You must be reporting to the ATO via STP Phase 2

The ability to report payroll via STP Phase 1 in MYOB will end soon. If you've been using STP Phase 1 reporting in MYOB, we encourage you to move to STP Phase 2 to ensure that you are compliant and can continue to report Single Touch Payroll to the ATO.

Single Touch Payroll (STP) Phase 2 is an expansion of the ATO's payroll reporting system. Under this expansion, you'll report additional information to the ATO and clarify the payments you make to your employees.

Reporting via STP Phase 2 will:

reduce your reporting burden if you currently report to multiple government agencies, and

support the administration of Services Australia.

To learn all about STP Phase 2 and the benefits, visit the ATO website.

If you set up STP after mid-December 2021, you'll already be reporting via STP Phase 2. If you're not sure, see the FAQs below.

What's changing from STP Phase 1?

There are many things that won't change under STP Phase 2, like:

how and when you lodge your STP reports

the types of payments you report

your tax and super obligations

end of year finalisation.

You'll need to enter some additional payroll details

To report successfully under STP Phase 2, the ATO require some additional employee and payroll details to be entered into MYOB. This is a one-off task and you'll be guided to enter this information when you first set up STP or when you make the move from STP Phase 1.

New ATO reporting categories

ATO reporting categories help the ATO classify the wage, deduction and superannuation payments in your employees' pays. For STP Phase 2, there are some updated and new ATO reporting categories to better classify your employee payments. This includes some new ATO reporting categories like Overtime and Bonuses and commissions that might previously have been reported as Gross payments. Similarly, leave payments were previously reported as gross payments, but now they have their own, more specific ATO reporting categories. Learn more about assigning ATO reporting categories.Income type and Home country (Country code)

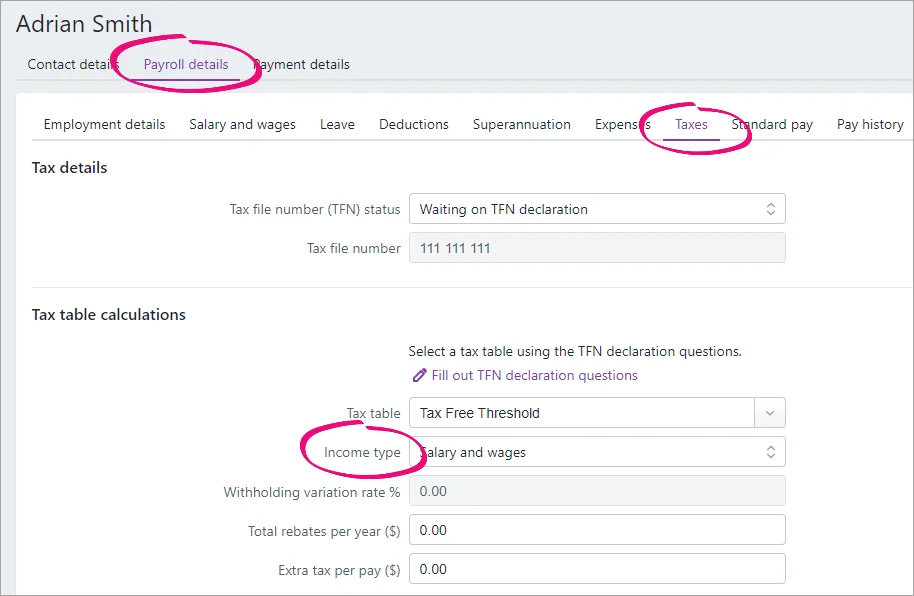

The ATO need to know what type of income you'll be paying each of your employees. For a lot of employees this would typically be Salary and wages, but other choices include Closely held payees, Labour hire, or Seasonal worker program. If you choose Working holiday maker, you'll also need to choose the employee's Home country (Country code). You'll find the Income type field via Payroll > Employees > click an employee > Payroll details tab > Taxes tab > Income type.

Lump sum E payments need the financial year they relate to

If you've paid a lump sum E payment (an amount of back payment that accrued, or was payable, more than 12 months before the date of payment and is $1200 or more), you'll need to advise the ATO which financial year the payment relates to. For all the details, see this help topic.

Some of your payroll processes will change (for the better!)

Tax file number declarations

Under STP Phase 2, when a new employee starts working for you, you won't have to send the ATO a tax file number declaration. Instead, the ATO will be provided all the required information when you report the employee's first pay run via STP. You'll find the employee's tax fine number via Payroll > Employees > click an employee > Payroll details tab > Taxes tab > Tax file number.Termination reason

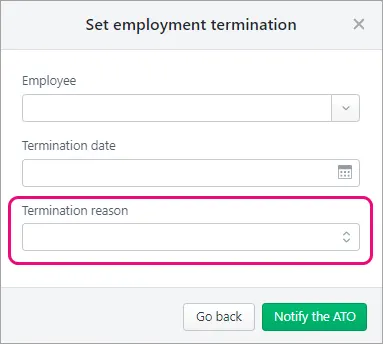

When you process a final pay for an employee who's leaving your business and you report this termination through the STP reporting centre, you'll need to select the Termination reason. This is now a requirement for both the ATO and Services Australia. Learn more about terminating an employee in Single Touch Payroll reporting.

Your end-of-year reports are clearer

After moving to STP Phase 2, your end of year reports will reflect STP Phase 2 information (Payroll > Single Touch Payroll reporting > EOFY finalisation tab).

The YTD verification report lists the new ATO reporting categories. In STP Phase 1 this report showed the aggregated gross wages, but it now shows the disaggregated values.

The Summary of Payments report (accessible by clicking the ellipsis button for an employee > View summary report (PDF)) only lists pay items that have been used for the employee in that payroll year. Previously all of the employee's pay items were listed, even those with $0.00 values.

Moving to STP Phase 2

You'll be prompted in your MYOB business to make the move to STP Phase 2. It's a simple process and we'll guide you every step of the way.

During the move, your business and employee details will be checked to make sure they meet the new STP requirements. This includes checking inactive and terminated employees if you've paid them in the current payroll year. If anything needs fixing, we'll let you know.

See how easy it is to move

To move to STP Phase 2

STP can be complex for some businesses, so if you need help moving to STP Phase 2 we recommend speaking to an accounting advisor.

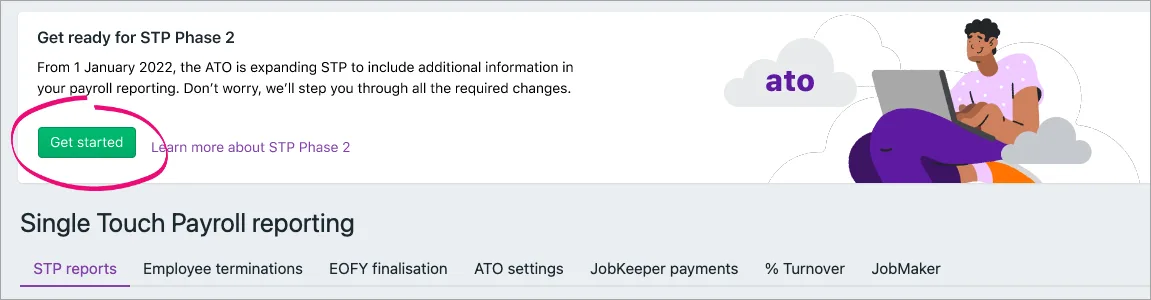

Open the STP reporting centre (Payroll menu > Single Touch Payroll reporting).

Click Get started.

Click Check my payroll information. If any issues are found they'll be listed, ready to fix. To fix:

Business details: Click Edit business details. Details of what needs updating will be shown at the top of the screen. Make the required changes and click Save.

Employee details: Click the employee's name. Details of what needs updating will be shown at the top of the screen. Make the required changes and click Save. After updating and saving the employee's details, click the link at the top of the screen to continue preparing for STP Phase 2.

Employee income type: For each listed employee, choose the applicable Income type (Salary and wages, Closely held payees, Working holiday maker, Seasonal worker program or Labour hire). If unsure, check with your accounting advisor or the ATO. If you choose Working holiday maker, also choose the employee's Home country (Country code). Click Save and check details to see if anything else needs fixing.

ATO reporting categories: For each listed pay item, choose the applicable Phase 2 ATO category. Learn about assigning ATO reporting categories for Single Touch Payroll.

Click Save and check details to see if anything else needs fixing.

Lump sum E payments: If you paid a lump sum E payment that related to one financial year, specify which year the payment related to. You should also unlink the lump sum E pay item from all employees (Payroll > Pay items > Wages and salary tab > click to open the lump sum E pay item > click the remove icon next to each employee > Save). You can now repeat the above steps to move to STP Phase 2.If you paid a lump sum E payment that related to multiple financial years, you'll need to advise the ATO which financial years the payment related to. For all the details on how to do this, see Lump sum E payments.

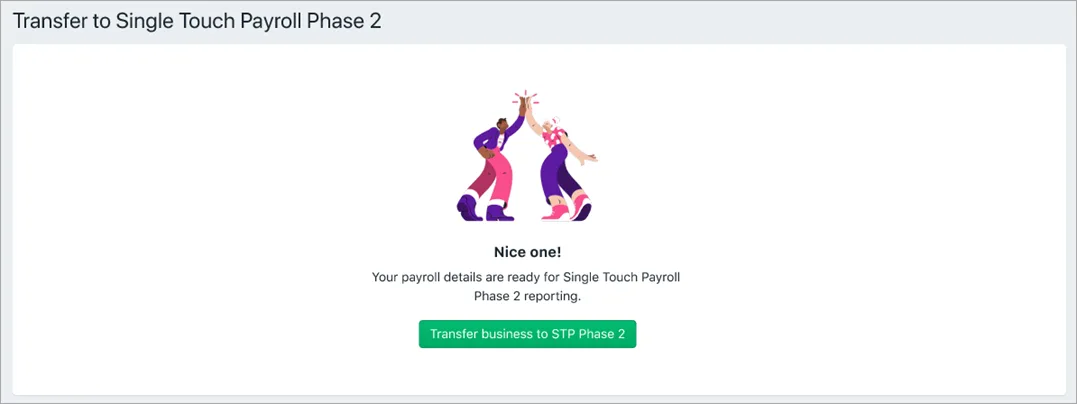

When no more issues are found, click Transfer business to STP Phase 2.

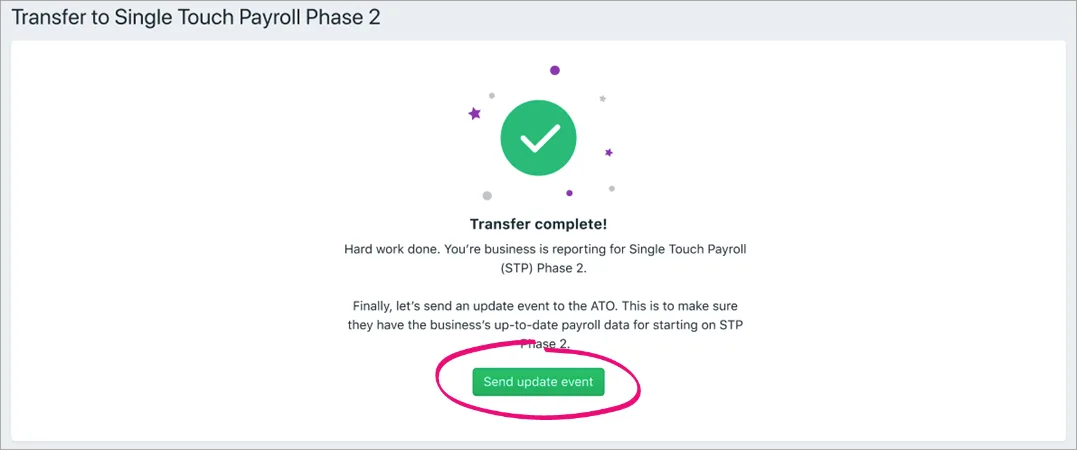

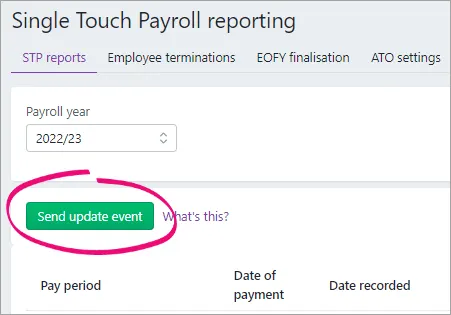

Finally, click Send update event to make sure the ATO has the current year-to-date payroll totals for your employees.

You should now check the STP totals you've reported to the ATO to ensure they match the payroll figures in MYOB.

Avoid common STP mistakes

To find out about some common STP Phase 2 reporting questions and mistakes, see this ATO information.

FAQs

Will MYOB move me to STP Phase 2 automatically?

Every business is different and there's some information required as part of the move that only you will be able to provide. Therefore, MYOB can't move you automatically.

There's a handy assistant in MYOB that guides you through the move (see above for the details). And if you need more help moving to STP Phase 2, we recommend speaking to an accounting advisor.

What changes will I notice after moving to STP Phase 2?

After the move, you'll notice these changes:

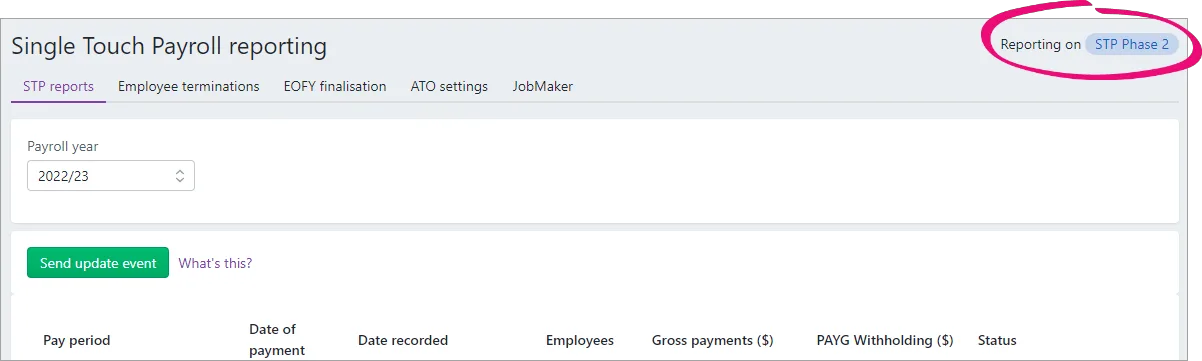

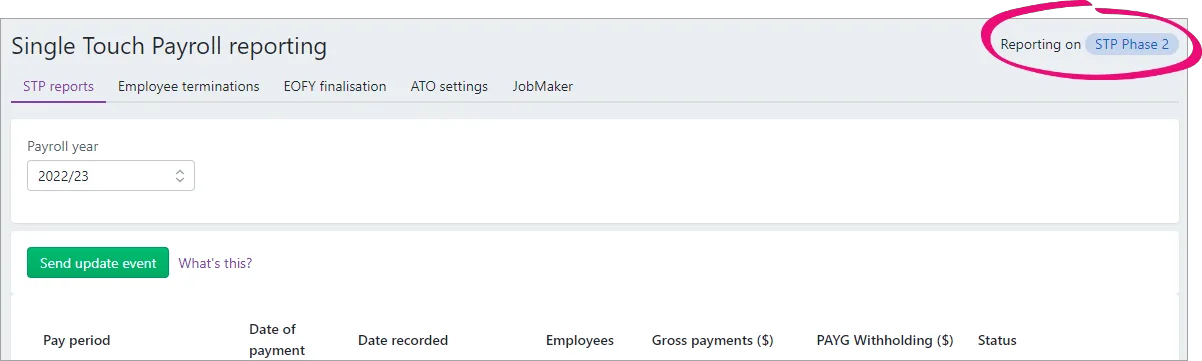

You'll see a label in the STP reporting centre showing you're reporting on STP Phase 2.

When terminating an employee in the STP reporting centre, you'll choose a Termination reason.

There's a new Send update event button in the STP reporting centre to send your employees' latest year-to-date payroll totals to the ATO. Previously you could only do this by recording a zero dollar ($0) pay.

What payroll details are checked during the move to STP Phase 2?

When you move from STP Phase 1 to STP Phase 2, the following details are checked in MYOB to make sure they meet the new STP requirements.

| What gets checked |

|---|---|

Business information | • Business name • ABN • GST branch number (if you have one) what is this? • Address You can access this information in MYOB by clicking your business name > Business settings. |

Employee details | Employees paid in the current and previous payroll year are included in the payroll check, including inactive and terminated employees.Here is the information that's checked for your employees (accessed via the Payroll menu > Employees > click an employee).On the Contact details tab: • First name • Surname or family name • Country • Address • Suburb/town/locality • State/territory • Postcode On the Payroll details tab > Employment details section: • Date of birth • Start date • Employment basis On the Payroll details tab > Taxes section: • Tax file number • Income type Do you employ working holiday makers? If you choose Working holiday maker as the Income type, you'll also need to choose the worker's Home country (Country code). Also check that the correct Tax table is assigned to working holiday makers based on your business's working holiday maker registration status. |

Pay items | Wages and salary, superannuation and deduction pay items used in the current and previous payroll year are included in the check. You can access your pay items via the Payroll menu > Pay items. Each of these must have an ATO reporting category assigned. By default, this is set to To be assigned, so you know what pay items still need assigning. |

How can I tell if I'm on STP Phase 2?

You can check in the STP reporting centre (Payroll menu > Single Touch Payroll reporting).

Why do the amounts in the STP reporting centre look wrong?

When you look at the EOFY finalisation tab or the YTD verification report in the STP reporting centre for the current or last payroll year, you might notice the values don't look right. This can happen if you've recently moved to STP Phase 2.

You can easily fix this by sending an update event. If needed you can do this for the current and previous payroll years.

In the STP reporting centre, click the STP reports tab.

Choose the Payroll year (for the year where the values don't look right).

Click Send update event.

When prompted to send your payroll information to the ATO, enter your details and click Send.