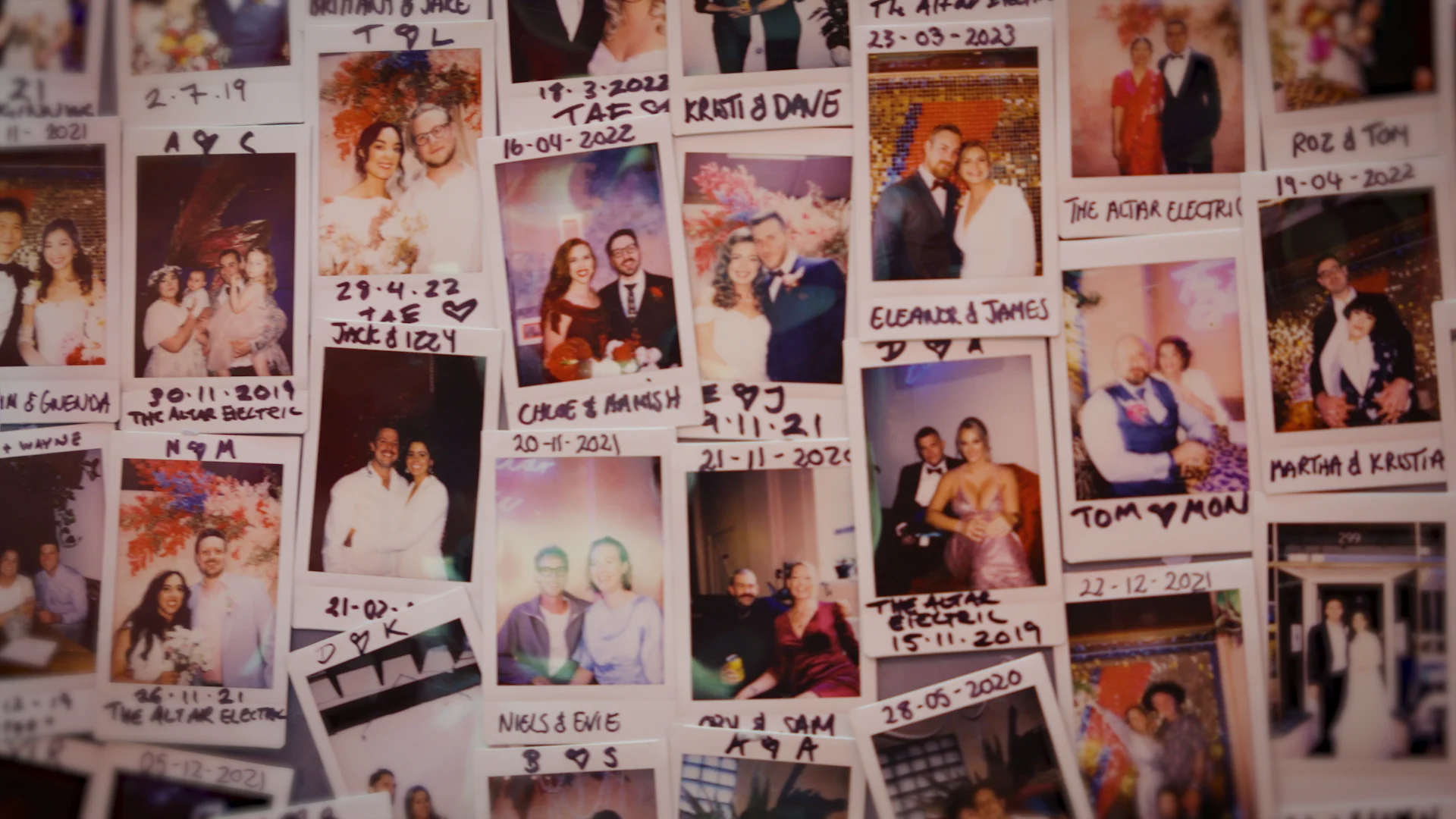

What kind of job involves asking couples for their life stories, talking to random third cousins, and learning Turkish at the last minute? For Sarah Davoli and Clare Alice, that’s just life as a wedding celebrant.

Sarah recalls learning Turkish for one couple’s ceremony, describing it as her proudest moment. Clare talks about her ‘emo Millennial’ couples who need to be brought out of their shells. Despite the jokes, it’s clear that both love the vulnerability and connection that come with the job.

The admin? Not so much. Managing their celebrant businesses alongside other big life stuff — like full-time jobs, side hustles and motherhood — made things tricky. Worse, both celebrants felt that admin work took them away from the important things.

Juggling work, life and way too many systems

What was life like in the pre-Solo days? Both Sarah and Clare were using a mix of manual systems and apps to manage invoicing, payments and tax. Neither had run a business before, which meant they were figuring things out as they went along. It was a messy, time-consuming and stressful setup — not ideal for two very busy people.

“I’ve repressed the memories,” laughs Sarah. “It was very laborious.”

Clare remembers getting bogged down in spreadsheets and folders, banking and accounting apps, and manual invoices. The chaos made it hard to track expenses, write invoices, and chase up payments. More technical tasks, like adding credit card surcharges to payments, were even trickier.

“It’s really easy to feel like you’re drowning quickly from an admin and organisational perspective,” says Clare. “You end up having six or seven different things you’re trying to manage at the same time.”

The admin pulled her away from the more fulfilling work of being a celebrant (not to mention her full-time job). Like Sarah, she struggled to find a sustainable work-life balance and get everything done.

“And it’s like, ‘Sorry, am I an octopus?’ It’s just impossible.”

Letting tech take over the boring bits

Sarah and Clare came to Solo separately, but for similar reasons. Drowning in admin took time away from Clare’s job and Sarah’s new baby, prompting a search for something better.

The solution needed to take on the tedious admin tasks that were bogging both celebrants down, help them sort out mistakes, and give them more options when it came to invoicing and payments.

“I feel like for me, because I’m so time-poor, it’s always about: ‘How can I automate this?’” explains Sarah. “I want something that can anticipate my needs, and – not to be crass – just do what I say and get the job done.”

As it turned out, Solo was the winner. Designed just for sole traders, it’s helped Sarah and Clare get their heads around their finances (and escape the dreaded spreadsheet scramble).

“It feels like it’s been created for me, that every screen, every button feels natural. It doesn’t feel like I’m searching for the answers inside it,” says Clare. “It has everything at your fingertips.”

Some of their favourite features include:

AI-powered smart matching

Sarah used to spend hours scrolling through her bank transactions and invoices to check whether a client had paid. Now, Solo connects to her bank feed and uses AI to auto-match transactions to the correct invoice or expense receipt. The result? Less time fiddling around with invoice numbers and banking apps, more time writing couples’ stories or hanging with the family.

Invoicing and automated payments

The app lets both celebrants create and send invoices from their phones, complete with multiple payment options, including online payments and tap-to-pay. Even better? Automated payment reminders mean no more awkward conversations about late payments.

It’s really hard in our industry, because you’re spending so much creative time with a couple, to then turn around and go: ‘Hey, by the way, you haven’t paid me yet.’ Having to chase people is really awkward. The great thing about Solo is they have that automated, so you don’t have to do anything.”

— celebrant Sarah Davoli.

Expense Tracking

Sarah and Clare can take a photo of an expense receipt, upload it to the app, and it extracts the relevant data – simple. At tax time, all these expenses are listed and ready to claim – no more collecting crumpled receipts or searching for bank records.

“You don’t have to think about it, you just take a photo and that’s it. It’s such a seamless experience.” says Clare.

Visibility and reporting

Banking integration makes it easy to see expenses and payments in real time, while automated reporting and document prep make tax time much easier.

Both Sarah and Clare rave about the simplicity and functionality of the Solo platform.

The fact that you can have it on your phone and you can be doing a wedding interstate and you can still send an invoice, you can still answer those emails, and you can check your money. Having everything in one place feels like it’s been curated for you.”

— celebrant Clare Alice.

More time, more energy — less admin

What does life look like with Solo in the mix? With everything in one place, Sarah and Clare now have complete visibility across the financial elements of their businesses. They can open the app at any point and see graphs of spending and expenses instead of relying on guesswork. They can send invoices in seconds, track expenses, and even take payments via smartphone — meaning that some of the admin gets done while they’re at a wedding or out and about. Because everything happens in the app, tax time is simpler as well, with ATO-ready records and GST calculations complete.

For Sarah and Clare, it’s changed the way they run their businesses and helped them reclaim precious time for the really important things, like kids (and work).

“I have time to put my energy into the creativity of writing a unique script for a couple,” says Sarah. “And then also being a mother. Solo’s really saved my relationship with my child.”

Clare also has more time and energy for the creative, connected parts of the job, like building relationships with couples and writing their stories.

What’s the verdict? After navigating babies, burnout and lack of work-life boundaries, Solo has been a lifesaver.

Clare describes it as an assistant working in the background, getting things done before she even knows they need doing.

“You’re like: ‘Oh, great, my invoices have gone out, my reminders have gone out, my payments have come in. I can see my cash flow,’” she laughs. “Perfect assistant.”

Gone solo? Get Solo.

Information provided in this article is of a general nature and does not consider your personal situation. It does not constitute legal, financial, or other professional advice and should not be relied upon as a statement of law, policy or advice. You should consider whether this information is appropriate to your needs and, if necessary, seek independent advice. This information is only accurate at the time of publication. Although every effort has been made to verify the accuracy of the information contained on this webpage, MYOB disclaims, to the extent permitted by law, all liability for the information contained on this webpage or any loss or damage suffered by any person directly or indirectly through relying on this information.