Fuel tax credits are amounts you can claim for the fuel tax included in the price of fuel you acquire and use for your business activities.

You can refer to the ATO’s fuel tax credit tools to find out if you are eligible to claim, and to calculate how much you can claim.

Your business must be registered for both fuel tax credits and GST before you can claim fuel tax credits. For more information, see the ATO website.

Managing fuel tax credits in MYOB

If your business receives fuel tax credits, you can record the amount using a journal entry.

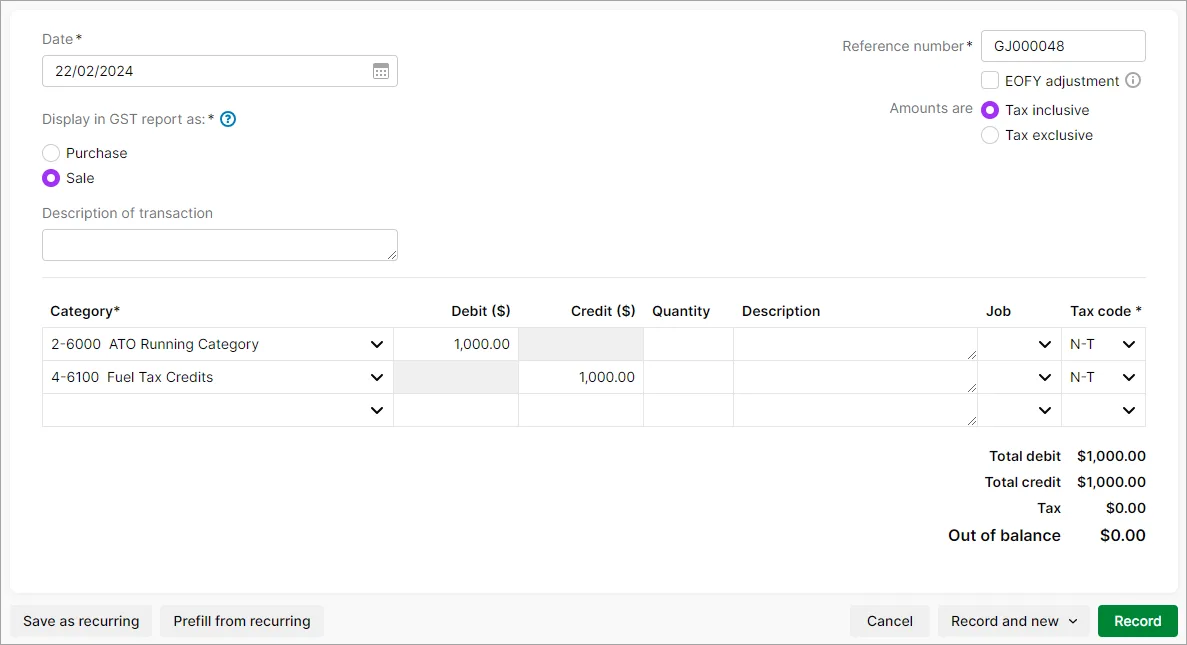

The journal entry would involve two categories:

A 4-XXXX or 8-XXXX Income category which would be credited. This increases income which amounts to decreasing expense.

A choice of a 2-XXXX Liability category or 1-XXXX Asset category which would be debited.

Ask an expert

The categories you set up for fuel tax credits will be specific to your business needs, so you might need help from an accounting advisor or check with the experts on the community forum.

For example, if you want to keep your tax credit category grouped with your other tax liability categories, such as GST collected and paid, you'd likely choose a liability category.

For information on creating categories, see Adding, editing and deleting categories.

Here's an example journal entry for a $1000 fuel tax credit for a reporting period:

FAQs

How do I determine the amount of fuel tax credit I'm eligible to claim?

To determine the amount of fuel tax credit you are eligible to claim for a given BAS period, use the ATO's Fuel tax credit calculator.

What BAS fields are used for fuel tax credits?

The following BAS fields are used for fuel tax credits:

7C (Fuel tax credit over claim) - This field is used to record fuel tax credits that may have been over-reported in previous periods

7D - (Fuel tax credit) - This field is used to claim fuel tax credits

When you lodge your activity statement, fields 7C and 7D will be available if you're registered for fuel tax credits with the ATO. You'll need to manually add values to these fields when preparing your activity statement.

Fuel tax credits are amounts you can claim for the fuel tax included in the price of fuel you acquire and use for your business activities.

You can refer to the ATO’s fuel tax credit tools to find out if you are eligible to claim, and to calculate how much you can claim.

Your business must be registered for both fuel tax credits and GST before you can claim fuel tax credits. For more information, see the ATO website.

Managing fuel tax credits in AccountRight

If your business receives fuel tax credits, you can record the amount using a journal entry.

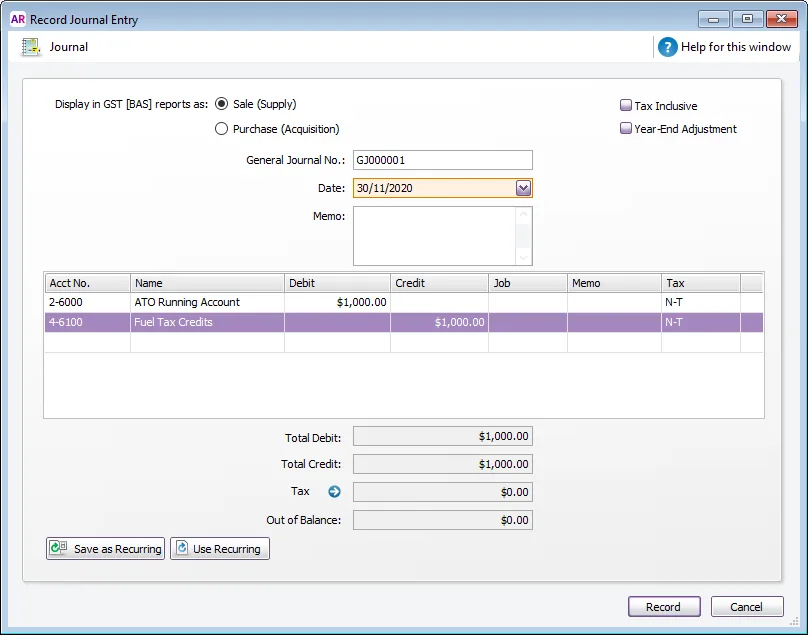

The journal entry would involve two accounts:

A 4-XXXX or 8-XXXX Income account which would be credited. This increases income which amounts to decreasing expense.

A choice of a 2-XXXX Liability account or 1-XXXX Asset account which would be debited.

Ask an expert

The categories you set up for fuel tax credits will be specific to your business needs, so you might need help from an accounting advisor or check with the experts on the community forum.

For example, if you want to keep your tax credit category grouped with your other tax liability categories, such as GST collected and paid, you'd likely choose a liability category.

For information on creating categories, see Adding, editing and deleting categories.

Here's an example journal entry for a $1000 fuel tax credit for a reporting period:

To manually enter exchange rates

If you've selected the Turn on Live Exchange Rates [System-wide] preference, you'll need to deselect it before you can manually edit exchange rates.

Go to the Lists menu and choose Currencies. The Currency List window opens. Can't see the Currencies option? Make sure you've activated the multi-currency preference.

Use the Search field to find a currency by code or name.

Enter the currency’s Exchange Rate. The rate represents the foreign value for $1 of local currency, e.g. 1 AUD = entered exchange rate.

Repeat to enter exchange rates for other currencies.

When you're done, click OK.

FAQs

How do I determine the amount of fuel tax credit I'm eligible to claim?

To determine the amount of fuel tax credit you are eligible to claim for a given BAS period, you can perform a Find transaction on the account - located at the bottom of any command centre.

The credit amount would normally be the net change in the account over your specified period.

You can also use the ATO's Fuel tax credit calculator.

MYOB Business - Accounting - Fuel tax credits (Desktop) - What BAS fields are used for fuel tax credits?

The following BAS fields are used for fuel tax credits:

7C (Fuel tax credit over claim) - This field is used to record fuel tax credits that may have been over-reported in previous periods

7D - (Fuel tax credit) - This field is used to claim fuel tax credits

If you prepare your activity statements online, fields 7C and 7D will appear on your activity statement if you're registered for fuel tax credits with the ATO. You'll need to manually add values to these fields when preparing your online BAS.

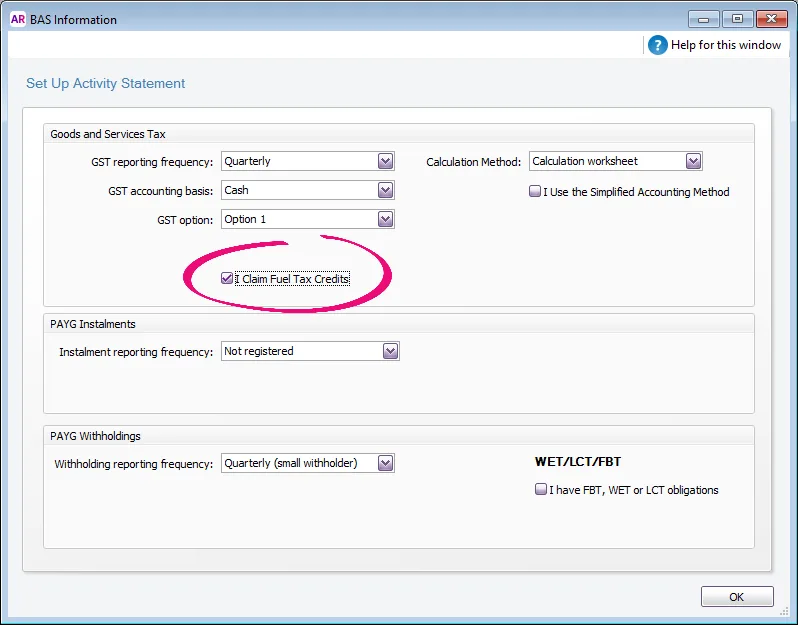

If you prepare your activity statements manually using BASlink, you'll need to activate these fields by selecting the option I Claim Fuel Tax Credits in the BAS Information window.

To automatically complete the fields in BASlink, all you need to do is link the fields to your applicable accounts.