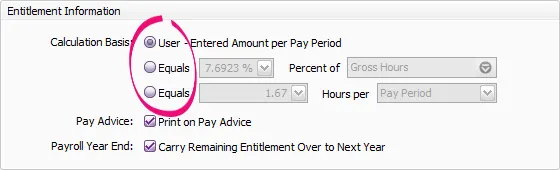

User - Entered Amount per Pay Period - Select this option if you want to enter the hours to accrue in each employee’s standard pay, or manually enter hours accrued when recording the pays.

Equals [x] Percent of - Select this option if your employees are paid on an hourly basis or work variable hours. This calculation basis means leave will calculate based on the hours recorded in an employee's pay.

If you select this option, you'll need to specify the percentage rate to be used in the calculation. This rate will be multiplied by the hours worked in the pay period, to determine the number of entitlement hours accrued.

Select the category to base the calculation on from the Percent of selection list. We suggest you select the Gross Hours option and then click Exempt to choose the categories you don’t want the entitlement to accrue on.

For example:

Say your employees work a 38 hour week, and occasionally work overtime. You need to exempt any categories that are paid in addition to the employee’s standard 38 hour working week, such as overtime hours, holiday leave loading. But don’t exempt categories that are paid instead of their normal hours, such as annual leave or personal leave, otherwise the accrual will not calculate correctly.The National Employment Standards specify that as a minimum, full-time and part-time employees get 4 weeks of annual leave, based on their ordinary hours of work. Also, the minimum personal leave entitlement is 10 days per year for full-time employees, or pro rata of 10 days for part-time employees, depending on their hours of work.

If your employees are entitled to:

-

4 weeks annual leave per year (or pro-rata for part-time employees), use the percentage 7.6923%

-

10 days personal leave per year (or pro-rata for part-time employees), use the percentage 3.8462%

If your employee entitlements are different to these, see Calculating an entitlement percentage.

Have more questions about minimum leave entitlements? See the Fair Work website.-

Equals [x] Hours per - Select this option if your employees are paid a salary, such as full time or part time.

To calculate the correct number of entitlement hours, you need to specify a fixed rate that should be accrued each Pay Period, Month or Year, regardless of the hours worked by the employee. No matter which option you choose, the total hours accrued per year will be the same, so choose the calculation that’s easiest for you to work out.Example - full time employee

Say your employees are entitled to 4 weeks annual leave per year, and they work a 7.6-hour day (38-hour week). You would enter:

-

152 hours per year (4 weeks x 38 hours) or

-

12.67 hours per month (152 hours / 12 months) or

-

the rate per pay period, which you calculate by dividing the entitlement hours by the number of pay periods. For example, if your employees are paid fortnightly, you would enter 5.846 per pay period (152 hours / 26 pay periods).

Example - part time employee

Say a part time employee is entitled to 4 weeks annual leave per year, and they work a 7.6-hour day for 3 days (22.8-hour week). You would enter:

-

91.2 hours per year (4 weeks x 22.8 hours) or

-

7.6 hours per month (91.2 hours / 12 months) or

-

the rate per pay period, which you calculate by dividing the entitlement hours by the number of pay periods. For example, if your employees are paid fortnightly, you would enter 3.507 per pay period (91.2 hours / 26 pay periods).

-

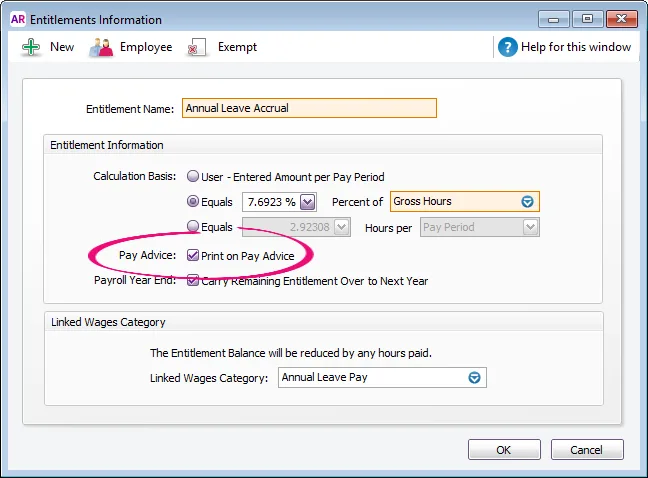

(Optional) To show accrued leave on pay slips, select the option Print on Pay Advice.

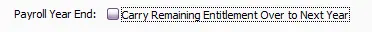

(Optional) To carry over accrued leave into the next payroll year, select the option Carry Remaining Entitlement Over to Next Year. If you don't select this option, the leave balance will reset to zero at the start of the new payroll year.

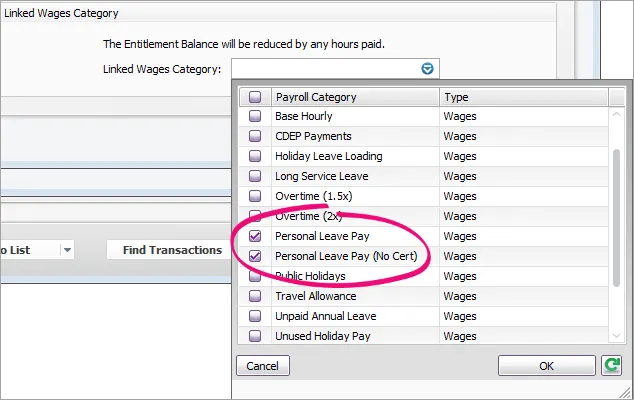

In the Linked Wages Category sectionFor the Linked Wages Category, select one or more wage categories.

Each entitlement category must be linked to at least one wage category. Select the categories that you’ll use to record the hours taken by employees for this entitlement (see above for setting up wage categories for leave payments). When recording a pay for an employee who has used their entitlement, for example, by taking annual leave, you allocate the hours taken using the linked wage category, and the employee’s accrued leave balance will be automatically reduced.

For example, when setting up a Personal Leave Accrual entitlement category, you could link the Personal Leave Pay and Personal Leave Pay (No Cert) wage categories (or whatever categories you've set up for this purpose). When an employee takes some personal leave, the Personal Leave Accrual balance is reduced by the hours you enter in those linked wage categories.

Click Employee and select all employees who are entitled to this leave, and to whom the rate or percentage you've entered applies.

If you have:

entered a percentage, only select employees who are paid hourly

entered a fixed rate, only select salaried employees.

chosen to enter a user-entered amount, select all the employees for whom you've specified entitlement hours in their standard pays.

What are Federal Hours?

Federal hours are the total of all hourly based wage categories assigned to an employee, except those wage categories which are exempt from PAYG Withholding.If you're not sure whether to use Gross Hours or Federal Hours in your entitlement calculation, check with the ATO or your accounting advisor.

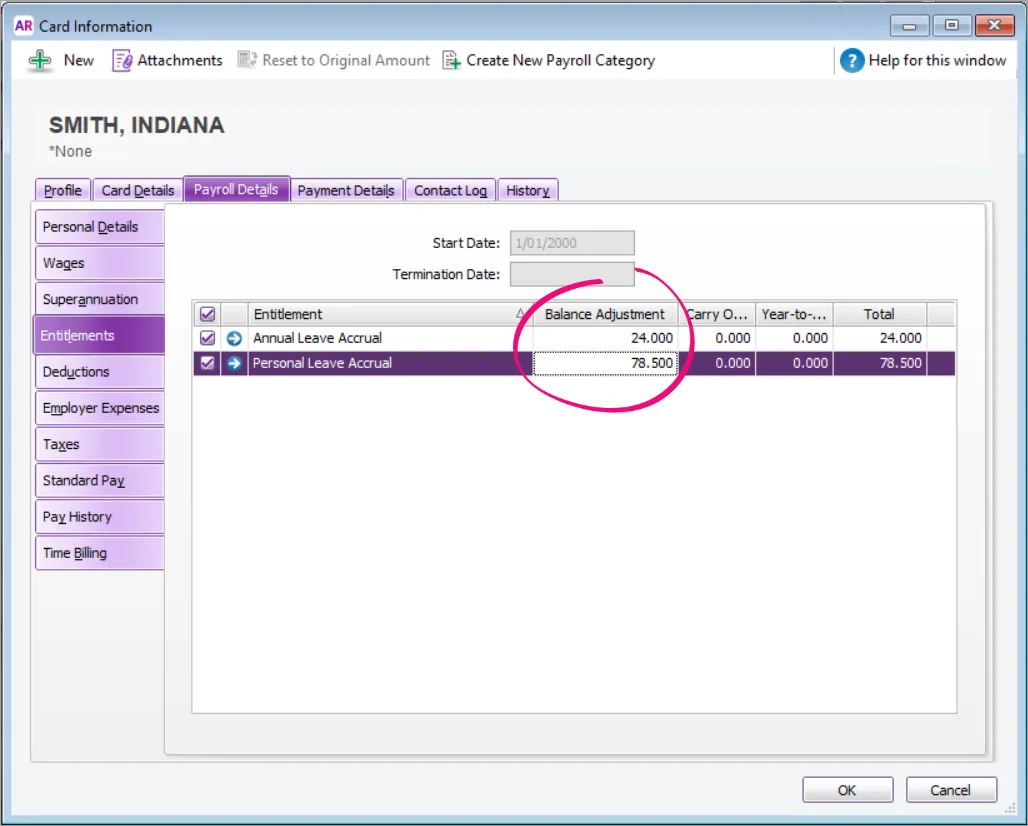

Entering opening leave balances

If your employees already had entitlement hours owing to them when you started using AccountRight’s payroll features, enter the opening balances in their card.

Go to Card File command centre > Cards List, open an employee card > Payroll Details tab > Entitlements. Enter the opening balances (in hours) in the Balance Adjustment column.

Paying leave

Once you've set up your employees' leave, you can include leave in their pays. More about paying leave.

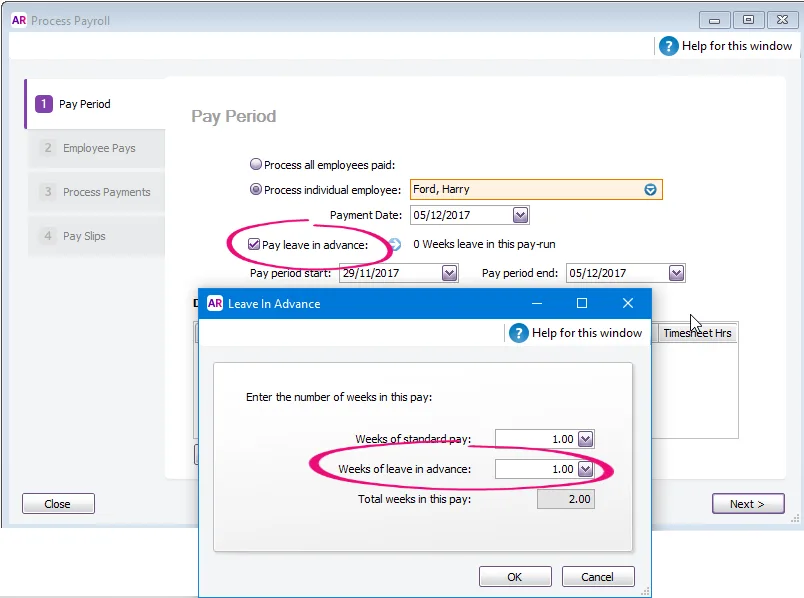

Paying leave in advance

If you’re processing a pay that includes an employee's standard pay, plus leave equal to additional pay periods, select the Pay leave in advance option in the Pay Period step of the Process Payroll Assistant. You can then select the number of standard pays you’re processing for the employee (0 or 1) plus the additional pay periods of leave.

FAQs

When does the year-to-date leave balance update in an employee's card?

At the start of a new financial year, you may notice that the balance in the Year-to-Date column in the Entitlement section, Payroll Details tab of an employee’s card still shows the previous YTD balance. This balance updates after you record the first pay in the new year.

How do I get leave balances to reset at the start of the payroll year?

Deselect the Carry Remaining Entitlement Over to Next Year option in the Entitlement Information window.

How do I show leave hours accrued in the pay period on pay slips?

Select the Print on Pay Advice option in the Entitlement Information window (Payroll > Payroll Categories > Entitlements tab > open the entitlement).

To include year-to-date amounts paid and entitlement balances (which includes any carry-over balances) on your employee pay slips, go to Setup > Preferences > Reports & Forms tab and select the option to Include all YTD amounts and Entitlement Balances on Paycheques Stubs.

Learn more about personalising pay slips.

How can I track leave taken, so I can process it in the next pay run?

We suggest you use timesheets. You can include the hours you record on the timesheet (Payroll command centre) in the pay run.

Learn more about Timesheets and including employee timesheets in a pay run.

How do I set up compassionate leave?

Employees don't accumulate compassionate leave and it's not a part of their sick and carer's leave entitlement. Employees can take compassionate leave any time they need it, for example for family bereavement.

So you just need to set up the wage category for paying compassionate bereavement leave (see 'Creating a wage category for paying leave', above) and record the leave taken in their pay run.

For guidelines on providing compassionate leave, see this Fair Work info.