If your business name has changed, you need to update it on the invoices and other business forms you send to customers. This ensures that you have the correct business name on your tax invoices and that your records are accurate.

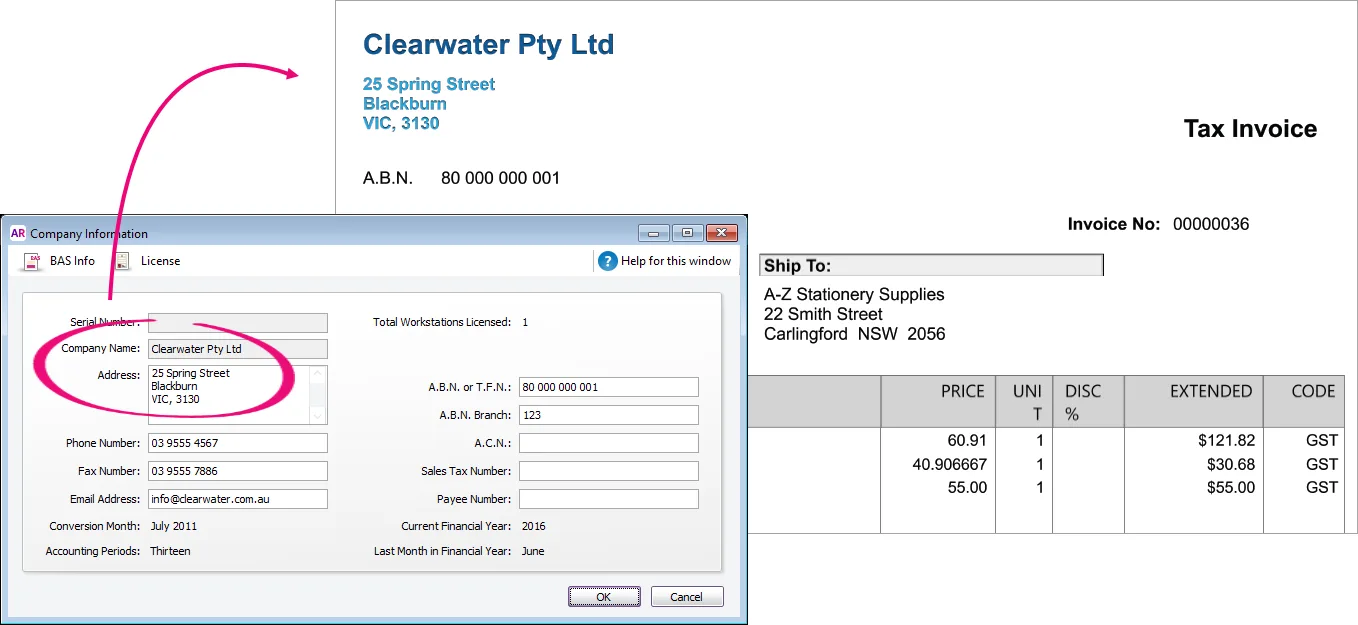

To change the business name, serial number, or other business details that appear on your customer invoices, other business forms, and reports, go to the Setup menu > Company Information.

Change the business name by editing the Company Name field. Note that:

The field has a maximum of 40 characters, including spaces

If your company file is stored offline, you also need to change its name in the My AccountRight files folder (or the folder where your library is located). See Manage libraries for more details.

Make your changes and click OK.

Old details still showing on forms?

If you've changed some details in the Company Information window but the old details are still showing on your forms, such as your invoices, it means the details have been added to the form in a text box. To change it, you'll need to open the customised form and edit the text box.

Need to change your business name on the invoices MYOB sends you?

The primary contact (the person who can change the subscription plan, business address, contact details) can send a support request via My Account. See the details.

FAQs

Whay can't I change my serial number?

If the Serial Number field is not editable, it's because the company file has been activated. If you need to change the serial number (perhaps because a MYOB Partner has created the file for you and entered their serial number by mistake), you'll need to go to the Help menu and choose Change Serial Number (you need to be online to complete this).

How do I change my financial year?

You can change the Current financial year or last month, when you close the financial year (File menu > Close a Year > Close a Financial Year). See End of financial year tasks.

You're not able to change the Conversion Month or Accounting Periods, as these were set when you created your company file and can't be changed.