MYOB Business Pro and AccountRight browser only

AI Business Insights (Beta) is an AI‑powered experience in MYOB Business Pro and AccountRight browser that helps you understand what’s happening in your business. It highlights key insights and trends in your income and expenses. This helps you (and your advisor) quickly see what’s going on in your business without running multiple reports.

AI Business Insights is currently in beta

A beta is an early version of a new feature that you can try and let us know what you think. Your feedback helps us improve our products.

If you’re part of the AI Business Insights beta, you’ll see an in‑product message and a purple banner on your MYOB Business dashboard.

If you'd like to access AI Business Insights before the broader rollout, contact us.

Key things to know

-

AI Business Insights is currently in beta and is only available to a limited number of MYOB Business Pro and AccountRight browser customers while we test and improve the feature.

-

You need the Administrator or Accountant/Bookkeeper user role to use this feature.

-

Your MYOB Business file must have an active bank feed and up-to-date income and expense transactions.

-

Business Insights provides a summary of financial data but doesn't replace your standard reports.

Using AI Business Insights

After signing in to MYOB Business, AI Business Insights will appear in a purple banner on your dashboard. Click View Latest Insights to get started.

Check recent insights

Click Check recent insights to see a feed of tiles with key highlights about your income and expenses. Each insight tile can be flipped to show more detail about what's driving your costs and spending for the selected period.

Insights are refreshed overnight, so updates you make today will be included in tomorrow's insights.

View your numbers

Switch to Your numbers to see interactive charts of your key metrics. Use these charts to see how figures change over time.

For example, choose Income to compare income to the previous month or year, then scroll down to review your SALES SUMMARY. Here you'll see:

your highest‑spending customers

your best‑selling products

From Your numbers, you can open your standard reports, like the Profit and Loss, to cross‑check figures and see the underlying transactions.

Use these insights alongside your existing reports and advisor input to understand the story behind the numbers.

Choose this... | To see this... |

|---|---|

Income | This view shows your revenue sources and sales activity. Total income: All revenue recorded during the selected period (account category 4-0000). The chart compares your monthly income to the same months last year. Income streams: Your top revenue sources for the selected period, broken down by income account (Level 2 categories under Income). Total invoices: The number of invoices issued during the selected period, including both positive invoices and credits. Average invoice value: Total invoiced amount divided by the number of invoices issued. Formula: Highest-spending customers: Your top 3 customers ranked by total invoiced amount during the selected period, showing each customer's spend and percentage of total invoices value. Formula for share of income: Most sold products: Your top 3 products ranked by sales amount during the selected period, showing each product's revenue and percentage of total income. Formula for share of income: |

Expenses | This breaks down where your money goes. Total expenses: The sum of all operating expenses recorded during the selected period (account category 6-0000). The chart compares your monthly expenses to the same months last year. Main expenses: Your top expense categories for the selected period. Up to 4 Level 2 expense categories are shown individually, sorted by highest dollar value. Remaining categories are summed under "Other." |

Cash | This view shows your total cash position and how quickly money moves through your business. Total cash: The combined balance of all your bank accounts connected via bank feeds as of the date shown. The chart tracks how your cash balance has changed over the selected period. Cash runway: How long your current cash balance will last based on your recent spending patterns. Measured in months. Formula: Average time to get paid: The average number of days between sending an invoice and receiving payment from your customers. Formula: Where Average Accounts Receivable = Average time to pay suppliers: The average number of days between receiving a bill and paying your suppliers. Formula: Where Average Accounts Payable = |

Profit | This view shows your net profit and profit margin over the selected period. Net profit (total amount): Your total income minus total expenses for the selected period. The chart compares your monthly net profit to the same months last year. Formula: Profit margin (net profit margin): Net profit as a percentage of total income. Shows how much of each dollar earned you keep after expenses. Formula: Income: Total revenue recorded during the selected period (account category 4-0000). Cost of sales: Direct costs tied to producing goods or services you sold (account category 5-0000). Displays "N/A" if no cost of sales accounts are set up. Gross profit margin: Income minus cost of sales, expressed as a percentage of income. Shows profitability before operating expenses. Formula: Or: |

How comparisons work

Each metric shows the change from the same period last year:

A green indicator with an upward arrow shows an increase

A red indicator with a downward arrow shows a decrease

Percentage changes help you spot trends at a glance

For Cash metrics, comparisons are within the selected period (start vs end of period), not year-over-year.

Get the most from your insights

AI Business Insight works from your data, so you’ll get better results when your data is complete and up to date.

To improve your insights:

keep your data current

reconcile bank transactions regularly

enter invoices, bills and journals promptly

close off completed periods where appropriate

review multiple views

look at the trend charts, summary tiles and category breakdowns together

use the AI‑generated commentary as a starting point, then explore the supporting charts and figures.

Remember that AI Business Insights is designed to help you understand the numbers, not to replace your judgement or to provide professional advice.

Share your feedback

Help us improve AI Business Insights!

Where available, use any in‑product feedback icons or pop ups to let us know what worked well or what could be better.

For more detailed feedback, contact MYOB support and include screenshots where possible.

Use Business Insights to analyse key financial information using a range of interactive tables and graphs. For example, use it to analyse your accounts, profit and loss, and the money that customers owe you.

You can also control who has access to Business Insights by managing their user role.

Gain insights into your business performance

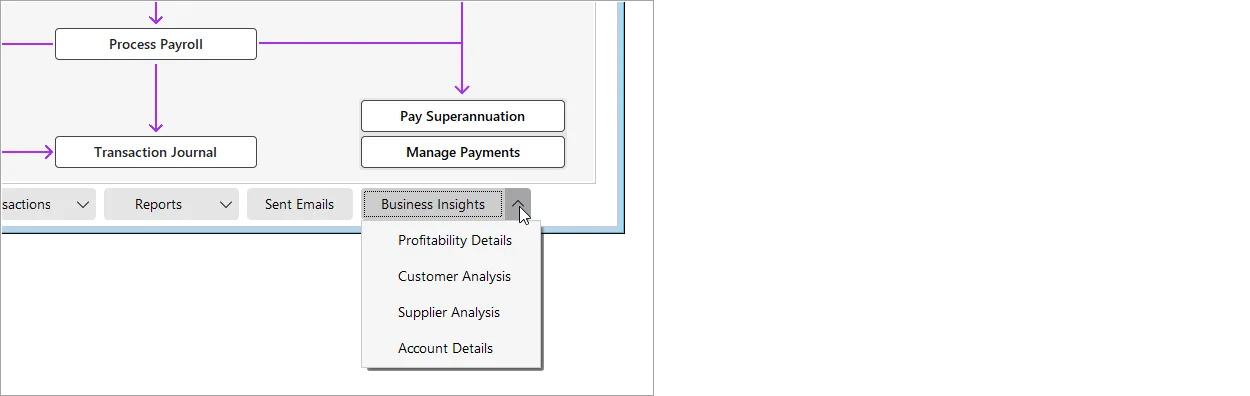

Open Business Insights from the bottom of any command centre.

The Business Insights window presents different types of financial information in several tabs.

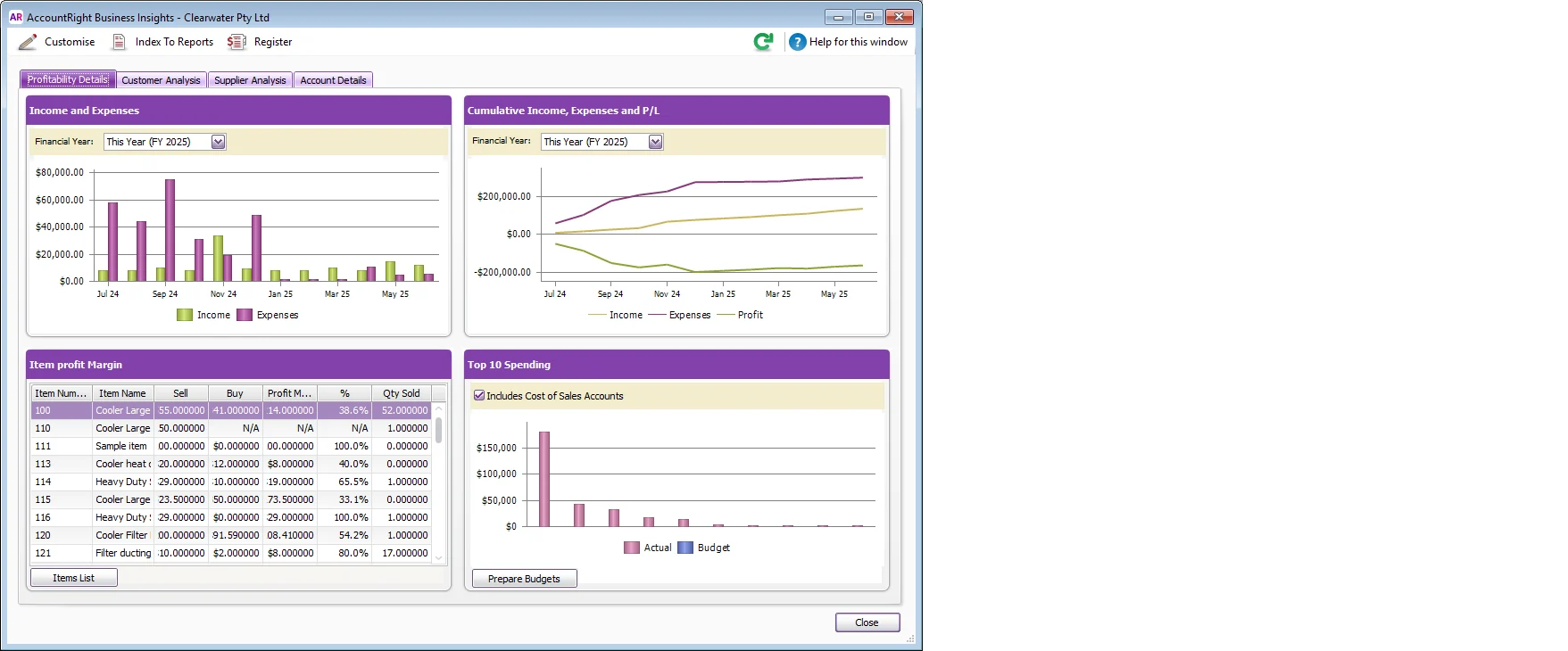

From each tab, you can perform functions related to that tab. For example, from the Account Details tab, you can open the Accounts List window to view your accounts in more detail. You can customise the contents of each Business Insights tab by clicking Customise.

You can also perform these functions:

To... | Do this... |

|---|---|

filter information in tables | Click a column heading to sort the table information. |

update with recent information | Click Refresh. All information entered since you opened Business Insights or last refreshed the window will be displayed. |

see totals in graphs | Hover over the graph bar or column to see its total. |

save graphs as images | Right-click a graph and click Save As. Choose where you want to save the image and click Save.You can then print the image or insert it into a document, such as an Excel spreadsheet, later. |

paste graphs into another document | Right-click a graph and choose Copy to Clipboard. You can then paste the copied image immediately into another document. |

paste table data into another document | Right-click a table and choose Copy to Clipboard. You can then paste the data into another document, such as an Excel spreadsheet, where you can edit it. Note that column totals are not included in the pasted data. |

Window details

Profitability details

This tab helps you analyse your income and expenses, and profit and loss.

Section | Description |

|---|---|

Cumulative Income, Expenses and P/L | View the cumulative totals of each successive month’s income and expenses for the selected financial year and the resulting profit or loss. The profit or loss is calculated by subtracting expenses from income. |

Income and Expenses | Compare the income and expenses for each month for the selected financial year. |

Item Profit Margin | Analyse the profit margins of the items you sell. Item profit margins are calculated by subtracting the last purchase price from the base selling price that’s recorded in the Item Information window for each item. |

Top 10 Spending | Compare the financial year expenses and cost of sales, to the budgeted figures. |

Customer Analysis

This tab displays customer and receivables information. The tab is divided into four sections:

Section | Description |

|---|---|

Aged receivables | View the amounts your customers owe you for each ageing period. You can choose an ageing method based either on days overdue since the date the invoice was recorded or by days overdue based on invoice credit terms. |

Customer sales history | View a summary of your customer sales and payment history, including total sales for each customer for the current and previous financial year. |

Customers who owe me money | See the total you are owed and details of each overdue customer payment (based on their invoiced credit terms), including the number of days overdue. |

Top 10 customers by YTD sales value | Analyse your top ten customers by sales value for the selected financial year. |

Supplier Analysis

This tab displays supplier and payables information. The tab is divided into four sections:

Section | Description |

|---|---|

Aged payables | See the value of payments you owe for each of your suppliers and the amount you owe them for each ageing period. You can choose an ageing method based either on days overdue since the date the purchase was recorded or by days overdue based on purchase credit terms. |

Supplier purchases history | View a summary of purchases and payment information about your suppliers, such as the last date you paid them and the average time it takes for you to pay them. |

Suppliers I need to pay | See your overdue supplier bills and debit notes and overdue payables totals by ageing period. |

Top 10 suppliers by YTD purchases value | Analyse your top ten suppliers by purchases value for the selected financial year. |

Account Details

This tab displays the balances of your bank and credit card accounts and shows your total assets and total liabilities. The tab is divided into three sections:

Section | Description |

|---|---|

Bank accounts & credit cards | The balances of your bank and credit card accounts, the totals of all bank accounts and all credit card accounts and the net balance of all of these accounts. |

Total assets | The balances of your bank, accounts receivable and other asset accounts and the total value of your assets. |

Total liabilities | The balances of your accounts payable and liability accounts and your total liabilities. |