19th May, 2015

Since the introduction of GST 15 years ago, businesses across Australia have been issuing and receiving tax invoices. Are your tax invoices compliant? Are you aware what the Australian Tax Office requirements are for invoicing? There are still many business sending and receiving invoices that are not compliant.

If you are not registered for GST, your invoice simply does not include a tax component and the document you provide is a regular invoice as opposed to tax invoice.

If you are registered for GST and the value of the purchase is more than $82.50 GST inclusive you must provide your customers with a tax invoice. Particularly upon request, you must provide it to them within 28 days.

And keep in mind, an invoice is an official record of a transaction, which means that if you get any details wrong when sending your invoice, there’s a very specific way to rectify the situation and not doing so may create legal headaches.

In order for you to claim the GST credits documents must be kept as proof such as receipts, invoices, cash register dockets, bank and credit card statements to support your claims. If you have sales over $1000 on your tax invoice you are also required to add your customer’s identity and their address or ABN.

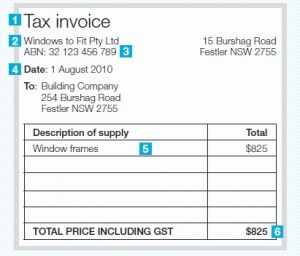

Six things you need to have tax compliant invoicing

Here is an example of a tax invoice from the ATO Website:

Another consideration when invoicing is the requirement for mixed supplies. This means an invoice has a combination of items with GST and other items that are GST Free or input taxed.

You must show which sales are taxable on your tax invoice – usually the tax code GST is applied to the items with GST on one line, and ‘FRE’ applied to the items that are GST-free.

Tax invoicing can be much easier to manage with the use of an accounting, POS, ERP or other system to help you produce your compliant document requirements for your customers.

Invoicing software will keep your business invoicing streamlined and compliant. Products such as MYOB AccountRight and MYOB Business makes for simple step process. You have the ability to create the form required with all of the steps noted above included quite easily. A computerised system equips you to manage your GST requirements so you can avoid penalties and fines.

An even easier way is MYOB’s smartphone App PayDirect. It allows you to invoice your customers on the go, email them the compliant tax invoice.

You have the ability to add some other features to your Tax Invoice to enable faster payment which also improves cash flow.

As mentioned at the start of this article, an invoice is an official document and that makes changing the details on one problematic.

The good news is, if you follow the below rules, you’ll steer clear of any trouble.

So no more uncompliant invoices. You now have all the information required to ensure your customers have what they need to claim back their GST credits for all those purchases. They won’t get into trouble from the tax man as your tax invoice is compliant!

The information provided here is of a general nature for Australians and should not be your only source of information. Please consult an experienced and registered tax agent as each small business’s circumstance will vary.

Subscribing or upgrading your MYOB software will ensure your business is always compliant with tax changes, including the government’s new SuperStream system for paying super contributions.