Build a better business with accounting software

Whatever your trade and wherever the job, create invoices, track payments and manage your spending – on mobile and tablet.

Software for every kind of business

Wherever you are in your business journey, we can help power it.

Manage your business on any device

Securely access your software on desktop, tablet or mobile, so you can work anywhere.

Support available 7 days a week

Get help from experts by phone, on LiveChat or in your account.

It's easy to get started with MYOB Business Lite

MYOB BUSINESS

Lite

For sole traders and small business with up to 2 employees.

- Track GST and lodge BAS

- Manage inventory and orders

- Add payroll for up to 2 employees (extra $2/month per employee)

- Create and send unlimited professional invoices and quotes

- Scan and store receipts

- Accept online payments

- Manage tax and basic reports

- Track income and expenses

- Connect up to 2 existing bank accounts

- Track jobs

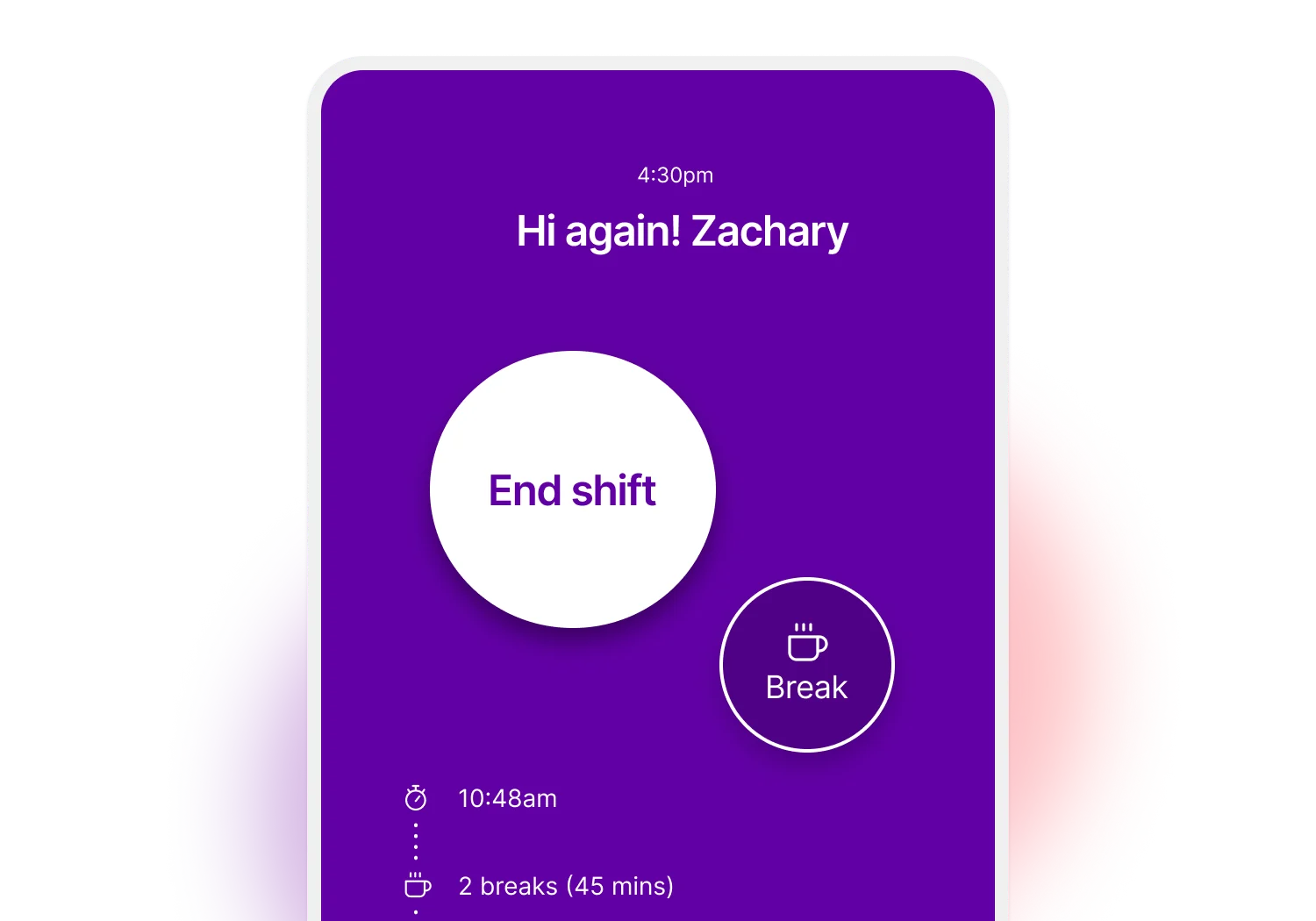

Work on the go

MYOB offers smart features that help you save time, stay organised and automate your business admin.

Get paid faster with online payments

Get cash flowing 3 x faster with convenient online payments. Customers can choose from AMEX, Apple Pay™, BPAY, Google Pay™, Mastercard, PayPal, and VISA.

Track expenses and tax deductions

Snap photos of receipts or upload them from your camera roll before they’re lost, helping you capture every deductible expense you’re entitled to.

Automate your supplier receipts

With Supplier Connect, you can connect your MYOB account directly to suppliers like Bunnings and Reece, and watch receipts flow in automatically.

MYOB integrates with software you already own

With over 300 apps available you can integrate and use all your business data in one place.

Got more complex business needs?

Frequently asked questions

Is there a minimum subscription period?

Nope. And there are no lock-in contracts either. Pay monthly (or yearly to save more) and enjoy the flexibility to cancel anytime.

How long does it take to set up?

Just a few minutes — honestly.

Choose the software plan that's right for your business

Sign up to access your software immediately

Log in to your software. Once you've logged in, we'll guide you through the set-up so you can spend less time on admin and more time doing what you do best.

Do I need to install any software?

MYOB Business Lite and Pro are 100% web-based. No downloads required.

Can I use my account on my phone?

Yep, our software is available on all desktop, mobile and tablet operating systems. We also have handy apps for managing your business on the go.

For small business plans, our accounting software is compatible with all browsers on desktop, mobile, and tablet. Plus, you can enhance your workflow with our companion app MYOB Assist, which allows you to create invoices and snap receipts directly from your mobile device. Explore the full range of MYOB mobile apps.

Can I change my software plan later?

You can! If your business grows (congrats!) or your needs change, you can adjust software features like inventory or payroll in a few clicks.

Can I let other people access my software?

Absolutely. You can share your account with your advisor, accountant, bookkeeper or business partner at any time for no extra cost. You can also control what they can see and do by adjusting their access levels.

Can I track jobs and bill customers by time?

With MYOB Business Lite or Pro, you can track a job's progress, profit and loss, and expenses.

If you'd like to bill your customers based on time or attach individual budgets to each job you track, check out our MYOB Business AccountRight Plus and Premier plans.

Can I migrate my data into my MYOB Business software?

There are two ways to move your data to MYOB.

Option 1: Manage your own move

See our step-by-step guides:

Migrate your data from other software (Reckon, Xero or QuickBooks)

Option 2: Get help moving from Reckon, QuickBooks or Xero to MYOB

With the help of MMC Convert, our migration partner, you can have your data securely migrated from your current accounting software to MYOB. Plus, we'll cover the cost to migrate data from the current and previous financial year. Make the move.

Is my data secure?

Yes. MYOB takes the security and protection of our customers’ data seriously. We use secure, encrypted channels for all communications between us and follow industry best practices including ISO 31000 Risk Management Standard.