AccountRight does a great job of keeping accounting jargon behind the scenes, so you don’t have to worry about debits and credits, and other accounting principles and rules.

But if you’ve dabbled in bookkeeping or accounting before, you might want a way to double-check what debit and credit entries will be posted to the journals when you record a transaction.

This is where the Recap Transaction feature is useful. You can see which accounts will be affected by a transaction you’re about to record by going to the Edit menu and choosing Recap Transaction.

At least two accounts will always be affected when you record a transaction, and the total of the Debit column will always equal the Credit column. In some cases many linked accounts are affected, but you won’t usually see that information in the transaction window itself.

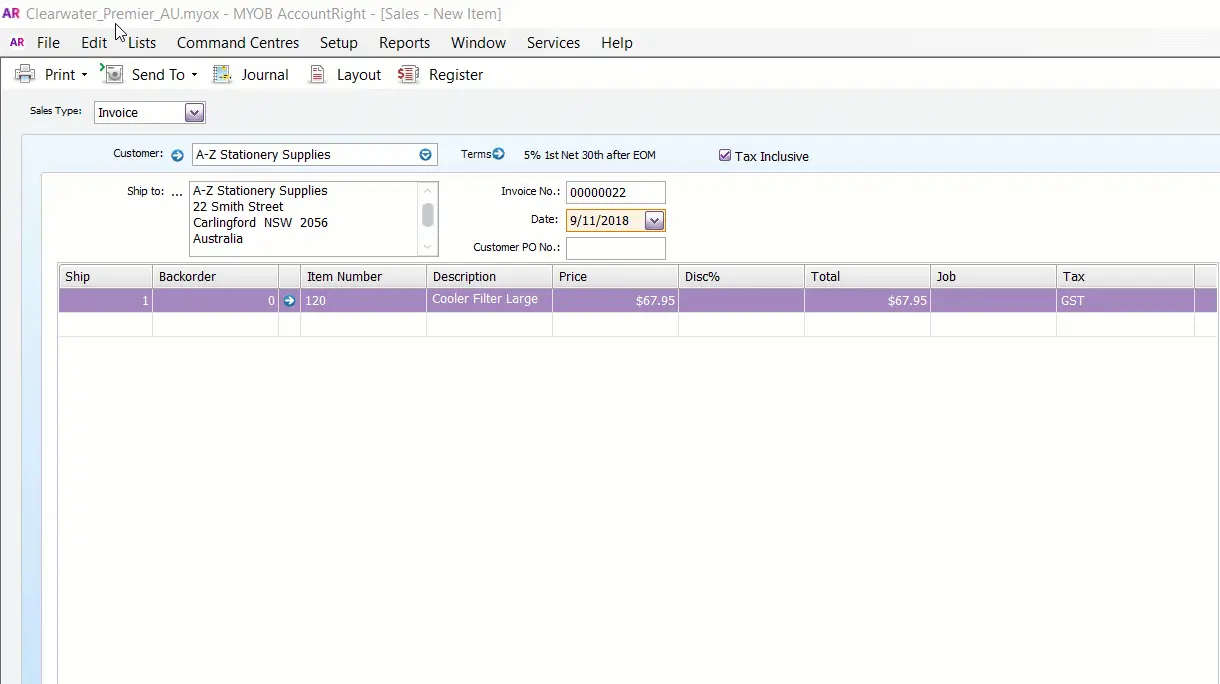

For example, if you recap an item invoice, you’ll see something like this:

the linked asset account for accounts receivable (trade debtors) is debited

the linked income accounts for the items sold are credited

the linked account for the GST code is credited

the linked asset account for inventory is credited*

the linked cost of sales account for the the item is debited*.

* These accounts will only appear if you track the item’s quantities in AccountRight.

For transactions that have already been recorded, recapping will show the effect of the transaction at the time it was recorded. You can also use the Transaction Journal (accessible from the Command Centre) to review the journal entry details for recorded transactions.

If you need to correct a mistake, see Changing a transaction.