Cloud payroll software for small businesses

Save time with smart, compliant and flexible payroll management. Less admin for you, great tools for your team and automatic Single Touch Payroll reporting to the ATO.

Streamline your payroll process with MYOB

Payroll compliance, simplified

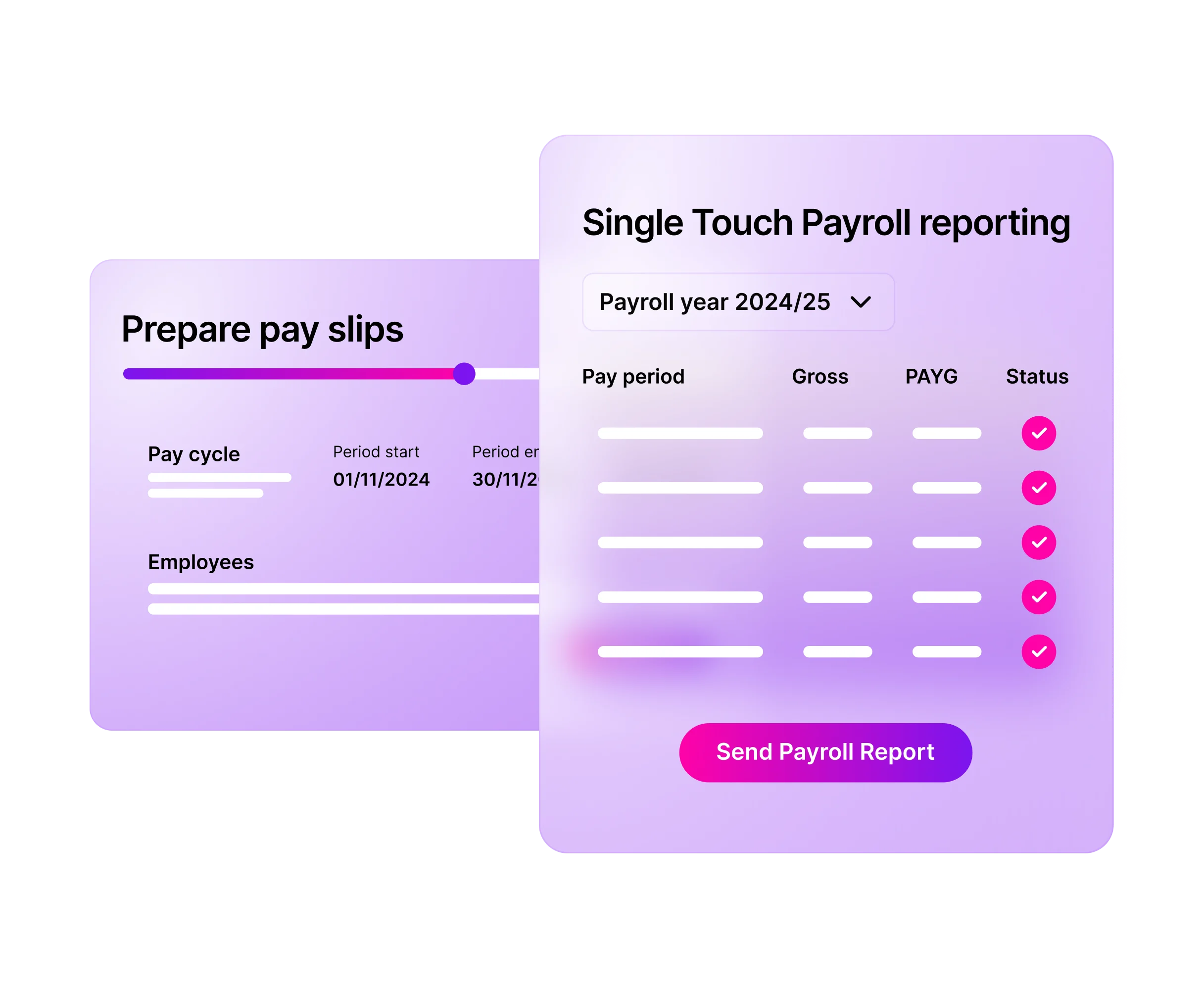

Avoid data entry and stay in the ATO's good books. Generate and send Single Touch Payroll (STP) reports directly from MYOB Business at the end of each pay cycle. You can rest easy for end of year reporting, and your employees can access their payroll information at any time.

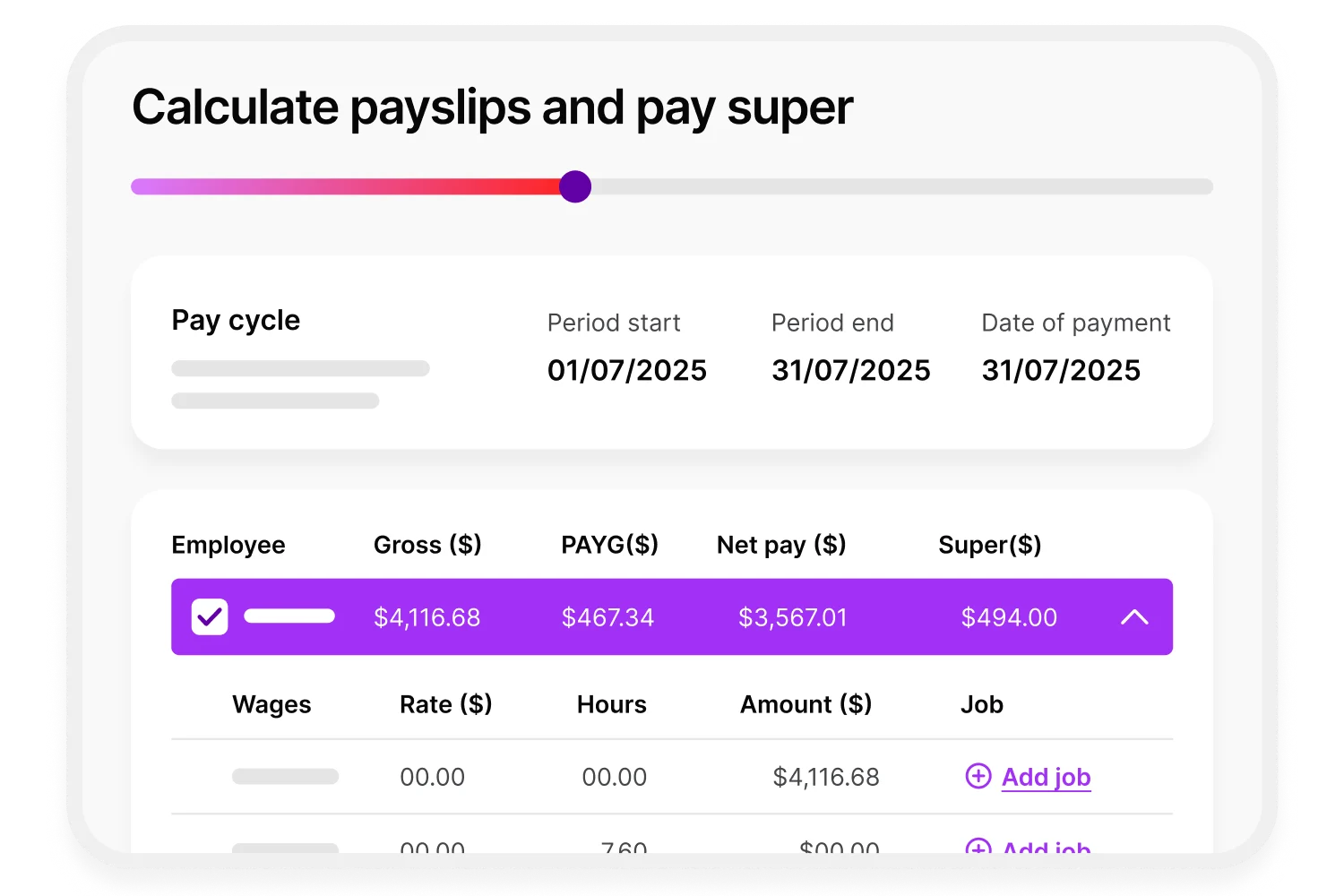

Calculate tax, superannuation and leave in just a few clicks

MYOB Business automatically calculates superannuation, tax, annual leave and overtime. We stay up to date with regulations and will alert you if we see something that doesn’t look right.

Onboarding? Let your employees self-serve.

Your team members can submit their bank, tax and superannuation details through our secure online form. Don’t worry about the filing cabinet, employee details and important documents like licenses and contracts are all in one place.

What our customers say about MYOB cloud payroll software

Swipe left and right to see more

Current slide:00|Total slides:00

Need more than payroll?

Cash flow management

Keep money coming in steadily with tools to manage income, remove the guesswork from budgeting, and get paid faster.

Invoicing and quotes

Create and send professional invoices with customisable templates. Costs are automatically calculated using pre-saved data, and customer contacts are added instantly so invoices are ready to send fast.

Got more complex payroll needs?

All your questions answered about MYOB cloud payroll software:

What is Payday Super?

Currently, employers must make superannuation payments each quarter. Many businesses already pay super with each pay cycle.

From 1 July 2026, employers must pay super at the same time they pay wages or salaries.

For small businesses, this means adjusting to more frequent superannuation payments. Without the right systems in place, businesses risk becoming non-compliant, and significantly increasing admin workloads. With MYOB, however, these obligations can be met seamlessly as part of the payroll workflow.

Do I need to install any software?

MYOB Business Lite and Pro are 100% web-based. No downloads required.

How long does it take to set up MYOB payroll software?

To set up MYOB payroll software, all you have to do is:

Choose the plan that's right for your business

Sign up

Invite your employees to input their payroll details

Let the software calculate the hard stuff for you

How do I migrate from another payroll software to MYOB?

Is my data secure?

Yes. MYOB takes the security and protection of our customers’ data seriously. We use secure, encrypted channels for all communications between us and follow industry best practices including ISO 31000 Risk Management Standard.

How does Single Touch Payroll work?

Single Touch Payroll (STP) is the Australian government's method for reporting employees' payroll, tax and superannuation information to the Australian Taxation Office (ATO). If you're using MYOB payroll software, you can send the information directly from your software to the ATO.

What are the benefits of Single Touch Payroll?

Single Touch Payroll (STP) means businesses don’t need to complete payment summaries and group certificates at the end of financial year. STP software automatically sends your employees’ tax and superannuation information to the ATO. STP helps employees, too. They no longer have to wait until EOFY to see their tax information. Their details - salary, PAYG withholding and superannuation - is readily available via their myGov account.

What is payroll software?

Payroll software helps you pay your employees. It automates processes like calculating pay, superannuation, tax and annual leave. It also helps ensure that figures are accurate and follow legal and tax requirements.

Can payroll software integrate with accounting and invoicing tools?

Yes, MYOB Business Payroll integrates with other software, particularly its own accounting products like AccountRight and MYOB Acumatica. MYOB Business Payroll also integrates with various third-party applications, including HR, rostering, and timesheet software, and offers services to help migrate data from other systems like Xero and Reckon.

What are the benefits of cloud payroll software?

Cloud payroll software, also known as online payroll software, is software that's accessed on a browser and requires an internet connection. You can access your online payroll software from a desktop, mobile or tablet, as well as all browsers.

With online payroll software, your data is stored in the cloud. Backups happen automatically, so you don’t have to constantly do them yourself.

Cloud software keeps your data secure. It has more room than other forms of data storage, meaning you can store more information.

How do I use payroll software?

Each type of payroll software is different. Cloud payroll software, like MYOB payroll, follows a standard structure. It stores financial information about your employees and uses this to generate pay, superannuation, tax and annual leave. Simple!

How do I set up payroll in my MYOB software?

Setting up payroll in your MYOB software is simple, and takes 3 easy steps:

Set up payroll for your business – start by entering a few details about how payroll works in your business.

Set up employees – you'll need to set up each of your full-time, part-time and casual employees. New employees can submit their own details.

If you've already paid an employee this payroll year using different software, you can enter the amounts you've already paid them.Set up reporting obligations – you're almost done. The last step is to set up Single Touch Payroll reporting to ensure your information is reported correctly to the ATO. And finally, you'll set up the superannuation payments you'll contribute for your employees.

For detailed instructions, view our help page to set up payroll with ease.

Is there a minimum subscription period?

Nope. And there are no lock-in contracts either. Pay monthly (or yearly to save more) and enjoy the flexibility to cancel anytime.