8th May, 2018

As a business that offers solutions to 1.2 million Australian businesses and accountants, MYOB has some ideas on how our lives could be improved by tonight’s budget.

Last week we heard from key industry players on what they would like to see from their budget. Their wish lists were shaped by various pain points and opportunities in their industries.

READ: What does the retail sector want?

READ: What does the hospitality industry want?

READ: What do accountants want?

READ: What does the construction industry want?

There was one common thread across all sectors: keep the $20,000 instant asset write-off scheme.

Out of the latest MYOB Snapshot, keeping the $20,000 instant asset write-off scheme is seen as the most important possible budget measure for small businesses. Two thirds say keeping it is a great idea.

That’s because the scheme gives small businesses the confidence to invest in new equipment to hoist their business to the next level.

Before the scheme meant investing in new equipment could be left on the backburner as cash flow worries piled up. But the ability to write off the asset from tax provides an elegant solution for businesses itching to invest so they can grow.

That’s why we think it’s time for the write-off scheme to be here to stay.

Now is good to give small businesses the confidence to invest with certainty, knowing that the scheme isn’t going anywhere rather than owners nervously waiting each year to see if it’s extended.

The current superannuation system is great, but it’s time to go to the next level.

A 9.5 percent compulsory rate means not enough is being tucked away by employers and employees for retirement.

There are countless reports and forecasts showing large numbers of Australians simply won’t have enough funds to retire on, and this problem is worse for women.

That’s why it’s time to bump up the compulsory rate to 12 percent.

But any major change to the superannuation system must be well-managed and phased in slowly.

For example, while SuperStream was a great initiative for small business owners, there were a fair few teething problems. And small business owners copped the headaches.

We don’t think Australia should have low taxes – we think Australia should have a competitive tax rate.

With countries around the world lowering their tax rates, it’s important that Australia remains competitive.

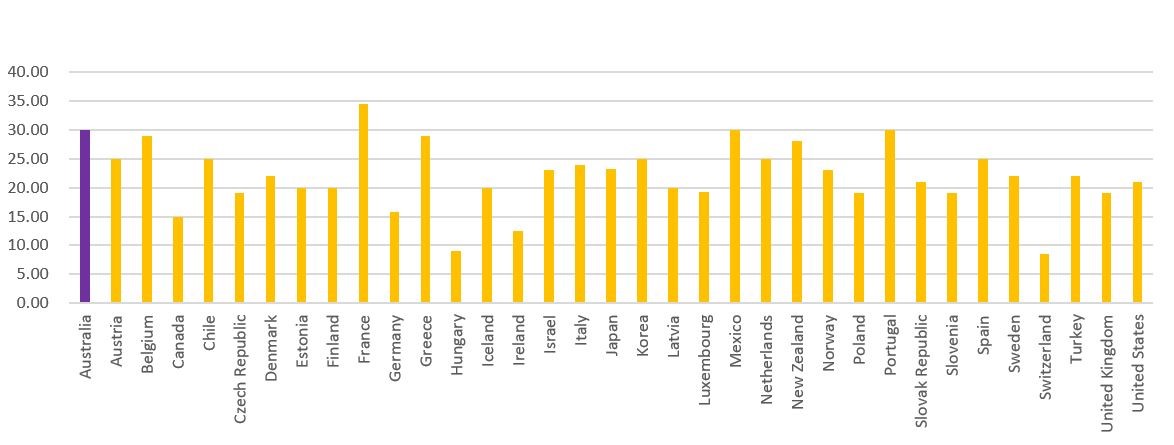

Our bigger business company tax rate is in the upper range of OECD countries.

In the past, Australia has lowered its tax rate to just below the average of OECD countries. Then a few years later other countries lower their rates – meaning our rate goes back up comparatively.

That’s our situation today.

It’s silly to suggest that a competitive tax rate is the only reason a business may seek to invest in Australia, but it’s naïve to think it’s not a factor.

That’s why it’s important to stay competitive – so foreign investment can ultimately employ people, inject money into the Australian economy, and create more work for smaller business suppliers.

Any budget measure that simplifies the lives of small business owners is a good one.

In particular, any move to simplify GST would be welcome.

At the moment, the GST applies to 46 percent of the Australian economy while in New Zealand it applies to about 98 percent.

This comes home to roost when small businesses buy several supplies from the one supplier.

They may pay for those supplies with one credit card so it shows up as one transaction in their accounting software.

So the business owner needs to go through line by line to figure out which items they paid GST on and which ones they didn’t.

While smart invoicing solutions make this process easier, it would be great to ease this process by simply broadening the GST base.

Sign up for added insights and business-critical news from MYOB.