Manage pay runs all in one place with MYOB

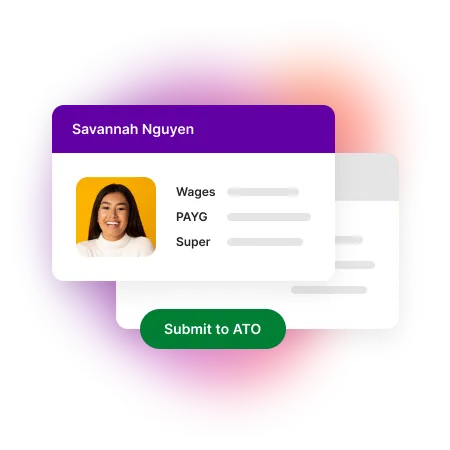

Payroll compliance, simplified

Stay in the ATO's good books. Generate and send Single Touch Payroll (STP) reports directly from MYOB Business so you can rest easy.

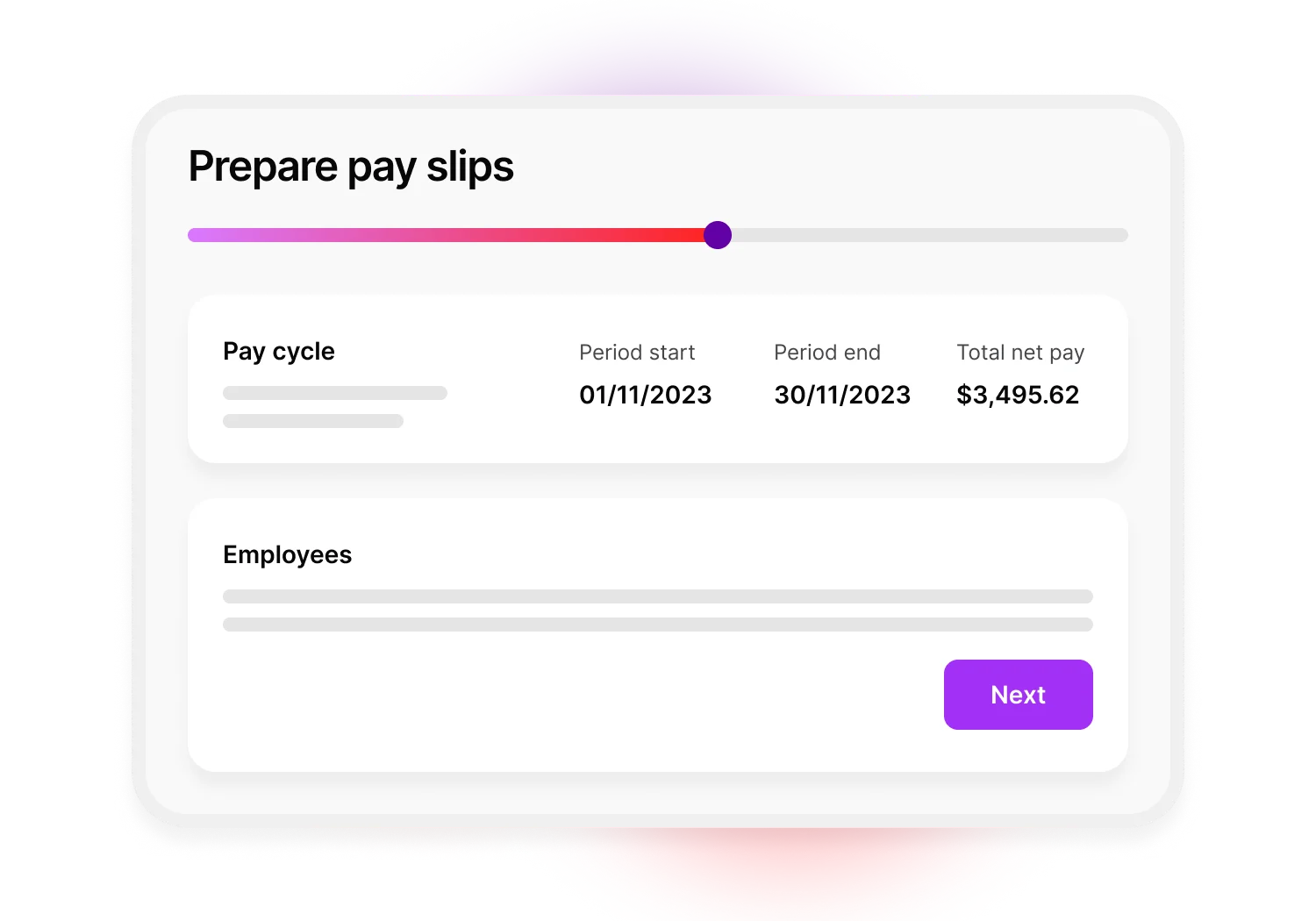

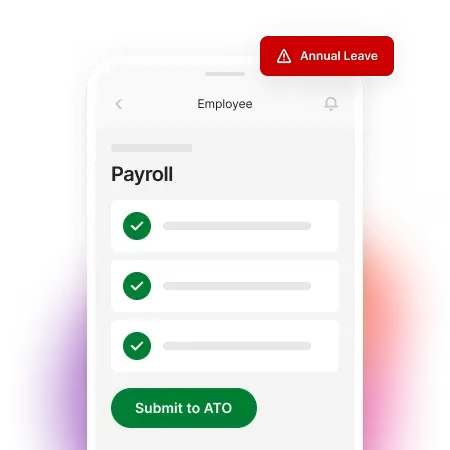

Calculate tax, superannuation and leave in just a few clicks

Automatically calculate payroll variables like superannuation, tax and annual leave all within your workflow. We’ll let you know with helpful error messages if we see something that doesn’t look right, like extra annual leave.

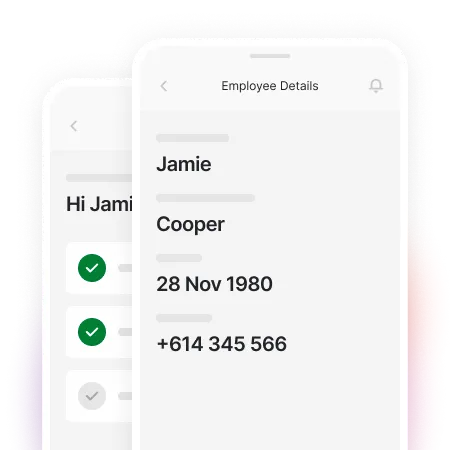

Avoid dreaded data entry. Let your employees DIY their onboarding

Your new team members can submit their bank, tax and superannuation details through our secure online form. All you need to do is add their name and email. We will handle the rest.

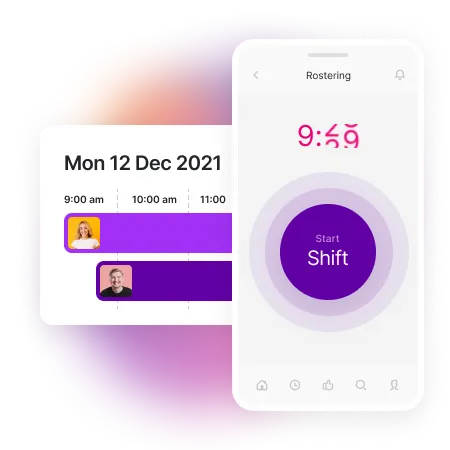

Forget paper. Manage rosters and timesheets from your online software

Generate rosters to match your team's skills and availability, while ensuring your business stays compliant – all from MYOB Business.

Only pay for what you use and need

As your business grows and adapts, so might your payroll requirements. Whether you employ one person or a whole team, you’ll only be charged for who you pay each month.

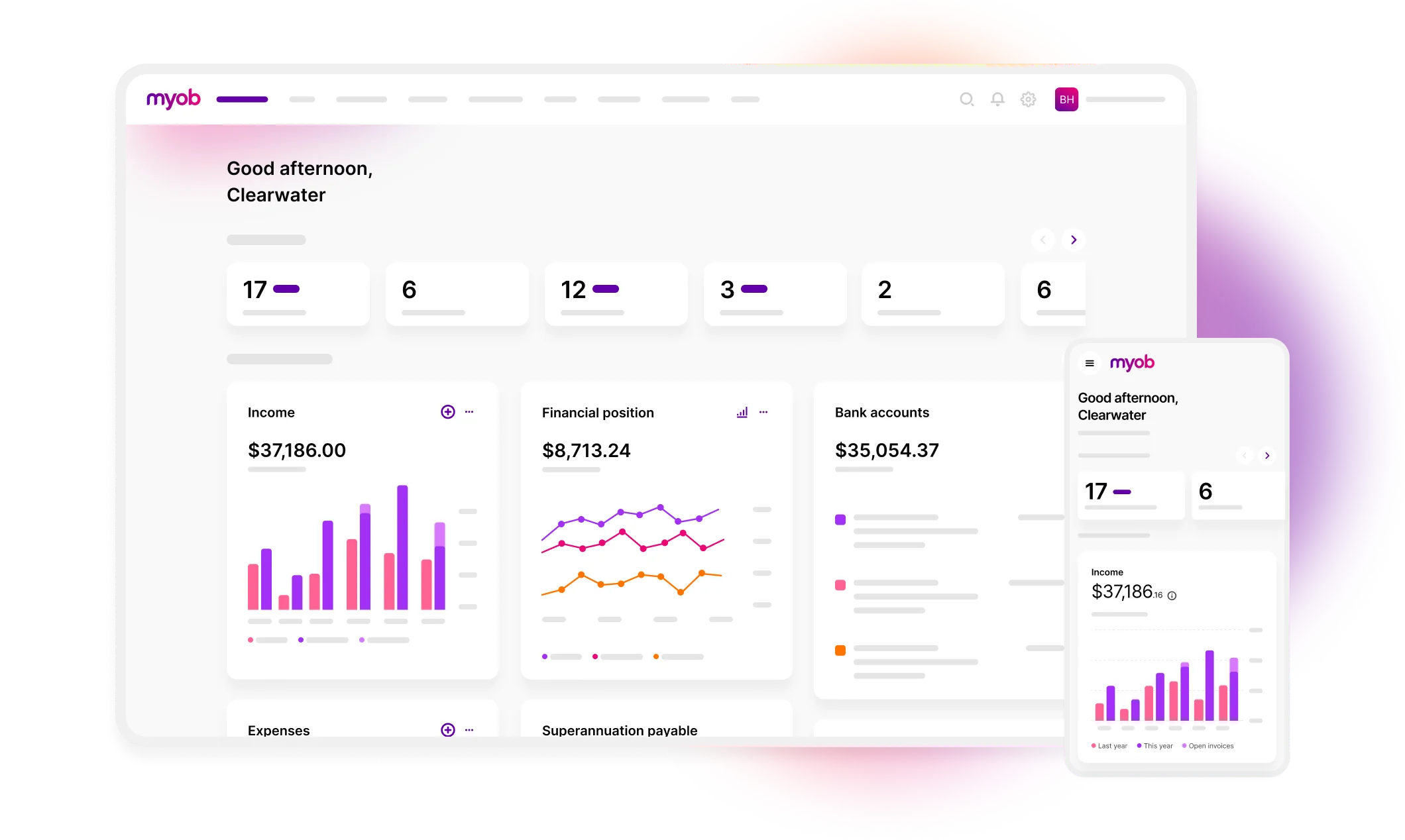

Get more for less with MYOB Business Pro

MYOB Business

Pro

For growing businesses with multiple employees wanting more advanced reporting

$29.00/monthWas $58.00

Features include:

Track income and expenses

Scan and store receipts

Connect unlimited bank accounts

Advanced reporting and analytics

Track budgets and jobs

Create and send unlimited professional invoices and quotes

Optional payroll and inventory

Track GST and lodge BAS

Need more than payroll?

Got more complex payroll needs?

All your questions answered about MYOB cloud payroll software:

Is there a minimum subscription period?

Nope. And there are no locked-in contracts either. Simply pay for your MYOB Business accounting software plan on a monthly basis with peace of mind that you can cancel at any time.

Plus, we offer a 90-day money-back guarantee if you decide your plan is not right for you.

Do I need to install any software?

MYOB Business Lite and Pro are 100% web-based. No downloads required.

How long does it take to set up MYOB payroll software?

To set up MYOB payroll software, all you have to do is:

Choose the plan that's right for your business

Sign up

Invite your employees to input their payroll details

Let the software calculate the hard stuff for you

How do I migrate from another payroll software to MYOB?

You can use our free migration service to securely move your payroll data from Xero, QuickBooks Desktop or Reckon to MYOB.

If you want to migrate your payroll data from an Excel spreadsheet, follow these step-by-step instructions.

Is my data secure?

Yes. MYOB takes the security and protection of our customers’ data seriously. We use secure, encrypted channels for all communications between us and follow industry best practices including ISO 31000 Risk Management Standard.

How does Single Touch Payroll work?

Single Touch Payroll (STP) is the Australian government's method for reporting employees' payroll, tax and super information to the Australian Taxation Office (ATO). If you're using MYOB payroll software, you can send the information directly from your software to the ATO.

What are the benefits of Single Touch Payroll?

Single Touch Payroll (STP) means businesses don’t need to complete payment summaries and group certificates at the end of financial year. STP software automatically sends your employees’ tax and superannuation information to the ATO. STP helps employees, too. They no longer have to wait until EOFY to see their tax information. Their details - salary, PAYG withholding and super - is readily available via their myGov account.

What is payroll software?

Payroll software helps you pay your employees. It automates processes like calculating pay, superannuation, tax and annual leave. It also helps ensure that figures are accurate and follow legal and tax requirements.

What are the benefits of cloud payroll software?

Cloud payroll software, also known as online payroll software, is software that's accessed on a browser and requires an internet connection. You can access your online payroll software from a desktop, mobile or tablet, as well as all browsers.

With online payroll software, your data is stored in the cloud. Backups happen automatically, so you don’t have to constantly do them yourself.

Cloud software keeps your data secure. It has more room than other forms of data storage, meaning you can store more information.

How do I use payroll software?

Each type of payroll software is different. Cloud payroll software, like MYOB payroll, follows a standard structure. It stores financial information about your employees and uses this to generate pay, super, tax and annual leave. Simple!