Get invoices paid faster with online payments*

Give your customers more convenient ways to pay and say goodbye to late payments.

Secure digital payment options for your clients that save you time

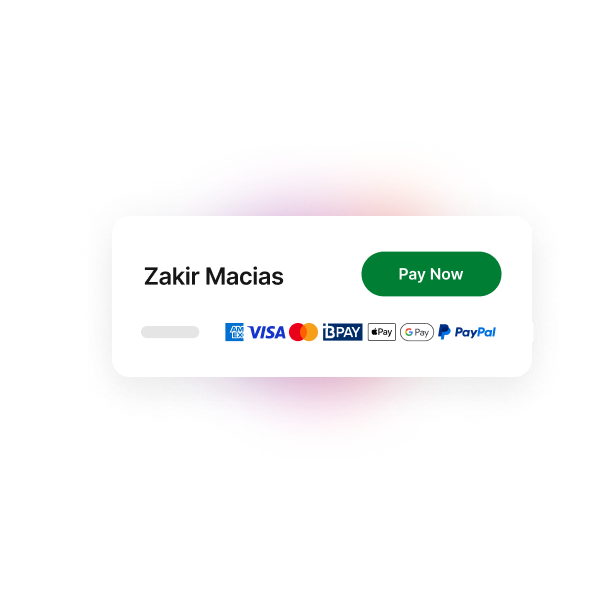

Give your customers more ways to pay

Get paid on your terms, fast, by giving your customers more payment options. They can pay with Apple Pay™, Google Pay™, VISA, Mastercard, PayPal and BPAY†.

Easily accept digital payments

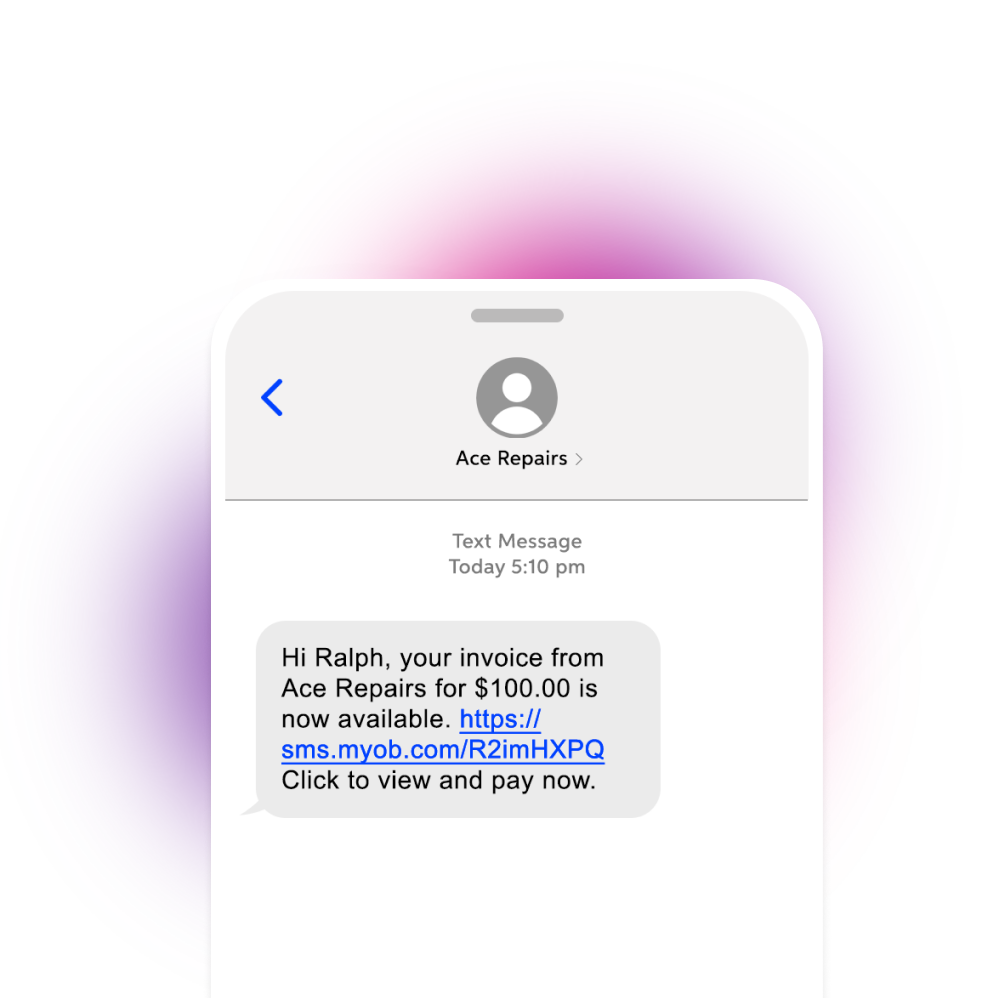

43% of customers check invoices on their mobiles**. With online invoice payments you can send your invoices via SMS or email. Customers can pay on their phone in seconds using stored cards in their digital wallet.

Stay safe with secure payments

Keep your customers’ data safe and your money secure with protected payment gateways that meet the highest level of PCI DSS compliance.

Reconciliation without

the frustration

Automatically reconcile payments by connecting your bank account. Your bookkeeper will be happy, and with less admin to worry about, so will you.

Nudge late payers

with auto-reminders

Keep your cash flowing and use payment tracking to automatically see which customers have paid and remind those who haven’t.

Rest easy with real

time notifications

Know the moment your invoice has been paid with instant payment notifications, and access insights from payments reports.

Meet Lisa and Isabella from OiOi

“Once we pack their order, we flick them an invoice and they’ve got several payment options. And it’s really great for them to also see what outstanding invoices they have.”

Isabella Bennetts-Roberts, Co-owner, OiOi

Super competitive fees

Say goodbye to monthly and setup fees. With only one fee per transaction (1.8% + $0.25c) online invoice payments are the easy choice.

Plus, rest easy knowing fees only apply when your customer pays their invoice using an online payment method.

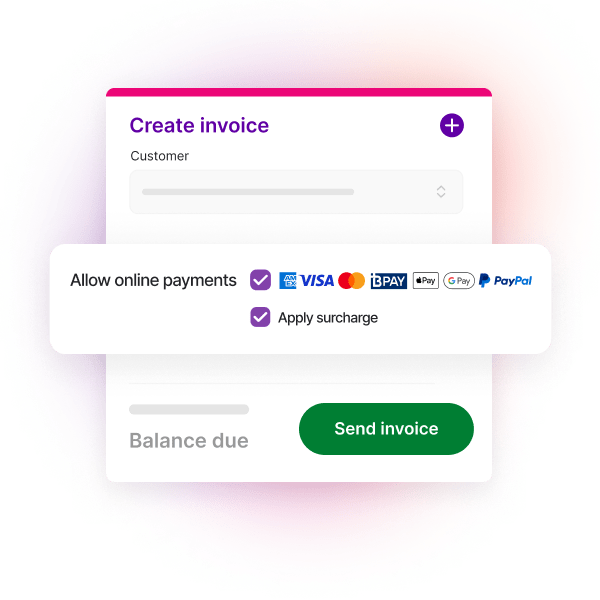

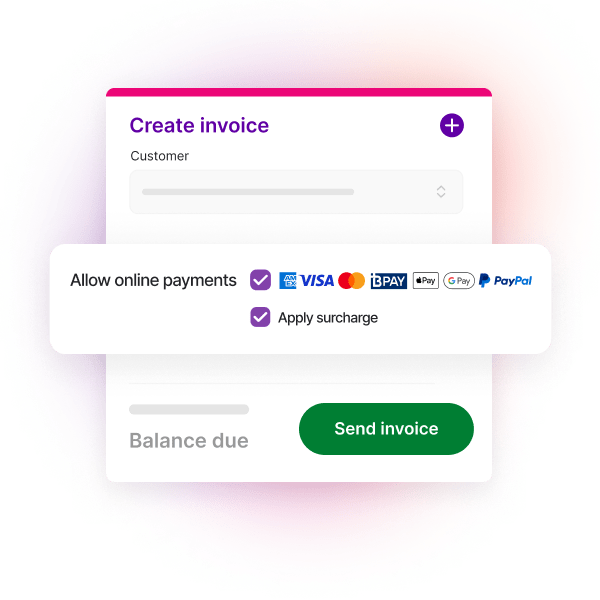

Extra flexible settings

Easily remove any hurdles to getting paid by absorbing the 1.8% surcharge fee (excludes BPAY), or choose to pass them onto your customer^. The choice is yours!

Extra flexible settings

Easily remove any hurdles to getting paid by absorbing the 1.8% surcharge fee (excludes BPAY), or choose to pass them onto your customer^. The choice is yours!

Accept secure payments wherever your customers are

Accept secure online payments wherever your customers are by sending your invoices through SMS and email, making it easier for your customers to pay you on time.

Set up online invoice payments in three simple steps

2

Verify

We'll verify and process your application and be in touch if we need more information.

3

Activate

Once approved, we’ll add a Pay Now

button to your invoices so your

customers can start paying you online.

Getting started is easy

Discover quick and easy tips to help you get the most out of online invoice payments.

Help articles

Tap into a wealth of expert

knowledge about online invoice payments specific to your software.

MYOB Academy

Learn how to get the most out of your invoice payments, at your own pace. Anytime, anywhere.

Contact us

Our sales team are here to help answer

questions and get you set up. Email us at payments_support@myob.com

†Applications for invoice payments are subject to approval. Fees apply when clients pay their invoices with invoice payments 1.8% + 0.25c per transaction (including GST). No monthly fees or set up fees apply. Rate applies to AMEX, VISA, Mastercard, BPAY, Apple Pay, Google Pay and PayPal transactions. View terms and conditions here.

^If you decide to toggle on surcharging, you will continue to be charged for all transactions settled to you on your monthly invoice. These fees will be paid to MYOB, whilst your customer pays the surcharge amount to you. Surcharging your customers is your decision and is subject to limitations and restrictions under applicable consumer law. You can surcharge customers up to your cost of acceptance, however you are not required to do so. MYOB makes no recommendation regarding whether you should surcharge your customers. Visit the ACCC website here to find out more about surcharging and your obligations.

*Based on a sample of 2 million MYOB invoices between August 2019 and July 2020 on days to payment for invoices paid via online invoice payments versus non online invoice payment invoices.

**Based on MYOB internal data analysing a sample of 315,814 online payment requests from 13/06/2022 to 11/09/2022.

Google Pay is a trademark of Google LLC.

Turning visitors into leads.