If you're not preparing your activity statements online, you can use the BASlink feature to prepare your Business Activity Statement (BAS) or Instalment Activity Statement (IAS).

Before you begin, you need to set up your activity statement information. If you've upgraded from AccountRight Classic (v19 or earlier), you can import your previous BASlink setup file.

Electronic activity statement lodgement

If you'll lodge your activity statement using the ATO’s Business Portal website, you need to have a digital certificate from the ATO on your computer. For more information, contact the ATO.

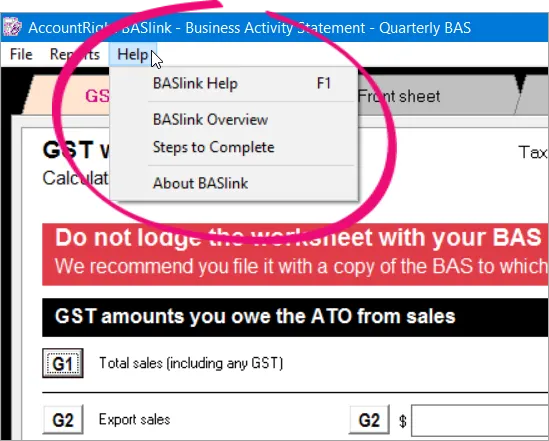

Need BASlink help? Display your worksheet and use the Help menu within BASlink.

To set up your activity statement information

Go to the Accounts command centre and click Prepare BAS/IAS. (In version 2016.2 and earlier, click BASlink.)

In the Lodge Manually tab, click BAS lnfo. The BAS Information window appears.

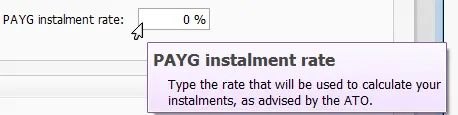

For information about the fields in this window, choose Show Field Help in the Help menu and then hover over a field. The ATO also has information about the PAYG installment rate options.

Specify your activity statement information. If registered for GST or PAYG, you need to specify:

GST information (such as your accounting basis, reporting frequency and calculation method)

PAYG Instalments information

Monthly PAYG instalments

AccountRight can't currently cater for monthly PAYG instalments. Instead, you'll need to calculate your figures manually.

PAYG Withholdings information.

Click OK.

To prepare your activity statement

Go to the Accounts command centre and click Prepare BAS/IAS. (In version 2016.2 and earlier, click BASlink.)

In the Lodge Manually tab, select the last month of your reporting period.

Select the right year

Ensure you select the correct financial year. For example, FY23 refers to the financial year ending in 2023.

If the financial year you need to prepare a BAS for is not available, you'll need to close a financial year that has already ended. Speak to your accountant before doing this. For information about what's involved, see End of financial year tasks.

If you've recorded end-of-year adjustments in your company file and you want to include them in your activity statement, select the Include Year-End Adjustments option.

Click Prepare Statement.

A message appears informing you that the details you added in the BAS Information window will determine the basis of the MYOB BASLink statement. Click OK to continue.

A disclaimer window appears, stating that BASlink is a calculation tool, and does not provide tax advice. Click OK to continue.

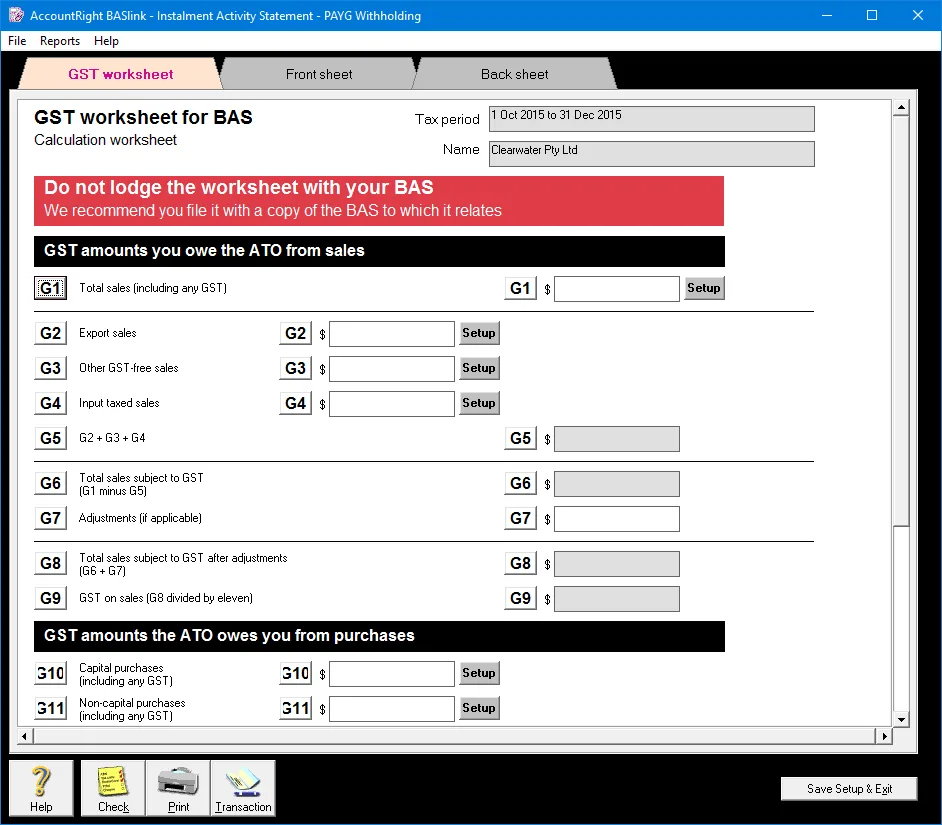

The AccountRight BASlink window appears.BASlink help

If you're using BASlink for the first time, a window also appears with the option to open the BASlink Help window. Click Yes if you need setup assistance.

If you're setting up BASlink for the first time, or you've added new tax codes, payroll categories or accounts since your last reporting period, you need to review the setup of each field. You need to do this on each sheet of the BAS.

Click the Setup and Link buttons next to the applicable fields to set the information that will appear in them. Click on a field label for more information about a field.Click Check to check your activity statement for errors. If there are any errors—for example, a field has not been completed or has an invalid amount—an Error List appears detailing the error and the field name.

If you need a copy of the activity statement for your records (recommended), click Print. You can also use the printed statement to copy the field values to the ATO’s paper or electronic activity statements.

Print the ATO transaction that you need to record in your company file.

Click Transaction to view a report showing the Spend Money or Receive Money transaction.

Large rounding and adjustments value?

If you've edited the tax on transactions this can cause a large rounding and adjustments value. Run the Tax Amount Variance report to see which transactions are causing the issue.

Click Print.

Click Save Setup & Exit to save your current BASlink setup and the details of your current activity statement reporting period. A window appears, reminding you to back up your activity statement. Click Yes to create a backup copy of your activity statement details.

To lodge your activity statement with the ATO

Once you've prepared your activity statement information using BASlink, you can lodge your activity statement electronically or by post.

Completing the activity statement manually and sending by post. Copy the BASlink values to the Business Activity Statement or Instalment Activity Statement sent to you by the ATO. Also send the tax payable to the ATO by the payment due date on the activity statement.

Lodging the activity statement electronically. If you use the ATO’s Business Portal website or Electronic Commerce Interface (ECI) software, type the BASlink values in the corresponding fields on the electronic version of the activity statement.

Next steps

When you make the required payment to the ATO, or receive your refund, you need to record the transaction in AccountRight. For tips on how to record the transaction, see Recording your ATO payment or credit.

Activity statement due dates

The due dates for lodging your BAS are as follows:

Monthly reporting

The due date for your monthly BAS is usually on the 21st day of the following month. If the due date is on a weekend or public holiday, you can lodge your form and make any payment due on the next business day.

Quarterly reporting

Quarter | Due date |

|---|---|

July - September | 28 October |

October - December | 28 February |

January - March | 28 April |

April - June | 28 July |

For more information on BAS/IAS lodgement dates, check the ATO website.

Got a BASlink question?

Check our BASlink FAQs or contact us.