Tomorrow’s invoices, paid today with invoice financing

Get paid faster to easily manage your cash flow. Apply today to get up to 100% of eligible invoices funded with invoice financing.

Financing made easy

Access your money before your clients have paid. Application is fast and simple, all from your MYOB account.

Grow your funding limit

Butn offers a growing funding limit that adapts to the changing requirements of your business.

Simple pricing

No ongoing feeds or early repayment charges. Pay a fixed fee per transaction to keep surprises at bay^

Invoice financing keeps your cash flow flowing

We’ve partnered with Butn to provide eligible MYOB customers with convenient invoice financing. Once approved, you’ll receive financing against your unpaid invoices in as little as 24 hours so you can focus on what matters.

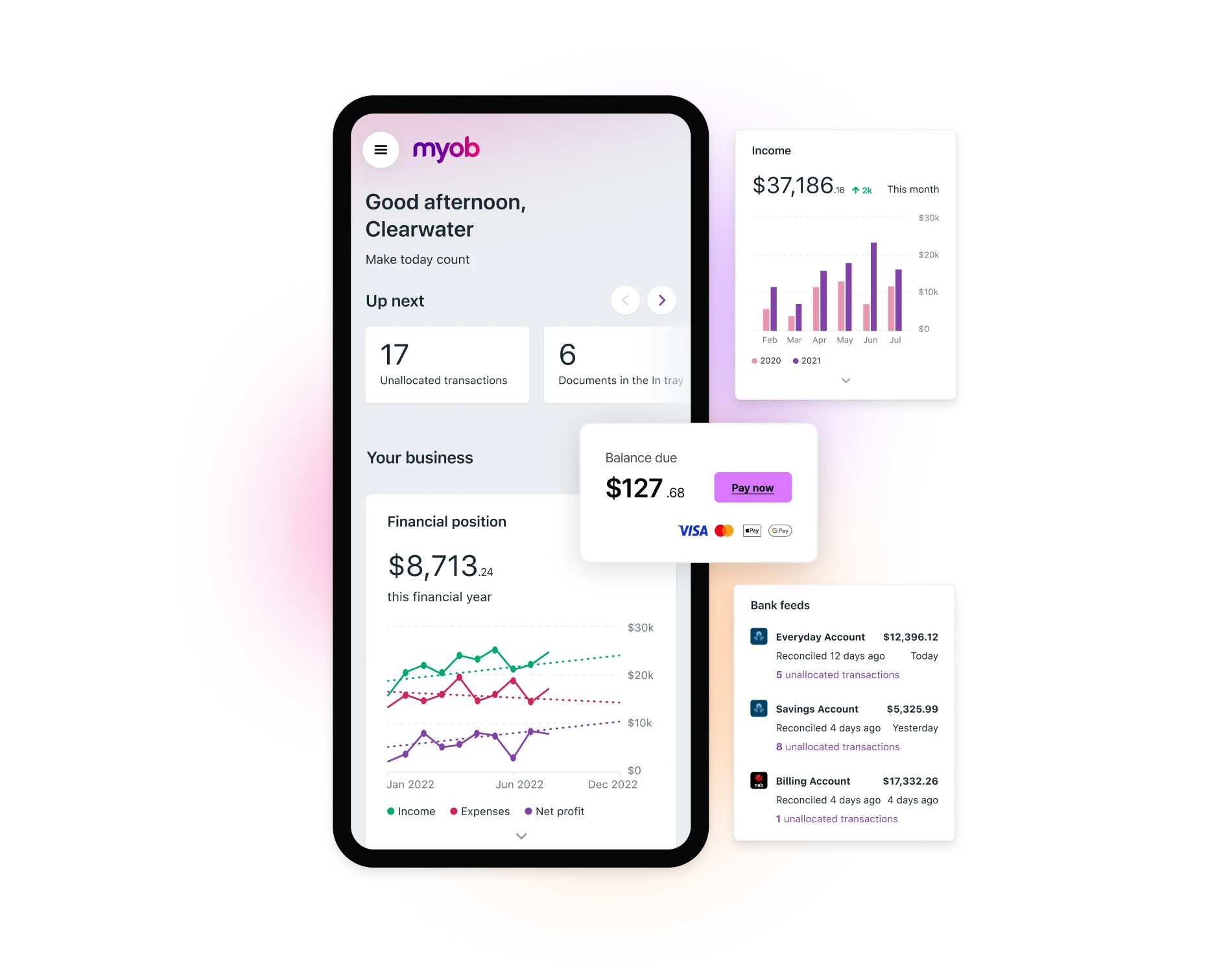

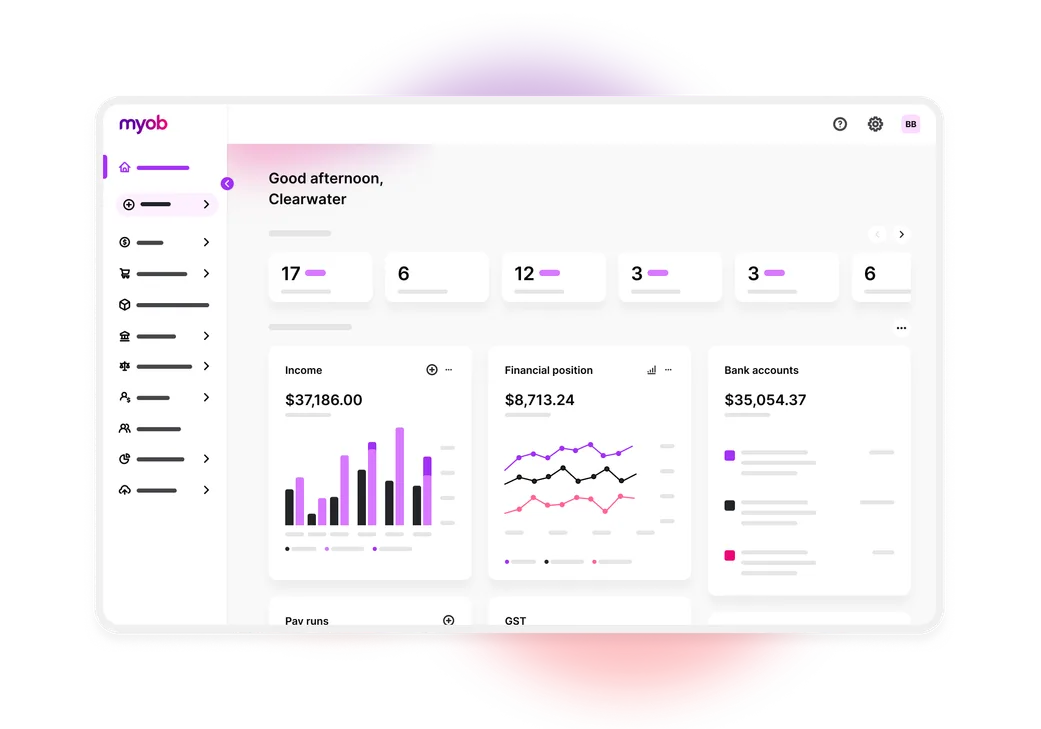

Already with MYOB?

It’s easy to apply for invoice financing from the MYOB platform. Once you've signed up with Butn, you can finance as many invoices as you need.

Log into MYOB or your AccountRight browser and click on 'Banking.' From the dropdown menu, select 'Loans and finance'.

Navigate to the Butn section, click ‘Set up invoice financing’ and follow the prompts to sign up with Butn.

Once approved, click the 'Fund this invoice' link on any eligible unpaid invoice.

Get up to 100% of your invoice funded by Butn minus funding fees (subject to loan approval).

You can also click the 'Fund this invoice with Butn' link on the top right of your invoice to sign up with Butn.

Need help getting started? Watch the video below for a brief tutorial.

Maningham Fine Foods

“Having that extra confidence of being able to pay your bills, knowing as soon as we send out an invoice we can use that invoice as cash straight away is a game changer”

Frequently asked questions

What is invoice financing?

Invoice financing lets you borrow money based on what your clients owe you. Leverage your unpaid invoices to access cash flow without waiting for your clients to pay.

How does Butn invoice financing work with MYOB?

With Butn, you can choose which of your eligible invoices you want an advance on and get up to 100% of the invoice value funded (minus funding fees) in as little as 24 hours (once your initial account application has been approved).

Butn is integrated into MYOB Business, making it easy to request advance payments within your existing MYOB software. Simply select the invoice you want to fund (or create a new one), then click the 'Fund this invoice' button to kick things off.

You can also check your funding status and reconcile your invoices, all within MYOB Business.

Who can apply with Butn?

We only display the registration link to MYOB users who meet certain eligibility criteria: namely, registered Australian businesses who have been in business at least 12 months.

This helps ensure those applying have a high chance of being approved by Butn, so businesses don't waste time filling out an application only to be declined.

Who is Butn?

Butn Limited (ACN 644 182 883) is an Australian business-to-business financing company. They offer a range of funding solutions to help small businesses manage their cash flow and provide them with faster access to their money. Visit Butn.co for more information.

Why has MYOB partnered with Butn?

We've partnered with Butn to help approved MYOB customers better manage their cash flow.

How do I apply for Butn invoice financing?

You can apply for a Butn account from the Loans and Finance section of the software or any open invoice in MYOB Business or when accessing AccountRight from the browser (eligible customers only). If approved, you can request funding for your individual invoices by clicking the 'Fund this invoice' button on the top right of your invoice.

Here's how the process works in more detail:

1. Applying for a Butn account

Complete a one-off registration process with Butn. Butn will then perform a fraud check and credit assessment on each director of your company. If successful, you and each director of the business will be sent an End User Agreement to sign and file with Butn. You're now able to request funding for individual invoices.

2. Requesting funding for an invoice

You can submit requests for invoices to be funded from the invoice screen in your MYOB accounting software. Simply visit the Loans and Finance section of the software or click the 'Fund this invoice' link on the top right of any open, eligible invoice.

You'll then be directed to your Butn portal to review and submit the funding request (or 'transaction', as Butn calls it).

If this is your first transaction, you'll now need to enter your bank details. This step establishes your trading history and verifies the bank account Butn will levy fees from.

How long does it take to complete an application with Butn?

As little as 15 minutes (assuming you have all the necessary documentation). You'll then need all of your directors to review and sign the Butn End User Agreement before filing with Butn.

Once your account is created, Butn will review your application. If approved, you'll be able to request funding for an invoice in a matter of minutes from your MYOB software.

Is there a limit to how much funding I can get?

Yes, though it varies depending on the circumstances of your business. Butn will determine how much they can fund as part of your application process.

How can I contact Butn?

You can call Butn on 1300 333 863 or email them at customerservice@butn.co.