Easy EOFY

End of financial year doesn't need to be stressful, so in MYOB there's not much you need to do.

But it's a good idea to take a few moments to make sure your books are in order, and everything's ready for your accountant at tax time.

Get started by completing your usual end of period tasks. Also check out our handy resources, including the EOFY calendar, at myob.com/au/eofy

If you use payroll, also see End of payroll year tasks in Australia.

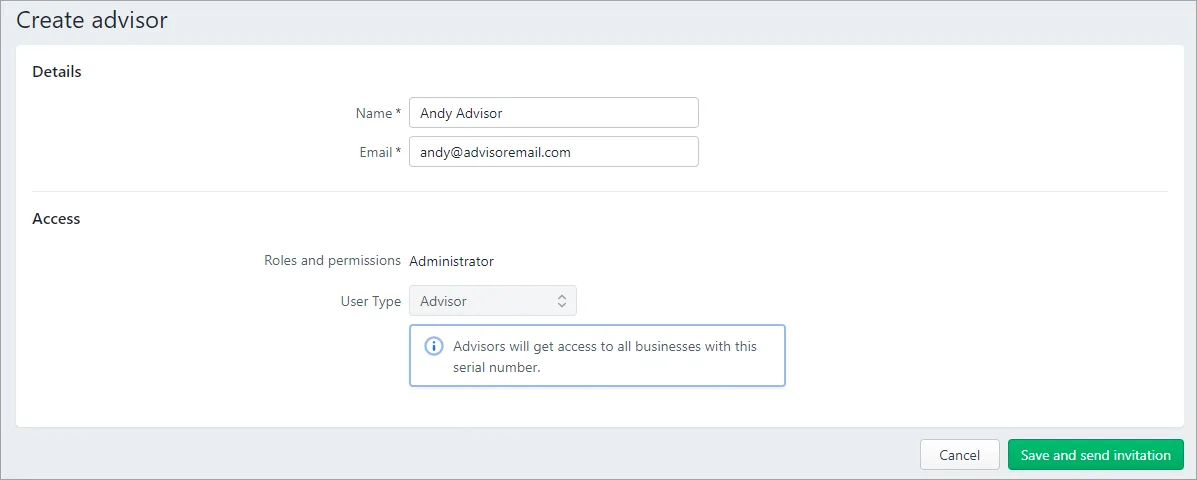

Invite your accountant

End of year wouldn't be the same without your accounting advisor, so why not invite them to your MYOB business?

They'll be able to log in and work directly with your data, so they can do your tax and make any required adjustments.

See Invite your accountant or bookkeeper.

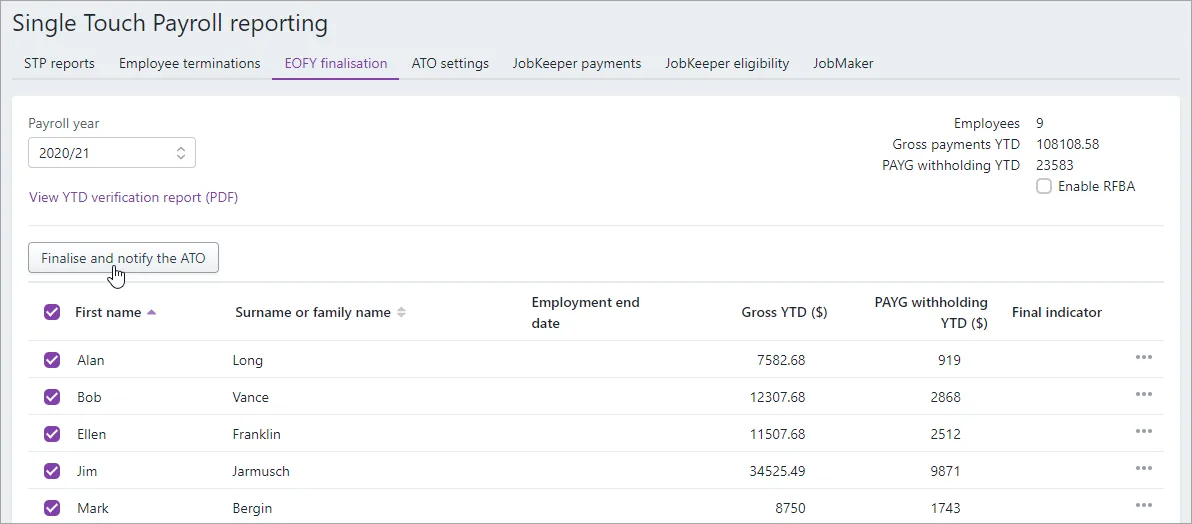

Report payroll information to the ATO

As part of Single Touch Payroll reporting, you need to finalise your payroll information, typically by 14 July. This lets the ATO know that you've completed all your pays for the payroll year.

Just check your year-to-date totals to make sure everything has been reported correctly throughout the year, then you're ready finalise in a couple of clicks.

Once you're done, your employees will be able to log into my.GOV to complete their tax returns.

See End of year finalisation with Single Touch Payroll reporting.

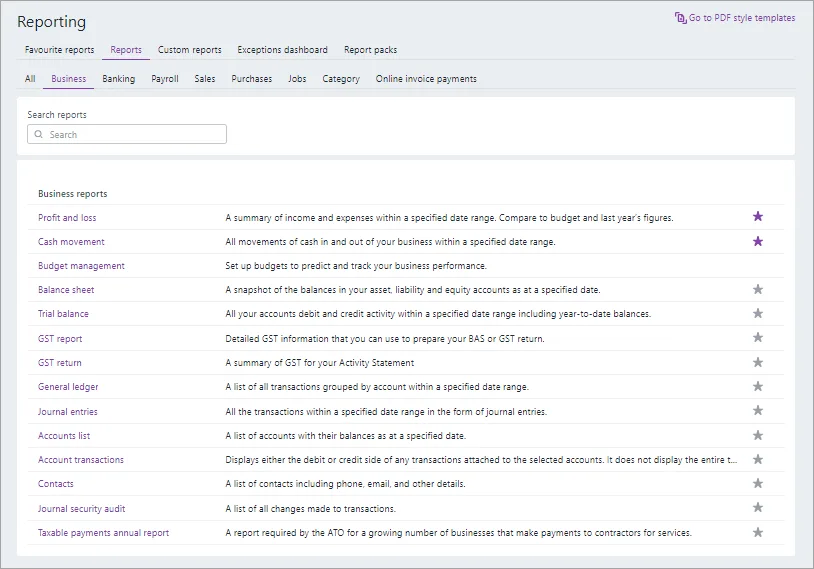

Run reports

Your Profit and loss and your Balance sheet let you know how your business has performed throughout the year (which you've probably been checking regularly). You might like to print a copy for yourself.

Profit and loss tells you how much profit your business has made in the last year, divided into income, expenses and net profit.

Balance sheet tells you your business's net worth up to the end of the financial year. It's divided into assets, liabilities and equity.

Add all your EOFY reports to a report pack—so you can run them all at once and share them.

See Business reports to learn how to produce these reports.

Using inventory tracking?

The Stock on hand report tells you the on-hand quantities of your inventory items. Use it to help you do a stocktake.

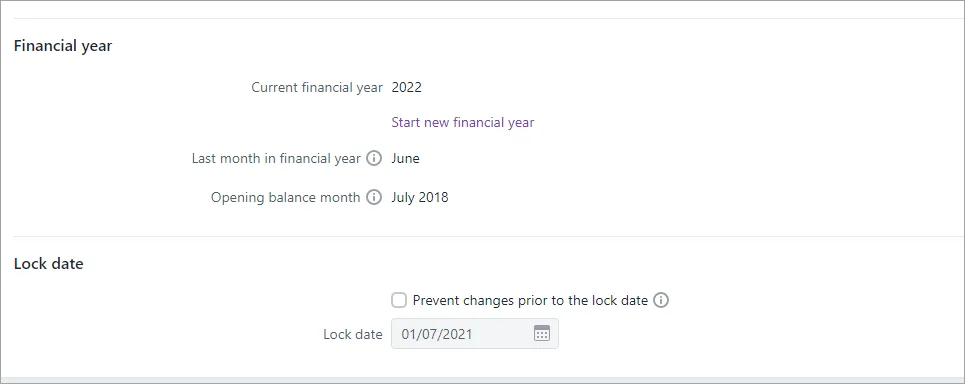

Start a new financial year

When you're happy that your books are in order for another year, you can start a new financial year in MYOB. Just click your business name > Business settings > Start a financial year.

When you start a new financial year:

your category balances will be updated (in accountant speak: "the current earnings will be moved to retained earnings")

you'll still be able to enter transactions in the previous financial year, providing you first remove the lock date option.