Victoria only

The Portable Long Service Benefits Scheme commenced operation on 1 July 2019. Portable long service means workers accrue long service benefits for all their years in a single industry, rather than with a single employer.

It’s 'portable' because it moves with workers through their years of employment.

The industries the scheme applies to are:

community services

contract cleaning

security industries

the National Disability Insurance Scheme (NDIS)

certain children's services providers.

If the Portable Long Service Benefits Scheme applies to your business, you need to register with the Authority by 31 March 2020.

How the Scheme works

Employers register their eligible workers through an online portal. Each quarter, employers complete a quarterly return that provides information about their workers, including the hours they worked, the ordinary pay they received and any long service leave they took under another arrangement.

The portal then calculates the levy payable by employers, which is represents a small percentage of the workers’ pay. This money is then managed in a fund so that after a period, workers can apply for their long service benefits.

Quarterly return due dates

All registered employers must lodge a quarterly return to the Portable Long Service Authority every three months, in April, July, October and January.

Quarter | Pay by |

|---|---|

1 January–31 March | 30 April |

1 April–30 June | 31 July |

1 July–30 September | 31 October |

1 October–31 December | 31 January |

Before you begin

First, check if you need to register your business with the Portable Long Service Benefits Scheme. To do this, visit the Portable Long Service Authority website.

Tracking the Portable Long Service Leave levy in MYOB

You can use MYOB to keep an eye on the amount of Portable Long Service Benefits Scheme levy you're required to pay. To do this, you'll need to set up levy expense and liability categories and create an expense pay item.

To set up the levy expense category

Go to the Accounting menu and choose Categories (Chart of accounts).

Click the Expenses tab.

Click Create category.

Leave the Detail category option selected. What is this?

For the Type, choose Expense. What is this?

Choose the applicable Parent header. This determines where the category will sit in your category list.

Enter a unique 4-digit Code after the dash. The prefix (the number before the dash) is based on the category type and can't be changed.

Enter the Name, for example Portable LSL Levy Expense or similar.

(Optional) Enter Notes about this category.

(Optional) Enter the category's Opening balance.

Choose the Tax code that you'll use most often with transactions posted to this category. You can choose a different tax code when entering transactions. If you're not sure what tax code to use, consult your advisor.

When you're done, click Save.

To set up the levy liability category

Go to the Accounting menu and choose Categories (Chart of accounts).

Click the Liabilities tab.

Click Create category.

Leave the Detail category option selected. What is this?

For the Type, choose Other liability. What is this?

Choose the applicable Parent header. This determines where the category will sit in your category list.

Enter a unique 4-digit Code after the dash. The prefix (the number before the dash) is based on the category type and can't be changed.

Enter the Name, for example Portable LSL Liability or similar.

(Optional) Enter Notes about this category.

(Optional) Enter the category's Opening balance.

Choose the appropriate classification for statements of cash flow.

Not sure which classification to use?

Check with your accounting advisor or ask an expert on the community forum.

Choose the Tax code that you'll use most often with transactions posted to this category. You can choose a different tax code when entering transactions. If you're not sure what tax code to use, consult your advisor.

When you're done, click Save.

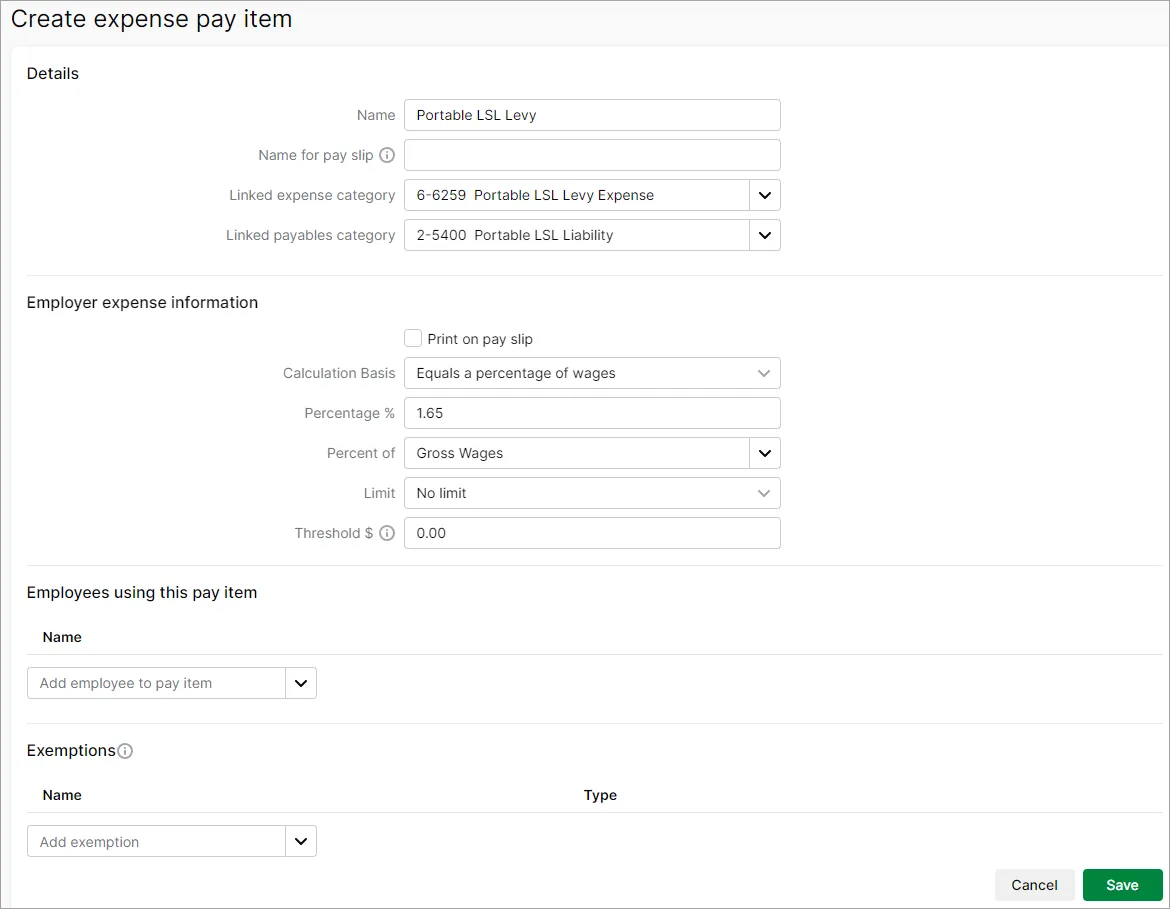

To create a pay item for the levy

Go to the Payroll menu > Pay items.

Click the Expenses tab.

Click Create expense pay item. The Create expense pay item page appears.

Name the pay item Portable LSL Levy or similar.

(Optional) If you want a different name to display on pay slips for this pay item, enter a Name for pay slip.

Select the Portable LSL expense category you created as the Linked expense category.

Select the Portable LSL liability category you created as the Linked payable category.

Set the Calculation Basis option to Equals a percentage of wages. The value entered in the percentage field needs to be your Portable Long Service Leave Levy rate. This rate varies depending on your industry.

Set the Limit option to No Limit.

Set the Threshold to $0.00. The Create expense pay item page will look similar to the following example:

Under Employees using this pay item, choose the employees associated with this expense.

Under Exemptions, choose all pay items that should be excluded from this expense. If you're not sure, check with your accounting advisor or the ATO.

When you're done, click Save.

Paying the levy

When you're required to pay the quarterly levy, you'll be sent an invoice from the Portable Long Service Leave Authority. The levy must be paid within 14 days. You can pay the levy via the employer portal by BPay.

The first time you pay the levy, you'll need to register your employees for the scheme.

For more information on how to pay the levy, visit the Portable Long Service Leave Authority website.

In MYOB, you can record the payment to Authority using a spend money transaction. If you've been tracking Portable Long Service Leave in MYOB using the steps above, allocate the payment to the levy liability category you created. If you haven't been tracking Portable Long Service Leave in MYOB, allocate the payment to an appropriate expense category.

What to do when an employee takes long service leave

In some situations, an employer may apply to the Authority for a reimbursement of a long service leave payment made to an employee. For more information, see Claiming back long service leave payments.

For information on how to set up and pay long service leave, see Long service leave.

Victoria only

The Portable Long Service Benefits Scheme commenced operation on 1 July 2019. Portable long service means workers accrue long service benefits for all their years in a single industry, rather than with a single employer.

It’s 'portable' because it moves with workers through their years of employment.

The industries the scheme applies to are:

community services

contract cleaning

security industries

the National Disability Insurance Scheme (NDIS)

certain children's services providers.

If the Portable Long Service Benefits Scheme applies to your business, you need to register with the Authority by 31 March 2020.

How the Scheme works

Employers register their eligible workers through an online portal. Each quarter, employers complete a quarterly return that provides information about their workers, including the hours they worked, the ordinary pay they received and any long service leave they took under another arrangement.

The portal then calculates the levy payable by employers, which is represents a small percentage of the workers’ pay. This money is then managed in a fund so that after a period, workers can apply for their long service benefits.

Quarterly return due dates

All registered employers must lodge a quarterly return to the Portable Long Service Authority every three months, in April, July, October and January.

Quarter | Pay by |

|---|---|

1 January–31 March | 30 April |

1 April–30 June | 31 July |

1 July–30 September | 31 October |

1 October–31 December | 31 January |

Before you begin

First, check if you need to register your business with the Portable Long Service Benefits Scheme. To do this, visit the Portable Long Service Authority website.

Tracking the Portable Long Service Leave levy in AccountRight

You can use AccountRight to keep an eye on the amount of Portable Long Service Benefits Scheme levy you're required to pay. To do this, you'll need to set up levy expense and liability accounts and create an expense payroll category.

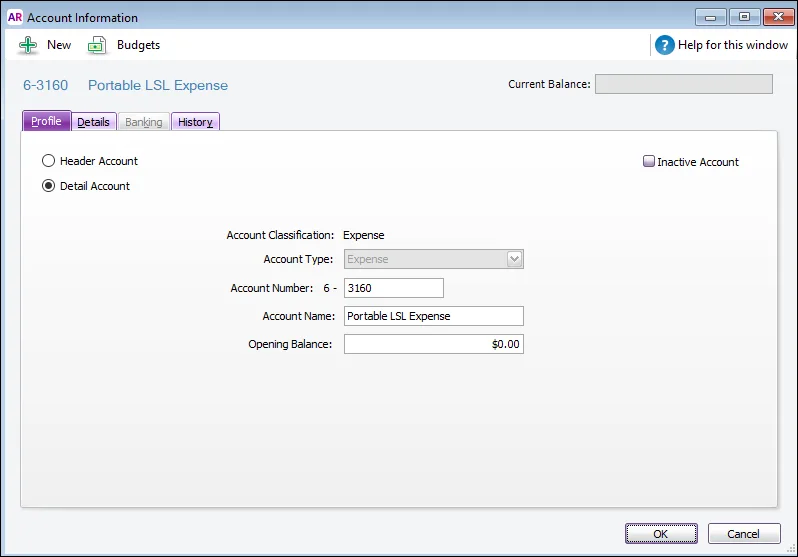

To set up the levy expense account

Go to the Accounts command centre and click Accounts List.

Click the Expenses tab.

Click New. The Account Information window appears.

Select the Detail Account option.

Enter a four-digit number for the account in the Account Number field. The number must be unique within each account classification.

Press Tab and type a name for the account such as Portable LSL Levy Expense.

(Optional) Enter the account's Opening Balance.

Click the Details tab.

(Optional) Type a brief description of the account in the Description field.

In the Tax Code field, enter the tax code that you use most often with transactions that will be posted to this account. If you're not sure what tax code to use, consult your advisor.

The Account Information window should look similar to the following example:

When you're done, click OK.

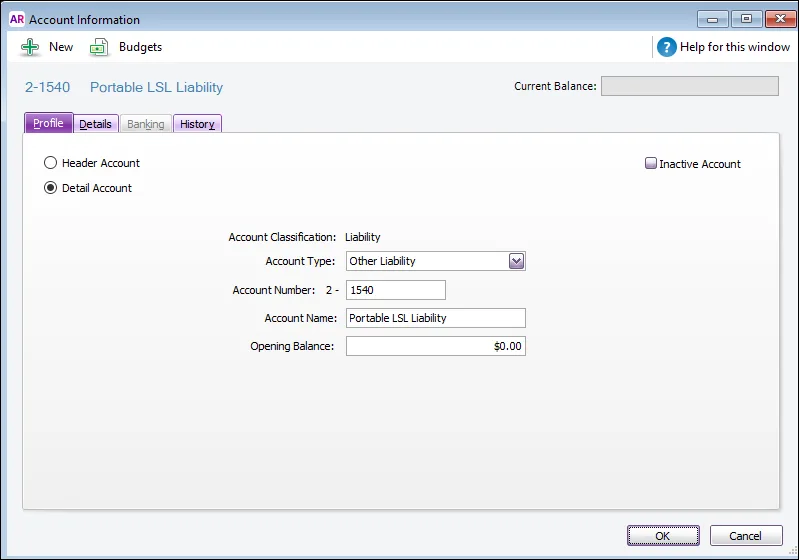

To set up the levy liability account

Go to the Accounts command centre and click Accounts List.

Click the Liability tab.

Click New. The Account Information window appears.

Select the Detail Account option.

Enter a four-digit number for the account in the Account Number field. The number must be unique within each account classification.

Press Tab and type a name for the account such as Portable LSL Liability.

(Optional) Enter the account's Opening Balance.

Click the Details tab.

(Optional) Type a brief description of the account in the Description field.

Choose the appropriate classification for statements of cash flow.

Not sure which classification to use?

Check with your accounting advisor or ask an expert on the community forum.

In the Tax Code field, enter the tax code that you use most often with transactions that will be posted to this account. If you're not sure what tax code to use, consult your advisor. Click OK.

The Account Information window should look similar to the following example:

When you're done, click OK.

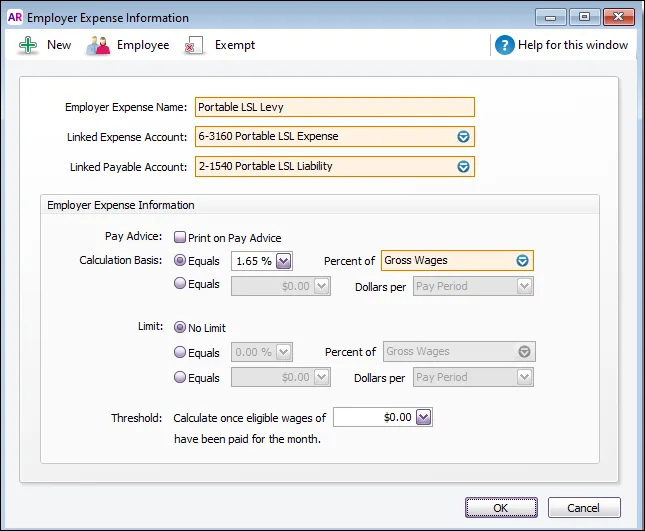

To create a payroll category for the levy

Go to the Payroll command centre and click Payroll Categories.

Click the Expenses tab.

Click New. The Employer Expense Information window appears.

Name the category Portable LSL Levy.

Select the Portable LSL expense account you created as the Linked Expense Account.

Select the Portable LSL liability account you created as the Linked Payable Account.

Set the Calculation Basis option to Equals XX Percent of Gross Wages. The value entered in the percentage field needs to be your Portable Long Service Leave Levy rate. This rate varies depending on your industry.

Set the Limit option to No Limit.

Set the Threshold to $0.00.

The Employer Expense Information window will look similar to the following example:

Click Employee. The Linked Employees window is displayed.

Select the relevant employees.

Click OK to the Linked Employees window and then click OK again at the Employer Expense Information window.

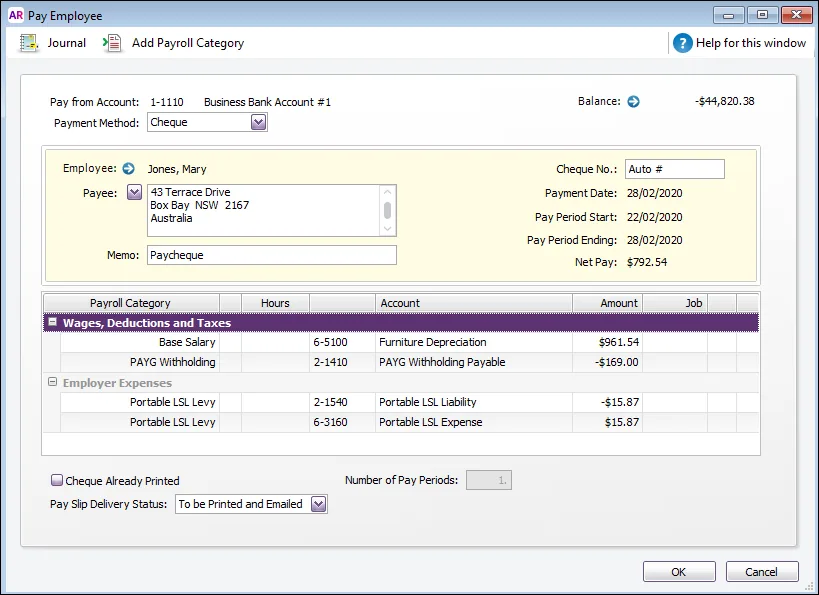

Whenever you process the payroll for the employees you've linked, the Portable Long Service Leave levy amounts will appear in their pay:

Paying the levy

When you're required to pay the quarterly levy, you'll be sent an invoice from the Portable Long Service Leave Authority. The levy must be paid within 14 days. You can pay the levy via the employer portal by BPay.

The first time you pay the levy, you'll need to register your employees for the scheme.

For more information on how to pay the levy, visit the Portable Long Service Leave Authority website.

In AccountRight, you can record the payment to Authority using a Spend Money transaction. If you've been tracking Portable Long Service Leave in AccountRight using the steps above, assign the payment to the levy liability account you created. If you haven't been tracking Portable Long Service Leave in AccountRight, assign the payment to an appropriate expense account.

What to do when an employee takes long service leave

In some situations, an employer may apply to the Authority for a reimbursement of a long service leave payment made to an employee. For more information, see Claiming back long service leave payments.

For information on how to set up and pay long service leave in AccountRight, see Long service leave.