If you use Squarespace for your e-commerce and online sales, you can sync your Squarespace sales data into MYOB Business by integrating Squarespace and MYOB via Amaka.

When integrated with MYOB Business via Amaka, Squarespace allows daily syncing of sales, payment, and tax information directly into MYOB Business, helping you streamline your accounting and ensure accurate financial records.

How it works

Each day, the integration syncs your Squarespace transaction data to MYOB Business. You can choose to summarise your sales information (for easy reconciliation) or create detailed entries for each order, depending on your needs and your setup preferences.

This process provides visibility of your total sales, payment methods, and the status of orders—making it simple to keep track of your eCommerce performance directly within MYOB Business.

Why you should set it up

Centralises your data. It enables your business to centralise sales data from multiple channels for accurate financial reporting and inventory management.

Helps you make better decisions. The synchronisation supports better decision-making with up-to-date sales insights from MYOB reports.

Easier reconciliation. Automatically sync your sales data from Square into MYOB daily via bank feeds, fast-tracking your reconciliation process.

Easy setup. The setup process is streamlined and can be completed in just a few clicks using Amaka's Express Setup, with clear account mapping and customisation options to suit your needs.

Already have sales? No problem, you can back-date your data synchronisation and generate sales summaries for your previous sales.

Pricing

Amaka’s integrations are typically offered under a freemium pricing model (the first integration and some basic features are free to use, additional integrations and advanced features are available for a fee).

For premium integrations, Amaka offers a 7-day free trial - allowing you to find a solution that fits your need before committing to purchase.

Support

Get unlimited support from Amaka’s 5-star rated Integration Experts.

Schedule a 30-minute session with Amaka’s CPA-trained, MYOB certified team for onboarding and ongoing assistance. Support channels extend from personalised Zoom sessions, live chats and help desk ticketing.

Setting up Squarespace + MYOB integration

Below is an overview of how to set up the integration based on Amaka's Express simple setup mode. For more details, including the Advanced setup option, refer to the Squarespace + MYOB setup guide.

Before you begin

To get the full benefits of this solution, check that you've set these things up in MYOB Business:

-

Customers and suppliers – check that you've created your customer and supplier records so you don't need to enter these each time you buy or sell. You can also speed up getting paid by giving customers an easy way to pay your invoices online – see Online payments.

-

Bank feeds – if you want to reconcile your online sales automatically, you'll need to have set up bank feeds and connected your bank to the MYOB Business category you'll use to track your online sales.

-

Categories – if you choose the Express Amaka setup, you won't need to create any new categories in MYOB Business to track your sales – Amaka will create default categories in MYOB Business to map sales and payments from your e-commerce. If you choose the Advanced Amaka setup (recommended for accountants and bookkeepers), which allows you to choose your own custom sales and payments mapping, you may need to create categories in MYOB Business.

1. Connect accounts

Create or sign in to your Amaka account.

On the Connect Accounts page, click Connect to Squarespace.

Sign up or sign in to Squarespace.

Follow the guided process to allow Amaka the relevant permissions to your Squarespace account.

On the Connect Accounts page, click Connect to MYOB.

Allow Amaka access to your MYOB account.

Set your Company Timezone. This ensures that all sales, payments, and other transaction data pulled from Square are time-stamped accurately in MYOB according to your business's local time.

2. Select relevant features

Choose whether you want to summarise all your daily Squarespace transactions as a single invoice in MYOB Business or create a separate invoice for all transactions.

If you need help setting up your integration, click Yes in the Do you need help? message to schedule a call with an integration expert.

3. Choose settings

Tax Types. Map taxes for Squarespace tax rates to the tax codes in your MYOB Business. This ensures the tax components of your sales are recorded correctly in MYOB Business.

Bank Accounts. This is where you connect your Squarespace transactions to the appropriate categories in MYOB Business. Setting this up ensures your sales from Squarespace flow directly into MYOB, making your bookkeeping and reconciliation a lot easier and saving you time compared to manually entering the data.

Invoice Preview. See how your Squarespace payments will look in the invoice in your MYOB Business.

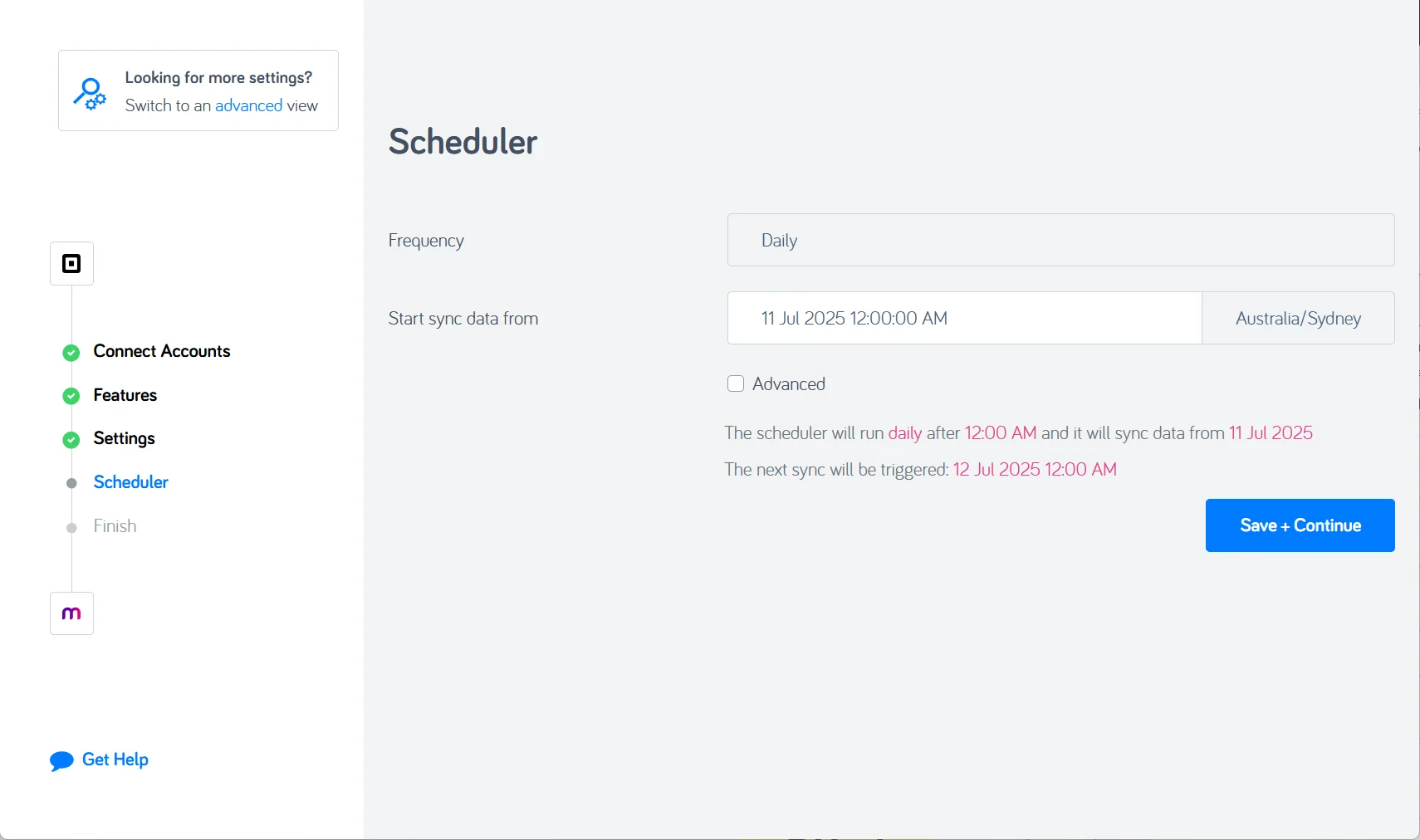

4. Scheduler

Review or change the date to start syncing data from, which allows back-dating of integration to cover past sales data if needed.

5. Finish

Find out what to expect next or return to your Amaka dashboard.

FAQs

Can I turn off an integration?

Yes, at any time you can go to the Amaka dashboard and disable an integration by either turning it off or deleting it entirely. For more information, see Amaka help.

How often is my data synchronised from Amaka?

Your e-commerce data is synchronised with MYOB Business daily. The time your data is synchronised depends on the time and date you choose in the Amaka Scheduler:

For more information, see Amaka help.