How to lodge the Taxable Payments Annual Report this EOFY

1st January, 2015

If your business is primarily in the building and construction industry, you may need to lodge the taxable payments annual report.

If you have an ABN and you make payments to contractors in the building and construction services, it might be time to put down your tools to prepare for the Taxable Payments Annual Report (TPAR) which is due on 21 July 2013.

The TPAR was announced in the 2011-2012 Federal Budget. From 1 July 2012, businesses in the building and construction industry must report total payments made to contractors for building or construction services by 21 July annually.

The purpose of the TPAR is to improve compliance. Data matching is done to detect contractors who have failed to lodge tax returns or failed to disclose their income.

First, you need to figure out if you need to prepare a TPAR. Refer to the ATO website for details on “Who needs to report”. In a nutshell:

- You are a business primarily in the building and construction industry

- You make payments to contractors for building and construction services (not stock)

- You have an ABN (Australian Business Number)

If you are unsure, consult with a professional advisor.

Lodging your TPAR with MYOB

MYOB has tools to prepare your TPAR lodgement if you update to the latest version of AccountRight Live or use LiveAccounts.

If your MYOB file has not been set up for this function during the financial year 1 July 2012 to 30 June 2013, you will need to identify all the suppliers that need to be reported.

Ensure the contractors’ ABN details, name and address have been set up under the MYOB supplier card file. These contactors could be set up under payroll or purchases.

If you require assistance to set up the Taxable Payments function in MYOB, engage the services of a Certified Consultant or a MYOB approved bookkeeper.

Some simple tips to set up your MYOB AccountRight Live file:

To update a supplier’s card to track taxable payments:

1. Go to the Card File command centre, Cards List.

2. Select the Supplier tab.

3. Zoom into the arrow next to the supplier you require.

4. Select the Profile tab and check that the supplier’s address details are current and complete.

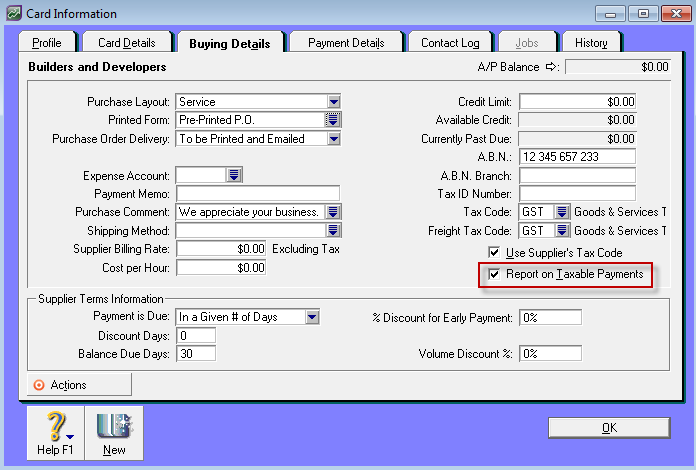

5. Click the Buying Details tab.

6. Place a tick in the option ‘Report on Taxable Payments as shown below.

7. Enter the supplier’s ABN in the A.B.N field. If you don’t know this, use the ABN Lookup site to find it.

8. Click OK. This supplier is now setup for taxable payments reporting.

9. Repeat steps 3 – 8 for all suppliers who need to be set up for taxable payments reporting.

By selecting the above option all payment transactions for this supplier will be automatically marked as reportable.

Producing the TPAR

You can then produce the TPAR via the Purchases command centre by clicking Report Taxable Payments (or Print Taxable Payments in older versions).

This opens an assistant which helps you. All that’s required here is to review your company information, the reportable transactions, and the suppliers you have set up for taxable payments reporting.

Next, print the Taxable Payments Annual Report for you to file. Also, provide your suppliers a list of their reportable payments. Alternatively, you could transpose the information on the pre-printed forms provided by the ATO

At this point the ATO have deemed that the preparation and lodgement should not be under BAS agent services.

This means, only the business owner or tax agent can verify the information and lodge the TPAR.

A BAS agent can work under the direction of the client and run the software to produce the information and draft forms but the client or tax agent must complete the verification and lodgement to the ATO.

You will need to establish how you intend to lodge the TPAR to the ATO. In summary the ATO will accept three methods:

-

- Business Portal or Tax Agent Portal (for tax agents only) or Standard Business Reporting

- Electronic storage media that you mail to the ATO (Generated by the approved accounting software)

- Completing the Paper Form, Taxable Payments Annual Report NAT74109

Visit the ATO website for information on lodging your Taxable Payments Annual Report.

For a peace of mind this financial year, it is important to meet all your tax and compliance obligations for the 2013 EOFY period. Visit MYOB’s Tax Tips & Changes Information section, meant to help small businesses and startups stay on top of their game with tax changes and more.

The information provided here is of a general nature for Australia and should not be your only source of information. Please consult an experienced tax agent as each small business’ circumstance will vary for end of financial year.